NABARD 7.64% Tax-Free Bonds – March 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Tax-Free Bonds, which carry coupon rates as per the G-Sec yield in the market, have suddenly become more attractive post this year’s budget. Finance Minister Arun Jaitley in his Budget speech announced his target to contain the government’s fiscal deficit at 3.5% of GDP in 2016-17. This lower than expected fiscal deficit has resulted in a sharp fall in bond yields in the past one week or so.

Moreover, these bonds will not be available in 2016-17 and probably afterwards as well. This will increase demand for these bonds multifolds. So, before these bonds become part of history, we have two such issues left – one is from NABARD and the other would be from IRFC. I will cover the IRFC issue in another post, let’s have a look at the salient features of the NABARD issue.

Issue Opening & Closing Dates – The issue is opening for subscription on 9th of March, the coming Wednesday and will get closed on March 14.

Size of the Issue – NABARD is authorized to raise Rs. 5,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,500 crore by issuing these bonds through a private placement. NABARD will raise the remaining Rs. 3,500 crore in this issue.

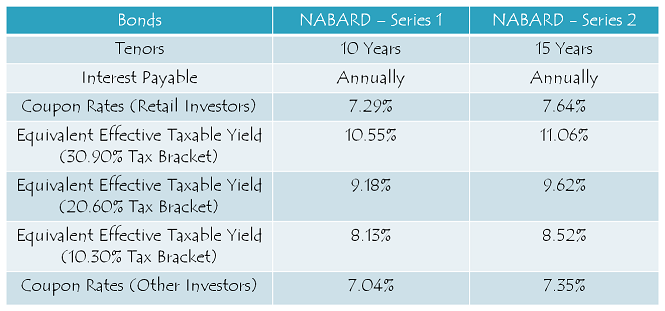

Coupon Rates on Offer – 10-year and 15-year G-Sec yields have fallen in the last few days, which has resulted in a fall in the coupon rates of these tax-free bonds as well. This issue will carry 7.29% for 10 years and 7.64% for 15 years.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 15% of the issue is reserved i.e. Rs. 525 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 525 crore

Category III – High Net Worth Individuals including HUFs – 10% of the issue is reserved i.e. Rs. 350 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 2,100 crore

60% Issue Reserved for Retail Investors – This is something very unique to this issue. As we all know, the retail investors were getting 40% of the bonds reserved in all previous issues. This will be the first issue in which the retail investors will be allotted 60% of the total issue size. I think this is a good step in favour of the retail investors.

NRI/QFI Investment NOT Allowed – Like most of the past issues, Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue as well.

Rating of the Issue – CRISIL and India Ratings consider investing in these bonds to be safe and that is why they have assigned ‘AAA’ rating to the issue. Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

Listing & Allotment – NABARD has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the Bombay Stock Exchange (BSE).

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. To apply in physical or demat form, the applicant is required to fill the physical form and attach the KYC documents along with the investment cheque. KYC documents include a self-attested PAN card copy, a self-attested address proof copy and a cancelled cheque.

Whether you apply for these bonds in demat or physical form, the interest payment will still be credited to your bank account through ECS. Moreover, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – After these bonds get listed on the stock exchanges, these tax-free bonds are freely tradable and do not carry any lock-in period, the investors can sell them at the market price whenever they want.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.29% p.a. for 10 years and 7.64% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NABARD will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced as the company allots its bonds to the successful applicants.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

60% of the NABARD issue i.e. Rs. 2,100 crore is reserved for the retail investors. Not 100% sure, but I think it should take at least a couple of days for this issue to get subscribed in the retail investors category. I think many investors would have got the NHAI refunds credited by then.

As the Finance Ministry has a view that these tax-free bonds create some kind of imbalance in the market, especially for our commercial banks, they have decided not to extend such support to these issuers from the next financial year onwards. That makes this issue and the IRFC issue to be the last two opportunities for the investors in the higher tax brackets to make their investments. Such issues will not be available for at least next 18 months or so, even if the government decides to allow their issuances in Budget 2017. So, if you want to invest in these bonds and earn tax-free income, you need to act now and fast.

Application Form for NABARD & IRFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NABARD or IRFC tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at [email protected]

I like this article. A good extract of all facts about the issue along with advise in simple to understand manner.

Thanks Vasu!

Shiv – Do we know if IRFC wld provide TFBs for 20 yr period?

No Bobby, IRFC issue does not carry the 20-year investment period.

and interest payment date of irfc dear shiv

Hi Nitesh,

I do not have any info about the same as yet.

What is the opening date of this issue?

Found it on some other site. Its 9th March.

Yes, that’s right Shirish, it is March 9th. I have updated the same above in the post as well.

Thanks Shiv for the info. Will subscribe.

Thanks KS!

hdfcsec gives the issue size as 1788 crores. Probably a copy paste error from HUDCO issue. Which is correct? 3500 crores or 1788 crores?

NABARD issue size is Rs. 3,500 crore.

Thanks Shiv.

1. Do we have the opening date for IRFC?

2. When are you planning to write similar article on IRFC?

Hi Bobby,

1. IRFC issue is opening on March 10.

2. I’ll write a post about it by today evening.

are you sure nhai refund will come before nabard TFB

Hi Vishal,

Yes, I am quite confident that NHAI refunds should get credited either today or tomorrow morning.

