This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Low interest rates on bank FDs and post office small saving schemes has resulted in investors searching for higher yield fixed income options, including short term debt funds. One such investment option is available right now in the form of non-convertible debentures (NCDs) from SREI Infrastructure Finance Limited.

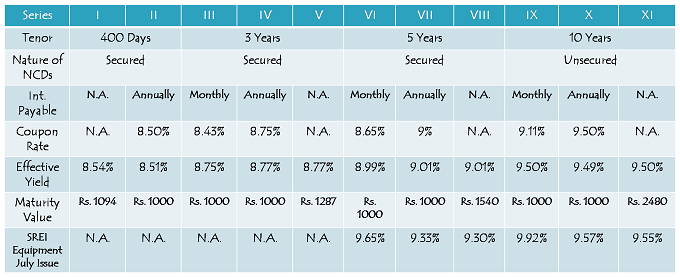

The issue opened on February 9, 2018 and is carrying a maximum of 9.50% per annum coupon rate. It will remain open for two more weeks to close on March 7, 2018. These NCDs are offering monthly, annually and cumulative interest payment options.

As we analyse it further, let us take a quick look at the salient features of this issue.

Size & Objective of the Issue – Base size of this issue is Rs. 200 crore, with a green-shoe option to retain an additional Rs. 1,800 crore, thus making it a Rs. 2,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry a coupon rate of 9.50% p.a. payable on an annual or cumulative basis for a period of 10 years, 9% p.a. for a period of 5 years, 8.75% for 3 years and 8.50% for 400 days. For investors seeking regular income, monthly interest payment option is also available for a period of 3, 5 and 10 years. Though coupon rates will be lower with the monthly interest payment options, effective rates will be close to the coupon rates of annual interest payment options.

0.25% Additional Coupon for SREI Infra Shareholders, NCD Holders, Senior Citizens & Employees – Existing shareholders and NCD holders of SREI Infra, senior citizens aged more than 60 years of age and the employees of SREI Infra will be offered an additional coupon of 0.25% per annum. Record date for the payment of interest will be considered as the relevant date for these investors to be eligible for this additional rate of interest.

Minimum Investment – Investors are required to make a minimum investment of Rs. 10,000 i.e. ten NCDs of face value Rs. 1,000 each.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 400 crore

Category II – Non-Institutional Investors – 10% of the issue i.e. Rs. 200 crore

Category III – Individual & HUF Investors – 60% of the issue i.e. Rs. 1,200 crore

Category IV – Trusts & Society Investors – 10% of the issue i.e. Rs. 200 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – Rating agency Brickwork Ratings (BWR) has rated this issue as ‘AA+’. Debt instruments with such a rating are considered to have high degree of safety regarding timely payment of interest and principal. NCDs issued for 400 days, 3 years and 5 years are ‘Secured’ in nature and in case of any default on its payment of interest or principal, the bondholders will have the right on certain secured assets of SREI Infra. However, NCDs issued for 10 years are ‘Unsecured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will be listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can sell these bonds on the stock exchanges.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors will have the option to apply for these NCDs in physical or certificate form as well.

TDS – Interest income earned is taxable with these NCDs and the investors are required to pay tax on the interest income as per their respective tax slabs. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in SREI Infrastructure Finance NCDs?

Post the implementation of GST in July 2017, the government has reduced its rates from 28% to 18%, from 18% to 12% and from 12% to 5% on many of the items. Probably that is one of the primary reasons why GST tax collection has been below the government’s own estimates. Such shortfall in tax collection and lower than expected economic growth has put a lot of pressure on the government’s finances and thus resulted in a spike in bond yields. The benchmark 10-year G-Sec yield has jumped to 7.91% from a low of 6.1-6.2% post demonetisation.

In such a scenario, I would have liked SREI Infra to offer somewhat higher rate of interest in this issue. SREI Infra’s subsidiary, SREI Equipment Finance in its July issue offered relatively attractive rate of interest. Since then, bond yields have risen by at least 75 basis points. So, SREI Infra offering relatively lower rate of interest in a rising bond yield scenario has left me somewhat disappointed as an investor.

