IREDA 7.74% Tax-Free Bonds – January 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

First of all, we wish all the readers of OneMint a very Happy & Prosperous New Year !! May God give you success in your work and peace in your life and 2016 turns out to be the best year in your life !!! 🙂

IREDA 7.74% Tax-Free Bonds

Hunger without food is bad for health, so is overeating. Investors were hungry for tax-free bonds, especially a big issue to satisfy their demand, like the NHAI one. But, when such an issue came, they were not able to have full of it. It only got subscribed by 0.86 times in the retail investors category.

Such a big supply or say shortage of demand resulted in poor listing for the IRFC bonds. Investors were expecting some healthy listing gains with IRFC bonds after it received a good response and big oversubscription on the first day itself. But, that did not materialise, probably because NHAI offered slightly higher rate of interest or probably many investors subscribed to IRFC bonds to get its listing gains only.

As the NHAI issue got closed on the last day of 2015, IREDA announced slightly higher rate of interest for its issue which is getting launched on Friday next week i.e. January 8th. It will offer a maximum of 7.74% coupon rate for a period of 15 years, which is 0.14% higher than NHAI’s 7.60%. But, at the same time, this issue is AA+ rated, so it can carry a slightly higher rate of interest.

The issue is officially scheduled to close on January 22, but I think it should get fully subscribed much before than that.

Before we analyse it further, let us first quickly check the salient features of this issue:

Size of the Issue – IREDA is authorized to raise Rs. 2,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 284 crore by issuing these bonds through a private placement. The company will try to raise the remaining Rs. 1,716 crore in this issue.

Rating of the Issue – ICRA and India Ratings have assigned ‘AA+’ rating to the issue, thus suggesting that these bonds carry very low credit risk and high degree of safety regarding timely payment of financial obligations. As all the previous issues were rated ‘AAA’, this is the first issue this financial year which is rated AA+.

Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

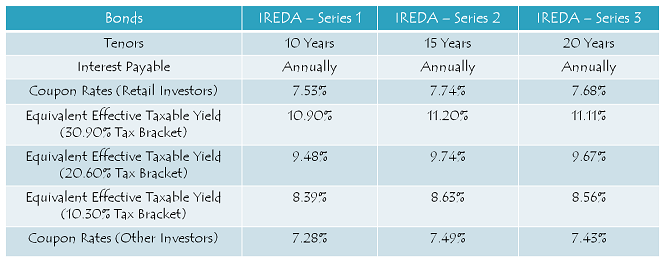

Coupon Rates on Offer – As this issue is rated AA+, it can offer interest rates which are 10 basis points (or 0.10%) higher than the rates which a AAA-rated issue could have offered. While NHAI 15-year option carried 7.60% rate of interest, IREDA is offering 7.74% for the same duration. For 10-year period, IREDA issue will have 7.53% rate of interest as against 7.39% which NHAI was offering.

As the NHAI issue did not offer 20-year investment period, IREDA offer will be attractive for the long-term institutional investors like insurance companies or pension funds. For 20-year period, IREDA is offering 7.68% to the retail investors and 7.43% for the non-retail investors.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

NRI/QFI Investment NOT Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 343.20 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 343.20 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 343.20 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 686.4 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IREDA has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.53% p.a. for 10 years and 7.74% p.a. for 15 years and 7.68% p.a. for 20 years on their application money, from the date of realization of application money up to one day prior to the date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IREDA will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

IREDA (Indian Renewable Energy Development Agency), 100% owned by the Government of India, was established in 1987 to promote, develop and extend financial assistance for renewable energy and energy efficiency/conservation projects. As the company has strategic importance in the development of the renewable energy sector, certain special privileges have been provided to the company:

* Regular capital infusion in the company by the Government,

* Sovereign guarantee to the lenders against approximately 58% of IREDA’s total borrowings,

* Rs. 300 crore allocation from the National Clean Energy Fund (NCEF),

* Access to cheaper sources of funding, like these tax-free bonds etc.

Reasons for a lower Credit Rating as ‘AA+’ – Many investors want to know why this issue has been rated ‘AA+’ this time around when last time in February 2014, IREDA issued these bonds and the issue was assigned ‘AAA’ rating by the credit rating agencies. Investors also need to decide whether they should invest in this issue with a higher rate of interest being a AA+ rated issue or wait for HUDCO to announce its interest rates and then take a decision.

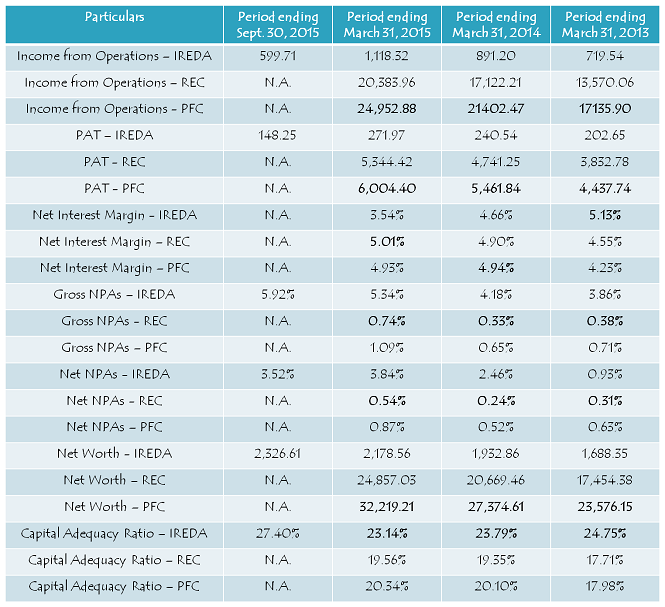

So, as the HUDCO interest rates are yet to get announced and we also don’t know when exactly the issue will be launched, it is difficult to guesstimate its interest rates. That is why I can talk only about this issue at this point in time. As far as the rating is concerned, I think higher NPAs and lower yield on its lending portfolio resulting in a fall in the company’s net interest margins (NIMs) are the two primary reasons for its rating downgrade from AAA to AA+.

IREDA was doing well in terms of managing its asset quality a couple of years back. Its Gross NPAs improved from 19.9% in 2007 to 3.86% in 2013. But, in recent times, its financials have taken a hit and its Gross NPAs have again increased to 5.34% by March 31, 2015 and 5.92% by September 30, 2015.