Hi,

In the budget speech there is some mention of allocation of bonds to seven entities, in the next financial year… isn’t it not referring to this kind of similar tax free bonds?

“83. To augment infrastructure spending further, Government will permit mobilisation of additional finances to the extent of `31,300 crore by NHAI, PFC, REC, IREDA, NABARD and Inland Water Authority through raising of Bonds during 2016-17.”

Kindly throw light on this matter.

Regards,

Chirag.

Government clarified that , these bonds in next fiscal do not have tax-free status.

http://www.mydigitalfc.com/government-finance/infra-bonds-not-be-tax-free-fy17-418

Thanks Vasu!

Dear Shiv,

When is IRFC Issue date ?

Possible to get HUDCO Tranch 2 refund by then ?

Hi Vasu,

IRFC issue is opening on 10th of March. I don’t think HUDCO refunds would get credited by 10th, but I think it should be there by 11th or 14th morning. It is highly unlikely that IRFC will remain open till 14th.

Many thanks for your feedback.

True, it´s bit risky to depend on HUDCO refund.

You are welcome Vasu! In case you want to invest in the IRFC issue based on HUDCO refunds, then please drop me a mail, I’ll try my best to help you do that.

So, it´s bit risky to depend on HUDCO refund.

Many thanks for your advise.

Sir..good afternoon

really u r v helping to each n every 1s..

when s coming irtc bonds which is expected

on 10th..

pl give your CTC n office details

with phone nombr. .

thanks

Hi Anoop,

IRFC issue is opening on March 10th. My contact no. is +91-9811797407.

U r doing so good n help to investment

In gov.tfb..

Can I purchase from market.now

Your cell is not reachable. .

Thanks for good guidance

Sir..

Thanku for valuable guidance

I did not received any SMS or allotments

N refund of Nabard. .u hv advice

to wait.28..now what we can…?

Hi Anoop,

You should first check the allotment status here before contacting the Registrar – http://www.linkintime.co.in/bonds/BondsAllot.aspx

Thanks Shiv – this links helps a lot.

I see the allotment, however, on entering my bank account, this shows that the account number is incorrect.

Would that be because the data is yet to be updated (I see my address blank) or is that because someone has entered incorrect bank account. 🙁

Hi Praveen,

Just wait for a few more days and let the Registrar do its work. If you don’t receive your bond certificate/allotment advice and/or your interest on allotment, then probably you can contact the Registrar to get its data corrected.

Its not Karvy and probably thats the reason for the delayed responses. Now I realize how much the prompt and accurate services of Karvy has spoilt us 😉

🙂

Hi Shiv,

Thanks for the details.

You are welcome Nagarajan!

IRFC Limited (Indian Railway Finance Corporation Limited) – (AAA)

Issue Opening Date March 10, 2016 (Thursday)

Issue Closing Date March 14, 2016

Issue Size Amount aggregating to a total of up to Rs. 2,450 crore

Interest Rates:

Coupon rate for Category IV (Retail Individuals up to 10 Lacs)

Series of Bonds Coupon / Interest Rate

Series 1B (10 Yrs) 7.29%

Series 2B (15 Yrs) 7.64%

Recvd in email….

Kindly verify Shiv and keep-up the good work!!!

Thanks Aashish, the details are correct!

according to wealth 18.com care and icra have given nabard AAA is true shiv

Hi Nitesh,

It is CRISIL and India Ratings which have rated NABARD issue and not CARE and ICRA.

Dear Shiv,

Is the interest on NABARD bonds payable every year and not the full amount on maturity?

Yes Mr. Mittal, that’s right. Interest will be paid every year on the “Interest Payment Date” which will be declared once the bonds get allotted.

Subscribe

Dear Shiv,

Are the NRIs (Gulf countries) can invest in upcoming IRFC TFBs?Pls clarify.

Nishar

i think yes

NRIs are not allowed to subscribe to TAX Free Bonds as mentioned in prospectus. Suggest, to invest in the name of family members who live in India. (Resident Individual Investor)

Hi Firoz,

NRIs are allowed to invest in the IRFC issue.

I understand we can buy the TFBs from secondary market also. Can you please share the link for yields on different TFBs in the market

Technically Yes, you can purchase thru secondary market.

Since liquidity is less, difficult to find a seller for a reasonable price.

Yields are not fixed, depends on last traded price (which is not accurate as it depends on seller price for that last transaction only).

While trading in secondary market very important to put limit value prices .

Some older TFB issues have less interest rates , if bought in secondary market.

The ideal way is to get thru primary market and we are left with only two last opportunities now.

What´s unique for these issue is, the retail quota increased to 60% (normally it´s 40%).

So I strongly suggest, to subscribe now.

There is no mention of TFBs in this budget for next year.

Hope this helps, though I await Mr Shiv´s comment on this.

Thanks Vasu for your inputs!

Some older TFB issues have less interest rates , if bought in secondary market.

