Tax-Free Bonds Notification – FY 2015-16

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

After a gap of one year, tax free bonds would be making a comeback this year. Central Board of Direct Taxes (CBDT) on July 6 issued a notification in this regards and allowed seven CPSEs to mop up Rs. 40,000 in the remaining nine months of the current financial year.

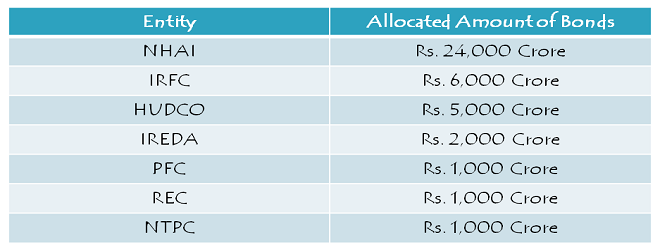

These CPSEs include NHAI, IRFC, HUDCO, IREDA, REC, PFC and NTPC. Out of total Rs. 40,000, NHAI alone would be mopping up 60% chunk of the total allowed amount to be raised i.e. Rs. 24,000 crore worth of bonds. IRFC would raise Rs. 6,000 crore, HUDCO Rs. 5,000 crore, IREDA Rs. 2,000 crore and REC, PFC & NTPC Rs. 1,000 crore each.

Here is the link to the Notification No. 59/2015 – Tax-Free Bonds Notification – FY 2015-16

Before we check the advantages of tax-free bonds vis-a-vis fixed deposits, let us first focus on the main points of the notification:

Tenure of Bonds – These bonds will be issued for a period of 10, 15 or 20 years.

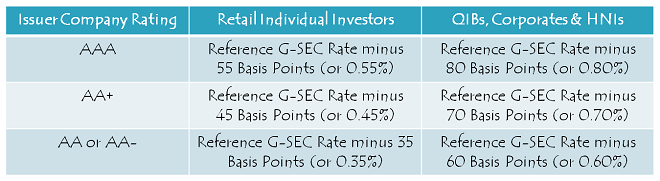

Interest Rate Ceiling – Interest rates offered by these companies will be subject to a ceiling on the coupon rates based on the reference Government Security (G-Sec) rate. The ceiling coupon rates would be as under:

AAA Rated Issuer – Reference G-Sec Rate minus 55 Basis Points (or 0.55%) for RIIs

AAA Rated Issuer – Reference G-Sec Rate minus 80 Basis Points (or 0.80%) for Other Investors

AA+ Rated Issuer – Reference G-Sec Rate minus 45 basis Points (or 0.45%) for RIIs

AA+ Rated Issuer – Reference G-Sec Rate minus 70 basis Points (or 0.70%) for Other Investors

AA or AA- Rated Issuer – Reference G-Sec Rate minus 35 basis Points (or 0.35%) for RIIs

AA or AA- Rated Issuer – Reference G-Sec Rate minus 60 basis Points (or 0.60%) for Other Investors

Here, the reference G-Sec rate will be the average of the base yield of G-Sec for equivalent maturity period, reported by FIMMDA on a daily basis prevailing for two weeks ending on the Friday immediately preceding the filing of the final prospectus with the Exchange or Registrar of Companies (RoC).

These ceiling rates will be applicable for annual payment of interest. In case the payment of interest is made on a semi-annual basis, the interest rates will have to be reduced by 15 basis points (or 0.15% per annum). Moreover, in case the bonds are sold or transferred by a retail individual investor (RII) to a non-retail individual investor, the interest rate applicable will be reduced accordingly by 0.25%.