IREDA vs. REC vs. PFC

(Note: Figures are in Rs. Crore, except figures in %)

Moreover, as per ICRA, lending only to the renewable energy sector, low net worth of the company as compared to some of the bigger players in the power financing business and higher NPAs in the small hydro, cogen and biomass segment are a few other reasons for a lower rating.

However, as IREDA is 100% owned and backed by the Government of India and as the government is committed to encourage the use and development of renewable sources of energy, I think the company should be able to improve its financials going forward. Its capital adequacy ratio (CAR) is quite comfortable at 27.40% on September 30, 2015 and its debt-to-equity ratio is expected to be 3.93% after this issue gets completed. IREDA also plans to go public in the next 2-3 years.

Personally, I am quite comfortable investing in this issue as I think IREDA should be able to improve its balance sheet going forward and the government backing will always be there for a company financing the renewable energy space. However, conservative investors, who need to invest only Rs. 10 lakh or less in these tax-free bonds, should wait for the HUDCO issue or NHAI Tranche II.

Application Form for IREDA Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IREDA tax-free bonds, you can contact me at +919811797407

thanks for the details, but will invest only after your Update details .. awaiting…

Thanks P.S., I’ll update it by tomorrow or Monday.

Sir, I am waiting for Update..reply soon..thanks..

Hi P.S.,

I have updated the post above, I hope it helps!

Shiv Kukreja ji thanks for updating…

will invest in this for long term like 15 years–to get 7.74% retail.

thank you once again

Dear Shiv,

Thanks for the update on new issue. Considering the rise in coupon rates of Gilt and AA+ status of IREDA , 15 basis points rise in coupon rate was expected. But considering the low volume, and participation of NRIs the issue may get oversubscribed on day one also. But there will not be the same interest as earlier considering that many short term investors will keep away taking into account the loss made in IRFC. It is also question mark why this bond moved from AAA last time AA+ this time. Where as HUDCO moved up from AA+ to AAA. May be you will have some answers for in the further updates.

Hi George,

I’ll definitely try to find the reason for IREDA’s downgrade, but I don’t think there would be any considerable factor behind it. Also, NRIs are not allowed to invest in this issue. Still, Category I, II & III should get oversubscribed on the first day itself. Let’s see how it goes with the retail investors.

Dear Shiv,

In the above post Mr George mentioned about loss made in IRFC. I am new to Tax-free bonds and have invested 7.9 lakhs in IRFC bonds(2015 issue); was it a wrong decision to commit such a sum? What are your views? Are these bonds not fetching good returns on the Stock Exchange.

Many thanks

Hi Parag,

If your sole purpose of investing in these bonds was to have listing gains, then probably it was a mistake. But, if you want to stay invested for long-term interest income and gradual capital appreciation, then you have taken a right decision by investing in these bonds. These bonds are trading around their intrinsic value as there are more sellers than buyers at the current prices.

Dear Shiv Ji,

This is an unrelated query. I am a keen follower of your blog since 2012 when I first got interested in Tax Free Bonds. I hold NHAI Tax Free Bonds which were alotted in January 2012 ( NHAI N 1) for Rs 5 lakhs. At that time, the upper limit for investment by retail investors was Rs. 5 lakhs. Recently, I purchased some more bonds of this issue from secondary market, thus exceeding the limit of Rs. 5 lakh. My query is will I get less interest on this additional purchase.

If yes, if I transfer these bonds to my wife who does not hold any of these bonds, will she get the interest originally meant for retail investors, ie 8.20%

Thank you

Vin.

Hi Vin,

There is no “Step-Down Interest” clause with NHAI N1 & N2 bonds. So, even if your holding exceeds 500 bonds, you’ll continue getting 8.20% interest.

Dear Shiv,

I have a similar querry about SBI bonds series N5, issued in March 2011 bearing coupan of 9.95% for retail and 9.45% for non-retail category. Retail category limit was Rs.5 Lacs at the time of the issue.

I own some of these bonds. I am getting 9.95% interest at present. I want to acquire some more bonds due to which the total face value of bonds held by me would exceed Rs.5 Lacs. Will I get 9.95% interest even after the total face value of bonds held by me crosses Rs. 5 Lacs or will I get only 9.45% interest (applicable to non-retail categories) ?

Thanks

Hi TCB,

Yes, you’ll get 9.95% rate of interest even if your holding exceeds 50 bonds. Currently, it is yielding 8.7659% at Rs. 11,525 – http://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=SBIN&series=N5

Hi Shiv

If the yield is 8.7659% then it means these SBI Bonds are better than IREDA Tax Free bonds? Are these also Tax Free? Is it better to buy bonds from secondary market because of better post tax Yield than from primary market? Kindly clarify.

Thanks

Manu

Hi Manu,

SBI 9.95% bonds are taxable bonds and hence not better than IREDA tax-free bonds for the investors in the 30% or 20% tax bracket.

Dear Shiv,

Thanks a lot for your reply.

You are welcome TCB! 🙂

Dear Shiv Ji,

Iam new to BOND Investment and have few queries, please clarify :

1) If I purchase IREDA bond then can i avail tax benefit on investment made apart of the limit 1.5 lakhs under Section 80C, 80CCC & 80CCD? If yes then how much?

2) My wife is a home maker if my wife purchase the IREDA bonds then can i avail tax benefit ?

3) What are the various modes to purchase IREDA bonds ?

Await for your response.

Best Regards,

Rohit Gupta

Hello Rohit,

For the current financial year, i.e., 2015-2016, these bonds cannot be availed for tax benefit.

Regards,

Bharani

Hi Rohit,

1 & 2. Tax-Free bonds do not carry any tax deduction under any section of the Income Tax Act. Only the interest earned of these bonds is exempt from tax.

3. You can buy these bonds in demat form or physical/certificate form.

Dear Bharani/ Shiv JI,

Thanks for the clarification I am very new to Bonds/NCD’s etc.. so dont have knowledge about these. Might be i purchase the bonds very soon and will also be a learning experience for me.

I am not ready to go through DEMAT to purchase the bond, please do let me know how to purchase the physical form of certificate, plz provide me any weblink for the said.

best regards,

Rohit Gupta

Hi Rohit,

To invest in IREDA tax-free bonds in physical form, you need to download the application form from the link pasted above in the post & mail me the scanned copy of the duly filled form on my email id – [email protected]

I’ll do the bidding of your application and provide you the “Bid Id” of your application generated on the BSE platform. You’ll be required to mention the Bid Id on your application form and submit it at one of the designated bank branches in your area along with your PAN card copy, address proof, a cancelled cheque and an investment cheque. For any assistance or query, you can contact me on my number 9811797407

Dear Mr. Shiv Kukreja,

Could you please clarify if the interest(s) received on our Application money (2 interest amounts are displayed at times) are TAX FREE & are EXEMPT INCOME to be shown in ITR.

