REC 7.43% Tax-Free Bonds – October 2015 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Amid a mad rush and healthy listing gains for NTPC & PFC tax-free bonds, Rural Electrification Corporation (REC) will launch its issue of tax-free bonds from tomorrow i.e. October 27th. Like NTPC & PFC issues, this issue will also be of a smaller size i.e. only Rs. 700 crore. Though the issue is scheduled to close on November 4, given its smaller size, it is likely to get oversubscribed on the first day itself and get closed soon after that.

Since the RBI cut the Repo Rate by 50 basis points in its monetary policy last month, the 10-year benchmark G-Sec bond yield had fallen from 7.72% to 7.50% or so. But, for the past few days, it has remained steady in the range of 7.50% to 7.60%. Based on that, the coupon rate offered by REC has been fixed at 7.14% p.a. for the 10-year tenure option. After this issue, NHAI would launch its issue of tax-free bonds and I think it would carry interest rates which would fall more or less in this range only.

Before we take a decision to invest in this issue or not, let us first quickly check the salient features of this issue:

Size of the Issue – REC is authorized to raise Rs. 1,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 300 crore by issuing these bonds in private placement. The company will raise the remaining Rs. 700 crore from this issue.

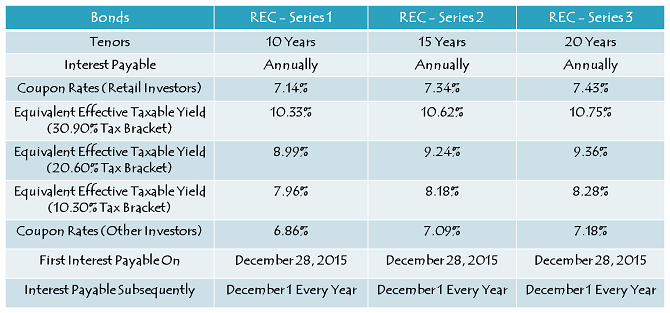

Coupon Rates on Offer – Due to falling G-Sec rates, coupon rates for this issue have also fallen by 0.17% to 0.22%. REC will offer yearly rate of interest of 7.14% for its 10-year option, 7.34% for the 15-year option and 7.43% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As always, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

Rating of the Issue – CRISIL, ICRA, CARE and India Ratings have assigned ‘AAA’ rating to the issue due to the fact that REC is a government company with reasonably decent fundamentals. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI Investment Allowed – Non-Resident Indians (NRIs) are also eligible to invest in this issue, on a repatriation basis as well as non-repatriation basis.

QFI Investment – Qualified Foreign Investors (QFIs) are not allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 70 crore

Category II – Non-Institutional Investors (NIIs) – 25% of the issue is reserved i.e. Rs. 175 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 175 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 280 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – REC has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat/Physical Option – Like PFC issue, it is not mandatory to have a demat account to apply for these bonds. Investors will have the option to subscribe to them in physical or certificate form as well. Demat or physical form, interest payment will still get credited to the investors’ bank accounts through ECS.

Also, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchange.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – REC will make its first interest payment on December 28, 2015. However, next year onwards, interest will be paid on December 1 every year like it is done with its bonds issued in previous years.

Should you invest in this issue?

NHAI tax-free bonds issue is likely to hit markets within next 10 working days or so. Between REC and NHAI, I would personally opt for the NHAI bonds as I think interest rate for its bonds would be very close to the rates offered by REC in this issue. Moreover, NHAI’s issue size would be a big one as compared to this issue and therefore it would increase our chances of getting full allotment as against this issue, which I think will again get oversubscribed on the first day itself.

Fundamentally, I think both companies are financial stable and carry government backing in difficult times. So, I would give this issue a miss and prefer investing my money with NHAI.

Application Form for REC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in REC tax-free bonds, you can contact me at +919811797407

Even I’m skipping this one, but overall rates are much lower than last year and don’t think these bonds will get much appreciation in secondary market as well.

Hi Ikjot,

Yes, you are right, these bonds will not give 3-5% listing gains. However, it doesn’t make sense to compare current rates with the rates prevailing 2 years back. Nobody knows where the interest rates are headed. Rates might go further down from here in future and then we might regret not investing in these bonds later. Investors need to make a balance of all asset classes based on their investment cycles. Buy when the pessimism is overdone & sell when their is too much euphoria.

Thanks for the reply Shiv.

You are welcome Ikjot!

Thanks Shiv for the post. Your suggestion to investors to skip this considering that NHAI is coming with a large issue is true not only terms of allocatio n but also from a liquidity perspective. If the issue is large better chances of liquidity. More over what I have seen over the last 3 years is NHAI always had better traction than other issues. When evaluate the TF interest from these bonds beneficial to 30% bracket, it is also to be noted that the Govt of India is pushing for low tax regime keeping corporate tax at 25% in next 2-3 years. This will mean even personal tax will come below 25%.

