This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

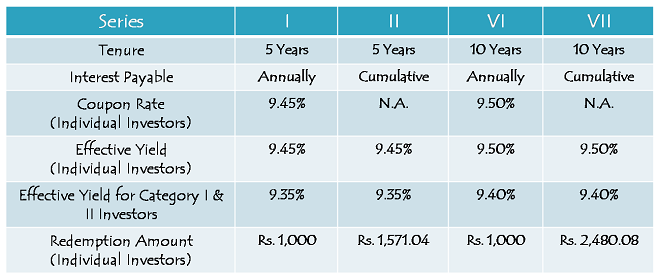

IFCI yesterday launched its second public issue of non-convertible debentures (NCDs). The issue carries annual interest rate of 9.50% for 10 years and 9.45% for 5 years, which is 50 basis points lower than its last public issue of October 2014. IFCI plans to raise Rs. 250 crore in this issue with an option to retain oversubscription up to the residual shelf limit of Rs. 790.81 crore.

IFCI has decided to issue these NCDs for a period of 5 years and 10 years only. Last time it had the option of 7 years as well. The company has also decided not to offer the monthly interest payment option this time around. Last time IFCI offered monthly interest payment option with its 5 year maturity period. The issue is scheduled to remain open for over a month to close on February 4th.

Categories of Investors & Allocation Ratio – The investors would be classified in the following four categories and each category will have the following percentage fixed during the allotment process:

Category I – Institutional Investors – 25% of the issue size is reserved

Category II – Domestic Corporates – 25% of the issue size is reserved

Category III – High Networth Individuals including HUFs – 25% of the issue size is reserved

Category IV – Retail Individual Investors including HUFs – 25% of the issue size is reserved

Allotment will be made on a first-come first-served (FCFS) basis.

Coupon Rates for Category I & II Investors – Like last time, IFCI has kept the differential between the coupon rates offered to the individual investors and non-individual investors as 0.10% only. I think this move would again make these NCDs more attractive to the non-individual investors as compared to the retail investors.

NRI Investment Not Allowed – Foreign investors, including foreign nationals and non-resident Indians (NRIs), are not allowed to invest in this issue.

Credit Rating & Nature of NCDs – While Brickwork Ratings has assigned a credit rating of ‘AA-’ to the issue with a ‘Stable’ outlook, ICRA has given it a credit rating of ‘A’ again with a ‘Stable’ outlook. Moreover, these NCDs are ‘Secured’ in nature and in case of any default in payment, the investors will have the right to claim their money against certain receivables of IFCI.

Minimum Investment – These NCDs carry a face value of Rs. 1,000 and one needs to apply for a minimum of 10 NCDs, thus making Rs. 10,000 as the minimum investment to be made.

Maximum Investment – Like the last time, IFCI has kept Rs. 2 lakhs as the maximum amount one can invest in the retail investors category. Individual investors investing more than Rs. 2 lakhs will be categorised as high networth individuals and there is no such cap on the investment amount for such investors.

Allotment in Demat/Physical Form – Investors will have the option to get these NCDs allotted either in demat form or physical form as per their choice.

Listing – These NCDs will get listed on both the stock exchanges, Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), within 12 working days from the closing date of the issue.

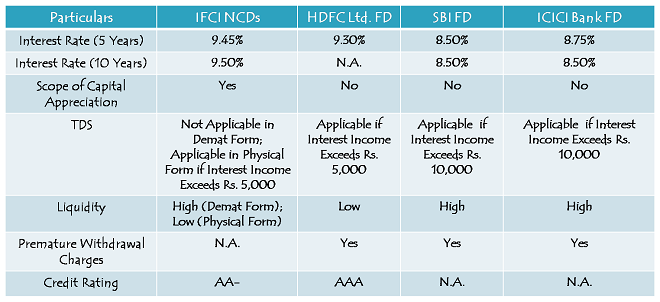

Taxation & TDS – Interest earned on these NCDs will be taxable as per the tax slab of the investor and tax will be deducted at source if NCDs are taken in physical form and the interest amount exceeds Rs. 5,000 in any of the financial years. However, there will be no TDS on NCDs taken in a demat form.

Moreover, if these NCDs are sold after holding for more than 12 months, the investor is liable to pay long term capital gain (LTCG) tax at a flat rate of 10%. However, if sold prior to the completion of 12 months, short term capital gain (STCG) tax is applicable at the slab rate of the investor.

Interest Payment Date – Again, IFCI has not fixed any date in advance for the purpose of its annual interest payment and that is why its first due interest will be paid exactly one year after the deemed date of allotment.

Interest on Application Money & Refund – IFCI will pay interest to the successful allottees on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment, at the applicable coupon rates. However, unsuccessful allottees will be paid interest @ 4% per annum on their money liable to be refunded.