Eligibility – As per the notification, the following investors will be eligible to subscribe to the bonds:

(i) Retail Individual Investors (RIIs)

(ii) Qualified Institutional Investors (QIBs)

(iii) Corporates (including statutory corporations), trusts, partnership firms, limited liability partnerships (LLPs), co-operative banks and other legal entities, subject to compliance with their respective Acts

(iv) High Networth Individuals (HNIs)

Retail Investment Limit – Individual investors, including HUFs through Karta, investing upto Rs. 10 lakhs in a single issue will be considered Retail Individual Investors (RIIs). Above Rs. 10 lakhs of investment, these individual investors will be categorised as high networth individuals (HNIs) and will earn a lower rate of interest.

NRI Investment – Non-Resident Indians (NRIs) will be allowed to invest in these bonds, on repatriation basis as well as non-repatriation basis.

Public Issues – At least 70% of the money to be raised by each individual company will be raised through public issues and rest of the money they can raise through private placements.

Credit Rating – These issues will be rated by a credit rating agency which is approved by the Securities and Exchange Board of India (SEBI) as well as the Reserve Bank of India. In case the issuer is rated by more than one rating agency, the lower of the two ratings will be considered.

Expected Rate of Interest – Power Finance Corporation (PFC) on July 14 raised Rs. 300 crore through a private placement at 7.16% for a 10-year maturity period. The Company had also fixed 7.39% coupon for 15-year bonds and 7.45% coupon for 20-year bonds. Had it been a public issue, the retail individual investor would have got these bonds offered at 7.41% for 10 years, 7.64% for 15 years and 7.70% for 20 years.

What makes Tax-Free Bonds Popular?

Tax-Free Interest – Unlike fixed deposits (FDs), interest earned on these bonds is exempt from income tax for the investors. This is what makes these bonds highly popular among the tax paying retail investors and high net worth individuals (HNIs).

Scope of Capital Appreciation – There is no scope of capital appreciation with bank fixed deposits or company deposits as such investments are not directly linked to interest rate movement in the bond markets. Unlike bank/company deposits, tax free bonds get listed on the stock exchanges and their market value goes up when there is a fall in the interest rates.

Tax Free Bonds issued during FY 2013-14 with coupon rate of 8.75% to 9% have been trading at a premium of 15-25% apart from their regular interest payments.

Easy Liquidity – With tax-free bonds, you can sell your bond holdings whenever you want to. These bonds get listed on the stock exchanges and due to big issue sizes, these bonds can easily be sold whenever required.

Highest Credit Rating – These bonds get issued by the public sector enterprises most of which are AAA rated. So, from the safety point of view, these bonds are highly secured and attract a big number of risk-averse investors. To me, it makes perfect sense to invest in these bonds as against riskier company deposits.

Tax-Free Bonds to be issued this year would not carry as attractive interest rate as they did in 2013-14. The 10-year G-Sec yield has come down by more than 100 basis points or 1% since then. I do not expect these bonds to carry coupon rates above 7.75-8%.

With crude prices coming down once again, Monsoon rains being above expectations and inflation remaining under control, I think the interest rates would remain under pressure going forward as well. So, it is in the interest of the investors and these companies also if these bond issues get launched as soon as possible. Are these companies already working on that?

Application Form for Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in tax-free bonds, you can contact me at +919811797407

thanks for excellent article

1.kindly guide us how to invest in this bond once they are open for allotment

2.is demat account must for investing in these bonds

3. what is average time given for allotment is it on fcfs basis??

Hi Sonia,

1. Sure, as & when an issue opens for subscription, I’ll post an article giving information on how to subscribe for tax-free bonds.

2. Demat account is not compulsory for investing in these bonds. You can apply for these bonds in certificate form as well.

3. Yes, it is on a FCFS basis.

Hi. Any idea when, meaning in which months, would you expect these offerings to hit the market. Thanks.

Hi,

No company has yet announced any timeline for their issues. So, I would like not to speculate on their timings. However, as NHAI is required to raise Rs. 24,000 crore, I think the company would start exploring its options sooner than later. Also, November, December and January are the peak months for such issues.

Is there any existing bonds which we can invest which provides good YTM?