This is normal. The interest (Yield to Maturity “YTM”) rates are in direct proportion to the tenure (outstanding period) of the bond. Since the balance outstanding period for the older bond is lower..the rate (YTM) will be lower. One good example is that the rate for the 10 year bond is lower than the 15 year bond.

The interest rate is not dependent on balance amount. It´s fixed at the time of issue and the rates are generally different for different tenures (Ex: 10/15 yrs have different rate). However when YTM is only calculated based on LTP (Last traded price), which again not a realistic guideline because it´s based on just last trade. Unlike stocks where we have very high volumes .., we can predict at what price you are going to get a particular stock. However in TFB trades in secondary market, it´s difficult. (Must have limit prices , or else you may lose a lot while selling, and pay a lot while buying). Brokers may assist in purchasing from secondary market.

My mention of older issues was, for some issues that came couple of years back…they had a special clause of different applicable interest rate…once they are bought in secondary market. They were not many such issues though…

There are two parts. I have mentioned YTM, which is the final return that you get on your secondary purchase. This is independent of the “coupon yield” that is the interest rate fixed at the time of issue of the bond.

As I explained in my other post, even though you have purchased a “coupon rate” of 8.20, the YTM that you have managed is closer to 7.5 odd. This is the reason discount/premium on the bonds. exists.

To simplify..if I were to sell a bond 8.20 bond today at a premium and buy a similiar bond @ 7.69, my net cash flow would not change. The extra money I get for the 8.20 bond is compensated by the lower interest (7.69) per year on the HIGHER invested amount and I most probably will be at a loss due to the brokerage.

Shiv can correct me if I am wrong, but if I buy from a HNI who was issued at a lower COUPON rate..I will get the lower COUPON rate..but this is adjusted in the YTM.

When you compare prices of two different bonds on the exchange with same tenure, most probably the difference is due to the different interest dates (accrued interest) but the YTM will be similiar.

Hi Tarun,

Here is the link to check the LIVE trading status of all the tax-free bonds/corporate NCDs listed on the NSE – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

You can get the details about each of these securities by clicking on their symbols.

Hi Shiv ,

I don’t have demat account .

Is it possible to buy Nabard TFB in physical form currently and later convert it into demat form after opening a demat account?

Please advise.

read the post….it says Demat A/c. Not Mandatory. All your questions are answered there…

Better hurry since you have a lot of documentation to do

Hi AS,

Yes, you can buy these bonds in physical form now and get them converted later whenever you want.

Thanks Shiv for the info..

You are welcome AS!

Subscribing to this issue. Will use the proceeds of NHAI to subscribe to IRFC if it comes by time, else this will be the last issue for me.

That’s great!

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1073&type=DPI&idtype=1&status=L&IPONo=1149&startdt=3/9/2016

watch live status ..NABARD

http://economictimes.indiatimes.com/markets/bonds/nabard-tax-free-bond-offers-up-to-7-64-draws-huge-response-20-sold-in-30-mins/articleshow/51323019.cms

Only 24% subscription in retail category still..

Yes, I think the response is below expectations. Investors must be waiting for HUDCO refunds.

sir can you tell what is listing price of nabard TFB OF 7.64% 15 YEARS

Hi Vishal,

NABARD bonds are yet to get listed on the stock exchanges, so I cannot tell you its listing price. The issue has opened today itself for subscription. You mean face value of NABARD bonds?

expected listing price

I think NABARD bonds should get listed between Rs. 1,010-1,020.

Hi Shiv, what’s the expected allocation for application on day 1 for NABARD?

Can one expect 100% allocation?

Retail portion is subscribed 40% till now. Overall subscription is 115% thus far.

If you apply now, in retail category, you may get full allotment.

Hi SG,

Going by the trend so far, you will get 100% allotment even if you bid for it on Friday.

Thanks so much for the wonderful work!

Thanks SG!

Subscription has suddenly gathered pace, it is subscribed by Rs. 1328 crore now in the retail category at 4 p.m.

Clarification : vishal and Vishal are different person .

don’t assume to be one person

Sure

Subscription in retail category reaches 1366.6 crores at 5 PM. Expect full allotment if applied today and possibly tomorrow.

today’s subscription figures please

Day 1 (March 9) subscription figures:

Category I – Rs. 5,630 crore as against Rs. 525 crore reserved – 10.72 times

Category II – Rs. 5,274.25 crore as against Rs. 525 crore reserved – 10.05 times

Category III – Rs. 1,415.98 crore as against Rs. 350 crore reserved – 4.05 times

Category IV – Rs. 1,551.32 crore as against Rs. 2,100 crore reserved – 0.74 times

Total Subscription – Rs. 13,871.54 crore as against total issue size of Rs. 3,500 crore – 3.96 times

I think retail response is good. What do you say sir?

what would be the expected allotment in retail category for Nabard then?

Day 1 investors in retail get full allocation as per the prospectus.

Allotments to the maximum extent, as possible, will be made on a firstcome first-serve basis and thereafter on proportionate basis in each portion, i.e. full Allotment of Bonds to the Applicants on a first come first basis up to the date falling 1 (one) day prior to the date of oversubscription and proportionate allotment of Bonds to the Applicants on the date of oversubscription

Dear Nn,

Very useful information, on how allotments are done – Thanks

Thanks Nn for your inputs!