Hi S.K.,

Interest earned on your application money is not tax-free, it is taxable and investors need to add it to their taxable income as Income from other Sources.

Dear Mr. Shiv Kukreja,

Could you please clarify if the all the recent issues of TFB’s have the ‘step down interest’ conditions in case holdings of investors exceed Rs. 10L.

In case, we had applied in HNI category and were allotted only 200 bonds or so, then if we buy RETAIL CATEGORY BONDS at higher rate from market then will we get full RETAIL INTEREST RATE? I read somewhere that PAN number would be used for clubbing of BOND HOLDINGS to determine RATE OF INTEREST PAYABLE.

Finally, if I have been allocated recent TFB’s of IRFC to the extent of Rs. 7.91L & also have earlier bonds purchased from the market if different/older series and the total holdings exceed Rs. 10L then will IRFC pay me lower interest rate for both old & new Bonds?

Frankly, it is quite confusing to us, please clarify in detail for the benefit of all readers please.

Thank you.

SK, As I know any issue if you exceed holding of 10L you will lose retail benefits except first issues of NHAI and PFC which was issued 3 years back. You can buy 10L each in multiple issues of same co.

Hi S.K.,

1. Buying these bonds of the same issue for more than Rs. 10L will change your category of investor and will make you an HNI investor (High Networth Individual) i.e. Category III investor. Category III investors will get a lower rate of interest by 0.25% per annum. This condition is applicable to all recent issues.

2. If your holding across all Series of the same issue is more than Rs. 10L, then you’ll get a lower rate of interest for all your bonds.

3. You’ll get a higher rate of interest if your holding in each of the issues of the same company is Rs. 10L or less, i.e. you can have bonds worth more than Rs. 10L of the same company and still earn higher rate of interest, if you hold Rs. 10 lakh or less worth of bonds in each of the issues.

Can I revert back to retail category If I sell some bonds and make my holding less than 10 lakhs?

Thanks Shiv!!

IREDA TAXFREE BONDS NOT AVAILABLE ON WBSITE. IT WILL BE HELPFUL IF APPLICATION FORMS ARE MADE AVILABLE AS SOON AS THE ISUU IS DECLARED

Check Here

http://www.ireda.gov.in/forms/contentpage.aspx?lid=1407

Hi Mr. Sharma,

Application Forms are now available for you to download – http://www.fountainheadindia.in/FormPrinting/FrmDirectPrinting.aspx?details=UBx2/PhH8SdJWCAsyn50Jw==&&Reference=EswKb3+CHFOoRzYKsD0K0w==&&Flag=K1byKZlOeCylulT1F2Yh/g==

Hi Shiv

I am wondering what could be the reasons for not investing in these bonds. Is lower rating of AA+ could be one such reason OR the liquidity. Please clarify. Also let us know how easy or difficult is the sell these bonds in case funds are required? Does these bonds usually have buyers?

Also let us know the repercussions of listing these bonds only on BSE (and not on NSE).

Thanks – Manu

Hi Manu,

1. Higher expected interest rates could be the only reason for not investing in these bonds. There is no other reason for me not to invest.

2. AAA rating is definitely better than AA+, but AA+ rating of IREDA or lower liquidity is not a deterrent to me. IREDA is a government company and that is good enough for me to invest in this issue. Moreover, the current government is very much committed to encourage use/development of renewable sources and that is going to benefit IREDA for sure.

3. In case of an emergency, liquidity with these bonds is good enough to liquidate your holdings as a retail investor.

4. I don’t think there is any big negative impact of these bonds not getting listed on the NSE.

Dear Shiv:

Best wishes for 2016.

I see that with this new IREDA issue, we have seen six of the seven issues for FY 2015-16 (NTPC, PFC, REC, IRFC NHAI, IREDA).

That leaves only HUDCO – if I am correct.

IREDA has been allowed a total quantum of 2000 crores from which they have already raised 284 crores from private placement and the category IV component is 686.4 crores.

Hudco has been allowed a total of 5000 crores and of this, I believe that they have to raised a 70% component by the public issue – so there must surely be a significant part for category IV.

So, to cut a long story short, should we put money in IREDA or wait for HUDCO?

I am putting this query today so that you can address in your second post on the IREDA (invest/ not invest) aspect.

Sincerely,

SKR

Thanks Sandeep for your wishes, I wish you too have a wonderful 2016! 🙂

I think there are at least 3 more issues left this financial year – this one, HUDCO issue & NHAI Tranche II and if the HUDCO issue details do not come out by Friday, then I think one should go ahead & subscribe to IREDA bonds depending on the total investable funds you have to invest in these bonds.

Hi Shiv,

I had invested in IREDA tax free bonds last year, but now the rating is reduced to AA/+ (from AAA). Do you know what is the possible reason?

Also which other tax free bonds are expected in the the coming months till march 2016?

Hi RS,

1. I’ll try to find out the answer of rating downgrade when I’ll update the post later today.

2. After IREDA issue, at least 2 more issues are expected to come out till March 2016 – HUDCO issue and NHAI Tranche II.

Thanks Shiv.

Is there any indication on the probable interest rates for these two remaining issues?

Hi RS,

It is very difficult to guesstimate the rates of these issues as I don’t know when these issues will precisely get issued.

Hi mr shiv,

Good Morning,

I have old bonds from Ireda 1000.

can apply in this series 1000 in retail category

Hi Raju, Good Evening!

Yes, you can apply for 1,000 bonds as a Category IV retail investor and still earn a higher rate of interest for both your investments.

Is there Cumulative interest option facility for retail investers opting for 10 year term?. Pl. Clarify to the above E-mail id and oblige.

Hi Ramaprasad,

Cumulative interest payment option is not there with any of these bonds/issues.

Hi Shiv,

I am in 30% tax bracket. Holding some money in Liquid/Debt fund (getting around 8.5 % per annum). Is it good to put the money in Tax free bonds or leave the money in Liquid/Debt fund. Please help.

Hi Sarala,

I won’t be able to take this query here on this forum as it requires analysing your current investments in debt/liquid funds. Please consult your financial advisor for the same or you can avail our one time consulting service – https://www.onemint.com/services/

Thanks Shiv … awaiting post updates.

