NHAI 7.69% Tax-Free Bonds – Tranche II – February 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

2016 so far has turned out to be a nightmare for the equity investors. Portfolios have undergone a massive value erosion and sentiment has turned extremely negative. Financial advisors, who were recommending a higher allocation to equity so far, have also become cautious to advise higher equity investments. Some analysts have started calling it a bearish phase and not just a deep correction in a bullish phase.

However, it is not just the equity portfolios which are bleeding. Debt portion of portfolios are also facing the music. Past few months have seen the 10-year G-Sec yield rising to 7.95% from a range of 7.60-7.65% in September last year. Due to a scary fall in international crude prices and commodity prices like steel, aluminium etc., many companies are facing it difficult to service their debt. Credit rating agencies have also started downgrading these companies resulting in a fall in the NAVs of debt mutual funds which have lent huge money to such companies.

In such a difficult environment, investors want to opt for safer investment options and it seems that tax-free bonds are among the best options available. NHAI is launching one such issue from 24th February i.e. Wednesday and the issue is scheduled to get closed on the first of March. NHAI will raise Rs. 3,300 crore from this issue.

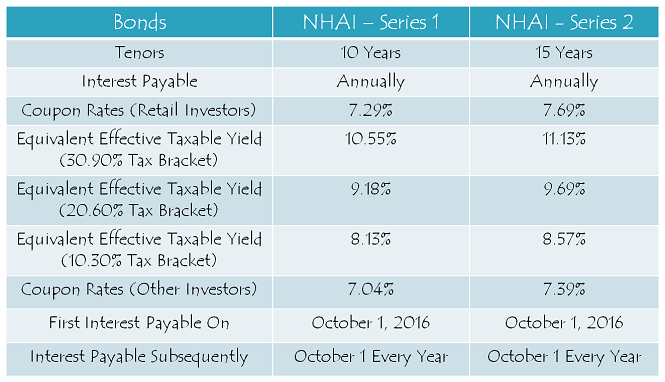

Here you have the salient features of this issue:

Size of the Issue – Though base size of this issue is Rs. 500 crore, NHAI will retain an additional Rs. 2,800 crore in case of oversubscription, thus making it a Rs. 3,300 crore issue. NHAI has already raised approximately Rs. 15,700 crore by issuing tax-free bonds through its public issue in December and a couple of private placements in September 2015 and February 2016.

With this Rs. 3,300 crore issue, NHAI will exhaust its full quota of Rs. 19,000 crore for the current financial year.

Coupon Rates on Offer – With a widening gap between the 10-year G-Sec yield and 15-year G-Sec yield, NHAI issue will carry 7.69% coupon rate for 15 years and 7.29% for 10 years. As with its first issue, 20-year investment option will not be there this time as well.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option and 30 basis points (or 0.30%) for the 15-year option.

Rating of the Issue – CRISIL, ICRA, CARE and India Ratings have once again assigned ‘AAA’ rating to this issue. Also, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment Not Allowed – Like its previous issue, Non-Resident Indians (NRIs) won’t be able to make investment in this issue as well. Qualified Foreign Investors (QFIs) are also not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 660 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 660 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 660 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 1,320 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NHAI has again decided to get these bonds listed on both the stock exchanges i.e. National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). Bonds will be allotted and get listed on the exchanges within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – Again, it is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form also. Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

However, whether you apply for these bonds in demat form or physical form, the interest payment will still get credited to your bank account through ECS.

No Lock-In Period – These tax-free bonds do not carry any lock-in period and you can buy/sell them on the stock exchanges at the market price whenever you want.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.29% p.a. for 10 years and 7.69% p.a. for 15 years, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NHAI will make its first interest payment on October 1 this year and subsequent interest payments will also be made on October 1 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

I think tax-free bonds are one of the best fixed income options available for the retail investors. There is no fixed income option which carries so many distinct advantages which these bonds have, like tax-free interest, easy liquidity, favourable tax liability if sold after holding for more than one year, scope of capital appreciation, annual interest payments etc. Risk-averse investors with a long term view should definitely invest in these bonds.

