This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

DHFL, or Dewan Housing Finance Limited, is coming out with its issue of Non-Convertible Debentures (NCDs) from the coming Tuesday i.e. May 22, 2018. These NCDs will carry coupon rates in the range of 8.56% to 9.10%, resulting in an effective yield of 8.90% to 9.10% for the retail individual investors.

DHFL plans to raise Rs. 12,000 crore from this issue, including the green shoe option of Rs. 9,000 crore. The issue will remain open for 2 weeks and is scheduled to close on June 4, unless the company decides to foreclose it.

Before we take a decision whether to invest in this issue or not, let us first check the salient features of this issue.

Size & Objective of the Issue – Base size of the issue is Rs. 3,000 crore, with an option to retain oversubscription of an additional Rs. 9,000 crore, making the total issue size to be Rs. 12,000 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 25% of the issue i.e. Rs. 3,000 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 1,200 crore

Category III – High Net Worth Individuals (HNIs) investing more than Rs. 10 lakh, including HUFs – 30% of the issue is reserved i.e. Rs. 3,600 crore

Category IV – Resident Indian Individuals investing up to Rs. 10 lakh, including HUFs – 35% of the issue is reserved i.e. Rs. 4,200 crore

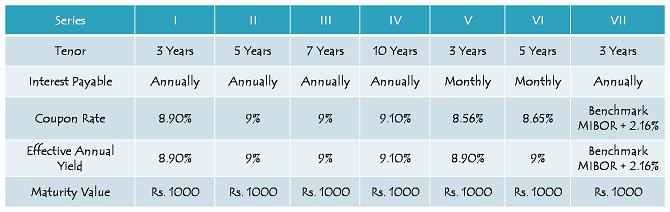

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 8.90% p.a. for a period of 3 years, 9% p.a. for 5 years and 7 years and 9.10% p.a. for 10 years. These rates are applicable for annual interest rate payment only. Monthly interest payment option is available only with 3 years and 5 years tenors, and coupon rates for these periods have been fixed at 8.56% p.a. and 8.65% p.a. respectively.

Additional 0.10% Coupon for Senior Citizens – Category III and Category IV investors, who are senior citizens on the deemed date of allotment, will be eligible for an additional 0.10% interest rate provided they hold these NCDs on the record date for the purpose of interest payment.

One-Time Additional Incentive on Maturity – Category III and Category IV initial allottees will be paid a one-time additional incentive of 0.50% for the 5-year annual as well monthly interest payment options, 0.70% for the 7-year option and 1% for the 10-year option. This incentive will be paid at the time of maturity and only to those investors who hold these NCDs throughout their respective duration. No such incentive will be paid with the 3-year interest payment options.

MIBOR Linked Floating Interest Rate – Like its previous issue, DHFL has decided to offer an option to have floating interest rate with these NCDs. The specified spread will be 2.16% p.a. over and above the benchmark MIBOR for all the categories of investors. Benchmark MIBOR will be computed on an annualized basis, based on the Reference Overnight MIBOR published by Financial Benchmark India Pvt. Ltd. (FBIL), and it will be reset once every year in the second and third year.

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AAA’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the national exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these NCDs on the stock exchanges. There is no option either with the company to ‘Call’ these NCDs prematurely.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors will have the option to apply for these NCDs in physical or certificate form as well.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in a demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return.

Should you invest in DHFL NCDs?

Bond yields have been rising for the last 12-18 months, and that too, at an unusually fast speed. Benchmark 10-year government bond yield is currently trading very close to 7.90% levels, while it touched a low of around 6.10% during demonetization period.

In August 2016, when the bond yields were trading between 6.70% to 7%, DHFL issued its NCDs with coupon rates ranging between 8.83% to 9.30% and the issue got oversubscribed to the tune of 4.70 times on the first day itself. Encouraged by such an extraordinary response, DHFL came out with its second tranche of a bigger size a few days later, and that too got oversubscribed 1.26 times on Day 1.

Going by that experience, I think this issue should also get oversubscribed much before its official closing date. But, despite of the fact that the bond yields have risen by around 2% since demonetization, it is somewhat disappointing to have coupon rates on offer even lower than its August 2016 issues.

The current NDA government is about to complete its 4-year term and I expect both equity markets as well as bond markets to exhibit a lot of volatility in the next 1-2 years. Given such a scenario, I think it is time the passive or risk-averse investors should park their money in safer investment instruments. These NCDs too are relatively safer carrying ‘AAA’ rating, except for the fact that DHFL is a private issuer.

Coupon rates of 8.56% to 9.10% do not attract me much, despite the issue being rated ‘AAA’. I would rather prefer to invest in debt mutual funds, hoping bond yields to fall once the economy stabilizes post next year’s elections. However, investors, who are not required to pay any tax on their annual taxable income or who fall in the 10% tax bracket, can consider investing in these NCDs for a period of 3 years or max 5 years. As expressed earlier as well, I personally avoid longer term investment periods with private companies, so would advise my clients to avoid longer period investments in such NCDs.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. To invest in these NCDs, bidding of your application form or any further info, you may contact us at +919811797407

This issue stands closed on May 24.

