I included an ETF that invests in both China and India when I first created the India ETF list because there were just so few that focus solely on India.

Since that time, there have been quite a few additions in this space, and now you see a much greater variety – there is an ETF that tracks Nifty, one that invests based on its own methodology, an ETN, leveraged ETFs, one that invests in infrastructure, and another one in small caps.

There are 7 ETFs and 1 ETN that solely focus on India, and Wisdom Tree’s India Earnings Fund is easily the biggest with assets under management of 1.18 billion dollars. It also happens to have performed the best year till date with 11.71% returns.

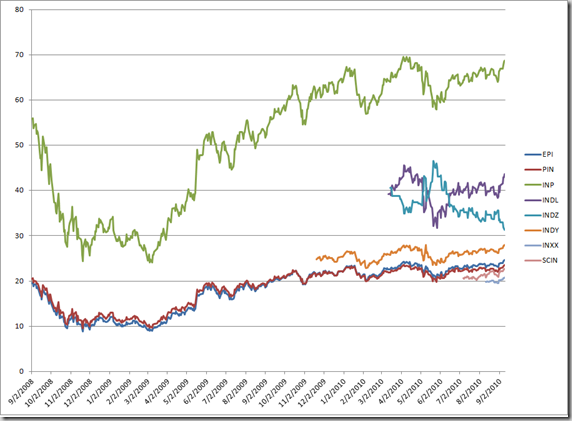

Here is how some of the other India ETFs have performed. I have updated the original India ETF list with the new ones, so you can read details about any of these funds on this page.

| ETF Symbol | Name | YTD Performance |

| EPI | Wisdom Tree India Earnings Fund | 11.71% |

| PIN | PowerShares India Portfolio | 6.58% |

| INP | iPath MSCI India Index ETN | 7.67% |

| INDY | iShares S&P India Nifty 50 Index | 10.34% |

| INXX | EG Shares India Infrastructure | Released – August 2010 |

| SCIN | EG Shares India Small Cap | Released – July 2010 |

| INDL | Direxion Daily India Bull 2x Shares | Released – March 2010 |

| INDZ | Direxion Daily India Bear 2x Shares | Released – March 2010 |

Here is how these ETFs have moved in the last two years (or since they were released).

Which one is the best option? Whether to hold the gold in physical form or invest in Gold Funds? If the answer is investing in Gold Fund, which one is the best fund in India

Markets may pull back till 5400 and surge again, be cautious with your longs and buy only when markets pull back. Markets have to break 4700 decisively in September itself, else NIFTY can reach 6536 in next 3 months before crash ensues