Hi RS,

Day 1 retail applicants will get 100% allotment in the NABARD issue.

Yes, a good response! Maybe would have been fully subscribed, in retail category too, if earlier issue refunds had been received by all. -KS

Yes, good response from the retail investors. But, a super response from the institutional and corporate investors. I wonder why the government sell its valuable PSUs at such a low valuations and why don’t they borrow money from the investors by issuing such tax-free bonds at 7-7.5% and invest this money for infrastructure development. Rs. 13,871.54 crore or more could have been raised in a single day. Amazing stuff!

Dear Shiv:

Greetings again.

As always, thanks for maintaining this fantastic blog.

Can you please advise on whether day 1 retail subscribers for NABARD will get 100% allotment as it was only 0.74 times subscribed in retail category at end of day 1?

Likewise, can you also guide (after close of market, today) on what is the expected position for day 1 retail subscribers for IRFC will get 100% allotment?

Sincerely,

SKR

Thanks Sandeep!

Yes, Day 1 NABARD applicants will get 100% allotment. Also, I think Day 1 IRFC applicants will also get 100% allotment. Will keep this post updated.

splendid subscription even better than nhai 7.69% issue I think that news that there will be no taxfree status for these bonds next year works here isn’t it shiv

Yes Nitesh, probably that has played a significant role. Falling bond yield has also played a very important role.

Mr. Shiv, could you please explain why market prices of Tax Free Bonds have suddenly shot up in past few days, for instance recent issue of NHAI is now @1025 from 1010 earlier. Are these prices likely to come down in next few days?

2) In case, we need to buy TFB’s from open market, what should be the strategy so as to buy at lowest prices of the day? Like buy during what time period of the day, which TFB’s to select to buy etc?

3) If you were to buy from Market, which 5 TFB’s would you select & why?

4) Are the YTMs provided by BSE & NSE accurate? Please explain how YTM is arrived at in an easy manner.

Hi S.K..

1. Market prices of tax free bonds are rising due to a fall in the government bond yields, which in turn is a result of the government’s target of a lower fiscal deficit target of 3.5% for FY 2016-17. I don’t foresee any reason for these prices to come down as sharply as they have risen.

2. I don’t know about any such strategy or any such time period to buy these bonds at their lowest price during any given day.

3. Sorry, I won’t be able to comment on such a query here on this forum.

4. YTMs provided by these exchanges are correct in most of the cases. But, one should be very careful about it and do his/her own calculations before taking any investment decision. Please check this link for YTM calculation – https://www.onemint.com/2012/07/25/how-to-calculate-yield-to-maturity-of-a-bond-or-ncd/

Dear Mr. Shiv,

Thank you. Would be grateful if you could reconsider and respond to Query No. 3 above since it would be beneficial to All your fans especially since it pertains to the Same Subject of Tax Free Bonds being discussed in the blog/forum:

3) If you were to buy from Market, which 5 TFB’s would you select & why?

Will he grateful for your kind response please.

Sorry S.K., won’t be able to name any issue. But, I would go for those bonds which carry highest YTMs, issued by professional companies and carry good liquidity.

I believe, the price of tax free bonds also includes the accumulated interest. Therefore, the bond price rises as interest payment date approaches. Shiv any comments?

Regards,

That’s right Shirish, it is definitely one of the reasons. But, a sudden sharp surge in bond prices cannot be attributed to interest accrual. S.K. probably wanted to know the reason for a sharp rise in their prices.

Mr. Shiv, For instance can a retail subscriber apply on Day#1 for an amount of Rs 1 Lakh & then on Day#2/3 another Rs.9 Lakhs if additional funds become available subsequently? Why does ICICI Direct not permit this?

Yes S.K., it is possible to submit multiple applications for a single issue. However, I don’t know the reason why ICICI Direct or other brokers do not allow it for online applications. You can do so by submitting physical applications though.

In case of multiple applications, how will Bonds be allotted on both applications (methodology).

Can you provide more information on INFLATION LINKED BONDS, how to buy them, how/where are they listed etc? Are these better than TFBs & FDs & if so, how?

Hi S.K.,

Allotment for multiple applications of the same investor will happen in the same way as it happens for different applications of different investors. Full allotment will happen if the retail category is not subscribed on that day and pro rata allotment will happen for the day it gets oversubscribed.

Here you have the link for the Inflation Indexed National Saving Securities – https://www.onemint.com/2013/12/23/inflation-indexed-national-saving-securities-cumulative-iinss-c-december-2013/

Disappointed, apparently, these inflation linked bonds were originally only open for subscription & are not traded in the market.

If retail portion is not oversubscribed, then you can cancel first order in ICICIdirect and then place new order for total amount.

It is a risk, cancelling your first application and then getting partial allotment in your second application.

In fact, in ICICI DIRECT we cannot cancel the order, since it lues in ‘ordered status’ for a little while & then gets ”EXECUTED’.

In ICICI Direct, we cannot put multiple orders for the an IPO.