Hi Pradeep,

Most of the previous tax-free bond issues are yielding in the range of 7.10% to 7.40%. You’ll have to explore such opportunities in the bond market – http://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

If Pradeep is not looking for investment above 100 Lakhs, better wait for new issues. It is better to buy issues considering that you will spend another 0.5% to 1% in brokerage. Your YTM comes down further. You will definitely get a better offer in IPO.

Good Shiv, you have initiated the thread on Tax Free Bonds. 2013 was an excellent year for those who wanted to go long term or make some quick returns. As things stand, the interest rate for these bonds to be issued will be in the range of 7.5% to 7.8% for retail investors. But in 2013 also initially everyone expected the interest rate to be in the range of 7.8% 8.2%. But once the bonds started hitting the market, the scenario changed and we had interest rate in the range of 8.4 % to 9%. This time around we can not expect such scenario, but definitely it can go to 7.8% to 8.3% range considering the amount of supply of Corporate bonds and Tax free bonds planned, Possible hike of interest rate by US. RBI reluctance to reduce rate considering the inflation. Considering that there will be many issuers and multiple issues expected , one should plan and invest. Should not put your full investments in 01st or 2nd issue.

Hi George,

In 2013, the coupon rates increased later on due to a panic created due to the concerns of the US Fed’s decision of hiking interest rates and the government’s inability to control the situation. Currently, I think the economy is struggling and despite negative news creating all sort of pressures, inflation and interest rates are not moving up. This time around, the biggest threat is China’s slowdown. Still I think interest rates should go down going forward. Let’s see how things move in the next few months.

Dear Shiv,

I agree with you that the interest rate went up due to various internal and external factors at that time. At present also Fed Hike, China etc is very much on cards. The Inflation was under control due to low crude price and exchange stability. Some of the decisions the previous govt taken at the time of the crisis and the continuation of some good policies by the present govt and also the RBI. Though 75 basis points was reduced by RBI, Govt bonds are at around 8%. Still there is a chance of Tax free bonds being offered at around 8% for Retail investors in some of the issues. Lets hope for best.

irfc have also raised 7.19% coupan rate through a private placement issue so will they will come with another taxfree bond issues for retailer

.

It seems HUDCO will be the first to come out with its tax-free bond issue. The company has appointed Edelweiss as one of the lead managers for its tax free bond issue.

Will issue come up in Aug?

Don’t know which month it will come.

Any news on upcoming TF bonds?

Hi SB,

HUDCO and PFC are planning to come out with their respective issues in the first half of next month.

Good discussion. Useful info

Thanks Mr. Jain!

Hi Shiv,

Why is that Hudco has AA+ and not AAA inspite of being a Govt Company.

Thanks,

Anuj

Hi Anuj,

It is not necessary for every government company to have a ‘AAA’ rating. These ratings are based on the fundamentals & credit worthiness of a company. There are many government companies which are fundamentally very weak & reporting losses/low profits, those companies do not deserve to be rated even AA+.

Thanks Shiv.

What if a govt. company defaults? Is there a chance that investors don’t get paid.

Hi Anuj,

Nobody can claim that a government company cannot default. It is possible that deteriorating fundamentals may force a government company to default on its payments. But, I am yet to see such a situation. With government backing, such companies normally pay back interest and principal on time.

Thanks Shiv. I really admire your frank and useful responses.

Hi Shiv,

Any idea which banker is placing the NTPC bonds on a private placement and if there would be a retail issue?

Thanks,

AB

Hi AB,

I have no idea which company acted as the banker for NTPC’s private placement. But, as 70% of its allocated amount has to be through public issue(s), retail investors will definitely get a chance to participate.

Hi Shiv,

Thanks for your comments. Do keep us informed regarding upcoming tax free bonds. Your updates and expert comments/advice are like oxygen for me, and I’m sure for many of us as well, when it comes to making financial investments. Thanks once again.