Also, there is no certainty that these bonds will be allowed to be issued next year as well. For that, we’ll have to wait for the Budget speech on February 29. In case the Finance Minister decides not to allow these bonds for the next year, it will result in a sharp increase in their demand. Also, as there is a difference of 0.40% between the interest rates of 10-year bonds and 15-year bonds, I think it makes more sense to subscribe to the 15-year option.

Application Form for NHAI Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NHAI tax-free bonds, you can contact me at +919811797407

There will be a frenzy for these bonds.

First day will be better since retail OFS of NTPC also happening. The chances of 100% allocation for retail is good.

I don’t think so. I think it should get oversubscribed on the first day itself.

Hi Siv,

Thanks for the info. Had a question regarding interest payment date; you’ve mentioned interested will be paid on Oct 1 every year; I remember reading it as April 1st in ICICIDirect. Which one is correct?

Hi Krish,

Interest Payment Date for this issue is October 1. If ICICI Direct is showing it to be April 1, then it is an incorrect information they are providing.

Kindly advise, if in tranche 1 issue of Dec 2015, full 10 lakh limit has been invested, additional sum investing in tranche II will be retail category or HNI.

Hi Pankaj,

You will still be considered a retail investor.

Thanks Shiv.

You are welcome Pankaj!

Dear Shiv,

Good Morning,

Thanks for the information.when we can expect next Tf bonds

Regards

Raju

Hi Raju,

HUDCO and IRFC issues are expected in the first week of March.

Thank you sir

You are welcome Raju!

Hi Shiv, thanks for the article. One question please. Out of NHAI, HUDCO and IRFC, can you rate these companies with regards to meeting there financial obligations as long term perspective.

Hi Saurabh,

I think all are equally good in meeting their financial obligations, but I personally prefer IRFC, NHAI and HUDCO in this order.

One more question please Mr. Shiv…If i have invested 1 Lac rs in dec issue of nhai (value = 1000 rs for each bond)…and after 15 years, bond value is 1200 rs, then i should be getting my invested amount only or the market value at that time…consider also scenario in which value is decreased after 15 years.

After 15 years on the maturity date, the market value of these bonds will be Rs. 1,000 each i.e. exactly equal to its face value of Rs. 1,000. No buyer would give you Rs. 1,200 against which he/she is going to get Rs. 1,000 back from NHAI.

Thanks Shiv.

Thanks for the post Shiv. I am planning to apply.

Good to know that Mr. Srinivasan, thanks!

Hi,

I want to know that if I invest in these bonds, is there an option to sell them before the 10/15 year mark? Or will I be freezing my funds in the bonds for 10/15 years?

Hi Akhilesh,

Selling these bonds is possible on the stock exchanges where these bonds get traded on a daily basis. You can sell them whenever you want.

Thanks Shiv,

But would it be easier to sell these bonds on the secondary market? I read somewhere that demand for these bonds wouldnt be much and it would be really hard to sell them at a higher price.

Hi Akhilesh,

I don’t know what do you mean by a ‘higher price’, but the bonds issued two years back are all ruling at a premium of 20-25% and there is good enough volume traded on a daily basis. Check this link – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Oh, thanks a lot Shiv……..Premium is what I meant by higher price

Thanks Akhilesh!

Shiv,

Considering that equities are available at reasonable valuations, would it be better to invest in equities than these bonds?

Hi Temp,

It is definitely a good idea to invest in equities for long term wealth creation. Bond investment is meant for risk averse investors and/or to rebalance your portfolio as per your asset allocation targets.

Shiv kukreja ji,

Is it possible to see subscribed values live (real time) on some NSE, BSE Websites? I would like to invest in retail ct.

Hi PS,

Here you have the link to check the LIVE subscription details:

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1067&type=DPI&idtype=1&status=L&IPONo=1143&startdt=2%2f24%2f2016

Retail have full chance of allotment !! Shiv Sir your opinion. ..

Yes PS, it will be very close to the quota reserved for the retail category. Surprisingly low participation this time around.

Could it be because equities are available at low valuations? Or maybe people are waiting for IRFC tax free bond?