Sure, I’ll try to do that as soon as possible.

Dear Shiv,

Thanks for information posted regarding TFB. This will more helpful for

new investors as well as old investors.

Thanks Mr. Sain!

dear shiv

i have not received the interest payment for 786pfc28 which was due today

in two of my accounts.is this the case with others also? should i wait?

Hi Dr. Puneet,

I have no idea why there is a delay in interest payment as I do not have my or my family’s investments in this issue of PFC.

Dr.Puneet, I have received it yesterday and you will be getting by today.

George ji: for whatever reason, I have not received it even today (end of 05/Jan)

Regards,

SKR

still i have not received it. alas! there is no easy money

Hi Dr. Puneet, Hi Sandeep,

Are you guys sure you are checking the right bank account for getting the interest credited? If you hold these bonds in a demat form, then you should check your bank account which is linked to your demat account. If that is not the case, then you should contact MCS Limited, the Registrar for the PFC issue.

Hello Shiv/ Dr. Puneet:

I contacted PFC team and they gave me some story of software glitches at their end itself. I explained them that no change have happened at my end – I continue to use same demat and bank accounts.

They have said that they will resolve the problem soon (there are a lot of folks like me) and we should get the money credited soon.

———-

Shiv,

coming to the edits made by you today on investing here v/s Hudco etc., — ”conservative investors, who need to invest only Rs. 10 lakh or less in these tax-free bonds, should wait for the HUDCO issue or NHAI Tranche II.”

a) I am not a conservative investor and the AA rating aspect does not make me uncomfortable;

b) If rating is not an issue, is there any other reason on why I should wait for the other 2 issues? (I do not intend to cross 10 L in any case – don’t have that much cash now or for present year). I acknowledge that interest rates for other 2 issues- which to me are the most important aspect- are not known yet.

Regards,

Sandeep

Hi Sandeep,

I think a higher expected coupon rate or diversification of investment among different companies could be the only other reasons.

i talked at mcs ,they say if interest is not credited to your account it will be redirected to mcs and then they will issue DD.let ‘s see what happens.moreover i had my complaint registered at grievance redressal cell of mcs.

i had a talk with mcs,they say that for the first time the transactions were done via route other than rbi, so there were a lot of rejections .they are resending the amount and we will be getting it in a day or so

i just got it in both of my accounts.sorry shiv for all those botheration.

That’s great !! No botheration Dr. Puneet!

Sir, I have also not received interest on pic tax free bonds which were purchased through ICICI direct. The bond are in d mat account. Pl advise whole to contact and how i.e. at what address etc. What is mcs and what is their contact address or phone no. Dr Puneet please advise. Thanks.

Hi Mr. Handa,

You can contact MCS on 011-41406149 or write a mail at [email protected]

Listing Notice – http://www.bseindia.com/markets/MarketInfo/DispNoticesNCirculars.aspx?Noticeid=%7B026102CE-05AA-44CD-83A7-D8472031101F%7D¬iceno=20130109-10&dt=01/09/2013&icount=10&totcount=21&flag=0

handa ji, contact at number given by mr. shiv.even i got this number from his previous posts.people at mcs are very co operative.dont worry.and inform sos.there is one toll free number as well-1800110660

Hi Shiv,

Wish you happy New Year 2016 🙂

Thanks for highlighting the new TFB.

I have applied NHAI 10L 2015 Retail Individual category. If i apply IRDA will I be consider as HNI or I can apply under Cat IV?.

Regards

Nagarajan

Thanks Nagarajan for your wishes, you too have a Prosperous New Year! 🙂

Yes, you can apply for IREDA bonds under Category IV and you’ll get a higher rate of interest.

Noted, Thanks lot Shiv.

You are welcome Nagarajan!

Dear Mr. Shiv Kukreja,

Thank you for your excellent write-ups on tax free bonds.Thank you also for responding to our queries.

Everything is perfect, but may I humbly suggest the below idea to make your email alerts sent to our inboxes even better.

Your email alerts to our inboxes are most welcome but would be even more appreciated by your readers if for a particular person’s query, the ENTIRE Conversation Thread of both Query & Answer(s) be included in the email. It could put the responses in proper perspective and be understood clearly by all.

Currently, emails are in random chronological order based on blog activity either by readers or yourself.

Thank you once again.

Thanks S.K. for your kind words and the suggestion as well! I’ll discuss it with Manshu and try to get it incorporated, if possible.

Thanks Shiv again for the wonderful post. Only question is,is it worth waiting for HUDCO which seems a better option?

Thanks Harinee,

As we don’t know what rate of interest the HUDCO issue would carry and when exactly the issue would get launched, it is very difficult to make a choice. I’ve updated the post above, so you can read my view about it.

Really informative discussions. Please mail me details of future issues of Tax Free Bonds along with your analysis . Thank you.

Thanks Mr. Poddar,

You may please subscribe to our free newsletter to receive these updates – https://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed

HUDCO may not prove to be a better issue. IREDA has offered the highest interest so far. Who knows by the time HUDCO issue comes out, the interest rate may be lower. I plan to split my investment in equal parts in IREDA, HUDCO and NHAI, if it’s second tranche comes.

Thanks Vin for your inputs!

Hi,

While you have mentioned NRI’s and QFI’s are not allowed, in the subsequent para, you have mentioned in Category 3 is for HNI’s and NRI’s with 20% of the issue reserved.

Can you please review and confirm whether NRI’s are allowed or not or are they allowed to invest only in the HNI category. Thanks ..

Hi Prashant,

Thanks a lot for pointing that out, I’ve made the required changes now. NRIs/QFIs are not eligible to invest in this issue.

HDFC’s Keki Mistry, media entrepreneur Raghav Bahl, Bollywood bid for Rs 10,000-crore NHAI bonds

http://economictimes.indiatimes.com/articleshow/50460497.cms

Reliance invested Rs. 350 crore, SBI Rs. 3,000 crore, Akshay Kumar Rs. 65 crore and Kareena & Karishma Rs. 25 crore between them. Axis Bank, IDFC Bank and Yes Bank put in between Rs. 500 crore to Rs. 1,500 crore.

The minimum subscription is five bonds across all series and in multiples of one bond thereafter.

The issue will open on January 9 and close on January 22.

The bonds have been assigned credit rating of ‘CARE AA+’ by CARE and ‘IND AA+’ by India

Ratings and Research Private Limited (IRRPL), indicating high degree of safety regarding timely

servicing of financial obligations and carrying low credit risk.