Regards,

SB

Thanks SB for your kind and motivating words! 🙂

rec will also coming up with a bond issue through private placement issue so when retail inveters will get chance to subscribe any bond issues I think it is very late

Dear Mr Shiv Kukreja,

Request you to please advise whether it is advisable to buy existing Tax Free Bonds from the Market considering their higher price, & at premiums at around 20% to issue price + Brokerage @1%. I am in the 30% Tax bracket.

Why are brokerage charges higher at 1% for tax-free bonds as compared to Equities?

Can you suggest the best Bank Linked Real-time Brokerage with least brokerage/transaction charges where we can buy even a single share without being loaded with a minimum charge of Rs 35 like ICICI does?

Thank you.

Hi S.K.,

It is a difficult call to make, but I think it is better to buy these bonds from the company itself rather from the secondary markets. I am not aware why the brokerages are charging high brokerage on these bonds/NCDs. It is something which only brokerages can answer. Also, I have not gone deep into such thing which tells me the cheapest brokerage house to buy these bonds/NCDs. But, I think discount brokerages such as Zerodha, SAMCO etc. must be charging a lower fee for such transactions.

NHAI tax-free bonds assigned ‘AAA’ rating by India Ratings – http://www.business-standard.com/article/pti-stories/ind-ra-assigns-ind-aaa-rating-to-nhai-s-tax-free-bonds-115090200680_1.html

Hi Shiv. Not a major digression to this subject…

How would you compare these tax free bonds with say PNB housing finance fixed deposits, which on a 10 year cumulative deposit, earn 13%+, meaning the post tax earnings are more than 9 percent. Thanks.

Mr. Comparison, How can you compare 10year Cumulative yield with annual yield and compute post tax return? Hope you wrote this because of your ignorance. No company is giving annual yield of 13%.

When is the first public issue expected?

Is first half of september still holds?

Hi

Do you have any idea of issuance for First issue.

Regards

Piyush

HUDCO and NTPC will be coming up with TF bonds in Sep mostly 3rd or 4th week. Coupon rates are expected to between 7.4 to 7.8 for 1-20 years bonds.

Thanks George for this info!

Hi George.

Our investment objectives can be different, and that doesn’t mean one of us has to be ignorant. I may not have any use for a 7pc+ cash interest paid out annually on these bonds, which may as a result lie idle in my bank account, earning me almost nothing. So I may want to evaluate that option vs an almost 9pc annualized, received post tax on a cumulative fixed deposit, after completing 10 years.

Your less-than-smart comment assumes you know other people’s preferences, and can pass judgement…

Mr. Comparison,

I have no issue with you or anyone and the intention was not to put down your view or pass a judgement. I may not be in a position to judge what is your background and how you look at yield calculation. You may be right in saying that 10 year investment and cumulative yield may be one’s priority. But the same is taxed on annual basis which may result in less yield. Any way, my apologies if you have got offended by my comment. May be Shiv can throw some light on the confusion.

Agreed, Mr George, and that’s why I had pointed this query to Mr Shiv. The interest rate on the said instrument, when seen on a cumulative basis, is over 13%. But yes like you rightly say, once you take into account the annual interest, this comes down to 9pc, give or take – depending on how you approach this calculation. This is something I wanted to confirm and compare…

Normally cumulative FDs are not for more than 5 years. This one is for 10, which makes it appear interesting.

Happy to know that you are in agreement. Many of the deposits by financial institution mentions cumulative yield based on compound interest which sometimes misleads investor. Since this forum is for sharing info, I have replied to your concern considering that Shiv can always share his thoughts if it fits. If my response was helpful it is fine, Shiv can always clarify.

Hi Mr. Comparison,

I think it is highly unjustified on PNB Housing’s part to quote a tentative YTM of 13.03% with its 10-year deposit scheme. In this scheme, your money earns 8.70% every year, which is taxable and grows by 2.303 times by the end of 10 years. I think 13.03% is just a simple interest and not an annual yield which the investors would be getting.