Hi RS,

It is primarily because NHAI issue has come at a very short notice. Moreover, investors did not want to invest more in NHAI as they had already invested good amount in December and got full allotment.

Shiv,

How much subscription has happened so far?

Hi Amit,

It is around Rs. 1650 crore as against total issue size of Rs. 3300 crore. Retail category is around Rs. 500 as against Rs. 1320 crore reserved.

Thanks, Shiv.

You are welcome Amit!

Shiv,

So retail has chance for full allotment?

Yes RS, there is a good chance of full allotment.

Yes Shiv. Looks like it will be fully subscribed, but chances are very good that we will not have to wait for refund and only wait for allocation.

It is oversubscribed by 1.15 times in the retail category, so unfortunately we’ll have to wait for the refund.

Agreed. Looks like last moment rush. Since NTPC was quoting low, it was undersubscribed and that also helped in last moment rush. Any way 85% allocation is not all that bad.

Yes, 87% is good enough allocation. I expected even higher subscription.

Thanks Shiv as always for the valuable info 🙂

QQs:

1. What is the expected size of IRFC and HUDCO TFBs? What would be the retail portion for these?

2. Is there a link on NSE/BSE where the future/forthcoming TFBs are listed in advance? If so, could you pls share that link(s)?

Thanks Bobby!

1. IRFC issue size should be Rs. 2,450 crore and HUDCO issue size should be around Rs. 1,788.50 crore. Out of these figures, 40% would be reserved for the retail individual investors.

2. There is no such link which provides advance details of the forthcoming issues.

Any update on NABARD issue. What is likely interest rate for upcoming tax fee bonds.

Thanks.

Hi Ameya,

There is no update as yet on the NABARD issue. Likely interest rates for the upcoming tax-free bonds will fall in the range of 7.30% (10 years) to 7.85% (20 years).

Dear Shiv,

your article is very useful. If I want to sell these bonds, what is the ideal time for selling them? Because if i sell them near the maturity time, I suppose there will be less taker, I suppose.

Thanks Meenu!

It is very difficult to guesstimate the ideal time to sell these bonds, but I think one should sell these bonds whenever India’s Macroeconomic situation improves considerably – controlled fiscal deficit & current account deficit, reasonably healthy GDP growth, low inflation, exports-imports get recovered, reforms get implemented.

I think on closing of 1st day , all the investor in Retail will get full 100% allocation.

Hi PS,

Around 87% allocation will be made.

What is the latest information about NABARD TFB ?

Hi Mr. Poddar,

There is no info we have about NABARD tax-free bonds as yet.

Hi Shiv,

What is the final tally for today.

today’s subscription figures please and I have applied for 140 bonds should I will get full allotment shiv

Hi Nitesh,

Retail investors will get around 87% allocation.

Hi Shiv,

What was the final tally for the day. I could not understand the cumulative figures as given on the BSE web site.

Hi Vin,

Please check the final tally in the comment below.

Day 1 (February 24) subscription figures:

Category I – Rs. 1,845 crore as against Rs. 660 crore reserved – 2.80 times

Category II – Rs. 4,355.68 crore as against Rs. 660 crore reserved – 6.60 times

Category III – Rs. 1,375.85 crore as against Rs. 660 crore reserved – 2.08 times

Category IV – Rs. 1,523.36 crore as against Rs. 1,320 crore reserved – 1.15 times

Total Subscription – Rs. 9,099.89 crore as against total issue size of Rs. 3,300 crore – 2.76 times

Thank you very much, Shiv. Let me once again reiterate- you have provided an invaluable platform for retail investors like us!

Thanks a lot Vin for your kind and motivating words! 🙂

Shiv – retail category oversubscribed by 6.63 times, so I think successful applicants should get (1320/200)/6.63 = 99.55 % allocation. Please confirm.

Hi Vineet,

You are checking the BSE subscription numbers only. There are NSE subscription numbers also to be added.