The company intends to utilise the issue proceeds for lending purposes, working capital

requirements, augmenting the resource base of the company and for other operational

requirements.

HUDCO is offering 15 basis points more than other issuers which have recently launched their

tax-free bonds, Chairman and Managing Director V. P. Baligar told reporters here, adding, “for

the first time ever, non-resident Indians and foreign institutional investors will be able to

participate in the issue.”

Last year, the company mobilised Rs.5,000 crore and managed to utilise all the funds, he said.

The coupon rate for qualified institutional buyers (QIB), corporates and high-net worth

individuals has been fixed at 7.51 per cent per annum for 15 years and 7.34 per cent for 10 years.

For retail investors, the coupon rate is 7.84 per cent for 10 years and 8.01 per cent for 15 years.

The bonds will be listed on the National Stock Exchange .

Kindly ignore these details as they belong to HUDCO’s January 2013 issue.

Dear Mr shiv,

Good Evening,

Kindly cross check above article regarding the Hudco bonds issue.I saw in google search just now.is it true or not?

Oh come on man, these details belong to the January 2013 issue of HUDCO. Please don’t share these details.

sorry sir kindly delete this message .

It is ok, I have mentioned it there that it belongs to January 2013 issue.

Dear Mr. Shiv,

I had applied for NTPC/PFC and was allotted few bonds in HNI category at lower rate. Can I buy in SAME SERIES RETAIL TFB’s and get higher interest rate? Or is this HNI classification PERMANENT?

Request that in future please post in a separate writeup most attractive bargains of TFB’s available in Market with good yields & safety & liquidity and RETAIL PURCHASE LIMITS for getting higher rate & hence not getting downgraded if limit is exceeded due to lack of knowledge.

Hi S.K.,

Yes, you can buy Retail Series bonds. But, your total investment should not cross Rs. 10 lakh across all Series.

How can one apply for these bonds? Where do I submit the physical form? Is there a webpage for electronic application? Thanks in advance for your answer.

Hi Ashish,

To invest in IREDA tax-free bonds in physical form, you need to download the application form from the link pasted above in the post & mail me the scanned copy of the duly filled form on my email id – [email protected]

I’ll do the bidding of your application and provide you the “Bid Id” of your application generated on the BSE platform. You’ll be required to mention the Bid Id on your application form and submit it at one of the designated bank branches in your area along with your PAN card copy, address proof copy, a cancelled cheque and an investment cheque. For any assistance or query, you can contact me on my number 9811797407

please provide links to check today’s supscription figures of ireda taxfree bonds

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1034&type=DPI&idtype=1&status=L&IPONo=1109&startdt=1%2f8%2f2016

categories 2,3,4 filling up very fast.

seems retail portion will get oversubscribed today itself..

Yes Chaitanya, seems so.

Can I make 2 bids for a separate series – eg. 20 year category + 15 year category?

Yes, you can do do. But, your total investment should not exceed Rs. 10 lakh to get a higher rate of interest.

Retail category is fully subscribed (Rs.687 Cr.) in the first half of the bidding period.

Applicants can expect partial allotment.

Retail portion fully subscribed now: 6864000 reserved, 6900642 subscribed.

Retail Category is Rs. 968.27 crore subscribed, should easily cross Rs. 1,250 crore by 5 p.m.

In my above application (Application copy attached) for Tax Free Bonds of 5.10.2015, I had applied for Bonds in Physical Mode, since my demat account was under process. However, subsequently, my NEW DEMAT ACCOUNT has been opened recently and I wish that my Tax Free Bonds be DIRECTLY CREDITED to my New Demat Account, instead of sending them in physical mode.

Attached ?? Where is it ??

Sorry, I meant to say allotment letter copy was attached and sent to BIGONLINE & PFC.

Oh ok, that’s fine.

I had written to both BIGSHAREONLINE & PFC on several occasions but without success to both the following emails.

[email protected],

[email protected]

I had provided them all details of my Newly Opened Demat Account while requwsting them to fredit my Demat account directly.

My Physical Certificate too has not arrived so far. What do you suggest I do to directly credit TFB’s to my DEMAT Account?

Do you have any other/additional contact emails/telephone numbers which may be of use.

Here you have the contact numbers of Bigshare Services – 022-40430200, 011-23522373

Hi Shiv,

I am Comparing NHAI issue & IREDA issue, wrt Subcription numbers.

On Day1 of NHAI, Institution Subscription was 4 times, while in this issue its till now less than 0.7 times.

Why institutions are staying away from this small issue.. while they were madly interested in bigger issue of NHAI ?? when its offering higher rate.

Normally they bid in the last hour.

Reply is in your query. In case of smaller issues, their sizable fund gets blocked almost for 15 days and also chances of getting higher allotment are much lower, compared to the large issues. So it is advisable to get higher allotment at slightly lower rate than to get smaller allotment at minimal 10 – 15 higher basis points.

In relative terms, Subscription TIMES should have been same in both, if not more because of higher rate.

In NHAI they will get 25% of their application, in this they will get 100% of application.

So, ideally it should close at 4 times.

Though, I checked it again at 4:38, now its 10 times (for Rs 1000), so directionally going correct. Factoring, the oversubscribtion absorbtion, it will close above 5 times.

It is 6.11 times finally.

Hi Shiv,

Can you let us know today’s subscription figures and the possible allotment ratio for retail investors.

Thanks in advance.

Regards,

Soumya

Hi SB,

Retail investors will get approximately 55% allotment.

Nothing surprising in retail getting oversubscribed considering that the issue gave best coupon rate so far and retail investor is not much concerned about rating of AAA or AA+. Any way , the issue gave an opportunity for some of them to buy the other issues at a relatively lower price from secondary market. IRFC was still trading on par. I used the opportunity buy few on top of my allotment. Even NTPC was priced reasonable in last few days. We can expect a jump in secondary market for all this recent listed bonds considering the over subscription and only 2 issues left. I am sure HUDCO will not be providing better coupon rate based on current level of Gsec bonds. NHAI will likely issue second trache only by Feb end or Mar beginning.

NHAI Trache -1 will give some small margin in opening sale.

I agree George!

Will there be brokerage if bought in secondary market? If so, how much typically? as that should be added to bond price for net gain.

Yes Chaitanya, brokerage will have to be paid while buying these bonds in the secondary markets. Brokerage varies anywhere between 0.25% to 1% odd.