Do other service providers like KOTAK, HDFC; SHARE KHAN, ANGEL BROKING have this facilty of allowing multiple Subscription orders for an IPO?

Mr. Shiv, can 1st order be online through ICICI DIRECT & asubsequent order in physical form? Is it allowed? Will both orders not be cancelled due to disqualification.

I have done that multiple times and had no issues to get allotment. Applied first through ICICI Direct on first day online. When additional funds was available , you can apply offline with any other vendor ( SBICAPS , ICICI Direct etc) and can get allotment. No disqualification at all. Only risk is for your second application , you may not be get full allotment depending on how the subscription fares on the day.

Regards

Ramadas

Yes, that’s right S.K., you can submit second application in physical form and it will not get rejected. We also provide such service to our clients.

In Kotak you can submit another application online. But allocation depends on availability in that category. They previously used to restrict but that has been removed for quite some time.

Thanks Ash for this info!

Hi Shiv,

Just clarification needed on your calculation of Effective tax yield calculation you mentioned here.

Example , take 15 yr bond(7.64%) with 20.6% tax bracket.

So effective tax yield should be 7.64 + ( 7.64 *(20.6/100) ) = 7.64+1.57 = 9.213%.. But you have mentioned as 9.62%. Correct me if am wrong.

Hi Raja,

If I pay 20.60% tax on 9.213%, I am left with 7.315%, whereas when I pay the same tax on 9.622%, I have 7.64% with me.

For taxable income..you earn 100 and receive (100-20.6) = 79.4 cash in hand

So the 7.64% cash in hand is equivalent to 79.4..the pretax earning should be 100 or more correctly 7.64/79.4*100 = 9.622%.

Good calculation. In simple words. Thanks.

nicely explained 🙂

Day 2 (March 10) subscription figures:

Category I – Rs. 5,630 crore as against Rs. 525 crore reserved – 10.72 times

Category II – Rs. 5,296.67 crore as against Rs. 525 crore reserved – 10.09 times

Category III – Rs. 1,420.80 crore as against Rs. 350 crore reserved – 4.06 times

Category IV – Rs. 1,724.54 crore as against Rs. 2,100 crore reserved – 0.82 times

Total Subscription – Rs. 14,072 crore as against total issue size of Rs. 3,500 crore – 4.02 times

above indicates that 100% allotment for retail on first day as well as 2nd day

3rd day as well Mr. Varma and I think it should be Day 4 as well.

Today closing of 3rd day subscribe details please…NABARD TFB.

Day 3 (March 11) subscription figures:

Category I – Rs. 5,630 crore as against Rs. 525 crore reserved – 10.72 times

Category II – Rs. 5,296.84 crore as against Rs. 525 crore reserved – 10.09 times

Category III – Rs. 1,428.87 crore as against Rs. 350 crore reserved – 4.08 times

Category IV – Rs. 1,852.40 crore as against Rs. 2,100 crore reserved – 0.88 times

Total Subscription – Rs. 14,208.11 crore as against total issue size of Rs. 3,500 crore – 4.06 times

Thanks Shiv for your consistently relevant updates on TFB. I started subscribing to your posts from 2014. Great work.

1) can you please point me to the link/url for the post where you had published the interest rates for TFB issues in 2014 and also if you have one for 2016

2) would be great if you can analyse/share insights on some consistently best performing equity oriented MF’s to start SIPs in

I was thinking that these can be a good bet

1. Large cap – Franklin India Bluechip Fund

2. Large and mid cap – Birla Sun Life Frontline Equity Fund

3. Hybrid equity – HDFC Balanced Fund

4. Mid and small cap – HDFC mid cap

5. Mid and small cap – Franklin India smaller companies fund

6. Mid and small cap – Motilal Oswal MOSt Focused Midcap 30 Fund – Regular Plan

7. Mid and small cap – Mirae Asset Emerging Bluechip Fund – Regular Plan

8. Mid and small cap – ICICI Prudential Value Discovery Fund

Hi Shiv,can you please point me to the link/url for the post where you had published the interest rates for TFB issues in 2014 and also if you have one for 2016

Thank you so much.

Hi RS,

Here you have the link to that post – https://www.onemint.com/2014/02/01/tax-free-bonds-fy-2013-14-interest-payment-date-date-of-allotment-maturity-date-bse-code-nse-code-other-info/

I’ll soon try to cover a post having some of the consistently performing mutual funds and their other relevant details.

Thanks Shiv! and kudos to your passion and the effort you make responding to the comments and advising the readers.

Thanks RS for your motivating words! 🙂

Shiv, you deserve thanks! If you had an office in Bangalore, I would have invested in tax free bonds thru you.

Thanks RS! 🙂 My bad luck that I don’t have an office in Bangalore !! I really get many queries from Bangalore and Mumbai, but not enough from Delhi/NCR. God please help me! 🙂

Maybe one day you will have offices in mumbai and bangalore as well! best wishes 🙂

Thanks a lot for such good wishes RS !! 🙂

Dear Shiv,

Thanks so much for your accurate advance info and precise analysis on your blog.You are my favourite blogger.As rightly predicted by you,NHAI refunded my entire online bid amount for even its second tranche as I bid on the second day.But the refund was very timely as I could utilise the same to make an online bid for the IRFC TFB tranche II issue on the first day.Thanks to your alerts,I could make online bids in the HUDCO TFB tranche II issue and NABARD TFB issue on the first day.Shiv,can I subscribe to any good ELSS issue via SIP through your firm even though I am based in Hyderabad?Yes,your selfless blogging in this commercialised world makes you a rarest of rare genuine financial planner and an expert at that. I particularly urge all the NCR based investors following Shiv’s blog to forget others and become clients to Shiv.

