Month: October 2013

Below are all the posts archived for the month.

RBI’s Monetary Policy Review – October 2013

in Economy

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in Infosys did it a few days back, now it was the turn of Dr. Raghuram Rajan. I mean both had made people to have low expectations

Continue reading

Use Balanced Funds to Start Out Investing

in Investments

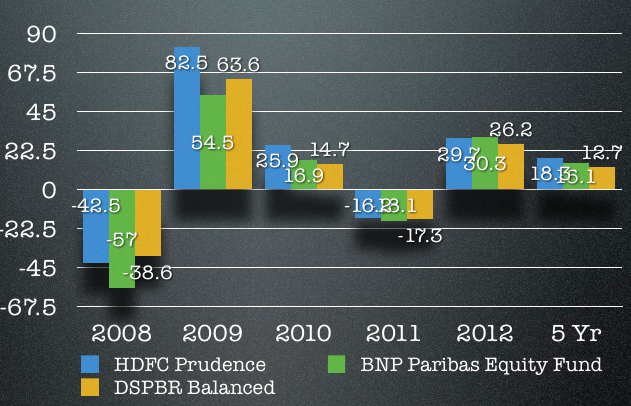

Chethan tweeted out to me asking about ETFs versus mutual funds sometime last week, and I said that I preferred ETFs but if he is just starting out building a portfolio then he should take a look at balanced mutual funds as well. Balanced mutual funds have a little more than 65% in equity and

Continue reading

On doing nothing

in Opinion

The US government shutdown has finally ended and it was interesting to see that the S&P 500 was actually up by about 3% in October which roughly overlaps the time this circus lasted. I was watching these events closely from an investment perspective because I have a lot more money invested in the American markets

Continue reading

Comparative Analysis – PFC 8.92% vs. NHPC 8.92% – which tax-free bonds issue is better to invest?

in Investments

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in Two power sector companies are inviting your applications for their tax-free bonds – PFC 8.92% bond issue is already open, the issue size is Rs. 3,875.90

Continue reading

NHPC 8.92% Tax-Free Bonds – October 2013 Issue

in Investments

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in NHPC Limited (formerly National Hydroelectric Power Corporation) will launch its issue of tax-free bonds from October 18th, the coming Friday. Coupon rates of NHPC are absolutely same as they

Continue reading

Cost of a car in Singapore which costs Rs. 775,000 here in India – Shockingly Very High at Rs. 7,000,000

in World

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in Wish you all a Happy Dussehra! Festive season has started here in India and though somewhat muted, usual festival activities are up and running now. People

Continue reading

PFC 8.92% Tax-Free Bonds – October 2013 Issue

in Investments

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in ‘AAA’ rated REC issue offered 8.71% to its investors, ‘AA+’ rated HUDCO issue fixed it at 8.76% and then ‘AAA’ rated IIFCL issue managed to cross

Continue reading

Weekend links – 10/4/2013

in Links

Let’s start this week with a great article in the Economist about America’s shutdown, and how that’s no way to run a country. Washington Post on how Australia once had a shutdown similar to the US, and the surprising consequences of that. Abheek Barua has a highly instructive, if somewhat technical op-ed on India’s monetary

Continue reading

Primer on US Government Shutdown

in Economy

The American government shutdown will probably cover the next few news cycles unless something very big happens, or it gets resolved very quickly, and in this post I’m going to give a quick primer on what this shutdown actually means. What does the government shut down Mean? The US federal government employs more than 2 million

Continue reading

IIFCL 8.75% Tax-Free Bonds – October 2013 Tranche-I Issue

in Investments

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in After REC 8.71% issue and HUDCO 8.76% issue, India Infrastructure Finance Company Limited (IIFCL) would be the third such company to come up with its public

Continue reading