Day 1 (January 8) subscription figures:

Category I – Rs. 2,096 crore as against Rs. 343.20 crore reserved – 6.11 times

Category II – Rs. 1,032.40 crore as against Rs. 343.20 crore reserved – 3.01 times

Category III – Rs. 701.54 crore as against Rs. 343.20 crore reserved – 2.04 times

Category IV – Rs. 1,262.12 crore as against Rs. 686.40 crore reserved – 1.84 times

Total Subscription – Rs. 5,092.05 crore as against total issue size of Rs. 1,716 crore – 2.97 times

This issue is over now. Now, only two issues left – HUDCO & NHAI Tranche II.

What is the size of hudco and nhai tranche 2

HUDCO issue size should be of Rs. 3,711.50 crore and NHAI is allowed to raise an additional Rs. 10,128 crore this financial year.

Thanks sir. Hope we get better allotment on these at least.

When are these issues expected?

HUDCO issue can get announced any time this month and NHAI issue should come in February or March.

Now, waiting for – HUDCO & NHAI Tranche II.

Shiv ji do update about this as early as possible..thanks

Sure P.S., I’ll do that as soon as I have any info about it.

Dear Sir,

I need a small clarification. How does this “first come first served” basis work? Does it not mean that applications are accepted only upto the available number of bonds on offer and the rest are rejected? Kindly enlighten. Thank you

Hi Satish,

As there is an electronic system of bidding, it is very difficult to accept/reject applications on a time entry basis. So, the exchanges make proportionate allotment to all those applications which get submitted on the day the issue gets oversubscribed. Applications which get submitted before that day get 100% allotment. First come first served basis work on a day-by-day basis. In IREDA’s case, as the retail portion has got oversubscribed on the very first day, all successful applicants will get proportionate allotment of approximately 55%.

Thank you Sir.

You are welcome Satish!

Sir, how did you came to know that if ever we are alloted it would be 55% allotment on FCFB?

Hi Sandhya,

Retail subscription of 1.84 times makes it 55% available for each applicant.

Hi Shiv, what % allocation can one expect in retail category if applied on day 1 (i.e. 8th Jan) of this issue?

Thx!

Hi SG,

Around 55% allotment will happen in the retail category if applied on Day 1.

Hi Sir,

I have the below list of questions which will be useful for my future planning.

1) When will we get the 5% interest for un allotted amount in TFB. On Dec 8, i purchased IRFC bonds, but only un allocated amount is credited, so wondering when will i get the interest?

2) If I have TFB in my account for 9 months and for some reason I couldnt hold it for 12 months and i sell it on 10th month, will i get any partial interest?

3) I know there is flat 10% interest rate If i sell TFB after one year irrespective of tax slab, will there be any indexation benefits If I hold bonds for more than 3 years

4) If I buy/sell TFB in demat account, i know 0.25 to 1% will be charged as brokerage. Does this means If I buy/sell bonds for 1 Lakh, around

Rs.250/- to Rs.1000/ will be charged.

5) IF I buy TFB in demat account, how long it takes to reflect in my demat account?

Hi Raja,

1. Interest amount must have got credited in your bank account for the allotted bonds as well as refund amount. Please check your bank account once again. If it is not there, you need to contact the Registrar.

2. You will not get any interest if you sell your bonds in the 10th month or before the “Ex-Interest Date”. Ex-interest date falls a couple of days before the Record Date.

3. There is no indexation benefit with the listed bonds.

4. Yes, that’s correct.

5. It takes 2-3 days for the bonds to get credited.

Thanks a lot for your immediate response.

Is it a fair idea to buy TFB before few days/weeks of interest payment date to reap the benefits of full year interest. I understand that most of them sell their bonds after interest payment date, but atleast few tend to sell TFB few weeks before the interest date due to their personal needs.

Hi Raja,

I don’t think there is a scope of good gains in such an opportunity (buying/selling it just before the ex-interest date). I think it is better to apply for these bonds from the company itself during these public offerings, rather than paying additional 0.5-1% brokerage for buying it from the secondary markets.

nice post

Thanks Ashish!

I am bit surprised to get interest for the REC 7.43 bond for the period 5/11/2015 to 27/12/2015. I thought the interest payment is supposed to be on 01st Dec every year.

Yes, REC in your post you have mentioned the interest will be paid on 28th Dec for the first year. That clarifies.

🙂

Mr Shiv,

If I apply TFBs under Category III but the allotment does not exceed Rs. 10 lakhs in the issue across all series) then, will I be eligible for receiving interest at the higher rate, which is applicable for Category IV investors?

Can retail investors buy the TFBs, which are traded under other category /non-retail category in the secondary market? If yes and total holding across all series does not exceed Rs. 10 lakhs, then what will be the applicable interest rate (retail OR non-retail)?

I also take this opportunity to Thank you for all your efforts in making this blog as most interactive and informative.

Thanks Shubh for your kind & motivating words!

1. You’ll get a lower rate of interest applicable to Category III investors if you apply for these bonds under Category III & allotment you get is below Rs. 10 lakh.

2. Yes, retail investors can buy non-retail bonds in the secondary markets. But, they will get a lower rate of interest if they buy these non-retail bonds.

Shiv, do you know when the IREDA issue was closed. Wants to calculate the allotment and refund.

It got closed on Monday George.

In which case we can expect the refund and allocation by 20th. Hope HUDCO issue starts only after that since we will have at least 1 week lead time from announcement.

Let’s see when HUDCO decides to launch its issue, we have been waiting since September-October for the same.

Looks like Hudco will also offer 7.7%. The Gilt coupon is up.

IRFC and NHAI are still trading at 1001-1003 level. Hope to have HUDCO announcement this week.

Dear Mr. Shiv,

There is no response from the numbers given by you for ‘Big Share’.

You may remember my case:

Refer PFC Tax Free Bonds of 5.10.2015. I had applied for Bonds in Physical Mode, since my demat account was under process. However, subsequently, my NEW DEMAT ACCOUNT has been opened recently and I wish that my Tax Free Bonds be DIRECTLY CREDITED to my New Demat Account, instead of sending them in physical mode.

I had submitted all details of my application form and my complete new Demat Account details. Despite this there has been no response from them. Kindly assist please and oblige.

Thank you.