As per notification on 18th Feb, Nabard is allowed to raise 5000 Crore Tax Free bonds. Again we can expect an issue of 3500 Crore for Public from NABARD. We can expect coupon rate of 7.65% 7.8% considering the current trend of GILT.

https://www.taxmann.com/topstories/104010000000047645/nabard-allowed-to-issue-rs-5000-crore-tax-free-bonds.aspx

Thanks George for sharing this info!

I read somewhere that Nabard is not planning public issue of tax free bonds. They are going for private placement only

Hi Ramadas,

It is an incorrect information you have read. NABARD has been authorised to raise Rs. 5,000 crore by issuing tax-free bonds this financial year. It will raise Rs. 1,500 through private placement, after which it will have to mandatorily raise Rs. 3,500 crore through a public issue. It cannot raise more than 30% of the allocated amount through private placement.

You are right Shiv. I just reread in Financial express that they are raising 1500 crore through private placement of TFB. Nothing was mentioned on public issue and I was under the impression that it is only private placement. Thanks for clarifying.

Thanks Ramadas!

Hi Shiv,

Thanks for the wonderful infomation you are providing.

Can you please clarify on selling these bonds in stock exchanges where these bonds get traded. Below are my questions.

1. The bonds are purchased at 1000/- each. Is there an chance of bond value getting increased in stock market?

2. If the above is true can the bond value also get decreased resulting in Losses? If that is the case (gain/loss) how come these can be called fixed income investments?

3. If I sell the bond(s) in stock market, what will happen to the interest on the bond? Interest hence forth would not be paid to me but would be paid to whomsoever bought the bond?

4. Once the bond value increases/decreases, how come its value remain same during maturity.

Sorry for the multiple questions but I’m confused with these.

Many Thanks,

Venu

Thanks Venu,

1. Yes, if the bond yields (YTM) go down, then the market value of these bonds would go up. Tax-Free Bonds issued two years ago are all trading at a 20-25% premium.

2. Yes, the market value of these bonds can also go down, if the bond yields go up. They are called fixed income investments as these bonds carry coupon rate of 7.69% per annum which remains fixed throughout its tenure of 15 years, irrespective of its market price going up or down.

3. Yes, full year’s interest will be paid to the bondholder whose name is there in the records of the company on the record date.

4. Its value will be equal to its face value on maturity as nobody will pay you any premium for the bonds which will cease to exist on maturity.

Thank you very much Shiv for patiently answering my questions. I’ve come to this site by chance but now I’m an regular follower.

Glad to know that, thanks Venu!

As you mentioned that TFBs issued 2 years ago are trading at 20 – 25% premium currently, so will their market value come down toward their face value as their maturity date comes close? As you mentioned in another comment, as the maturity date comes near no one will pay more than the face value as that is what they will get for the bond on the maturity date. Just wanted to clarify my understanding. Thanks.

Hi Melwyn,

Yes, the market value of these bonds will merge with the face value on the maturity date.

HUDCO issue is expected to get launched next on 2nd or 3rd of March.

Shiv, Have to admire your super patience and kindness in replying to so many repeat and mundane questions … by many ‘novice’ people who are anxious to do the right thing with their savings. Good to know you do this service with no upfront charge. The many sincere thanks you receive are payment enough, I guess. Great work!

Thanks a lot Mr. Srinivasan for your kind and encouraging words! 🙂

Dear Mr. Shiv Kukreja,

Kindly let me know the charges by law, that generally DEMAT Service Providers can charge customers for ‘off market’ DEMAT transfers of TFB’s/Equity between 2 family Accounts of same DEMAT service provider.

Thank you.

Hi S.K.,

Please check the tariff structure of CDSL, including the Off-Market transactions – https://www.cdslindia.com/dp/dpfees.html

Dear Mr. Shiv,

Was unable to appreciate the link sent. Please elaborate in your words directly. Will be grateful fir your help.

I fully agree with Vin and others.

Shiv, all your postings and replies on TFB are very useful to us. I really appreciate your dedication on this forum. Looking forward for upcoming TFB issues and your posts. Once again, thanks a million, from bottom of my heart.

Thanks Mr. Singh! It is your love and affection which keeps me motivated, dedicated and patient! Thanks once again! 🙂

Shiv

Any idea why the subscription is so low.I really expected it to see only 47% like last time but seems quite a high number will get this time.

