Which is the best gold ETF in India?

Update: I have done a more recent comparison on gold ETFs and that data can be found here. The methodology is the same which you can read there as well, but reading this post gives a good perspective on how this space has evolved. Â Updated Article.Â

This question keeps popping up in emails and comments from time to time, and I thought I’d address this with a post. Let me begin this post by saying that this is just my way of deciding which is the best gold ETF in India, and you are free to poke holes in this methodology, or even reject it outright, but if I were to invest in a gold ETF – this is the way I would go about it.

First off – I’d compare the expense ratios of all existing Indian gold ETFs, and see which are the ones with the lower expenses. I have already done that research earlier on this blog, and know that right now the Gold BeeS ETF from Benchmark Funds has the lowest expense ratio of 1%. Quantum Funds comes second with 1.25%. All the other funds charge higher expenses. The lower the expenses – the better it is because it leaves more on the table for investors.

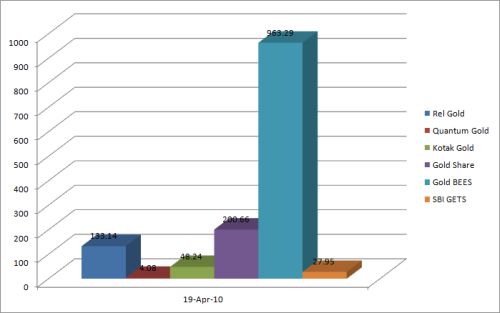

Expenses alone are not enough for me because I want my investment to be liquid, and need the fund to have good volumes too. I went to the NSE website and gathered the volume data for all gold ETFs for the last month or so. I am presenting you yesterday’s volume data of all gold ETFs here. I am presenting just one day’s worth of data because that is pretty much representative of the overall volumes and is easier to read.

As you can see from the image – Gold BeeS, which has the lowest expenses also has the highest volume, and by a large margin too.

That does it for me – and if I had to invest in a Gold ETF – it would be this.

Keep in mind though that this is just my opinion and not expert advice tailored to your investing situation. Also bear in mind that I am not going to invest in this ETF because I am not looking at investing in gold right now, and even if I was – I would probably go for the more direct option of buying gold coins.

Update: I have done a more recent comparison on gold ETFs and that data can be found here.Â

s i like to invest.

You can invest in an ETF just like you do in a stock. Do you have an account with a broker?

Gold and silver jewelry. Maybe a good investment too. There are many other items for sale on my site. If you get your own site, sign up throught my email and get double enhancement credit.

Hi,

I am new to the world of ETFs and I was looking to invest in the best Gold ETF when I came across this useful post. As you say Goldbees is best having lowest expense ratio of 1% and Quantum Gold the second best, having expense ratio of 1.25%. I notice while Gold ETF has the NAV of Rs.1800 + , Quantum Gold has the NAV of Rs. 900+. Interestingly, % returns from both the funds are more or less the same. So, shouldn’t I choose Quantum over Goldbees as former is available at half the price of the latter thereby being more affordable? However, I also observe that volume traded in Quantum Gold is much less than that of Goldbees. I hope to hear from you. Thanks!

@Chhavi: The unit considered in Quantum is approx. half-gram while in Goldbees its 1 gm- hence Quantum’s NAV is half of Goldbees …

Dear Kiran,

Thanks for clearing my doubt. That was very helpful indeed. Thanks again!

hai kiran i seen your reply it is nice suggestion, now i am new to invest gold etf funds i am planing to invest monthly 5000 in gold etf few are recomanded SBI ETF this is beter than Goldbees pl give me reply

update of all getf funds

Interested in goldETF.Is there anyone who could helep me?I am from Chandigarh.

DEAR SIR,

I WANT TO KNOW ‘MARKET CODE’ OF GOLD ETFS IN BSE & NSE BOTH. YESTERDAY I TAKEN PRICE OF GOLD ETF IT WAS SHOWING ABOUT 1995/- PER UNIT APPROX HOWEVER MCX GOLD WAS SHOWING VERY HIGHTER RATE. WHY THERE IS MAJOR DIFFERENCE.

THANKS

Here are the codes of ETFs on NSE

* GOLDBEES

* GOLDSHARE

* KOTAKGOLD

* RELGOLD

* QUANTUMGOLD

* SBIGETS

* RELIGAREGOLD

* HDFCMFGETF

* IPGETF

* Axis Gold ETF

You can search these tickers on BSE’s website, and get the tickers there as well.

I think you were looking at a future contract on MCX Gold which is about 10 grams whereas most of these ETFs represent just one gram of gold, and that might be the cause of the difference. Can you tell me what were you looking at specifically?

Hi Sir,

i am new to this ETF market, i have an online demat account, i would like to invest in silver , please suggest how can i buy some silver (invest in silver) and sell it when i want to sell.

i came to know that there are no Silver ETF in india,

can i do trading on any of the foreign exchanges using indian online Demat account ?please advise

regards

vamsi

Vamsi here is a post that tells you about silver alternatives in India:

https://www.onemint.com/2010/11/16/silver-etf-alternatives-in-india/

Dear Vamsi,

Yes there is no Silver ETF as of now. You can buy E-Gold and E-Silver which is safe and secured and better than even holding of Physical metal. You can buy and sell anytime and the rates are available online on NSEL site.

You can buy through us if you want.

Why to invest in Gold ETF when i can directly buy gold from goldsmith ?

What is the benifit of Gold ETF?

If you are able to buy and sell gold coins directly from the goldsmith, and get a good rate, then that is a good option for you. Some people prefer the convenience of electronic trading and like the fact that they don’t have to worry about storing gold, so they buy it in the form of ETFs.

one factor that we must be aware of while buying from a goldsmith is the purity of the gold. gold in form of jewelery bought from goldsmith WITHOUT the BIS Hallmark certification is most likely to be below the carat you are paying for. also there will be a 11-15% “making charge” that is a straight loss when you want to liquify the gold jewelery.

in all, a sure cost of 11-15% of the cost of gold and also the cost of holding physical gold adds to the attractiveness of Gold ETFs.

Manshu, that means considering expense ratios and other administrative charges of ETFs direct investment in gold is always give more returns, if we keep aside worry of storing gold.