I believe it is more like a misrepresentation which PNB Housing is doing by calling it a tentative YTM of 13.03%. In fact, I think PNB Housing is misguiding its investors in this manner and the regulator is sitting silent about it.

8.70% p.a. for a non-tax payer is good, but not for those who are in 20-30% tax bracket and seek high post-tax returns. Apart from high tax-free returns, tax-free bonds carry scope of capital appreciation, provide easy liquidity, no TDS gets deducted and much more.

This is an interesting debate. Leaving aside misleading terminology used, as Shiv has said, the fact is interest earned is 13.03 % simple interest per year. Even if one is in 30% bracket, one would earn a simple interest of 9% per year. Is it not better than TFB tax free interest of say around 7.5%, leaving aside factors like safety etc.

You comments purely from financial return angle, without any bias please.

Thanks.

It seems NTPC is coming out with tax free bonds soon

If not in the second half of September, we’ll have at least 2-3 issues in October for sure.

NTPC tax-free bonds issue is expected to open on September 23rd. Coupon Rates are expected to be 7.39% (10 years), 7.56% (15 years) and 7.68% (20 years).

Dear Shiv,

I know I am asking the repeated question. Do we have dates/schedule for these bonds?

Regards,

Vineet Garg

Sorry Vineet, there is no such info available for these bonds. Only info we have as of now is that NTPC issue is opening on September 23rd and PFC is the next in the queue, followed by REC, HUDCO, NHAI & IRFC.

Hello Shiv,

I had applied for NHAI bonds on 28 August 2015. I have not yet received any intimation about he same. whereas the money has been deducted from my account.

How do I find the status please, since I had filled the form manually in the Union Bank, and there is no Application number too. They had said that application number will be generated once it reaches the NHAI office.

Thanks,

Ravin

Hi Ravin,

It takes Beetal Financial, the Registrar for the NHAI capital gain tax saving bonds, approx. 3 months to process your application and issue bond certificates. If your cheque got cleared by August 31, 2015 or before, then your deemed date of allotment would be August 31, 2015. In case it got cleared on September 1 or 2, then deemed date of allotment would be September 30, 2015.

You can contact Beetal Financial for its status or further details – http://www.beetalfinancial.com/contact.aspx

You can quote your cheque no. or PAN no. for further tracking.

When is the next NHAI TFB issue planned?

Hi SB,

I think it should come by next month.

NTPC tax-free bonds issue update – Issue opens 23rd September, 2015. Issue size Rs. 700 crore. Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.36% p.a.

15 years – 7.53% p.a.

20 years – 7.62% p.a.

Thanks shiv, do you know about PFC bonds

Hi Raj,

PFC details should be out sometime next week.

Dear Sir,

Are any of these bonds offering monthly/quarterly payment of interest. Looks like interest from NTPC is on annual basis.

Hi Mr. Hariharan,

These companies are allowed to make yearly or half-yearly interest payments and historically, all of these companies have decided to pay interest on an yearly basis.

Was there already an TFB issue from NTPC and NHAI in August this year? If yes was it open for retail customers? Definitely missed out on that one.

Is the NTPC offering in September second time?

Thanks

Hi Ash,

Tax-Free bonds in the current financial year have been issued on a private placement basis i.e. retail investors were not allowed to participate in those issues. NTPC issue is the first public issue for the current financial year.

NTPC Tax-Free Bonds – September 2015 Issue Details:

https://www.onemint.com/2015/09/20/ntpc-7-62-tax-free-bonds-september-2015-issue/

Hi shiv

Can u guide how to apply for such bonds

Regards

Vikas

Hi Vikas,

To invest in NTPC tax-free bonds, you need to have a demat account. If you have a demat account, then you can either invest in it through your broker OR you can download the form from the link pasted in the post above & contact me on 09811797407 to do the bidding of your application. After the bidding is done, I’ll let you know your Exchange Bid Id, get your application collected from your place and submit it at the designated collection centre.