Thanks George!

I agree to all your points mentioned here. With tax rates coming down, it should increase corporate profitability & ultimately result in lower interest rates. That should make these bonds more attractive. What do you think?

Shiv, That could be a possibility. Either way, for someone looking for regular tax free income for next 20 years it is still a good option. The risk is only for those who cannot hold on until maturity or say next 10 years.

My point is there is a 50:50 probability of interest rate going up & going down. So, why should investors wait for the interest rates to move up before investing in tax-free bonds?

Sir

Please give the link to find out as to how much the issue has been subscribed so that we can decide by around 1:00 PM whether to subcribe or not.

Hi Ashok,

Here you have the link to track LIVE subscription numbers – http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1012

What is the subscription status?

Hi SB,

It is subscribed by approximately 2.20 times in the Retail Investors category.

In Retail its showing as 7.29 ? Is this needs to be divided by 7 ?

multiply by 3 then divide by 7

That’s correct. Thanks Dr. Puneet!

u r an expert

i learned it from you

🙂

That means allocation will be 1/3rd approx., right?

Hi SB,

It is 4.76 times in the retail category, so only 21% allotment will be there.

Thanks !

Day 1 (October 27) subscription figures:

Category I – Rs. 135.02 crore vs. Rs. 70 crore reserved – 1.93 times oversubscribed

Category II – Rs. 764.77 crore vs. Rs. 175 crore reserved – 4.37 times oversubscribed

Category III – Rs. 579.17 crore vs. Rs. 175 crore reserved – 3.31 times oversubscribed

Category IV – Rs. 1333.32 crore vs. Rs. 280 crore reserved – 4.76 times oversubscribed

Total Subscription – Rs. 2812.28 crore vs. total issue size of Rs. 700 crore – 4.02 times oversubscribed

Will we get our money back by the time NHAI is opened ? Thanks !

Hi KK,

It depends on the date on which the NHAI issue opens. Issue opening date is not announced as yet.

Ok.. Thanks Shiv !

Last 3 days the Govt Securities have improved yield. Hope NHAI will take the latest yield for calculation.

I need all the information for this…

Dear Shiv, am a nri working in Dubai. Could u pls tell me about the catagory 3 which is reserved fo HNIS like (a) for residents(b) forHUF ( c) for nris… The reserved quota is 175 crore. I want to know all the oversubscribed bonds will be divided in 3 or there is again reservation % for these 3 as well… Pls clarify

US FED has given signals that they will increase interest rates in next meeting this year(In Dec). If that happens yield will go up and bonds coming in Jan-16 will offer better interest rates.

I feel it is not necessary that Interest rates in India will go up because of Fed raising interest rate. Fed is expected to raise rates gradually. Taking the past experience, usually NDA likes to keep interest rates low and will not allow it to go further up. The current movement in GSecs yield is a sudden reaction to the Fed guidelines. Possibly this will help the next few issues to give reasonable coupon.

Hi Shiv,

Can you shed some light on Sovereign Gold Bonds issue from RBI.

Thanks

Any information about the gold bonds that will be sold next week? Can they be bought through the online account or have to go to the bank?

Thanks

Shiv

Really want to see your post on the gold bonds. Think its a very clever scheme by the govt to reduce physical gold demand. But looking at how gold is going and 2.75% taxable interest not looking very attractive.

Hi Ikjot/Ash/Harinee,

I’ll cover the Sovereign Gold Bonds issue soon.

Thanks Shiv, Always checking One mint for any issues/advice.

Sir,

As the tax free bonds are on first come first serve (allocate) basis then why limited bonds are credited. It shall be either allocated (full) or nil. Request you to elaborate to understand allocation methodology.

Sir

I am also new at this. But what I have understood is that all the valid applications received on day one are treated as having been received at the same time (one block of time). So if the subscription is more, than pro-rata allotment is made. However if subscription is less and subscription is received on day two also than applications received on day two are treated as having been received at the same time (2nd block time). In such case full allottment is made to applications received on day one and pro rata of balance to applications received on day two. And so on for days onwards. What I do not understand is that in case of NTPC when issue had been oversubscribed a number of times on day one why applcations were received on day two also thus blocking money of many ignorant people like me. Please clarify. Thanks.

Hi Viral,

All those investors, who apply for these bonds the day the issue gets oversubscribed, get proportionate allotment. So, if the issue gets oversubscribed on the first day itself, then all the investors get proportionate allotment. As the past issues were of a smaller size, they were getting oversubscribed on the first day itself. I am sure this will not be the case with the upcoming NHAI issue.

Thanks Shiv for clarification.

Hope NHAI is not over subscribed on first day itself.

When NHAI issue is coming??