Sarika,

when you sell physical gold to goldsmith they deduct a charge of 10-20% of gold value. That is a much bigger amount in comparison to return. that means if you earned 20 % gain in a year and sell that gold after two year then you will get only 15.2 % return if you sell it to goldsmith. Further, there is always a chances of less pure gold. You can purchase gold coins from bank and post office. but you can not sell them back your gold coin purchased. Thus i think gold etf is much liquid and safe investment.

I would like to invest in Gold ETF. But i am very new to this. Can i do the investment with my existing trading account or i have to open a new one. Also want to know that Gold ETF rate is exactly the 10% of GOLD market price. Please revert me on this

Yes, you can invest using your existing trading account – there is no need to open a new account just for this. One ETF unit often represents 1 gram of gold, and that’s why you see the price being about a tenth of the quoted rate which is quoted for 10 grams.

Which are the 2 best performing Gold ETFs now? is it a good idea to invest in Gold ETFs by SIP plans? Is it possible under Indian system?

There is no direct way of investing in ETFs through a SIP. This post tells you about some indirect ways in which you can set up a gold ETF SIP.

Does ETF value also depends on other aspects? or is it totally depended on the Gold rate.

It depends on other factors like how much expenses the fund is charging investors (the lower the better), and the tracking error, which is how efficiently the fund is tracking gold prices.

can iI convert Gold Etfs into physical gold ?

No, I don’t think that’s possible.

No as ETF is not Gold itself. Its a kind of share which you buy. Don’t get confused it with the Gold certificate you use to buy from Banks.

I want to invest in gold but not inerested in purchasing a phicical gold…..

then which gold market can i invest????????????

your option is to buy E-Gold and E-Silver which are traded on NSEL.

What are the expense for investing in Gold Etf? Are there any exit expenses or any recurring expenses annually?

Why there are different entry expenses for gold etf by different companies?

I would like to undergo free training. Please let me know what next ?

I would like to open gold etf account any body help me, and give me some good broker details,

If I buy ETF through my trading account, do I have to pay the service charges to my broker as well? So, for an Indiabulls account , I pay 1% other than the fund house’s expenses, right?

Right.

Hi I want to invest in Gold ETF, what are the condition in investing in.

I’ve invested a small amount in Gold ETF. I just want to know what is goldbees and quantum gold. And also want to know the growth of it. Wher will I check these informations ?

Goldbees and Quantum Gold, both are kinds of Gold ETFs. The unit considered in Quantum is approx. half-gram while in Goldbees the unit considered is one gram and hence Quantum’s NAV is roughly half of Goldbees NAV. Like today on the website of moneycontrol, NAV of Goldbees is Rs.1869 while NAV of Quantum Gold is Rs.927 on NSE.

heloo,

i want to know that is there iny risk in gold etf.

how can i invest and what is the profit.

Hi Aditya, I just realized that I wrote an entire post responding to your comment but didn’t actually leave a link here, so here goes:

https://www.onemint.com/2010/09/21/is-there-any-risk-in-a-gold-etf/

Hi,

Besides considering the aspects like expense ratio & volume do we have to also consider reliability of the fund as well, meaning

1) Are all the present Gold ETF’s in india reliable? or is it suggested safe to buy Gold ETF’s only from funds like UTI, SBI, HDFC, ICICI, Kotak.

2) Can any listed Gold ETF fund in NSE get de-listed? if yes, then what happens to its investors?

Cheers,

Amrut.

Hi Again Amrut!

1. Gold ETFs in India are supposed to be backed by physical gold, so that should give you some comfort as far as the underlying asset is concerned.

But you will read a lot of threads online that say there is actually no gold and other crazy scary stuff like that. So if you trust the regulator then the reliability itself shouldn’t be a differentiating factor.

2. I don’t know of any gold ETF that got delisted in India, and don’t know what would happen. However, in the US, it is quite common for ETFs to delist, and most commonly I see that the investors are paid the closing NAV less any costs that are there.

One last word Amrut – there is always the option of buying physical gold if you are not comfortable with the paper product.

Dear friends ,can anybody help me to mention to invest in GOLD ETF in SIP form with NAV @Rs 10.I mean new ETF funds avilable in the market.

Hi

Can you pls tell me if there are any fund houses that run a fund on gold along with shares of companies dealing with gold (mining,jewellery etc)

Hi Swaroop,

There is only one listed gold mining company – Deccan Gold Mines Limited in India, but they aren’t profitable yet, and haven’t started gold mining as well.

Hutti Gold Mines is the only company in India that mines gold but it’s not listed.

Given this fact – there is a DSP Blackrock World Gold Fund that gives you exposure to global gold mining companies, but not local ones.

You can read details on gold mining here:

https://www.onemint.com/2010/10/10/gold-mining-in-india/

hai iam new invester in gold etf iam planing to by physical gold for use but i dont have that much many so i planed to invest sistamaticaly any gold etf for 5 years than i will by physical gold so please give me good and low expansive and safe gold etf fund details thanks waiting for reply

Koti, GoldBees from Benchmark is a gold ETF you can buy. You might know this already, but I thought I’d just note that you can’t exchange the ETF for physical gold, so when you buy gold jewelery eventually you will have to sell the ETF, get cash and buy physical gold.

Very good information about gold ETFs. i want also same informations about SILVER and also want to compare which one is best from ‘Return on investment’ point of view gold or silver

Sunil, there are no silver ETFs currently trading in the Indian market. There are other ways to get exposure to silver mentioned here: https://www.onemint.com/2010/04/15/silver-etf-in-india/ and a commenter has left a comment stating that if you have foreign stocks enabled in your trading account you can get exposure to US Silver ETFs from there also.

I also have a post this week about some more investing options in silver, so that will give you some more ideas. As for historical returns – I’ll look for information, and see if I can create a post in the next week or so.

Very good information provided, but still not sure for which ETF should I go?

I want to start SIP of ETF , Pl suggest some fund

Well Amit, I guess the question is why you want to start a SIP with an ETF? Normally people buy ETFs as a way to buy the underlying gold or index or oil or some other asset like that.

What is your goal with this?