I agree with Dr. Sharma. Though this blog is part of Shiv’s business, he has shown lot of commitments in answering many questions patiently without expecting any return. I am sure the Goodwill of some of the followers like Dr. Sharma will be an asset for Onemint and I wish all the best to Shiv and team.

Thanks a lot George for your encouraging words and wishes !! I’ll pray to the God that He keeps me mentally and physically fit to keep serving all the readers of OneMint! Thanks again! 🙂

Thanks a lot Dr. Sharma! It is one of the biggest compliments I have got here on this forum. Thanks again for your kind words! 🙂

Also, I’ll soon mail you a link to initiate an SIP investment in a good ELSS of your choice.

Hello Shiv,

Just 15 days back I started exploring the TFB option (and last 2 weeks were surely very active on the TFB front).

Your posts and the answers have helped me so much in knowing how it works and clarify confusion. No question remains un-answered after going thru your answers for the posted queries.

Please keep writing and educating us.

Thank you so much for your efforts!

Sure Praveen, I’ll definitely try to keep contributing good work here on this forum! Thanks for your encouragement!

nabrad and irfc are open today.

what are choice for physical application

Both are good Mr. Varma, you can go with any of these issues!

Can Mr. Shiv or the other readers of this extremely helpful Blog please update us, who are quite anxious, through this forum, as soon as they receive the refunds from HUDCO Bonds application money?

I hope you do get your HUDCO refund soon S.K.!

Final Day (March 14) subscription figures:

Category I – Rs. 5,630 crore as against Rs. 525 crore reserved – 10.72 times

Category II – Rs. 5,297.21 crore as against Rs. 525 crore reserved – 10.09 times

Category III – Rs. 1,429.82 crore as against Rs. 350 crore reserved – 4.09 times

Category IV – Rs. 2,053.14 crore as against Rs. 2,100 crore reserved – 0.98 times

Total Subscription – Rs. 14,410.17 crore as against total issue size of Rs. 3,500 crore – 4.12 times

100% allotment will be made to all the valid retail applications. Cheers!

Thanks for timely update…very useful info.

It seems , issue is just made it to full retail subscription and will not be any extension for sure.

Thanks Vasu!

Yes, there should not be any extension in either of these two issues – NABARD and IRFC. Some better than expected subscription pick up was there at least on the last day of these issues.

Appeal to all readers to kindly share with us any news about Refunds received in their Accounts through RTGS Transfer on account of HUDCO TRANCHE-2, March 2016 issue.

Received refund of HUDCO in ICICI Bank just now (Today, 15-March,8.50 am)

I too received the HUDCO refund this morning in HDFC bank

Received refunds for HUDCO Tranch II. Looks like I will be alloted 520 bonds out of 1000 that I applied.

Hello All,

Sorry for this basic question.

I got refund of HUDCO, and am getting 52% of applied bonds (calculated from the refund).

I have requested the bonds in physical format.

How will I come to know about the allocation and by when the physical bonds would be sent to me?

Will this site be uploaded with the bond details ? http://kosmic.karvy.com:81/ipotrack/

Thanks!

Will this site also be updated? http://www.bseindia.com/investors/appli_check.aspx

Hi Shiv – Will it be possible for you to publish a table for all the Tax Free Bonds with their interest payment dates that came during this financial year?

Hi Vineet,

I’ve started working on this post and will publish it sometime next week.

Thanks a lot.

Thanks a Ton for this!

You are welcome Praveen and Pankaj!

Hi Shiv – is this available now?

Pl give ifsc tfb details..

Pl give th total application on ist day

Which one is IFSC TFB?

Sir..

Irfc details.?

Total application n subcription..?

Hello Shiv,

When can we expect the allocation of the NABARD and IRFC bonds?

Hi Praveen,

NABARD and IRFC bonds are expected to get allotted by 28th of March and refund process to start by March 22nd or 23rd.

IF THIS IS GOING TO BE TRUE AS ALWAYS FROM THIS FORUM.IT WILL BE A GREAT NEWS.

I think the refund and the interest will come together.

Due to 100% allocation, I dont expect any refund, however I havent received the interest yet. I received it for IRFC.

Should I reach out to Karvy / NABARAD?

Just wait for a couple of days before taking any such action Praveen.

Dear Shiv

Can we have a consolidate table for all the tax free bonds issued in this financial year with their interest payment dates.

Regards

Piyush

Received info on IRFC allotment. when we expect for NABARD?

NABARD refund/allotment process has also started.

Just now the money got deducted for NABARD bonds from the bank. May be it will be allotted tomorrow

WHICH BANK ACCOUNT

Hi DCA,

Ravi is talking about his ASBA application.