But, even the fixed deposit rates have been ruling at lower than satisfactory levels. In such a scenario, one should either wait for some other company to come out with its NCDs issue carrying relatively attractive rate of interest, or deploy money in short term deposits or short-term debt mutual funds. However, investors who do not want to wait for some other issue to invest their surplus money can consider investing in this issue.

Application Form – SREI Infra NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Infra NCDs, you can reach us at +91-9811797407

when is the listing dear shiv.

It should get listed early next week.

Hi Shiv,

In the current scenario opting for Secured NCD is a better option isn’t it. Your view please.

Thanks

Hi Kiran,

Though it is always preferable to opt for Secured NCDs as compared to Unsecured, it makes very little difference to me if it is Secured or Unsecured from the same company. Whenever a company defaults, it becomes difficult to recover money even for Secured bondholders. But, when a company is doing good, all bondholders keep getting money on time. The current scenario is better than it was a few years ago.

This issue appears to be oversubscribed ….?

Is there any point investing now…?

Edelweiss is offering even lesser interest rates……

Looks like a missed opportunity.

I have invested in monthly interest pay out NCD of SREI & it has never defaulted on payments.

I don’t understand the paradox in the discussion above,if the company offers higher rate of interest then the issue apparently becomes attractive(ideally it should dent the companies financial health further).

I don’t think any company is offering double digit interest rates these days.

one has to take informed decision & look out for risk reward ratio before embarking upon any investment.

for me both the NCD & stock investment of this company has been fairly rewarding till now.

regards……

Hi Rajesh,

1. The issue is still not fully subscribed based on its total issue size of Rs. 2,000 crore. It has got oversubscribed only on the basis of its base issue size of Rs. 200 crore.

2. Edelweiss Retail & SREI Infra, both are offering the same coupon rates, except for the 10 year option in which SREI NCDs carry ‘Unsecured’ status.

3. SREI Infra never defaulting on its interest payments/principal amount doesn’t guarantee anything. It is a private issuer and it could default in case of a financial meltdown. So, the investors must be compensated enough to carry that risk. But, that ‘enough’ is something which varies wildly from investor to investor. For you, 9.50% is good enough, for me even 10-11% is not enough, for somebody else even 15% is not enough.

nice information regarding NCD

Thanks Jadhao!

Can u pls confim will there be any TDS deduction if held in demat form even if interest more than 5k?

Hi Kunar,

No TDS would get deducted in case these NCDs are held in a demat form, irrespective of the amount of interest.

Any other upcoming NCD you know of & tentative date?

Hi Akash,

Edelweiss Retail Finance has already filed its prospectus with the SEBI for its Rs. 500 crore NCDs issue. Issue details & dates are yet to be announced by the company. I think it will be out in the first fortnight of March.

Hi, have you analysed the financials of SREI Infra? Is the financial health of the company sound? What is the expected debt service coverage ratio after incorporating the new debt the company’s taking on?

Kind regards,

Sameer

Hi Sameer,

Financial health of the company seems to be better than it was 2-3 years ago. But, it is still far away to be considered as healthy. Its Gross NPA and Net NPA as of December 31, 2017 stand at 3.14 and 2.19 respectively. Post this issue, its debt to equity ratio would be 5.30 (as against 4.70 at present), assuming the whole issue of Rs. 2,000 crore gets subscribed, which seems to me highly unlikely.

Hi Shiv, thanks for the numbers. A Debt equity ratio of 5.30 is OBSCENE. Even if they have an Interest Coverage Ratio of 5x (which I’m sure they dont), the number of 5.30 does not leave any margin of safety financially in case something had to go fundamentally wrong with the company.

So the issue clearly needs to be avoided. Was a little surprised you had not covered this key aspect in your initial note.

Cheers,

Sam

Hi Sameer,

The state of SREI Infra financials has been such for a long period now. But, they have not defaulted on their deposits and interest payments till now. However, I have never been a big fan of any of the private sector fixed income instruments. Moreover, I always prefer either debt instruments from the government or public sector undertakings or stocks of fundamentally sound companies from the private sector (sometimes public sector also). Had it been an equity issue, I would have covered its financials and advised accordingly.