I am an investor, and normally trade in shares only. But If i go for Gold ETF, which company can give the best returns of my investment. Though Gold ETF price is directly connected to the price of Gold, but i want to know which company has the lowest charges.

Gold BeeS is the one with the lowest charges Amit.

Hi Manshu,

Very good n useful information….I’m a NRI..Would like to invest in Gold ETF…How will I invest in ETF from abroad. Can you please throw more light on it…

Thanks VJ, I’ll try to write about that topic in the future, you can take a look at this link from ICICI Direct to get started though – it has useful info. You can use any other broker of your choice; I am just pasting this link here because I knew about it.

http://content.icicidirect.com/mailimages/ETF%20FAQ.pdf

Thanks Manshu for your quick response. ll check that link.

You’re welcome, appreciate your reply, and I’ll see if I can myself write something up for the future.

what is teh advantage of buying gold thru ETF? As it will always be less than market price because of teh expense cost incurred?

It will be a lot easier to sell when compared with gold coins because when you go to sell a gold coin the jeweler usually deducts anywhere from 2 – 5%.

Hi Manshu,

I am new to Gold ETF. I want to buy Gold ETF units. I have a demat account in Shriram Insight. So How can I buy the gold ETF funds from there. Is that similar to normal equity shares kind of thing.

Please reply me for the same

Yes, buying gold ETF is exactly the same as buying a share, so if you have done that before you can do this the same way. Just find the code for the Gold ETF in your system and you can buy it the same way you did the stock.

Is it advisable to Have SIP in gold ETF , if one is looking to build this asset for future purpose as well as return ?? What is difference & more advisable to invest in terms of returns i.e Gold ETF v/s Gold Mutual Fund ??

I have heard its better to have term insurance & investment separately rather than ULIP plan having both this together..Any specific reason for same ??

Hi Manshu, Your blog is very informative and a guide to many small and early stage investors like me. I am planning to invest 60- 70 Krupees every month and out of that I am planning to buy 2gms gold every month and 1/2 kg silver per anum. And may go for some IPOs rarely. So as an early stage investor my annual investmentdoesnt cross 1 lakh and I maynot go for trading the shares very rarely. Right now I dont hve any Demat and Trading account. So based upon my portfolio which tading account you suggest me now.

Please let me know your suggestion ASAP, coz I am planning to execute my idea from this newyear 2011.

Thank You,

Rama Sudheer

So, you’re talking about opening a trading and demat account? Well, if you’re going to just buy bonds, and gold then with your amount I don’t see a need for you to open an account because you can buy bonds in physical form, and for gold coins you don’t need an account anyway.

I hope I understood this correctly Rama – please leave a comment if I didn’t.

I dont want to buy gold coins, I want them in ETF only because I want to transform into cash at any point of time. And there is a chance for me to trade aswell (in the future), so out of your experience, for a early stage investor which account would yor suggest?

SBI is something that’s cheap and reliable so that might be a good bet for you. Although there are several other trading and demat accounts I feel that your trading is not going to be much, so you are not likely to run a lot of commissions, and may look into SBI.

You can always check with the bank that you currently have a relationship as well because then that makes things a little streamlined and easier to manage.

Dear Rama,

We would suggest to look at E-Gold and E-Silver as an option if you are looking for a better option to INVEST and also TRADE in FUTURE. They are traded on NSEL and are 100% backed by underlying Gold or Silver. Their rate are more near to the Physical Gold and Silver price. You can buy as low as 1 gm of Gold and / or 100 gm of Silver, which is the minimum qty available for sale/purchase. You need to have a Demat account to Store and trade.

Unlike GOLD ETF, It doesn’t depends on other factors like how much expenses the fund is charging investors, and the tracking error, which is how efficiently the fund is tracking gold prices.

It is more like direct investing in Gold and Silver but in Electronic form, easier to keep, safe and trade.

hi pls tell me how can i, invest 1st time in ETF gold,………..

You can buy an ETF just like you buy any share Anurag, so if you have a demat, and a trading account through which you buy shares, you can use the same thing to buy ETFs also.

Somebody mention that 11-15% is straight loss if buying gold jewellery and selling thereoff. What abt Gold bar , buying and selling? Still when you go in Mkt to sell, 11-15% is deducted??. Pls adv. I have another question, i am NRI, can i go for Gold ETF sitting o/seas.

Yeah, people who have tried to sell gold coins have reported that the jewelers have told them that they’d have to deduct about 5%, so you can expect the deduction to be somewhere in that range. Also, it’s far better to be able to sell the gold coins from the jeweler you bought them originally from, and check the terms of sale at the time of purchase. Since this is not jewelery things like making charges etc. are not deducted viz. probably were the 11 – 15% figure come from.

I think NRIs can invest in Gold ETFs, so you can check your trading site Deepak to see if they show up in the list of securities you can buy or not.

Hi Manshu, tks for your advise. ForETF, i chked but seems i am unable to locate that whether sitting here i can open a demat or a trading a/c as i dont have one. Cannot do it just fm NREa/c. I probably need tovisit India for the same. Pls adv.Rgds

Deepak – I don’t have any experience with this, but what I’d recommend is for you to to go to the website of your bank say HDFC or SBI or wherever and then they have forms where NRIs can fill up info to request account opening, and their representative gets in touch with you. So, do that and see how it goes, at least this way you will not have to wait till you’re back home.

i have no account at broker, i want to invest some money in gold etf, how i can do it.

Sravan – It is necessary to have a Demat and trading account in order to buy a gold ETF, so you will have to open that first.

Hi Manshu

Your response to various questions regarding gold ETFs is very clear & impressive.

You are giving clear a picture and will be usefull for many investers.

Thanks dear, God bless you

Madhu

Wow Madhu! Thank you so much for your kind words, and taking the time out to write this comment!

i have no account at broker, i want to invest some money in gold etf, how i can do it.

There’s no other way Ajit.

Can an NRI invest in GOLD ETF FUNDS. Please let me know.

Yes Conrad – they can invest in gold ETFs.

Thanks Manshu,

After reading all the comments, I have learnt a new chapt GOLD ETF FUNDS

GREAT JOB !!!

Thank you for your comment Ratan – your thoughts are much appreciated!

Hi

If I Buy Gold bar of 10 gms or any coin.Is there any service charge has to be paid.

