This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Edelweiss Retail Finance Limited, a company acquired by Edelcap Securities in 2012, is launching its public issue of secured and redeemable non-convertible debentures (NCDs) from the coming Wednesday, March 7. The issue will offer an effective yield of 9.25% for 10 years, 9% for 5 years and 8.75% for a period of 3 years from deemed date of allotment with monthly and annual interest payment options. The issue is scheduled to remain open till March 22, unless the company decides to close it prematurely due to oversubscription or due to any other reason mentioned in its offer document.

Size & Objective of the Issue – Edelweiss Retail plans to raise Rs. 500 crore from this issue, including the green shoe option of Rs. 250 crore. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

Coupon Rate & Tenor of the Issue – The company has decided to issue its NCDs for a duration of 3 years, 5 years and 10 years. For 3 years, the company is offering 8.75% p.a. payable annually and 8.42% p.a. payable monthly. For 5 years, the coupon rates are 8.65% p.a. and 9% p.a. and for 10 years, these rates are 8.88% p.a. and 9.25% p.a. respectively.

Minimum Investment – Investors need to apply for a minimum of ten bonds of Rs. 1,000 face value in this issue i.e. an investment of Rs. 10,000 at least.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 100 crore

Category II – Non-Institutional Investors – 10% of the issue i.e. Rs. 50 crore

Category III – High Networth Individuals (HNIs) – 20% of the issue i.e. Rs. 100 crore

Category IV – Retail Individual Investors & HUFs – 50% of the issue i.e. Rs. 250 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CRISIL and ICRA have rated this issue as ‘AA’ with a ‘Stable’ outlook. As mentioned above, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these bonds on the exchanges. The company too does not have the option to ‘Call’ these NCDs during the tenure of these NCDs for which they are issued.

Demat & TDS – Demat account is not mandatory to invest in these bonds as the investors have the option to apply these NCDs in physical form as well. Also, though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS.

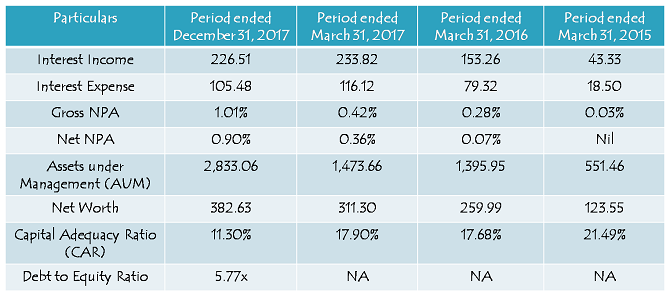

Financials of Edelweiss Retail Finance Limited

(Note: Figures are in Rs. Crore, except percentage figures & Debt to Equity Ratio)

Should you invest in Edelweiss Retail Finance NCDs?

Like I expressed my views about SREI Infrastructure Finance NCDs last week, for this issue too, I think the interest rates on offer fall at least 50 basis points (or 0.50% p.a.) short of my expectations. Despite of the fact that the interest rates this issue is carrying are still higher than almost all of the bank fixed deposits, these rates are not attractive enough for me to put my money in these NCDs. In a rising interest rate scenario, these companies should have offered higher rates in order to compensate higher risk they carry and also to make up for higher expected rates in future.

But, in the absence of a better alternate investment option, where should we invest our money? If you think that the worst of demonetisation and GST implementation is behind us and our macroeconomic numbers will improve from hereon, then probably it is time that we should move our money to either medium-term debt funds or long-term gilt funds. However, if you have a view that our economic recovery is still somewhat far from the desired levels, then it would be better to stay invested in short term funds, liquid funds or bank FDs.

However, investors, with an appetite to absorb somewhat higher risk and who have a view that the bond yields have peaked in the short term, can consider investing in this issue, but only for 3 years or 5 years. Investing for 10 years with a private issuer should be best avoided.

Application Form – Edelweiss Retail Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Edelweiss Retail Finance NCDs, you can reach us at +91-9811797407

FYI – Upcoming NCD – April 9, 2018 – From MUTHOOT FINANCE LIMITED

Received the following email:

Dear Sir,

Our next Non-Convertible Debenture ( NCD) in D Mat form will open on 9th April 2018. Our earlier two NCD s were oversubscribed on the same day.

This is yet another opportunity for our esteemed customers to invest in the Company . Please note that the “Subscription to NCD will be accepted only by Crossed /Account Payee cheque or Bank Draft favouring “ESCROW ACCOUNT MUTHOOT FINANCE NCD PUBLIC ISSUE”. MUTHOOT FINANCE LTD .

Please await announcement in the print media and read the prospectus for further details before investing.

