Month: May 2012

Below are all the posts archived for the month.

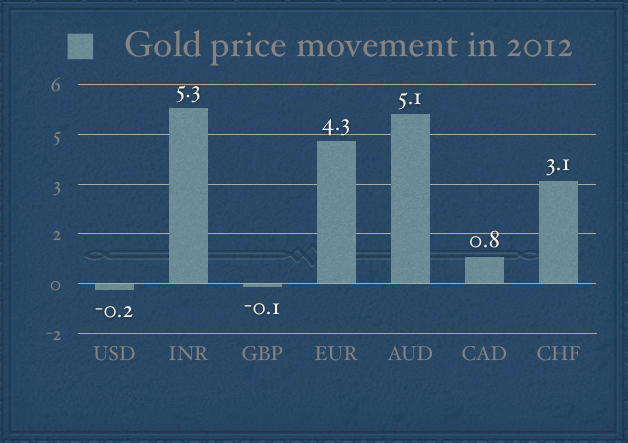

The role of exchange rates in gold prices

in Economy, Featured

You don’t think about currency exchange rates when you are buying gold because the two are generally not talked about together, and most people buying jewelery would perhaps be surprised to hear that the exchange rate has any bearing on gold prices at all. However since India, and much of the rest of the world

Continue reading

Where would you invest if you had only three options?

in Opinion

A friend of mine asked for some good investment ideas, but he put the condition that I give him just three options. He didn’t want an information overload and certainly didn’t want to deal with any more jargon than he had to. With that in mind, these are the three things I told him to

Continue reading

Ted Talk: Joshua Foer Feats of Memory Anyone Can Do

in Books

I reviewed the Classic Guide to Improving Your Memory in July last year, and while I had no doubt that the techniques in the book work I never got in the habit of using them and had all but forgotten about the it until a few days ago. Then I chanced upon this Ted Talk

Continue reading

What is Balance of Payments (BoP)?

in Economy

Balance of Payments (BoP) is an account of the international transactions of a country, and shows how the country is faring in trade, attracting capital from abroad, and the effect of that on its foreign exchange reserves. The budget website has a BoP document and that contains the components of the BoP and understanding the

Continue reading

You don’t need to buy a children’s plan to invest for your children

in Opinion

I feel that investing is a lot more about emotions than it is about numbers, and it becomes even more emotionally charged when you think about investing for your children. I regularly get emails about investing for children and there are two common things about all such emails. The first one is the use of

Continue reading

The Rs. 7.50 Petrol Price Hike and India’s Vicious Cycle

in Economy

The big news today is the massive Rs. 7.50 petrol price hike and with this, petrol prices have crossed Rs. 73.00 per liter in all the metros with Bangalore being the worst at over Rs. 81.00. Theoretically, oil market companies have hiked the prices and not the government since petrol prices are “deregulated” but no

Continue reading

Factors to keep in mind while deciding whether to invest in a company fixed deposit or not

in Fixed Deposits

Last week I wrote about the two big ideas that you should keep in mind while investing in corporate bonds, and this week I’m going to build on that post and write about some factors that will help you build a negative list of companies that you should avoid buying fixed deposits in. My assumption

Continue reading

What is the difference between basic and diluted EPS?

in Investments, Reader Suggestions

The P/E multiple or the Price / Earning ratio is probably cited more than any other when it comes to financial numbers. The EPS (Earnings Per Share) is one of two inputs of the P/E ratio and companies have to report two types of EPS numbers – Basic EPS and Diluted EPS. Basic EPS is

Continue reading

Rupee slide is a symptom, not a problem

in Economy

As the Rupee hits new all time lows against the Dollar, it is natural to look for ways to arrest this slide and look for solutions to this problem. The problem however is the not the Rupee slide itself – the fall in the Rupee is the symptom of underlying problems and you have to

Continue reading

Facebook, Grexit and Investing Wisdom

in Links

The big news today is that Facebook barely traded above its listing price and had it not been for the bankers behind the issue, the stock would have surely ended the day in discount. This probably doesn’t bode well for the future but then with the market you never know. There were a number of

Continue reading

Two big things to keep in mind while investing in company fixed deposits

in Investments

Rakesh had a comment on what parameters should be checked before investing in a company’s fixed deposit, and when investing in fixed income there are two big things that you should keep in mind, and I’m going to talk about them first before getting down to specific parameters in a subsequent post. Investing too much

Continue reading

How can the government carry out disinvestment through ETFs?

in Economy

I read an interesting article about the possibility of the government taking the ETF route to carry out disinvestment, and that can be a novel way to carry out disinvestment because the government did pathetically last year as far as disinvestment is concerned and things haven’t improved much since that time so it won’t be

Continue reading