VAT will be charged Harish.

Hello,

I just want to know today when market closed HDFC GOLD ETF increased more then 50 points on NSE, where as Reliance Gold decreased by 2-3 points.

Why so??? Gold rate is common for both the companies then why increase for one and decrease for one.

Thank,

Sanjay

Shouldn’t normally happen. I’ll check that later to see if I can find the cause, don’t know what happened right now.

Thanks Manshu, I will wait for your reply

Sanjay

Hi Manshu,

I have one query,

I have brought Gold Bees ETF shares. I am not getting why there is a difference between Gold Bees and HDFC Gold Exchange Traded Fund. because I found that Gold ETF had 1937 and HDFC Gold Exchange Traded Fund has 1975. Why this much of difference

HDFC gold ETF started out much later so that base might be different. There was another comment yesterday or day before talking about HDFC gold ETF rising sharply in a day, but I am a bit busy at the moment, and didn’t get an opportunity to look into it.

Hi manshu,

I am interested to take gold ETF’s. I have a demat account in HDFC bank. On seeing of earlier discussions and threads got to know Goldbees is best one.But i didn’t Goldbees.

can you plaese explain it?

From which organisation can i start trading on Gold?

Is there any service charge/VAT when buying gold ETF?

please clarify my doubts…

Thnks

krishna

GOLDBEES might have a different name or code on HDFC platform. Search for Benchmark Gold ETF and you will find the code. There is no VAT on buying ETFs. The charges remain the same as if you were buying shares.

Hi I want to invest in gold ETF (SIP) which is the best fund to invest for long term?

Did you read the post krishna?

Hi manshu,

I tried to buy GOLDBEES from icici-direct. I tried for a search with GOLDBEES in icici-direct but could not find one. But I was able to find ‘BENCHMARK GOLD EXCH TRADED SCH’ using the stock code of GOLDEX.

Just want to know whether GOLDEX is the same GOLDBEES etf. Does the stock code vary b/w different companies.(ie ICICI, Geojit etc..)?

Yeah, that sounds like the same thing, and diff companies do have diff codes.

HI

TELL ME BEST ETF FUND , WHERE I INVEST IN COIMBATORE

THANK U

There is no such thing as a BEST ETF FUND! What are you trying to invest in – gold?

I am new to Gold ETF. I want to buy Gold ETF units. Just now I’ve started demat account thru sharekhan. I am confused whether to buy Shares or gold etf.I don’t know abcd of both. Can you suggest the best? I want to invest for some 5 years .I should get a good return after that.

Please reply me for the same

Mercy

Since you a novice, equity investing is definitely not for you. Invest in a good large cap mutual fund using SIP. As fas as investing in gold is concerned, never over-do. You may hold a maximum of 20% of your total investment in gold. Not more.

Hi Masusha,

Good information about Gold ETF

Hi Manshu,

Very new to ETF’s gathered good info from this blog. You have compared expense ratios for some companies. What about Reliance gold ETF which ended yesterday. You thoughts and suggestions on this. I heard from a person from Kotak that they are going to launch GoldETF SIP very shortly.

Please give us your suggestions.

Many Thanks,

Srihari

Here is a full post I did on Rel Gold MF Srihari.

https://www.onemint.com/2011/02/17/thoughts-on-reliance-gold-mutual-fund/

It should answer your questions, and if you have any more then you can leave a comment there.

what is the stock code for Gold BeeS ETF from Benchmark Funds? In ICICI Direct GOLDEX is there. are both the same?

As per one of the comments here GOLDBEES is the code. But I was unable to find the same in ICICI Direct website.

GOLDEX against which it says BENCHMARK GOLD EXCH TRADED SCH is Gold BeeS Sanjit.

Hey Manshu,

You have not yet responded on the comment of HDFC Bank gaining sharply where other ETF fund decreased. Also a follow to that comment. If you can provide your expert opinion on that then I think I am ready to invest in Gold BEES (or HDFC ETF if your opinion changes 🙂 )

Thanks

Shiva

Hey Shiv – sorry about that. Got busier than usual and couldn’t look into it. Your comment is timed well because NSE has released its monthly ETF report, and they report that GOLDBEES has returned 3.80% last month whereas HDFC has gone up by 3.77%. However for the last 3 months both have returned exactly the same viz. 0.35%.

So, I think whatever you saw was an aberration and in the slightly longer term it got smoothened out.

Having said that – I see you’re giving good thought on the instrument, but have you given good thought to gold as an instrument itself, and how it fits in your portfolio, and with your goals?

Thanks Manshu for the response..

Since I have a baby girl, my main intension is to invest in Gold at regular intervals for her marriage. Having said that, I would be investing around 3-5k per month on a average in Gold ETF. I will also balance out it with physical gold purchase from time to time.

What do you say ?

So the best option would still be Benchmark Gold BEES?

Regards

Shiva

In my personal view I don’t see much merit in anyone holding more than 5 – 10% of their total portfolio in gold. The retail interest and steep price hike in gold in the past decade or so has more or less rendered it as just another asset class. People have forgotten that for about 3 decades gold prices stagnated, and there is no reason why that can’t happen 5 years from now.

would like to invest in gold sip can a respesentative of hdfc can call me

i like invest in hdfc

pl cal me 9565510066

Hi,

THanks a lot for the valuable information. Can you please let me know as of TODAY (24th March) which is the best Gold ETF? Does the status of Nuumber 1 for GOLDBEES stand even for today?

Regards,

kiran S – 9986043327

I don’t see anything which makes me change my opinion.

Manshu has done some serious analysis on Gold ETFs and i also agree that Benchmark AMC should be the best option for investing in GOLD ETF

Reasons

Lowest expense ratio

Hishest Liquidity for buying and selling

Pioneer in ETF in India

Recently acquired by Goldman Sachs so can expect much more improvement in the Indian ETF space

Goldman Sachs..!!!!!

Yikes!!!!!

Thanks a lot Manshu, very valuable information shared with the public. Helps the public!

Hi,

Your post is pretty good. I am looking into investing some money in electronic gold. In the comments section you have mentioned E-Gold and E-Silver. What is the difference between Gold ETF and E-Gold. If both are the same, what is the use of the ETF where one has to pay for managing the fund. Do you have any comments of E-Gold and E-Silver?