Last Day (May 24) Subscription Figures:

Category I – 7,619.29 crore as against Rs. 3,000 crore reserved – 2.54 times subscribed

Category II – Rs. 299.30 crore as against Rs. 1,200 crore reserved – 0.25 times

Category III – Rs. 2,242.03 crore as against Rs. 3,600 crore reserved – 0.62 times

Category IV – Rs. 865.72 crore as against Rs. 4,200 crore reserved –

Total Subscription – Rs. 11,026.35 crore as against total issue size of Rs. 12,000 crore – 0.92 times subscribed

Could you kindly share the latest subscription figures please.

Hi Shiv,

If the probability of rate hike is high do u recommend that one should go for MIBOR linked bonds.

Current MIBOR rate= 6.1% + markup of 2.16% will give 8.26% and with the expectation of 2 rate hikes (50 bps each) in this year will fetch 9.26% higher than 8.9%, do u think this will be a better option than the pure vanilla series 1 having 3 years maturity.

Thnx in advance.

Hi Krunal,

I have a view that interest rates should go down here in India in the medium to long term. The primary risk in my view is the change in the guard at the centre.

latest subscription figures please

jm financial credit ncd 2018 AA 9.75% annually and 9.34% monthly opening on 28 may and cumlative 9.24% 3 years 2 months

Nitesh, Thanks for the info on upcoming NCDs!!

I am a retired person from a private organization. I’m fully depends on internet to run my family as have no other sources of income. Do you advise me to invest in this NCD. If so please advise the period and how to apply .

Regards.

Sincerely

Rana Chakraborty

if i invest 100000 for 10 years 9.10 coupon rate then what princple i would get after adding 1% incentive 110000 or 101000 please clear my doubt shiv

Hi Nitesh,

It would be Rs. 1,01,000.

Dear Shiv,

I think you have taken a very balanced view on this issue with respect to coupon rate, rating, and risk. One must explore other options before plunging into it.

I personally feel that Company is trying to collect huge amount of money in a short period and trying to grow too fast, but will they be able to defy law of nature.

Can retired people, esp. those who are above 65-70, take risk. If something goes wrong, they may not see their money coming back to them!

What is your view.

Thanks Mahesh!

I think risk appetite does not depend on age only, there are other factors also. If one has enough financial/real assets and his/her liabilities are limited, then risk appetite is above average. But yes, if somebody has greater amount of liabilities and limited assets, then his/her risk appetite is below average even if the investor is younger. I think an investor should invest in equities if he/she is willing to take risk, rather than investing in fixed income products of a private company.

Well said.

Whether TDS would be deducted in case of investment made in physical form

Hi Anurag,

Yes, 10% TDS would be applicable if the interest amount exceeds Rs. 5000 in a financial year.

https://www.google.co.in/amp/s/m.timesofindia.com/business/india-business/dhfl-to-pay-1-extra-on-some-ncds/amp_articleshow/64212761.cms

Hi Vishal,

I have updated the post above with the relevant info. I somehow missed it in the product note. Thanks for pointing it out.

1) could you advice fixed rate or floating rate is good in 3 year time.

2) is there any loyalty 1% extra in 5 year

Hi Vishal,

1. Fixed or floating rate choice depends on your view about inflation, oil prices, fiscal deficit and interest rates going forward. If you think all these would be considerably higher for the next 2-3 years, then it makes sense to go for the floating rate option.

2. No, I don’t think there is any loyalty 1% additional rate with these NCDs.

Hi Shiv,

I think you have missed the following point from the prospectus:

Category III and Category IV Investors in the proposed Tranche 1 Issue who are senior citizens on the Deemed Date of Allotment shall be eligible for an additional incentive of 0.10% p.a. provided the NCDs issued under the proposed Tranche 1 Issue are continued to be held by such investors under Category III and Category IV on the relevant Record Date applicable for payment of respective coupons. This incentive shall be applicable on an amount not exceeding initial subscription amount.

Category III and Category IV Investors in the proposed Tranche 1 Issue, who are intial allottees as on the Deemed Date of Allotment, shall be eligible for a one-time additional incentive of 0.50%, 0.70%, 1.00% and 0.50% for Series II, Series III, Series IV and Series VI respectively, payable along with last interest payment, provided the NCDs under Series II, Series III, Series IV and Series VI, as applicable, are held by such investors under Category III and Category IV on the relevant Record Date, for all interest payments including the last interest payment. This incentive shall be applicable on an amount not exceeding initial subscription amount.

Thanks Amod!

Could you please clarify who is a Retail Investor & who will be classified as HNI? Are these NCD’s secured & safe?

Hi S.K.,

1. Investors investing up to Rs. 10 lakh qualify as Retail Investors (Category IV). Investors investing more than Rs. 10 lakh qualify as HNIs (Category III).

2. Yes, these NCDs are ‘Secred’ in nature.