Is it because of HUDCO,IRFC,NABARD following or people investing in equity direct as many shares are at a bargain?

Thanks

Hi Harinee,

As I have mentioned above, I think it is primarily because NHAI issue has come at a very short notice. Also, investors probably do not want to invest more in NHAI as they had already invested good amount in December and got full allotment.

Manshu/Shiv

Nothing on upcoming budget? Never thought I would say this but this govt is scaring us more than the previous one. At least you knew what to expect then in budgets.

Hi Harinee,

It is the human nature to get unduly scared and excited. Markets are falling due to the sins Congress did in the past and are doing in the present. The present government is trying to correct those anomalies and I think the course correction is taking its own sweet time. Global economic conditions are also working as headwinds and our wounds are getting more painful.

Is there a point in applying under retail if the NHAI issue is already oversubscribed for this category ?

No.

Yes. Only if you want 5% interest on money.

Hi KKJ,

If not applied on the first day, no allotment will be made against your application.

Hi Shiv

I applied for these bonds in retail category today ( Feb 25). Given that they were oversubscribed yesterday, what is the approximate allocation that I can expect?

Thanks

I do not think people who applied today will get any allotment. All of the amount will get refunded.

Hi Jyoti,

You should not expect any allotment against your application.

Any guess for allotment basis for retain investors, based on oversubscription in NHAI Tranche II Tax free bonds?

Hi Shirish,

Approximately 87-88% allotment will be made.

Hi Shiv,

are these bonds are tradeable in stock exchange as well

regards

Pawan Aggarwal

Hi Pawan,

Yes, these bonds are tradable on the stock exchanges – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Day 2 (February 25) subscription figures:

Category I – Rs. 1,895 crore as against Rs. 660 crore reserved – 2.87 times

Category II – Rs. 4,358.86 crore as against Rs. 660 crore reserved – 6.60 times

Category III – Rs. 1,384.94 crore as against Rs. 660 crore reserved – 2.10 times

Category IV – Rs. 1,560 crore as against Rs. 1,320 crore reserved – 1.18 times

Total Subscription – Rs. 9,198.80 crore as against total issue size of Rs. 3,300 crore – 2.79 times

Dear Shiv,

I know it’s too late for retail investors now to buy this 2nd tranche, but how do you go about buying this TFB? Can it be bought online without doing any paperwork? I’m having ICICI direct trading account, but don’t see it listed. Can I buy it directly from NHAI?

Want to be better prepared for next time 🙂

Thanks,

Melwyn

Hi Melwyn,

You can buy in secondary market from ICICI direct. Buy the earlier issues listed.Go to Equity, NCD List. You will find some list of TFBs. Click on view more. All the TFB with YTM will appear. Buy which ever is good for you. You need not boy NHAI only, there are whole lot of companies like NTPC, IRFC etc. Based on YTM, you can choose. ICICI Direct charges anothe 1.1 % towards brokerage etc. take that also into account.

Thanks George for your inputs!

Thanks George. For the upcoming TFB where do I find it? For eg HUDCO tranche 2 is coming on 2nd March, but I’m not able to find it on icici direct. Will it show up only on 2nd March? and if so, will it be listed in the same place you mentioned (under “Equity”, “NCD List”)?

Thanks for your response.

These are normally available under IPO. I do not recollect seeing this in the app, but have invested in the past using icicidirect.com. Had also received a mail from icicidirect regarding the ipo a couple of days ago.

If you buy in secondary, additional brokerage charges may be incurred so may make sense to wait for the ipo of the other issuers.

Thanks nn. Yes, I managed to find it today in the IPO section.

UPDATE

HUDCO is launching on 02/03 at the same rates.. 7.29/7.69 for retail. Total size 1788 crs (500 + 1288 oversubscription). Retail quota is 715 crs.

ICICI Direct would support it.

Thanks nn for the quick update!

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore

What does “Green-Shoe” option mean? Also why do they call it “coupon rate”? Is it different from “interest rate” that is there for Bank fixed deposits?