Regards,

Shankar

Thanks Shankar – both are not the same. In fact you will have to open a separate trading and Demat account for transacting in E-Gold. Here is a detailed post I wrote about it some time ago which you will find useful.

https://www.onemint.com/2011/01/13/e-gold-and-e-silver-from-nsel/

Hi manshu,

I just read your Explanation on the best ETF and I should thank you for the detailed information and the analysis to justify your viewpoint

howevere your article also states that you would take the direct option of buying gold coins if you had plans to invest in gold

My question is: Would you suugest that buying gold coins is a better option than buying ETF, if my idea is to save in Gold for my Daughter?

Kindly let me know

venkat

The final decision is up to you, but if the final objective of the gold is to make jewelery then I myself would prefer to buy gold from a reputed or known jeweler and then exchange it for jewelery when the time comes.

Hi

I do apreciate a father’s concern for his daughter’s wedding.

However gold etf has certain benefits

Even if you buy gold coins or bars, there would always be an extra premium for making them

Banks do not buy back physical gold and jewellers most of the times only exchange, so in case your daughter asks for a house over gold, it can become difficult for you to get the right money for your gold

No worries of theft in case of ETF and also save on locker charges

In case of ETF, you can aslwys track your investments in real time

We all know how jewellers fool us by reducing gold in wastage or impurties during the time of transformation to actual jewellery.

Dear Venkat,

Before you decide on Jewelleries or coins or ETF, suggest also have a look at E-Gold and E-Silver as an Long term investment. I am sure you will not regret it. Write to us at [email protected] for more details.

Dear Manshu,

I am new to gold etf.

I purchased 1 unit of reliance gold etf last month.

I have a doubt about the selling of these etf

1.can i get cash or gold against selling this ?

2.how much tax or charges i have to give at the time of selling?

1. Yes, you will get cash, and that’s the only thing you will get. You can’t get gold against it.

2. If you make capital gains on it and you’ve sold it within a year then its taxable at 15%.

Quantum offers the best ETF when looked upon holistically.

They have one of the lowest charges.

They have got the GOLD stocks checked phycically by an independent company (which is BV certified) and have the cert updated on the website as well.

I have invested myself in that and I have done my homework before that, I just wanted to shed some light over these facts and wanted to help you in making an informed choice.

Might seem very trivial. I have a demat account(opened only for getting the 80CCE infra bonds credited). Now I’d want to buy a gold ETF, cant I do so without a trading account?

Reason is I wouldn’t use the trading account for anything so why pay up another Rs800p.a. on that while any direct investment (IPO, FPO – actually even this is possible through ASBA; only secondary market buying may not be possible without a trading account) in the stock markets by me would only be passive

Nav – As far as I’m aware you can’t buy this without having a trading account. There may be an option that I’m not aware of but I have never heard of something like this.

Thanks Manshu! Might have to go the Fund of Funds way but again expense ratio climbs up there as well:)

Hi Nav

They are many brokers who are offering lifetime trading + Demat AMC free by just paying an amount much lesser than Rs 800.

Also you can apply for an IPO and FPO through ASBA, however if you want to sell those stocks you need a trading account.

Funds of funds has always been an expensive and a complicated product worldwide.

Also the infra bonds you have invested in have an option of selling in secondary markets in case you need money before the maturity date.

Having a online trading account would be beneficial as in future all the financial products including insurance also would be bought and sold through trading accounts only

Thanks Puneet for the advice!

btb any suggestions rgding preferred brokerages for a passive investor.

I have online account for buying and selling of shares. buy this same account can we buy the gold. shall i get gold or amount after selling the gold thru online dmat account.

thanks & Regards

Yes you can use the same account for gold ETF & when you sell it you will get cash, not gold.

@Manshu

Gold Rate 1950 – 50/gm

Gold Rate 1975 – 500/gm

Gold Rate 2002 – 5000/gm

Gold Rate 2011 – 22000/gm

On what basis are you saying that Gold rate has “stagnated”????

Show me another asset that has grown by 50000% in the last 60 years??!!

People, forget etf and other shares/stock junk these people get you to buy, only 3% ordinary people make money in it, the other 97% are the companies and these agents who cash in.

Buy gold every month, as much as you can afford, when you have enough in a few years, buy a flat ANYWHERE in the city, you cannot go wrong, you will be giving the greatest returns to your children.

Simple story – My grandfather bought a Rs. 2,00,000 house in Bandra Reclamation (One of the costliest suburbs in Mumbai today) in 1984, today, the flat’s price is a staggering Rs. 4,500000!!

What stocks, What shares?? Forget the gobbledygook stuff. Instead buy actual gold, save enough, and then buy land/flats.

Those 2 things will only and only increase in price and demand, but not in supply!!!!

And one last thing, now that you people will blast me with comments, let me just state one last benefit of land and actual gold. It is in my hands!!!

Your etf’s, shares, your money and other “portfolio items” are in the hands and control of someone else, someone who is beyond my control! 1 scam, 1 hack and all my money is gone!

Regards,

Am

yes reply i give value 2 your suggestion.

I really agree with you.

risk is always a factor for physical gold

@Am:

Accepted that gold has risen by over many many times over the past decades, but isnt it all in hindsight that we are making decisions for the future? If one can connect the dots looking fwd, then one’s genius. Its like saying that “today’s education system is gonna prepare kids in their careers for the next 30 years(while we dont know whats gonna happen inthe next 5 years” (Courtesy: Sir Ken Robinson))

We are speaking of a trend across 60 years..but the lifespan of an average investor(atleast one who is risk-averse) I guess would be about 30 years? And during that period, a single huge drop or even a few drops can erase a lot of capital which may not go back to the previous levels over the lifespan of the investor (The Gold, Silver crises in the 1980s, The Japanese index(Manshu hasa post on this I guess), the sub-prime crisis are all cases in point) Also to be considered is “when” the investor will need the money to reach goals and not the other way round(cashing in during bull runs or fleeing during bear phases)

Am not a proponent of any one asset, but to keep all eggs in one basket(even if its spread across a large time period like SIPs ) is kinda risky I suppose. Dwelling on this aspect in a few chapters is Taleb’s book “Fooled by Randomness” which is a good read .