Nabard 1000 bonds allotted. Thank you Mr.Shiv

You are welcome Asahi!

nabard bonds alloted. Received sms from nsdl

Thanks Mukesh for sharing this info!

How do we track interest received from these tax free bonds?

How is the interest calculation done?

Hi Amit,

Interest is paid annually on or around a particular date. Interest is calculated on 365 or 366 days basis.

Thanks Shiv for clarification.

There have been so many Tax Free Bonds issues from the in different organizations (HUDCO, NHAI..etc..) and I am sure many of us have been allocated bonds in different lots. When it comes to interest credit the bank statement shows Interest from HUDCO that’s it. From this information it’s difficult to track if it interest payment is for 2016 lot 1 or lot 2 or earlier years tax free bonds. Also; the amount calculated is correct or not. Can we have a simple tracker for all tax free bonds issues till date. Else there is a great chance that we may miss on some credit of interest and tracking will be tough later on.

The best thing is to maintain your own excel sheet for the bonds you hold. You can have columns like company, from date, to date, Amount invested, interest payment date, interest amt.

Yes, something of this sort should always be done.

Hi Amitkumar,

You have to be very careful with these things. The recent Sharepro Services scam is an eye opener in such matters.

Sure I will a develop a tracker for myself & be vigilant.

Sir..

I did not get refund n allotment of

Nabard…how people’s saying .they hv

Get refund..still waiting. .

Hi Anoop,

Just wait for March 28 for the refund/allotment info.

has any body received interest payment for 893 nhb? it was due on 24 th march.

Dear Mr. Shiv & Other Contributors to this valuable Blog.

1) Request you to kindly advise best 5-6 Debt Mutual Funds Growth Option where we can safely invest retirement savings for few years and which lend to safe companies. Also please advise MF DEBT FUNDS Short term & long term Capital Gains & suggest which option to choose.

2) Please advise best TFB’s buys in secondary market from earlier lots which are available at favorable prices, good yields & above all GOOD LIQUIDITY.

dear shiv ,i have not received interest for NHB tx fr bonds due on 24 th march?? what should i do?

Hi Dr. Puneet,

As March 24 was a public holiday, you’ll have to wait for the next working day to get your interest paid and that is March 28.

thanks for your response dear shiv.

actually 24th and 25th march were working days in madhya pradesh banking sector,hence the doubt.(i am from mp)

Just Posted – Should You Invest in NPS Post Budget 2016? – https://www.onemint.com/2016/03/25/post-budget-2016-should-you-invest-in-nps/

Excellent Article – Thanks Shiv – Yes, it helped me validate my decision to go for the 50K extra NPS contribution 🙂

That’s great Praveen! 🙂

NABARD tax-free bonds to get listed on the BSE on Tuesday, March 29th – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160328-8

Here are the BSE codes for the same:

7.29% 10-year bonds – BSE Code – 935688

7.64% 15-year bonds – BSE Code – 935690

Deemed date of allotment has been fixed as March 23, 2016. Interest will be paid on March 23rd every year.

bse link where nabard 7.64 is listed please

NABARD tax-free bonds got listed on the BSE today at Rs. 1,035, hit a low of Rs. 1,030.26, a high of Rs. 1,035 and finally closed at Rs. 1,032.85 per bond – http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=935690

Dear Shiv,

Today’s closing price of this bond -15y- is only Rs. 109.25 on BSE website with 1240 nos. quantity traded. Why is the price so low.

Dear Shiv

Thank for all your valuable information.

Can we have a consolidate table for all the tax free bonds issued in this financial year with their interest payment dates.

Regards

Piyush

Hi Piyush,

Here you have the consolidated table for the last financial year – https://www.onemint.com/2016/04/12/interest-payment-date-bse-code-nse-code-allotment-date-maturity-date-tax-free-bonds-issued-in-fy-2015-16/

Hey shiv

How to get updates about the release of these tax free bonds? And is there any upcoming tax free bonds.

Hi Anubhav,

No public issues of tax free bonds will get launched in the current financial year. You should explore the secondary markets.

I applied for these bonds after reading about them on your blog. I think the interest you earn on NABARD bonds are the best you can get in India. Are there any other comparable bond issue currently taking place ?

Hi Abhay,

No public issues of tax free bonds will get launched in the current financial year.

I have still not received the refund of the amount paid for NABARD Bonds. Nor are the bonds credited to my demat account. What should be done?

Hi Mr. Shankar,

You should contact Link Intime for the same – http://www.linkintime.co.in/publicissues/default.aspx

Hello Mr.Shiv,

Can you pl.tell me who is the registrar for NABARD Tax free bonds.

Hi Mr. Hari,

Link Intime is the Registrar for NABARD tax-free bonds – http://www.linkintime.co.in/publicissues/default.aspx

Could you kindly share the contact emails of the parties responsible for non-crediting the TDS deducted for NHAI & IRFC TFBs on the INTEREST PAID ON APPLICATION/ALLOTMENT AMOUNTS. The TDS amounts deducted are not shown in our online FORM 26AS. Can you clarify the possible reasons for the undue delays?

