ICICI Prudential has launched a new mutual fund called the ICICI Prudential US Equity Bluechip Fund which will invest in stocks of American companies, and I think this is just the second fund after Motilal Oswal’s NASDAQ 100 ETF that allows Indians to get exposure to US equities using a fund vehicle.

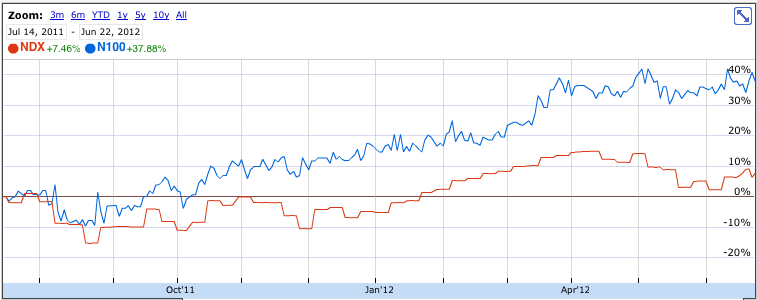

A look at the chart of the Motilal Oswal’s NASDAQ 100 ETF’s performance overlapped with the performance of NASDAQ itself helps drive home a very important point that you must keep in mind before investing in any fund that invests in the American market.

The big thing that you see from this chart is that even though the NASDAQ only grew 7.4%, the index fund based on that grew a whopping 37.8%!

Most of these gains are due to the currency rate movements and Rupee’s depreciation in the recent past has really helped this fund show the kind of returns that it has. Kapil Visht has done an analysis of Motilal Oswal’s NASDAQ fund to show the relationship between Rupee movement and fund performance and that is worth a read as well.

Simply put, if the fund had 100 crores in INR and the USDINR rate is Rs. 50, you can buy USD 2 crore or 20 million dollars worth of shares. But when the same rate moves to 57, and you sell those 20 million dollars worth of shares you get 114 crores in Rupees. You can use the rupees crores to million dollars calculator that I developed some time ago to see how this works.

This is an important point that you need to consider because it is not quite intuitive how big of a difference these currency rate movements can make, and you might feel that over a longer period they may not make a difference, but at least so far that hasn’t been true, and I think that’s going to continue for some time to come due to the Rupee volatility that we have seen in the past couple of years.

PP commented earlier in the day what would happen if the Rupee were to appreciate which it eventually will and I would say that there is no guarantee that the Rupee will or should appreciate and you can’t take that for granted. For people who remember 39 Rupees to a Dollar, they thought that it would go back to 39 once it hit 45, but it hit 50 instead and I’m sure there were a lot of people who thought this would go back to 45 but look where we are today.

However, if the Rupee were to rebound and American market were to remain flat or go down then you will make losses on your investment.

You can see this simply based on the above example where you have 20 million dollars worth of shares, and instead of selling it now, you hold them for a year when the Rupee rebounds to 45. In this situation your 20 million will just be able to buy 900 million rupees or 90 crore rupees and you will be left with a loss of 10%.

Now, the offer document does say that they are going to try and employ currency hedging but it doesn’t go into a lot of detail so you will have to wait and see what this really means and see how it actually plays out.

Now let’s look at some other aspects of this fund.

ICICI Prudential US Equity Bluechip Fund Is An Actively Managed Fund

This is an active fund and not an index fund, the benchmark is the S&P 500 and the fund will buy stocks only in companies that are listed in NYSE or NASDAQ. In their review of the ICICI Pru US Equity Bluechip Fund, Business Line says that the fund will invest in 20 – 25 stocks and I think that was mentioned at the press conference.

This is not a fund of fund

The good aspect of the fund is that it will invest directly in equities so there won’t be any double fees. There have been some international funds that have been fund of funds so this is also an important thing to keep in mind.

Expense Ratio

The expense ratio that’s mentioned in the fund document is 2.5% and this is pretty high, it remains to be seen whether they actually charge this much but 2.5% is a bit high for any fund.

Open and Close Dates and SIP Amounts

The NFO opened on June 18 2012 and will close on July 2 2012, and the minimum application for NFO is Rs. 5,000 and then for the SIP the minimum amount is Rs. 1,000. Regular readers know however that there is no benefit of investing in the NFO of a mutual fund.

Conclusion

This is an interesting product and and it is good that fund houses are coming up with funds that invest directly in American markets but the expenses seem to be high and it’s a lot better to have a passive index fund that’s low cost than an active fund with higher cost.

In two or three years there will be plenty of funds in this category and then perhaps you will have lower cost options but till then if you wanted to take exposure to the US markets then this is a viable option along with the Motilal Oswal NASDAQ fund.

This post was from the Suggest a Topic page.

The fund has returned an impressive 28.3% since its launch. Dollar appreciation has helped

The key here is Indian fund manager’s ability to take call on US stocks, which is constrained by lack of experience. If we read scheme document carefully, the dedicated equity fund manager for US portion only has 2 years of experience!!!!!, while a debt fund manager has been roped into manage cash & equivalents for redemptions. On a different note though, since the US bluechips are truly global companies, investing in this fund is taking a call on the global economy!!! But for me, currency risk is an added complication, given that we are peak of Dollar rate. Further, even hedging the currency risk will easily shave off 3-4% as hedging costs.But good to know about this fund in detail.

This is a repeat of my comment?

The key here is Indian fund manager’s ability to take call on US stocks, which is constrained by lack of experience. If we read scheme document carefully, the dedicated equity fund manager for US portion only has 2 years of experience!!!!!, while a debt fund manager has been roped into manage cash & equivalents for redemptions. On a different note though, since the US bluechips are truly global companies, investing in this fund is taking a call on the global economy!!! But for me, currency risk is an added complication, given that we are peak of Dollar rate. Further, even hedging the currency risk will easily shave off 3-4% as hedging costs.

Nice post. I had invested in Motilal Oswal’s NASDAQ 100 ETF when it came for NFO with 25k. It has given me decent returns till now with 38% +. I invested in this to diversify my portfolio with international exposure. But good to know about this fund in detail.

Thanks