Just wanted to share a few thoughts.

Hi,

if some body can help – I hold 06 gold coin of SBI and now i want to sell. whom / where should i contact to sell those gold coin

You will have to sell it to a jeweler – go to a few near your place and see who offers you the best rate.

Can you tell me what the expense ratio is. Suppose, I have Rs. 1,00,000 in hand. And at the end of 5 years, let’s say gold price is doubled. If I invest in physical gold through trusted jewellers, I will be getting back Rs. 2,00,000 roughly. But I am not sure how much will I get through ETF. Can you calculate the effect of expense ratio, which is 1% for most of the ETFs.

Thanks.

The expense ratio is expressed as a % and if you have 1% expenses then at the end of 5 years – 5% will be reduced from the returns. I’m still to see a comment here from someone who has had no problems or deductions while selling their gold back, so personally I won’t feel very confident about getting double the money if the spot gold prices doubles.

it’s true that jewellers don’t offer exactly the price of the gold,when u go to sell it.

Firstly,they often deduct the weight and you cant challenge thm on tht.

secondly, if u sell coins they are nt willing to purchase coz, they wont make mch out of it,they say that if u want to purchase or make jewellery they have say price(current rate) whereas if u want cash they deduct around Rs.200-300/gm

thirdly, you cant be sure whether 10 yrs from nw the same jeweller will be available.May be he shuts his shop or his children don’t wish to continue as jeweller. Other jeweller wont pay good enough for jewellery or coins purchased from someone else.

@Amit,

Buy Gold coins from Reputed Jewellers like Khazan Jewellers or Reliance Jewels. They will buy back gold coins from you and also exchange for jewellery. You can also take cash incase of Reliance Jewels. I happen to have invested in 12 months montly gold purchase scheme of Reliance and I have a Chance of buying jewellery or coin. Beware of the rising gold prices.

regards

Can you please explain why there is a difference in per unit value of various Gold ETFs even if they are representing (say) 1 gm unit of gold? Is it only because of the expense ratio?

Secondly, based on today’s data (20-May-2011), price of Axis Gold ETF is Rs. 2175 but price of Gold Bees is Rs 2137. Why is there so much of a difference? Does it also mean that apart from gold, the funds may hold other assets like bonds, etc?

Based on above, would Axis ETF be the best gold ETF to buy?

Regards

Tarun

Tarun – I have an entire post on the topic that should clear your doubts. It can be found here:

https://www.onemint.com/2011/02/15/why-do-different-gold-etfs-have-different-prices/

I dont know more about this gold funds or gold bonds, want to invest if got clear all concepts.

You can read this link and see if you understand. It’s a broad topic so difficult to explain in a comment, but you can get started here:

https://www.onemint.com/2009/10/23/what-is-an-etf-2/

Hi

I’m planning to invest on gold, can u give me a projection of hike in gold price the next 5 years. is it safe to invest on gold today. also suggest us wether to purchase on ornament or gold coins/bis’ts.

thx

I’m afraid I don’t know what will happen to gold prices tomorrow, let alone 5 years from now.

If i hv to invest in Gold EFT where should i invest

GOLDBEES is a decent option.

I do not want to buy physical gold but to buy through exchanges on monthly basis.

What is the way ? Can you name a few broking houses who can help ?

I already have a dmat account.

Do you have a trading account as well? If you’ve ever bought shares, then you can buy ETFs in the same way through the same trading account. There’s no need to go to a special broker for that Sukumar.

Hi,

Can you pls help me out how to buy GOLD ETF ( Reliance …)

Mahesh – it’s done just like stocks, if you have ever bought shares and have a Demat and trading account, you can buy ETFs in the same manner. Have you ever bought shares?

HI Manshu,

The post is really useful. I have also read your post here https://www.onemint.com/2009/09/07/gold-etf-in-india/.

In your research you mentioned the expense ratio of Gold Bees is less(1%) compare to other ETFs. I have gone through the document in the following link and it indicates the expense ratio of Gold Bees is also 2.5% – http://www.benchmarkfunds.com/Documents/SID_ETFs.pdf

There is no link to sebi site in the post “https://www.onemint.com/2009/09/07/gold-etf-in-india/”. Hence I have gone through their website. It looks like some ETFs like Nifty Bees, Bank Bees alone have 1% as expense ratio.

Please clarify, Regards.

Hi Karthik – I think that document is dated; if you go to their page here you will see the rates.

http://www.benchmarkfunds.com/Products/GoldBeES/Overview.aspx

Hi Concern,

I just want to invest on monthly basis in GOLD.

can u please help me to invest in GOLD and also confirm how can i invest?

What is GOLD EFT, is it best option to invest in gold?

Sunny,

You can invest in gold ETF just like you invest in any other shares. Have you ever done that? Benchmark GoldBees is a good one that you can try out.

Hi Manshu,

Thanks for your early response.

Actually, this is a first time I am trying this type of investment.

Hope I am going on right way.

What are the formalities to start the same by Benchmark GoldBees?

There are no special formalities, you just have to get a trading and Demat account like you would do for shares, and you are set.

Excellent work Manshu. I was researching for info on gold ETF and your articles saved me a lot of time.

That’s awesome! Thanks a lot for your comment! Look at some of the other stuff here and it might just be of interest to you as well. If it is then you can subscribe to the free daily newsletter using the box at the top right. Thanks again for your comment!

Hi Manshu

is it possible for you to update the graph on this page to show data as per 2011 ?

thanks

Sure, will try to get it done this weekend.

manshu,

on online trading acct, gold etf fall in eq segment, but they also have an expense ratio which is the feature of mf. so if investing in gold etf we end up paying expense ratio of 1 % as well as brokerage. at the same time if we try to invest in fund of fund like reliance gold savings fund, we end up paying expense for this gold fund as well as underlying gold etf. so, expensewise investing in gold etf or gold sip is far more expensive than shares. is my observation correct.

Pankaj

Pankaj,

Your description of costs is accurate though comparing mutual fund / ETF costs to transaction costs is like comparing apples to oranges to me. I feel that way because MFs, or ETFs are products that charge expenses to allow individuals the ability to buy a whole host of stocks or commodities that they ordinarily can’t buy themselves.