Hi S.K.,

Not sure who is actually responsible for such TDS deposits, but I think these companies or their Registrars take time to deposit such TDS. So, I think you should wait some more time for TDS figures to get reflected in your Form 26AS.

Thank you. Please share email addresses of NHAI & IRFC Co’s Tax Free Bonds related departments.

Thank you. By which date do you think our Form 26AS will be updated?

Please share email addresses of NHAI & IRFC Co’s Tax Free Bonds related departments.

Hi,

My question is regarding currently available instruments which offer tax free returns in debt market.

Apart from the tax free bonds… Is it possible to invest in liquid debt funds which offer dividend on regular intervals.

I wish to specially ask if amounts can be invested for a shorter period of time and having full liquidity.

I received 2 different opinions on the tax treatment. One said that the complete dividend even if invested for small period of 2-3 months is tax free. The other said only if period is more than 3 yrs the returns are tax free or else tax of 28.25 percent will be levied.

Can someone throw light on this matter?

Regards ,

Chirag Gandhi

Hi Shiv, I’m seeing the market rate of the NABARD Series IIB 7.64% (face value INR 1,000) shoot up to over INR 10,000 in my ICICI direct portfolio. Similar trends for HUDCO IIB (7.64%) and IREDA IIB (7.74%). Unable to understand this – can you pls throw some light?

You should write to ICICI Direct and point out this discrepancy. But ICICI does not rectify it’s mistakes easily! In many cases, ICICI DIRECT displays incorrect information. In many cases, even the column ‘INTEREST EARNED TILL DATE’ displays incorrect amounts.

Ha Ha … good answer, sk …”But ICICI does not rectify it’s mistakes easily! ” … and true as per my personal experience too. As an account holder I have awful experiences of their senseless and frequent “marketing” calls … somebody (mostly different person each time) will call up and say “Sir you have not traded for a long time on your account” … Sometimes I reply sensibly and say “but I am not Trader ..why should I trade?”. Some times when in a irritable mood (often now at my sr. citi. age) I say “I will start trading 6 months after I stop getting your stupid marketing calls” … but, I am sure, before 6 months a new RM is bound to call and say “Sir, you have not traded for a long time on your account”

Good one sir. Next time they call, tell them you have moved to Zerodha since they are offering zero brokerage for delivery. Try to negotiate and bring down your brokerage. I did this with another broker successfully.

Dear all, thanks for your replies. Much appreciated.

Yes, you are right! Have noticed some cases if incorrect MARKET PRICES if Tax Free Bonds in my portfolio today.

Can readers share their multiple experiences with other low cost brokers like ZERODHA, SHAREKHAN, ANGEL BROKING etc & their transparent brokerage & charges.

Even today itself, ICICI DIRECT has sent a new revised tariff list!

The following all brokerages will charge –

exchange transaction charge NSE: 0.00325% | BSE: 0.00275%

service tax (14% of brokerage and exchange transaction charge)

swatch bharat + krishi kalyan cess

security transaction tax 0.1%

sebi turnover fee 20 Rs / crore

stamp duty 0.01% – max Rs. 50/day

For Zerodha

DP charges: Rs 8 + Rs 5.5 (CDSL) per scrip on sell side for equity delivery trades. AMC of 300/- and zero brokerage for delivery.

Sharekhan I get 0.15% on delivery buy/sell and AMC of 500/-

DP charges are waived in Sharekhan

Check https://zerodha.com/charge-list for further details

Thank you, Mr. Bhaskar, for your kind response.

But, I read that ZERODHA does not charge AMC charges (Rs.300) at all.

So, between the two brokerages used by you, which one is transparent, honest & cost effective, especially for only delivery based Equity trades & TAX FREE BONDS buy/sell. I only have few transactions and am not a regular trader/investor.

Your valuable response will be appreciated.

Sir,

AMC charge will be there for Zerodha. For the first year, I think they take it as application fees only. If you are not a frequent investor/trader then I think you should remain with your existing broker and negotiate to reduce brokerage. Zerodha is a new player and trying out new services. Sharekhan website is very reliable and I had no issue with them for the last 8 years.

One thing you should do is to make sure you register in NSDL Ideas or CDSL myeasi ( depending on which your existing broker uses ) and get the portfolio holdings periodically.

https://eservices.nsdl.com/

https://web.cdslindia.com/easieasiest/

Dear Mr. Bhaskar,

Thank you for responding. I understand ShareKhan charges for an additional ‘Subscription Plan’ & only if you pay a lump sum upfront for the subscription, will you be entitled to low brokerage charges which will be debited from that annual subscription amount. Please provide more clarity on how ShareKhan works.

Thank you, again.

Hello Shiv, there is a news that NHAI might come up with a Tax Free Bond this year – how true is it? If so, what would be the timeline?

Any insider’s info? 🙂

News article: http://economictimes.indiatimes.com/news/economy/finance/nhai-may-raise-rs-5000-crore-more-from-epfo-via-bonds/articleshow/53626383.cms

Hi Praveen,

No such info I have received from my sources. I don’t think tax-free bonds will be issued/allotted by NHAI to the general public.

record date of nabard 7.64% having isin-ine261f07032