Sorry for the naïve questions.

Green-Shoe option is the option to retain oversubscription in case the issue gets oversubscribed over and above the base issue size. ‘Coupon’ term originated as historically coupons were affixed to bond certificates and the investors were supposed to detach and surrender the coupons to get their due interest payments periodically. Interest rate and coupon rate are used interchangeably.

Thank you Sir. Really learning a lot from your site. Don’t know if there is any other site where people clarify these kind of doubts. Much appreciated 🙂

Shiv,

Can you please confirm what other TFBs are due to come out this fiscal year ?

If possible please let me know their approximate sizes as well…

Thanks a lot !!

Hi Gaurav,

IRFC and NABARD issues are expected to get launched in the 2nd week of March. Expected issue sizes are Rs. 2,450 crore and Rs. 3,500 crore respectively.

Dear Shiv,

Will refund from Hudco tax free bond Tranch II issue come in time for upcoming IRFC or NABARD issue.

As HUDCO issue is smaller, may not get full allotment for 1st day subscribers. So how to go about investing in TFB’s . Wait for the bigger issue ??

Iam puzzled.

Hi Pankaj,

As the launch dates of IRFC and NABARD issues are yet to get announced, it is not possible for me to answer your query with certainty. But, I think if you need to invest in only one issue, then you should wait for the bigger issues of IRFC or NABARD.

Day 3 (February 26) subscription figures:

Category I – Rs. 1,895 crore as against Rs. 660 crore reserved – 2.87 times

Category II – Rs. 4,359.36 crore as against Rs. 660 crore reserved – 6.60 times

Category III – Rs. 1,385.94 crore as against Rs. 660 crore reserved – 2.10 times

Category IV – Rs. 1,567.81 crore as against Rs. 1,320 crore reserved – 1.19 times

Total Subscription – Rs. 9,208.11 crore as against total issue size of Rs. 3,300 crore – 2.79 times

The issue stands closed on February 26.

Dear Shiv Ji, I have been reading all the messages. I like your personal touch to each message and keeping up well informed about the TFBs. Congrats.

Thanks a lot Mr. Bala!

Sir,

When do we know about allotment status of NHAI Bonds? Also, I want to apply for HUDCO Bonds, so if in case on non-allotment of NHAI bonds, when can we expect the refund in our account?

Thanks,

Kamlesh

Hi Kamlesh,

I expect the NHAI allotment/refund process to start by 7th of March. I don’t think you would be able to utilize the NHAI refunds for the HUDCO issue.

Thanks sir for your patient reply.

I have applied today for HUDCO Infra Bonds.. hopeful of getting either of NHAI or HUDCO. Thanks for sharing useful information with all of us here. Keep it going.

Regards,

Kamlesh

Thanks Kamlesh! 🙂

My cheque has not been presented so far. I know of a relative whose cheque was cleared on Monday. Is there anyone else whose cheque has not been cleared so far.

When is the allotment of NHAI bond recently closed in last month? If not allotted when money will be returned back?

Hi Diwakar,

I expect the NHAI allotment/refund process to start from 7th of March.

Dear Shiv Ji, Thanks for your advice. Invested well in time and quantity. Hope to get good allotment.

Any update on the status of subscription. Thanks in advance.

Hi Mr. Bala,

Subscription figures have been updated above in the post, I think you mean allotment. Allotment should happen very soon, either today or tomorrow.

Hi,

When will refund of this issue get processed? NABARD issue is coming on 9th March

http://www.moneycontrol.com/news/economy/nabard-may-price-tax-free-bond-at-729-764-for-retail-part_5770801.html

Hi xyz,

I think refunds should start getting credited as soon as today or tomorrow morning.

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

hi

Can you please advise as to who the “first come first served ” actually work. Is it chronological order or some other matrix.

Regards

Hi Sampath,

It works on a day-by-day basis. If the issue remains unsusbcribed on Day 1 and gets oversubscribed on Day 2, then Day 1 applicants get full allotment. Pro rata allotment is made to the Day 2 applicants.

