This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Edelweiss Financial Services Limited is going to launch its public issue of secured and redeemable non-convertible debentures (NCDs) from January 3 i.e. the coming Tuesday. The company expects to raise around Rs. 200-400 crore from the issue.

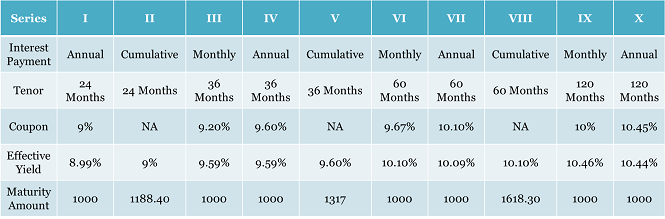

It is going to offer interest rates between 9% to 10.45% per annum, with maturity periods ranging between 24 months to 120 months. The issue will remain open till January 23.

Salient features of the issue:

Size & Objective of the Issue – Edelweiss expects to raise Rs. 400 crore from this issue, including the green-shoe option of Rs. 200 crore. The company plans to use at least 75% of the proceeds for the repayment or prepayment of interest and principal of its existing loans and the remaining proceeds for other general corporate purposes.

Tenors & Coupon Rates on Offer – Edelweiss has decided to issue these NCDs for a duration of 24, 36, 60 and 120 months. The company is offering interest rates in the range of 9% to 10.45% per annum, with interest payable monthly, annually and on a cumulative basis.

Higher Coupon Rate for Edelweiss Shareholders or NCD/Bond holders – Edelweiss has also decided to offer an additional 0.20% p.a. to the shareholders of the company and/or the holders of the NCDs/bonds issued by any of its subsidiaries including ECL Finance Limited, Nuvama Wealth & Investment Limited, Edelweiss Housing Finance Limited, Edelweiss Retail Finance Limited and Nuvama Wealth Finance Limited. So, even if you hold one equity share of Edelweiss or an NCD of any of the asssociate companies, you will get this additional rate of interest.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 10% of the issue

Category II – Non-Institutional Investors – 10% of the issue

Category III – High Networth Individuals (HNIs), including HUFs, investing more than Rs. 10 lakhs – 40% of the issue

Category IV – Retail Individual Investors, including HUFs, investing Rs. 10 lakhs or less – 40% of the issue

NCDs will be allotted on a first-come first-served basis.

NRI Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Rating of the Issue – These NCDs have been rated “CRISIL AA-/Negative” by CRISIL Ratings for Rs. 100 crore of the issue and “ACUITE AA-/Negative” by Acuite Ratings & Research for Rs. 100 crore of the issue.

Demat & TDS – Demat account is mandatory to invest in these bonds, so the investors will not have the option to apply these NCDs in physical form. Also, the interest income would be taxable with these bonds. However, NCDs taken in demat form will not attract any TDS.

Listing, Premature Withdrawal & Put/Call Option – The company is going to get its NCDs listed on the Bombay Stock Exchange (BSE) within six working days from the date of issue closure. The investors will not have the option to redeem these bonds back to the company before the maturity period gets over, but they can always sell these bonds on the stock exchange anytime they want. However, liquidity remains an area of concern with such NCDs.

There is neither any put option with the investors of these bonds nor there is a call option with the company to pay back early.

Minimum Investment – The investors will be required to apply for at least 10 NCDs in this issue which makes it a minimum investment of Rs. 10,000.

Registrar – KFin Technologies Limited has been appointed as Registrar to the issue.

Application Form of Edelweiss Financial Services Limited NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Edelweiss Financial Services Limited NCDs, you can contact us at +919811797407