Sir

Do you have any idea of PFC bonds plan and its interest rates. PFC have filed its DHRP.

Regards

Piyush

PFC tax-free bonds issue update – Issue opens 5th October, closes 9th October. Issue size Rs. 700 crore. Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.36% p.a.

15 years – 7.52% p.a.

20 years – 7.60% p.a.

Demat account is NOT mandatory for the PFC issue.

Thank you very much for your quick & prompt reply.

You are welcome!

Dear Sir,

Would like to invest in PFC tax free bonds . As I missed the submission on 23rd for NTPC bond , the broker from Mum. has returned the cheque stating late submission.

Kindly let me know the procedure for application, obtaining the prescribed form for PFC form etc before the final date.

Thanks,

Geeta B.

Sorry Geeta, I missed answering your query. Here is the Bidding Process – You need to download the form, take is print, duly fill it and share the scanned image of the form with us. After that, we’ll do the bidding of your application and provide you the BSE Bid Id. After that, we’ll get your application picked from your residence/office. Here is the link to download the application form – http://www.fountainheadindia.in/FormPrinting/FrmDirectPrinting.aspx?details=UBx2/PhH8SdJWCAsyn50Jw==&&Reference=EswKb3+CHFOoRzYKsD0K0w==&&Flag=K1byKZlOeCylulT1F2Yh/g==

For any further assistance, plz contact us on [email protected] or +91-9811797407

Sir i want to invest in these tax free bonds . please do notify me on my email

Hi Madhav,

Please subscribe to our free newsletter for latest updates on tax-free bonds – http://www.feedburner.com/fb/a/emailverifySubmit?feedId=2525998&loc=en_US

Hi Shiv,

When can we expect the NTPC bonds to be alloted.

Thanks

Gaurav

Hi Shiv,

When can we expect the NTPC bonds to be allotted.

Thanks

Gaurav

Hi Gaurav,

NTPC bonds should start getting allotted by Wednesday or Thursday.

NHAI to come up with its issue of tax-free bonds worth Rs. 11,200 crore by this month-end:

http://www.hindustantimes.com/india/nhai-set-to-tap-bond-market-to-fund-projects/story-vrbolwYMDCapnfhXrTxjpJ.html

kindly send application form of tax free bonds like NHAI, REC, IRFC etc.

I have applied for 50 Nos. NTPC Tax Free Bond though ICICIDirect.com. They have deducted 0.50% brokerage charges. I would like to know brokerage is chargable on IPOs ?

Hi Vishy,

No brokerage should be charged on public offerings such as NTPC tax-free bonds. So, I think you should get in touch with ICICIDirect for the same and claim your money deducted.

Can you indicate the schedule for tax free bonds so that I can plan my finances suitably

Hi Srinivas,

There is no schedule as such for tax-free bonds and exact issue dates get announced just a few days in advance.

Hi Shiv, the interest rate on tax free bond is also linked to the credit rating it is assigned. Higher the rating, lower the interest rate. Are all the remaining bonds after NTPC & PFC rated AAA or is there any AA rated bond in pipeline likely to give higher interest rate than others?

Hi Jason,

I think only HUDCO carries a AA+ rating, rest all companies would carry AAA rating.

Sir

When is allottment of PFC tax free bonds likely to be done. From where can we know the ststus of our applications.

REC tax-free bonds issue update – Issue opens 27th October, Issue size Rs. 700 crore. Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.14% p.a. vs. 7.36% PFC offered

15 years – 7.34% p.a. vs. 7.52% PFC offered

20 years – 7.43% p.a. vs. 7.60% PFC offered

Demat account is NOT mandatory for the REC issue as well

Any idea when NHAI tax free bonds are going to come out?