Regards

General Manager

MOHAN CHANDRAN

Muthoot Finance Ltd

Head Office

Kochi

To unsubscribe, please click here.

Muthoot Finance LTD

Muthoot corporate office,Kurians tower,Opp Saritha theater complex,banerji road,Cochin,pin 682018

pls inform us the listing date and ISINs no. it will be helpful.

is the issue closed?? and when it is the listing

Hi Abhinav,

The issue is still open, but getting closed today 5 p.m.

will subscribe to both the issue. both r good and credible management.

Sure, thanks for sharing your views!

Any TAX FREE BONDS are expected in the near future?

Hi S.K.,

The government has no plans to allow tax free bonds in the near future.

Srei ncd rating AA+ vs erfl ncd AA . Which is good in terms of credit rating ?

‘AA+’ rating is always better than ‘AA’, as per rating methodology.

By offering lower interest with lower credit rating do you think edelweiss has damaged goodwill in the mind of retail investor??

1) Is there any further ncd issue coming??

2) do you expectPPF Rate for next quarter cross 8% as bond yield up??

Hi Vishal,

1. No info of any other NCD issue coming in the near future.

2. I don’t think so. PPF rates are already fixed at a higher rate (as per the formula they use). They might up these rates closer to the state/centre elections later this year or early next year.

Hello Shiv,

Thanks for posting this article. I have couple of questions on your below information.

“” then probably it is time that we should move our money to either medium-term debt funds or long-term gilt funds. However, if you have a view that our economic recovery is still somewhat far from the desired levels, then it would be better to stay invested in short term funds, liquid funds or bank FDs. “”

Can you please help us to understand below –

1. Why one should put his/her money in short term funds, liquid funds or bank FDs Vs this NCD, as there is almost 2.5% difference with current bank FDs rates Vs this NCD interest rates ?

2. Why long term debt funds are giving -ve returns since last 6 months, if most of these funds are investing in debt funds (may be in long term debt) then also why there returns becomes -ve as compared to ultra short term debt fund ?

3. Considering the above point why one should not use ultra short term debt fund also for long terms, why its been said that use ultra short term fund for 1-2 years only ?

Thank you in advance !

KK

Hi KK,

Here are my responses:

1. If our economic recovery is still far from now, then it would put more burden on our fiscal deficit, which would result in bond yields going up & bond prices going down. In that case, upcoming NCDs or even bank FDs would yield higher. Short-term funds, liquid funds & bank FDs are for a shorter investment period.

2. Bcoz bond yields are rising. When bond yields rise, bond prices go down.

3. Ultra short-term funds are for 1-6 months period only, not even for 12-24 months. One should not invest in ultra short-term debt funds for long term as these funds ‘normally’ yield lower in the long term. When bond yields go down, long duration debt/gilt funds give returns in double digits.

Thank you Shiv !

1. What do you think for next one year, do you think bond yield will go up for next one year and hence the FD rates ?

2. Regarding the long term debt, I noticed that since 2014 bond yield is going down, which is in favor of long term debt fund but then also their 5 year average return was 7.5 %, I used SBI Dynamic Bond Fund (G) as an example but on the other side Ultra short term debt funds have provided 5 years average return as 8.7%, I used ICICI Prudential Flexible Income Plan (G) as an example here, so I am not clear as why one should not use these Ultra short term debt funds for long time.

Please suggest.. Thank you once again !

Thanks KK,

1. I think the FD rates will definitely go up. But, the bond yields should not go up much from here, rather it could go down as well if the economy does better than expected and the government is able to contain its fiscal deficit, which looks difficult in the current scenario.

2. The problem with many of the long-term debt/gilt funds is that they try to play an active role in bond trading and then take wrong calls, like a normal retail investor. Moreover, long-term debt/gilt funds were doing extremely well before & after demonetization and giving returns in double digits. But, when the fiscal situation turned bad, they started making losses. So, one should invest in long term debt/gilt funds when the bond yields are high and the situation looks scary. But, when the bond yields are expected to move higher, one should invest in short term/liquid funds.

Ok..Thank you Shiv !!

You are welcome!

Thank you, Mr. Kukreja. Suggest that STARS Rating be displayed on the following parameters at least for convenient understanding.

-Safety

-Liquidity

– Return on Investment

Thanks S.K.!

Didn’t get you regarding STARS Rating.

I mean to say, just like how movies, restaurants, are reviewed & finally at the end a star rating is indicated.

5 stars indicating BEST grade

1 Star meaning LOWEST grade.

Sir, This article is very informative and delineates the present scenario. Thanks for posting this article.

Thanks Mr. Subramaniam for your kind words!