Dear Shivji, We are yet to know about allotment of NHAI and HUDCO bond? When is it going start and when our money will be returned back if not allotted?

Hi Diwakar,

NHAI refunds should commence either today or tomorrow morning. HUDCO refunds will take time. I think HUDCO refunds should get credited on Friday or Monday morning.

I have applied for 50 bonds of NHAI on first day.

What are chances of full allotment?

Hi,

Does anyone has any idea of ratio of allotment in NHAI / HUDCO issues, basis the over-subscription in retail category , assuming application was put on day 1/ Day2 ?

when refund expected

Hi Mr. Varma,

Refund is expected by tomorrow.

Dear Shiv,

I’m trying to understand the data in the table above. Why is the Effective yield for 30.90% tax bracket = 11.13% (for Series 2). Could you share how you calculated this? The formula used? Are you comparing this TFB with another investment whose return is taxable?

Thanks,

Melwyn

Hi Melwyn,

Yes, 11.13% is the effective yield of comparable taxable investment for an investor in the 30% tax bracket.

What is the update on NHAI Tranche 2 bonds allocation? Our money is stuck up for quite some time now. Today NABARD has also come up with new series of bonds.

wait. it was expected today

Has NHAI trench II allotment taken place and credited to DMAT

NHAI refund/allotment process has started today.

I have been alloted the bonds. money debited now

allotment ratio ~87.9%.

Thanks a lot vvpatil for sharing this info, this is of great help to the investors!

Money debited ABSA account means that allotment finalised and bonds earmarked. But it will still take time for Bonds to Appear in DMAT account.

I am yet to get the allotment or refund. Anybody else got allotment?

Yes, I just received the refund

Thanks Jyoti for sharing this info!

Just now I called KARVY COMPUTERSHARE PRIVATE LIMITED who are the Registrar of NHAI, they told me that allotment has not started yet. It will take more 2-3 days. I am puzzled how Mr.VV Patil got the allotment.

Hi Diwakar,

NHAI refund process has started, allotment should start by today evening or tomorrow.

Thanks. Let us wait.

124 alloted out of 140 bonds to me shiv

Has it been credited to your DMAT.

Thanks Nitesh for this info!

ABSA aprticipant first get indication reagrding how many bonds have been alloted because that much money only is released.

Yes, that’s right!

Thanks Shiv. I got 89 out of 100 applied. I received SMS from NSDL that 89 bonds are credited to my demat account. But still I am not able to see these allotted bonds in my ICICIDIRECT account. Can you guide me about this.

Hi Diwakar,

With ICICI Direct, I think these bonds will start reflecting once they get listed and their trading begins on the stock exchanges.

Another query when the balance amount equivalent Nos. 11 Nos. of bonds will be refunded to my account?

NHAI refunds should have got credited by now. Have you checked your account?

No, have not yet received any refund, however, received SMS saying that I have been allocated 88 bonds..

Hi Jinay,

You should get the refund amount credited soon, probably today itself.

what is the expected listing price of 7.69% nhai TFB

I expect NHAI bonds to list between Rs. 1,010 and Rs. 1,020.

yes sir you are correct listing at 1010-1020 rrange

Great!

Dear Siv, Thanks for reply. No, the balance amount is still not refunded to my account.

Hi Diwakar,

Though it should have got credited by now, but you should wait for a couple of days more before contacting Karvy Computershare for the same.

Even I have n’t received the refund but I believe it should be there by end of today.

Also thanks to Shiv you for the wonderful service you are doing. I just got a question regarding earlier bonds issued in 2013. I practically have bonds from every issue. Do you think it’s good time to book the gains? Or Shall I wait for some more time?

Thanks

Thanks Ikjot!

I would hold these bonds till 10-year G-Sec yield falls below 6%. Rest its your decision when you want to book profits.

Thanks Shiv, your help is highly appreciated.

You are welcome Ikjot! 🙂

Thanks for your timely help Shiv. Just few minuets back amount is refunded to my account. Now next one is, when HUDCO bonds are likely to get allocated?

That’s great Diwakar! I think HUDCO bonds allocation should happen on Monday.