Thank you Shiv for continued advice with tips and analysis. These discussions are providing very valuable inputs to investors like us. Can you advice, for investors with more than 10 lakh (I think they get classified as HNI and not retail) would it be better to split investments across bonds or invest lump sum in one bond ?

I heard that Irfc issue opens next week on 26 Nov. Any confirmation?

Hi Shiv,

I was going through prospectus of these tax free bonds, especially ‘classification of investors’ from secondary market perspective. Most of the issues this year have been oversubscribed and as I’m looking to buy some bonds post listing wanted your help to understand rate of interest/coupon for secondary buyers. Below are the two items i didn’t understand (from prospectus of REC tax free bonds)…

c. If the Bonds allotted against Tranche I Series 1B, Tranche I Series 2B and Tranche I Series 3B are sold/ transferred by the RIIs to investor(s) who fall under the RII category as on the Record Date for payment of interest, then the coupon rates on such Bonds shall remain unchanged;

f. Bonds allotted under Tranche I Series 1A, Tranche I Series 2A and Tranche I Series 3A shall carry coupon rates indicated above till the respective maturity of Bonds irrespective of Category of holder(s) of such Bonds;

How would i know whether I’m buying from Series A or Series B seller on screen? I will not hold more than 10lacs worth of bonds on record date but if i buy from Series A sellers will i still be getting lower rate?

Link:

https://www.edelweisspartners.com/Mutual%20Fund%20Info/Product%20Note%20-%20REC%20Tax%20Free%20Bond.pdf

Appreciate your help in advance.

Thanks

Dev

Hi Dev,

Bonds issued to the retail investors carry different BSE/NSE codes as compared to the codes which are there for the non-retail bonds. So, if a retail investor buys these bonds which are meant for the retail investors, then there is no problem, he/she will get the same rate of interest. But, if you buy bonds which are meant for the non-retail investors, then you’ll get a lower rate of interest, even if you are a retail investor.

Dear Mr Shiv,

which are TFBs opening in Jan-Feb’16?

Hi Mr. Dubey,

IREDA, HUDCO & NHAI Tranche II would be available for subscription in the next 3 months. IREDA issue worth Rs. 1,716 crore is opening from January 8th.

IREDA 7.74% Tax-Free Bonds Issue – https://www.onemint.com/2016/01/02/ireda-7-74-tax-free-bonds-january-2016-issue/

CAN WE GET OVERDRAFT FACILITY FROM ANY BANK AGAINST PLEDGE OF THESE TAX FREE BONDS

Dear Mr Shiv,

(1)What are the likely dates,size and rate of interest, for retail investors,for HUDCO&NHAI Tranche II,

(2) Whether investor would continue to be retail investor if his total investments in NHAI Bonds exceeds Rs.10 lacs after getting TFB in Tranche II,

(3) Similarly if total investment in TFB of a PSU exceeds Rs 10 lacs after local purchase through stock exchange, does it loose the character of retail investor,

(4) What are the BSE/NSE Codes for 2013-14 TFBS for retail investors or else from where to get these ?

Thanks and regards,

S C Poddar

Hi Shiv, Any tax-free bonds coming up in FY2016-17? If not, how do I choose the best one to buy on the market? Thanks.

Hi Shiv,

Can I claim a LTCG loss on buying a tax free bond from the market at a price above its face value and then getting the original lower principal back on maturity.

Suppose, I buy a tax free bond on NSE for 1100 Rs and it matures in 5 years. When it matures, I get 1000Rs back per bond.

Can I take 100Rs LTCG loss?

Are the RBI 6.5% non-taxable bonds available for purchase?

All RBI Bonds are taxable, Jyoti, your question seems incorrect 🙂

As regards tax free bonds, most of them are available for purchase in secondary market at a premium, and it is much easier to go through someone who can do this off-market. Buying online is tough since you may not get the volume and number of bonds you need when you need it. I can recommend someone if you need