Premature redemption & Call Option – IFCI will not entertain any request for redemption before the maturity period gets over. Investors will have to sell these NCDs on the stock exchanges to liquidate their investments. IFCI too will not carry any option to call these NCDs for redemption before their maturity.

IFCI NCDs vs. Bank Fixed Deposits vs. Company Fixed Deposit

Should you subscribe to IFCI NCDs?

These were my views when its last issue came in October – “With CPI as well as WPI inflation falling sharply, Brent crude prices declining from $114 per barrel to $84-85 per barrel, commodity prices also correcting substantially and 10-year Indian G-Sec yield falling from 9%+ to 8.39%, I think the interest rates should still head lower going forward. In the present macroeconomic scenario, it makes sense to subscribe to these NCDs. Long term investors in the 30% tax bracket will do well to invest either in debt mutual funds or explore tax-free bonds from the secondary markets.”

Inflation has fallen further, both CPI as well as WPI. Crude prices have also fallen further with Brent crude trading at $57.33 per barrel as I write. Though the 10-year Indian G-Sec yield has also come down sharply to 7.88% from 8.39% earlier, I think the pace of fall should get slowed down now.

Though I think there is still some more room left for the deposit rates to fall, especially the bank deposit rates, I think the rates offered by IFCI this time are less attractive to me as compared to the last time, which is natural as well. If you are able to buy its previous issue’s NCDs from the secondary markets at a relatively reasonable cost, then you should avoid this issue. If you face difficulty in doing so, then you should still subscribe to these NCDs for your medium to long term investment. Long term investors in the 30% tax bracket would still do well to invest either in debt mutual funds or tax free bonds.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IFCI NCDs, you can contact me at +919811797407

Hi,

Since IFCI bonds/ncds are available at high yields these days in the secondary markets, just wanted to get your view on the default risks, if any, especially for the near term (1-2 years) maturities.

Thanks in advance!

go green infra bonds from yes bank how can we invest details please

Yes Bank’s ‘Green’ Infrastructure Bonds are not available for the retail investments. These bonds are getting issued for 10 years with sub 9% rate of interest.

yes bank green infra bonds how aretai invester can invest details please

Hi Shiv,

I have tax free bonds that I am keeping from last 2 years. They are getting sold at premium now in secondary market. If I sell them now in secondary market. Do I need to pay 30% tax (I am in higher Tax slab) or 10% Tax as LTCG. I am confused after 2014 budgets wherein FM told that all debt funds have to be kept for 3 years to take advantage of LTCG. Does selling of Tax free bonds fall in that category.

Regards

Dinesh

Hi Dinesh,

LTCG tax on tax free bonds is still charged at flat 10% and the changes made in last year’s budget are not applicable on these listed bonds.

Edelweiss group company, ECL Finance Limited, has filed a draft prospectus to launch an issue of secured NCDs to the tune of Rs. 800 crore. The issue is expected to open for subscription in 7-10 days.

Has the allottment started?

I’ve not received any intimation as yet.

Any updates on SREI Infrastructure bonds? Thanks!

As of now, we don’t have any info about it.

Can we ge the latest subscription figures please. thanks.

Subscription Figures as on January 16:

Category I – Rs. 8.87 crore as against Rs. 197.70 crore reserved

Category II – Rs. 40.93 crore as against Rs. 197.70 crore reserved

Category III – Rs. 11.19 crore as against Rs. 197.70 crore reserved

Category IV – Rs. 14.19 crore as against Rs. 197.70 crore reserved

Total Subscription – Rs. 75.18 crore as against total issue size of Rs. 790.81 crore

Hi Shiv,

Could you please provide latest subscription figures…thanks

Subscription Figures as on January 13:

Category I – Rs. 5.87 crore as against Rs. 197.70 crore reserved

Category II – Rs. 27.83 crore as against Rs. 197.70 crore reserved

Category III – Rs. 10.42 crore as against Rs. 197.70 crore reserved

Category IV – Rs. 12.39 crore as against Rs. 197.70 crore reserved

Total Subscription – Rs. 56.51 crore as against total issue size of Rs. 790.81 crore

Dear Mr Shiv.

hudco 9.01% Interest Record Date was 29-12-14

prices came down 26-12-14 due to EX-Rate. I sold

my holding on 29-12-14 and bonds were withdrawn from

my DP same date by my broker. Hudco is saying i dont

have any holding on record date 29-12-14 so no interest.

what should be done ?

Hi Mr. Agarwal,

I think it is a sorry situation for an investor to have lost both the interest payment as well as the capital gain. If you think you can justify your claim of getting the interest amount, you should take this matter to the Registrar or SEBI.

Thanks Shiv!!

You are welcome!