NHAI tax-free bonds to get listed on the BSE & the NSE today i.e. March 11th.

Here are the BSE and the NSE codes for the same:

7.29% 10-year bonds – BSE Code – 935662, NSE Code – NC

7.69% 15-year bonds – BSE Code – 935666, NSE Code – NE

Deemed date of allotment has been fixed as March 9, 2016. Interest will be paid on October 1st every year.

Thanks Shiv. I am yet to see NHAI bonds credited to my ICICIDIRECT DEMAT account. What could be the reason?

Hi Diwakar,

Check your ‘Bond’ holdings.

Hi Shiv, Has trading begun in these bonds

Yes Vin, trading has begun in the NHAI bonds. Here is the BSE link – http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=935666

Any news about HUDCO allotment?

Not yet Diwakar, but it should ideally start today itself.

Thanks, Shiv for the information. The link you provided gave me exhaustive information of trading in these bonds. You are amazing!

Thanks Vin! 🙂

I got refund for some part of the HUDCO BOND today. Yet to know about exact allotment.

Dear Shiva, Any news about IRFC and NABARD allotment? Regards, -Diwakar Rane

No Diwakar, not yet.

14 days after closing

I didn’t get any interest credited to my bank account dear shiv on 1st October dear shiv is it because of Saturday because markets are off on Saturday or it will be credited tomorrow that is on Monday dear shiv

I got interest from nhai bond on 1st oct

I have also not received the interest in respect of NHAI bonds issued in 2016. Surprisingly, the interest in respect of the bonds issued in 2012 was duly credited in my account on 1 October.

I have received the interest for both the bonds issues on 2012 and the latest one in feb 2016 on 1st october. I think the interest payout for the latest nhai bonds is less since this was not a full year.

I have just got credited today

I have 885 . How much I can get? Can someone help me.

Hi Ashok,

Your query is not clear.

Sorry, I got the amount. Thank You.

Hi Shiv,

I did not get the interest for the NHAI tax free bonds issued in FY 2011-12. Until last year there were no issues. I came to know that registrar changed from MCS to some one else. I wrote emails to MCS but they all bounced. Could you please help letting me know who is the new registrar and its contact number along with email that can be used to contact them in this context?

Thanks & Regards,

Vineet Garg

Shiv, I got the cheque today evening from the new registrar “Integrated Enterprises”. Apparently a transition issue from the old registrar to the new one, so the interest was not auto credited to my bank account 🙂

interest due on these tax free bond in March2017 not paid

any info

opvarma

Hi Mr. Varma,

Please check this link for the interest payment dates:

https://www.onemint.com/2016/04/12/interest-payment-date-bse-code-nse-code-allotment-date-maturity-date-tax-free-bonds-issued-in-fy-2015-16/

The interest from NHAI tax free bonds which was to be paid in Oct 16 has not been received. What do I do ?

Sir,

I have NHAI Tax free Bonds 2016 in your Company under folio No-NFFO401255,Amount Rs.4,43,000/.But unfortunately I am not yet received any Interest till now.

Please do the needful and oblige.

Sir,

I have NHAI Tax free Bonds 2016 in your Company under folio No-NADO403153,Amount Rs.5,00,000/.But unfortunately I am not yet received any Interest till now.

Please do the needful and oblige.

Shiv – Few days ago Nitin Gadkari made announcement around NHAI bonds (7%+ Interest).

1. Do we know if those are tax-free or taxable?

2. Do we know the tentative launch date?

3. Would you be kind enough to do an article on these? 🙂

Hi Bobby,

I wish you and every reader of OneMint a very Happy & Prosperous 2018! 🙂

1, 2. As we all know, no details have been publicly disclosed as yet. But, I think it is highly unlikely that NHAI Bonds would be tax-free in nature. Moreover, the issue is likely to open in the month of February, post Budget 2018.

3. I would be more than excited to cover this issue as & when the details are official.

Shiv – As always, many thanks for the prompt & kind response. Wish you too a great 2018.

Thanks Bobby!

Few years ago I mentioned that the interest rates will come down in the future. One learned man here ridiculed me saying we are not astrologers.