Hi S.K.,

I think only Big Share Services will be able to assist you regarding this. They will first check the status of your bond certificate. If they have received it back, then they will send it back to you first and then you’ll have to send a fresh request through your broker to get it dematerialised. If they have not received your certificate back, then you’ll have to provide them the indemnity bond to reissue the certificate. It really depends on Big Share Services how cooperative they are in such cases.

Dear Shiv,

Thank you for responding. PFC

Bond Certificate has not arrived so far, hence there is no chance of it going back. In the allotment letter itself they had indicated that it would be issued in March’16.

Any thoughts?

Thank you.

In that case, it really depends on Big Share Services whether they will accept your request for directly crediting your bonds to your demat account or not. You need to take this matter to Big Share itself, only they can clarify it for you. If they do it for you, it will be of mutual benefit.

Shiv

With markets crashed will bond yield go up? I am really glad to have followed this blog else I would never have invested in bonds .

Can we expect some post by Manshu or you on alternatives for investors in present situation? Thanks

Hi Harinee,

An economic slowdown results in a fall in bond yield, but a panic results in yield moving higher. So, you need to decide if there is a slowdown or a panic in the markets right now. I’ll ask Manshu if he can do a post on alternate investment options in this market scenario.

dear shiv ytm of 901hudco34 is shown as 7.52 at this link —–http://www.bseindia.com/markets/debt/debt_corporate_EOD.aspx?curPage=1&expandable=0 and it is shown as 7.66 at this link—-http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=961816

what could be the reason for this difference.i used online ytm calculators and both the yields are being shown by different calculators.which one is correct?should it be calculated using excel spreadsheet?

Hi Dr. Puneet,

These exchange calculators are not reliable, you should do your own calculations using excel spreadsheet.

dear shiv

i used excel(XIRR) and found that both the yields are correct .one assumes that interest received is reinvested at 9.01% and other assumes it to be reinvested at 7.65%.since chances of reinvesting at 9.01 is unlikely in the future so assuming it to be reinvested at current yield is a better option.(being a doctor it was very hard for me to calculate it).

so the correct yield would be 7.52 and not 7.65

YTM calculation assumes that the interest amount gets reinvested at the YTM itself.

thanks a lot for your guidance.

You are welcome Dr. Puneet!

Hi Shiv,

I heard today that HUDCO Issue is opening on 23 January, but I could not find any reference to it in any newspaper. Have you heard anything.

Vin

Hi Vin,

23rd January is Saturday and it is not possible for an issue to open on a Saturday. So, 23rd Jan is ruled out. But, one of my sources has informed me that it could possibly open from 27th January. However, there is no confirmation about it.

Shiv, I strongly feel that 27th will be the start date. Last article in Economic times on TF bonds is very misleading. It suggests that these bonds help rich people quoting that Film stars are buying. After all film stars are also tax paying citizens and they will also have bad times when money is required. More over ET instead of highlighting how this money can be used for nation development are only focusing on how individuals and organizations are benefited in getting tax free income. After all nothing is free, it comes with some risk taking. Long term commitment to a fixed interest. Where as these idle money which would have been invested in gold or other assets are getting diverted to nation building. Infrastructure development is for whole citizens. After all the tax payers are paying tax and in a country like India they get very little benefits. If some one earns 20 Lakhs per annum and suddenly finds no job and income, he will have to live on his savings if he has done. Absolutely no social security unlike developed countries, where citizen gets benefits at the time of retirement or out of jobs.

I agree with you, George. In fact media should be neutral when reporting something. They should not take their own decision\opinion\judgement on any issues.

Even draft/shelf prospectus isnt filed yet, so how can it be possible this month?

Draft Shelf Prospectus got filed in October. HUDCO now needs to file its final prospectus and launch the issue.

I was searching for it at below link. May be its not the right place to look for then?

http://www.sebi.gov.in/sebiweb/home/list/3/17/38/0/Draft-filed-with-SE

George, you have so brilliantly articulated the views of retail investors. When I read this article today, I immediately thought of Shiv and wished that the guy who had written this story had read Shiv’s blog and realised how small investors like us are so interested in tax free bonds.

Blocking one’s money for 10,15 and even 20 years should be regarded as a great service to the nation. Return of about 7.5% means a lot only to small investors. Let us also not think that investment in these bonds for a period of 15 to 20 years is without risk.

Vin

It is wrong to say that Film stars are rich. There are so many people in films who were rich but now living in penury just because they did not save and planned their life after films. I would say that they have taken correct financial decision in TFB rather then buying cars or investing in property bubble. TFB are win-win situation for everybody- Govt PSU’s and investing public.

I am happy that You recognize this fact. There are so many avenues where this HNI invests. Some are investing directly in some companies and some in startups etc. Middle class is the only one looking at FD, NSC, PPF, Equity, MF , TF bonds etc taking some risk. Many who invested in stocks will find that there net worth is 50% after investing for last 6 months. So it is important that Govt opens up more avenues for investments with a win-win situation like TFB,Gold monetization etc. I do not care which Govt is in power, these are innovative ways to bring idle money into nation building. Paying TF interest to Film stars is no way taking from poor and giving to rich.If some one puts up comments critisizing ET view many a times they do not publish it. I am afraid if we have narrow thinking like this country will develop.

Hi Shiv,

I bought IRFC (10 yrs – 7.32%) and NHAI bonds( 15 yrs – 7.6%) couple of weeks back.

1) Are these bonds listed in NSE or BSE? Can I sell these bonds in both NSE and BSE?

2) Is there are BSE id or NSE id for these 2 bonds? Can u pls share if any?

3) Is there any website or link to check what TFB bonds & how much volume are traded on daily basis.

4) If there are no buyers for my TFB in trading, Can i break this long term bond with any penalty

5) Can I avail loan facility on my TFB after couple of years?

Hi Shiv,

I bought IRFC (10 yrs – 7.32%) and NHAI bonds( 15 yrs – 7.6%) couple of weeks back.

1) Are these bonds listed in NSE or BSE? Can I sell these bonds in both NSE and BSE?

2) Is there are BSE id or NSE id for these 2 bonds? Can u pls share if any?

3) Is there any website or link to check what TFB bonds & how much volume are traded on daily basis.

4) If there are no buyers in trading, can i break these bonds with any penalty?

5) Can I avail loan facility after couple of years like PPF?

Hi Raja,

1. Both, IRFC bonds and NHAI bonds, are listed on the NSE as well as BSE. You can sell your bonds on both the stock exchanges.