Manshu,

Thanks.

what do u feel is better, SIPing into reliance gold savings fund/kotak gold fund OR buying into gold ETF through my online portal. My time frame is 10 years and I want to buy gold worth 5k every month. I seek advice in terms of cost incurred and security of purchased units.

Pankaj – In terms of cost Benchmark Gold ETF is the cheapest for expenses. You can look at how much brokerage your broker charges, and if it’s not a whole lot then buying the gold ETF and avoiding fund of funds is definitely better.

In terms of security, since mutual funds also eventually buy gold ETFs (something which many people aren’t aware of) so you don’t get any additional security by buying a gold mutual fund.

Hi Manshu,

Hope u dng good..

Heard Gold man sachs have taken over GOld bees now..from 14th july..I have invested in Gold bees & wanted to continue with it..but now since GoldMan Sachs has taken over, wat would be the impact on Gold bees..Gold Man sachs is Investment banking & their stock would not always reflect the gold price..as Gold Bees would invest 100% in Gold.

Please provide an update if u have on this..or do i need to diversiy my portfolio in SBI gold etfs..

Hi Rohit,

I’m good, how are you doing?

Goldman Sachs taking over Benchmark won’t impact the price of GoldBees. The gold ETF will continue to be priced according to the gold stocks it has. So, you don’t need to make any change in strategy just due to this ownership change.

hey there i have a question regarding gold etf . in 2007 my uncle had invested in UTI Mutual Fund – UTI Gold Exchange Traded Fund.he purchased 41 units.now my uncle passed away last month. my aunt has no knowledge of stock markets and neither do i . i want to know if my aunt should sell it or not and if yes how much does she get by selling it

Hi Samir – Gold ETFs follow the price of gold, and move up if gold prices go up, and move down in gold prices come down, so people who think that gold will go higher in the days to come won gold ETFs.

topic very informative

Hi Mansukh

I like you blog very much, it gives us lot of knowledge.

I was confused in one thing, I read somewhere that one gold etf of goldbees is equal to one gram of gold. Correct me if I am wrong.

But when I see goldbees current rate is Rs 2209.30

Where as the gold MCS Rate is Rs 2308.2

Which means the goldbess is Rs 98.9 discounted as compared to the MCX rate. Why is it so ?

Can you kindly guide me for the same.

http://www.nationalspotexchange.com/Investment%20Products%20in%20Commodities-%20A%20New%20Paradigm.pdf – The slide titled ‘Alternative Assets Comparison’ lists the Return Potential of Gold as ‘Medium’. Any comments from users here on what the historical rates of return have been or what’d be a realistic return to expect in the short/long term?

Hey Mansukh,

I would like to invest in physical gold and want to purchase 100 gms of gold bar, do feel this the rite time to invest or you suggest me to wail for few days.

Regards,

Monish Agarwal.

I really have no clue on what a good time to buy gold will be. I wish I knew, but I don’t. Sorry.

no time is bad to invest in gold. I feel one shud be clear as to wat for is he investing and hw mch can he hold.gold has not dissapointed investers even during recession times

Hi Mansu,

I have monthly SIP of 16,000/- Rs. in MF and I would like to invest in GOLD ETF @ 10,000 Rs./month.

Is it write time to open SIP for Gold ETF?

Other then Term plan/PPF investment, my total investment through SIP route only which fulfill my goals of education fund for my son and retirement funds after 20years. I am 38years old and i have started my SIP 11,000 Rs. since June 2008 and additional 5,000Rs from June’11.

Please give comments and investment plan if better then this.

Plese adivse hoe to invest in gold etf in current market senario.

I am going to start Gold mutual fund Through SIP, let me know adavantages and dis adavantages of this. Kindly advice.

I have found your articles and Blog very informative. I have never invested in Gold Fund / ETF so far, and mostly invest in MFs through SIPs.

Please tell me is it worth investing subscribing in SBI gold Fund NFO which is open right now,? Or is it better to invest in Gold BeeS / Quantum fund?

Here is a detailed review of SBI gold fund that I did some time ago and you can read the post to get a perspective of how these things work.

https://www.onemint.com/2011/08/24/sbi-gold-fund-review/

Its September now and Gold has again reached new summits. At this price, are ETFs (or physical gold for that reason) still a good buy? I think Yes, because the world economies are plunging day by day. At the same time, sceptics say there’s a Gold bubble forming.

Please share your views on a fresh investment at this stage.

I’m afraid I don’t have a clue on what’s going to happen Conan. I have been staying away from gold since 2008, and have missed the 100% price gain, so I’m certainly not the right person to say what’s going to happen in the next few years with gold prices. I have chosen to stay away myself because of the huge run up in prices, and interest, and that scares me as it reminds me too much of the real estate stocks or the IT stocks before them.

I am going to invest gold mutual fund through SIP. let me know the advantage and disadvantage.

hi mansu

cud u plz clarify whether expense ratio is annual or one time only

thanks nd regards

It’s annual Pawan.

Dear Manashu,

You r genius having a sharp knowledge about gold etf i have read your various comment/reply I am new investor as Shiva I have daughter of 1.9 years and I am preparing for her marriage and education kindly suggest me option for investment I can invest 2-3k per month and best way to purchase gold Etfs and also risk factors , probable benefits would get in 2025 years.

My Email ID [email protected]

Well, if you have to start with 2 – 3k only then just gold may not be wise for you – mix it up by investing in a mutual fund a fixed deposit investment and then a gold ETF or if you don’t have a Demat then gold mutual fund since I guess you are looking to buy some gold with this money. Mix it up well, and don’t expose yourself too much to just one type of asset.

hello manshu,

I am following your website since 2 months and i would like to ask you one question

can you tell me the best investment to put money monthly 4k or 5k.

I am 24 yrs old and want to earn money through mutual funds, gold or silver…

Can you suggest me…

There is no such thing as a best investment! It all depends on what your risk taking ability is, what your goals are, how long you can hold on to your investments etc. If you are young and starting out then I’d say having a mix of diversified mutual funds and fixed deposits is a good thing to start with, but there is no short answer to the question you are asking.

TQ for your reply.