Hi Shiv, that they have not defaulted so far does not imply that they wont default in the future.

So, if there are red flags (eg the crazy debt equity ratio in this case), you should certainly highlight them in your note. Else, there will be no difference between you and the thousands of other distributors who mindlessly broker the placement of high risk debt issuances like this one. Thats all I’m saying.

Regards,

Sameer

I agree with you point Sameer. But, it is difficult to raise each and every red flag for such issues. It is not an easy task to cover their financials for each of their issues. Even if I do that, there is a possibility that I skip certain points which could be red flags for some other reader(s). Moreover, I do not agree with you that it is such a “high risk” issue. What has never happened with a company could happen with it is something which is applicable to each and every company. Its rating agency has given it a ‘AA+’ rating. So, I think it is one’s own assessment that the issue is of high risk or investment worthy. For mindless brokers/distributors, each and every issue is a ‘Subscribe’, whether it is of SREI Infra or JP Associates or any other financially weak company.

Hi Shiv, yes, risk is in the eyes of the (bond)holder. To me, an Infrastructure Finance Company with a Debt Equity Ratio of 5.3 priced at a mere 200bps above the Sovereign Rate is an absolute “touch me not with a 10 feet pole”. To you, that may not be the case.

Good luck.

Cheers,

Sameer

That is the case with me also. That is why I never invested in any of the issues of SREI group. But, when you compare it with bank FDs or other fixed income investment options, some individual investors might be interested to look at such options having 8.75% to 9% returns. Bank FDs are currently carrying interest rates which are below the sovereign rates of respective maturities. So, there are various factors to be looked into.

Hi Shiv,

Where do we find the subscription status for this NCD? Is it published somewhere on daily basis?

Regards, CVS

Here you have the link to check the subscription status – https://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1545&type=DPI&idtype=1&status=L&IPONo=3619&startdt=2%2f9%2f2018

thank shiv for the analysis.

You are welcome Abhinav!

Thanks Shiv for posting this article finally. Was eagerly awaiting for your analysis.

A couple of queries: It mentions, 0.25% higher interest for shareholders of Srei Infra.

1) So, is there any minimum shareholding is required or someone with even one share will be eligible for additional interest?

2) Does one need to hold the share only while applying and allocation of NCDs or throughout the tenure of NCD for being eligible to earn higher interest? For example, someone sells the shares after 1 year and NCD opted duration is 5 years, so from 2nd year onwards will the additional interest will not be applicable?

Or someone buY’s share after some duration, so will the subsequent interest payments go up by 0.25%?

Thanks, CVS

Hi CVS,

1. There is no minimum shareholding requirement for 0.25% additional rate of interest.

2. As per its prospectus, you need to be a shareholder on the record date for the additional 0.25% interest.

Thank you Shiv for prompt response.

Record date in that case is the record date of the allotment of NCD OR record date for the payment of interest (monthly/annual)?

As per the below line in the prospectus, it seems both the conditions applicable (“… on Deemed Date of Allocation… … … held by the Investors on the relevant Record Date applicable for payment of respective coupon…”).

The prospectus says – “Investors in the proposed NCD who fall under Category III and who are holder of NCD(s)/Bond(s) previously issued by our Company and/or Srei Equipment Finance Limited

(“SEFL”), in past public issues of NCD and/ or are equity shareholder(s) of our Company (“SIFL”) and/or are Senior Citizens and/or are Employees of Srei Group, on Deemed Date

of Allotment and who have subscribed for Series III NCDs and/or Series IV NCDs and/or Series VI NCDs and/or Series VII NCDs and/or Series IX NCDs and/or Series X NCDs

shall be eligible for additional incentive of 0.25% p.a. provided the NCDs issued under the Proposed Tranche 1 Issue, are held by the Investors on the relevant Record Date

applicable for payment of respective coupon in respect of Series III, Series IV, Series VI, Series VII, Series IX and/or Series XNCDs.

So, it is little confusing here.

Regards, CVS

Hi CVS,

It seems to me that only the record date for the payment of interest is applicable for this additional 0.25% coupon. I’ll just update this info above in the post.