2. You can the Bid IDs of both these issues from their respective posts – IRFC – https://www.onemint.com/2015/12/05/irfc-7-53-tax-free-bonds-december-2015-issue/

NHAI – https://www.onemint.com/2015/12/14/nhai-7-60-tax-free-bonds-tranche-i-december-2015-issue/

3. Here is the link for all the bonds traded on the NSE – http://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

4. No, you cannot redeem these bonds back to the issuer before maturity.

5. Yes, you can use these bonds as collateral for taking loan/overdraft facility.

Sir, Could you guide us how to read and understand bonds trading on the NSE ..thanks

Hi P.S.,

Can you pick any one of these bonds and let me know what all you need to understand.?

Thanks a lot for your reply Shiv. I really appreciate your quick response and clarify all kind of queries for everyone!

Thanks Raja! 🙂

Hi Shiv,

Can we expect IREDA allotment by Jan 20, 2016?

Hi Janaki,

I think IREDA bond allotment should happen on January 20.

Finally HUDCO is expected to start issue on 27th Jan. The issue will open for subscription on January 27 and is expected to close on February 10. While the 10-year bonds offer 7.27% rate, investors can earn 7.64% from bonds with 15-year maturity

Read more at:

http://economictimes.indiatimes.com/articleshow/50646893.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Unfortunately HUDCO is palnning 2 issues of 1710 Crore each which means chances of fund getting locked and partial allotment is on cards.

HUDCO tax-free bonds issue update:

Issue opens – 27th January

Issue closes – 10th February

Base Issue Size – Rs. 500 crore

Total Issue Size – Rs. 1,711.50 crore

Interest Rates for Retail Individual investors investing upto Rs. 10 lacs:

10 years – 7.27% p.a.

15 years – 7.64% p.a.

Dear Shiv,

Are the NRIs are eligible for applying this HUDCO TF bonds?

No Nishar, NRIs are not eligible to invest in the HUDCO issue.

Thanks for the update!

You are welcome Chaitanya!

have all rating agency have given hudco taxfree bonds AAA rating shiv

Yes Nitesh, both credit rating agencies, CARE and India Ratings, have assigned ‘AAA’ rating to this issue.

when is the Ireda bond allotment Result coming up?

IREDA allotment should happen either today evening or tomorrow morning.

interest payments date please

Interest will be paid after one year from the date of allotment and on the same date every year from there onwards.

Dear Shiv, Any understanding whether NRI’s will be allowed in the upcoming HUDCO issue this time ?

No Ashish, NRIs are not allowed to invest in the HUDCO issue.

Did anyone get the refund of allotment of IREDA? We were expecting it by yesterday or today.

Hi George,

I have not received any refund so far. I can plan for HUDCO based on the refund from IREDA. I hope I receive the refund at least today.

Should get refund from IREDA today evening or tomorrow morning. I think there is good enough time for the HUDCO issue.

HUDCO 7.64% Tax-Free Bonds Review – https://www.onemint.com/2016/01/21/hudco-7-64-tax-free-bonds-tranche-i-january-2016-issue/

I don’t think anyone has received IREDA refund so far. It should come in a day or two well before the opening of HUDCO issue.

That’s right, thanks Vin!

I have received the refund from IREDA today evening.

As Shiv already mentioned, around 55% allocation is done for me. Thanks Shiv for predicting accurately 🙂

That’s great, thanks Raja for sharing this info! 🙂

Got allotment of 56% . Waiting for refund.

Same here. I got the allotment of IREDA TFB in my Demat A/C early in the morning but no sign of the refund so far…

I have received the refund now (44%).

That’s great, thanks for sharing!

I also got the refund at 1.30 pm.

Shiv, thank you very much for providing such a wonderful platform for the small investors to share information on TFB.

On to HUDCO bonds now…

Thanks Vin for becoming a part of this platform! 🙂

got ASBA debit from account, but still waiting for the allotment in DEMAT account.

Mr Shiv,

Good Morning,

Ireda tax free bonds(recent) is now trading?

Hi Raju,

IREDA listing is yet to happen.

Listing is happening on 27th Jan 2016. TheBSE scrip code for 7.74% bond is 935618.

Thanks Sanjay for the info!

Dear Shiv,

Can you please update the Allotment date and the Interest payment date for these bonds…like you have updated for earlier TFBs ?

Thanks !!

IREDA tax-free bonds got listed on the BSE on January 27th i.e. Tuesday – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160125-7

Here are the BSE codes for the same:

7.53% 10-year bonds – BSE Code – 935616

7.74% 15-year bonds – BSE Code – 935618

7.68% 20-year bonds – BSE Code – 935620

Deemed date of allotment has been fixed as January 21, 2016. Interest will be paid on January 21st every year.

IRFC will raise an additional Rs. 3,500 crore by issuing tax-free bonds this financial year – http://www.financialexpress.com/article/economy/indian-railway-finance-corporation-gets-rs-3500-crore-more-tax-free-bond-limit/211014/

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

Third tranche of Gold Bond Scheme (GBS) of worth 1,050 crore

http://moneydial.com/third-tranche-of-gold-bond-scheme-gbs-of-worth-1050-crore/

Hi Shiv,

If i buy recently issued tax free IREDA bonds from secondary Market under the Retail category (total investment less than 10 Lkahs), will there be a step down interest applicable to me just because i am not the primary investor.

Hi Abhishek,

You’ll get the same rate of interest given your total investment does not exceed Rs. 10 lakh in a single issue.

Hi Shiv,

I plan to go for higher studies abroad and in this regard I plan to take loan from Bank for INR 20,00,000.

For this loan Bank is asking for collateral and I plan for giving tax free bonds as collateral’s. However bank officials are saying that these bonds can not be kept as Bank Collateral.

I read one of your reply above wherein you have mentioned that these bonds can be used as collateral.

Can you share me the source / circular / let me know how I can persuade bank officials for granting me loan with Tax free Bonds

Hi, I have not yet received the due interest @7.74% on my IREDA Tax Free Bonds issued to me in January 2016. Where should I follow up?

Hi Arvind,

You should contact the Registrar of IREDA for the same – Karvy Computershare 1800 3454 001.

Hi Shiv,

A very helpful article!

I had invested 10lakhs in 10 yr category. However I received a very low interest of 4.20% on 21st Jan 2017; Is this the case for all investors or should I follow up? If yes, where?

Thanks Ragini!

You should have received the full interest amount as against 4.20%. You should connect with the Registrar of IREDA for the same – Karvy Computershare 1800 3454 001