Can you please suggest me some mutual funds in gold silver

There isn’t any silver ETF in India, and for gold there are several ETFs listed in the list on this post itself that you may select.

What is the best substitute for physical gold? I am not too keen on investing in golf MFs as performance will depend on tthe fund managers. I want virtual gold which I can buy at market price and sell at market price just like buying and selling stocks. Do ETFs meet my requirements?

No, they don’t and you need to get more familiar with gold mutual funds also. They just own ETFs nothing else – they are not actively managed like you presume.

Hi Manshu,

I have learnt much from this page on ETFs, gold, etc. Right now, I have about 10 L in SB account (NRI). I want to put it to good use. I dont have DEMAT account, I wont be coming home until Feb next. I would appreciate it, if you can give me some idea of where to invest.

Balaji

If you don’t have a Demat account, and are out of the country then probably the most effective way for you to get returns on this money is to open a fixed deposit and take advantage of the current high interest rates. That way your money will generate better returns, and when you do get back you can get things set up.

I know that ETFs are best in case of long term investment But what is the best way of buying gold in case of wedding say due to 6-8 months? Physical gold or ETF. And from where i can buy.

Dinesh – for such a short term try looking for some jewelers who allow you to lock on to today’s rate if you set up a plan with them to buy in the future. In some cases they give good discount also. Check with people in your family or neighborhood to see if any such deals exist where you are.

well, Gold ETF is the easiest available way of investing in the gold, at the same time the tracking error of most of ETFs is negligible.

In order to invest in gold etf one can go for the IPO route, or can buy them directly on exchange through broker, But gold ETF can also be bought directly from the Fund house, provided the investor buys minimum of 1000 units.

Source:

http://www.reformistindia.in/2011/11/14/what-is-gold-etf-how-to-invest-in-gold-etf/

what is gold eft scheme and how to invest in this scheme .

if locking period in this scheme. return %

thanks

i am a beginner

Can you please do a an analysis of the best Nifty ETF in India based on the expense ration and performance(C.A.G.R)

EXPENSE RATIO

Here is a post that I’ve already done about that Shinaj – I think you will find it useful.

http://www.google.com/url?q=https://www.onemint.com/2011/10/11/comprehensive-list-of-nifty-index-funds-and-etfs/

I understand that Gold ETFs are available online both at NSE and BSE. There is always a little price difference. So I think we should buy whereever the price is lesser and sell wherever the price is higher. Am I right? Or is it that if we buy at BSE we have to sell it at BSE only? Is liquidity different in the two exchanges?

You can do that if you see a price difference though I wouldn’t expect it to be much of a price difference at any time because that will create a good arbitrage opportunity. How much of a difference have you normally seen?

Liquidity is different in different exchanges and I suspect NSE to be more liquid for Goldbees trading than BSE though I have never seen the numbers.

Its the other way round BSE is more liquid than NSE in Goldbees .

Thanks Manshu.

if we can choose to sell them at either of the two exchanges, both price variation, however small and liquidity difference if any, should be of no concern. hope I have understood correctly.

That’s my understanding yes, though I have never actually done this myself, so I have no practical experience in this. I’ve always bought and sold on the NSE.

thanks Manshu.

seems equity is getting a silent bounce back ( 2012 Feb month, the time I posted ths msg 🙂 , in my POV, we must avoid GOLD and SILVER investment for now ad start looking equity for cherry pick. A detailed technical analysis can be found here:

http://arthaplanner.com/one/

If any one has query relates to financial planning pls visit my site http://www.manishpant.com

Me and my team aims to enhance financial literacy in the society and guide people to map their available finance resources into their personal financial goals that they aim to achieve, this would not only influence their financial satisfaction but also impact their life satisfaction.

manish pant

CERTIFIED FINANCIAL PLANNER

can i have your mobil no.

i read about gold bees fund run by goldman sachs.

goldman sachs is a foreign bank/company.

what our the risks and implications of such a company if it goes bust like lehman brothers or mf global.

secondly returnwise which gold fund or etf gives high percentage of return annually

regards

Sun

ETF structure is same across all companies and hence the returns are almost similar.The only difference come sin tracking error which is high in some funds.Look at this figure and you can select a fund with ow tracking error.

Gold Bees Fund was launched by Benchmark which is now bought by Goldman Sachs.I don’t see chances of it going burst like Lehman as there has been heavy regulation on it after the Lehman fiasco.Moreover MF structure is different from Investment Banking. Even if it has problem worlwide it will sell its assets in India like lehman did in most part of countries.

Hi

I am anil, Idont know how to invest in SIP in gold etf but i want to invest. So please guide me

1.how to invest and how much i invest in gold etf.

2.which points should remember when investing and what are the risk points.

3.which is the best gold etf.is sbi gold is good.

4.is any charges for entry or exit.and how much long time i can invest.

Thank U.

If you wanted to set up a SIP in gold ETF then you can buy a gold mutual fund which in turns invest in gold ETF. There are many like that. The biggest risk is if gold prices went down, then the price of the gold ETF will also go down. All ETFs are similar in nature GoldBeeS has low costs and is the biggest, but if you wanted to do a SIP then perhaps you should choose something else. Normal brokerage charges apply.

How much, good or bad time to invest is a question that you have to answer yourself because that’s your take on whether gold prices will continue to rise or not.

thanks jitendra solanki for the answer.

what is the general average return of gold etf funds annually in percentage?

regards

For what time period sun?

Sun,

Gold ETF have been able to produced 20+% returns in last few years.

But then there is a strong misconception that gold will continue producing these returns.In next few years you shoudl not expect repeat of thsi performance unless gold really carshes an dthen ris eagain.

I personally beleive when you are investing for inflation hedge you should expect 9-10% return from this asset class in long ter,.In short term its not more than a commodity which have its risk return characteristics.

12 months time period for 2009-1010, 2010-2011, 2011-2012,

http://www.investment-mantra.in/2012/all-about-gold-etf-and-gold-fund-of-funds-fof-at-investment-mantra-in/

Thank you

Please send me important gold invest messeges.

HI,

i am planning to open gold ETF.

Assuem i opened XXXX Gold ETF for 2 years and i have some amount of in ETF. i would like to know after the maturity date shall i redeem physical gold coins for that amount?