Shiv..i believe this is a good investment avenue to park ur funds… ..buy people are not yet out of the UTI debacle…so how to make ppl invest in these NCD’s…as they are still of the view that these governemnt and corporate borrowers will leave u them in lurch when it will come to repay their

principal…leave interest…!!!!,

Priyanka, UTI debacle happened due to equity market crash. Those UTI schemes got launched when the markets were peaking and investors panicked as the value gone down 60-70%. But, as the UTI was a government vehicle, people got their investments back with a reasonably lower return as well. Had it been a private fund, people would have lost a majority part of their investment.

I think IFCI NCDs are no ways a bad investment, I mean it is a good investment and I don’t think there is any risk as such with your principal investment or interest payments.

Hi Shiv..Happy new year !!

I wanna ask why these Ncd’s or take ncd’s in general will not be beneficial for investors in 30% bracket…they will be taxed @ 10.3% after 1 year…so they turn out to be better than fd’s and debt mutual funds…..

Or r u saying they are better in compariaion to the tax free bonds..??

Hi Priyanka, you too have a wonderful 2015 !! 🙂

I have no doubt that these NCDs are much superior as compared to bank FDs or company FDs. But, I think long-term debt mutual funds or tax-free bonds will be able to generate better returns than these NCDs. Moreover, as its interest income is taxable, that is why I am saying these are not suitable to the investors in the highest tax bracket.

Hi Shiv,

As government is planning huge investment in infrastructure, do you think tax free bonds will make come back for next FY? I strongly feel that it will be declared this budget. Government might change rules to allow at least 8.5% coupon rate for retail investors.

Regards,

Amit.

Hi Amit,

Not sure what the finance minister is going to do, but I am not as optimistic as you are. I think this govt is pro equity and anti debt. This govt wants domestic investment to go up in equities. Finance Minister’s moves of not allowing tax-free bonds for this financial year and raising the long term period of debt mutual funds to 3 years make me feel he’ll not allow tax free bonds to be issued anymore.

Thanks for your reply Shiv.

I hope these groups (Edelweiss & IIFL) come up with their issues and would prefer to wait for sometime for parking a small amount in their Debt.

Sure, you may do so, I’ll let you know once I have any details about their planned issue.

Hi Shiv,

Can we expect Edelweiss or India Infoline to come up with an NCD issue in next 1 or 2 months?

Or you feel that may not raise debt Via NCD this year as equity markets are performing very well?

Regards,

Jalpesh Patel

Hi Jalpesh,

As of now, I’ve no idea about Edelweiss’ or India Infoline’s plans to come up with an NCD issue. Moreover, I don’t think equity markets performing well has anything to do with their NCD issue plans. Both are different ways of raising money from the public. With interest rates going down, they should be more than happy to raise money at a cheaper cost now.

please give scrip code NSE BSE of old ifci ncd and opine better to buy them or subscribe to the present issue.

thanks

Hi Bhola,

Please check this link, NSE/BSE codes are given in one of my comments – http://www.onemint.com/2014/10/18/ifci-limited-10-ncds-october-2014-issue/

If you want to remain invested in these NCDs for more than 2-3 years, your brokerage rates are lower and you get old NCDs at a reasonably lower price, then I think you should go for the older issue.

Hello Shiv,

Thanks for the information.

Is it possible for you to mention any tax free bonds which are better than this offer?

Regards

Roberto

Hello Roberto,

As tax free bonds and these NCDs are strictly not comparable, it is difficult for me to pick any tax free bond and term it to be superior than these NCDs. Different investors have different investment objectives. I think these NCDs are not suitable for a person in the 30% tax bracket. Similarly, people in the lowest tax bracket would find tax free bonds unattractive at their current yields.

Hi Shiv,

Thanks for the in depth analysis, I always look forward to your report on new issues before investing. Interest rates look very unattractive to me in this issue,very little difference then most banks offering on 5 to 10 year FD. Just want to ask you: Are there any more NCD issues coming in month or two? Thanks and Wish you very happy and prosperous new year.

Thanks Ikjot for your wishes! I wish you too have a wonderful 2015 with lots of joy, prosperity and good health !! 🙂

Yes, the rates offered by IFCI seem unattractive to me as well, but then we, by nature, are greedy. I find no reason for IFCI to offer rates which are 1.5-2% higher than private/public sector banks. I think its our nature as investors to remain unsatisfied with whatever we get. Last year when we were getting 9%+ with tax free bonds, we wanted it to be even higher. Three months back, we wanted IFCI’s rates to be higher than 10%. So, I think in the current macroeconomic scenario, what IFCI is offering is perfectly fine.

Moreover, Manappuram Finance and SREI Equipment Finance are planning to come out with their respective NCD issues this month, but with no confirmed dates. I’ll share the dates here as soon as I have any info.

Thanks for your reply Shiv.

You are welcome Ikjot!