NHAI update:

It will be priced sub-7%

http://www.financialexpress.com/article/economy/public-issue-of-10-yr-rec-tax-free-bonds-priced-sub-7-for-institutional-category/155945/

Hi Piyush,

NHAI issue dates are yet to get announced by the company.

No Sandeep, that will not be the case in the NHAI Tax-Free bonds issue. In fact, interest rates will be higher as compared to the REC issue. The link you have pasted here is an older one & talks about the REC coupon rates for the institutional investors.

Shiv, Long wait indeed. Now I think investors can use the refund of REC bonds. It is also likely have a better coupon rate 7.5 to 7.6%. The only question is why such a delay after filing the Draft prospectus. May be the issue will be immediately after Diwali.

Hi Shiv,

Any Idea why the delay in announcing next TFB. NHAI filed Draft prospectus some time back. Any way with recent increase in GILT bonds we can expect better coupon

Hi George,

I have no idea why NHAI is delaying its issue. But, you are right, with G-Sec yield going up, NHAI’s coupon rates would also be higher.

Can I apply for Tax Free Bonds in name of my minor daughter. I will be guardian for minor account. If yes then retail limit of Rs 10 lakhs will apply separately or I have to divide the amount of rs 10 lakhs in between 2 applications. I have Pan No for my daughter

Regards

hello sir, i want to know the allotment status of rec bonds. how to check?

Any update on when the allotment/ Refund is expected to happen for REC and when is it going to be listed ?

Thanks in advance. 🙂

Allotted 21%. refund will happen by today or tomorrow. Will help in investing for NHAI

The refund got credited, but no news on NHAI.

Thanks a ton Brother, some rumours on street there may be slight improvement in interest offered by NHAI/ IREDA…

Got the allotment and Refunds just now. Shiv ji, the Codes are awaited and also suggestion if the secondary market should be tapped as I wish to have them for 500 units.

It need not be rumor and based on the GILT yield in last 1 week.

Amount debited from my ASBA application today, looks like approx. 21% allotment.

Received sms of 21.5% allotment today, thanks.

Thanks 🙂

Any clue on Balance Refund, and when is it going to be listed?

Dear DCW

Got refund alongwith interest yesterday. Bonds also in account. Listing date not known. May be in next 2-3 working days.

dear sir

what is listing date and code ..

thank you.

Sk

Got Listed Today 743REC2035 at 1035 and I think ended 1020 or around that.

Thanks.

When is the next issue coming?

It seems the Government FinMin has asked the companies not to come up with fresh issues of TFB until the Sovereign Gold Bond Scheme date is over?

Yes, this will be correct. Fin Min had a discussion with all TFB issuing co 1 week back. Otherwise, NHAI cannot delay so much. One way it is good, the coupon rates will be better based on latest yield of GILT. But those who are keeping fund for these issues, the wait is little longer.

Any idea about the date when Sovereign Gold Bond Scheme is going to end ?

Thanks !

November 20

The S Gold Bond will not be a success considering 2.75% coupon and the Gold price currently 4% below the fixed price. Only those who are desperate and not in touch with price movement will apply. Ideally the Govt should have priced it based on closing day Nov 20th Price. Hope Govt will not extend the end date due to poor response.

Hope this is closed now and not extended by Govt. ?

Yes Very much. Very poor show. They will come with next issue soon. We can expect NHAI or IRFC TFB getting announced in 1 week time. We can expect 7.35 to 7.55% of interest.

Ok.. Thanks !

Where to get the information about the opening date of NHAI TFB issue.

Hi Shiv,

I heard IRFC comes out with its issue next Wednesday (9th Dec) at 7.53 % coupon rate. Is it correct?

Regards,

SB

Hi SB,

Yes, it is confirmed that IRFC is coming out with its tax-free bonds issue with 7.53% as the highest rate of interest for the 15-year tenure. But, the issue opening date is 8th of December and not 9th.

http://www.saving-ideas.com/2015/12/7-53-percent-irfc-tax-free-bonds-dec-2015/

Can I apply for IRFC bonds through ASBA. Could you please guide.

Thanks and best regards

Anand

BSE codes for REC Bonds:

7.14% 10-year bonds – BSE Code – 935540

7.34% 15-year bonds – BSE Code – 935544

7.43% 20-year bonds – BSE Code – 935548

Deemed date of allotment got fixed as November 5, 2015. Interest will be paid on December 1st every year, except this year.

NHAI tax-free bonds issue update:

Issue opens 17th December, closes 31st December.

Issue size Rs. 10,000 crore.

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.39% p.a.

15 years – 7.60% p.a.

NRIs are not eligible to apply in the issue. Also, demat account is NOT mandatory for this issue as well.

IREDA 7.74% Tax-Free Bonds Issue – https://www.onemint.com/2016/01/02/ireda-7-74-tax-free-bonds-january-2016-issue/

Would it would be possible for you to let me know as to what is the current listing price of tax free bonds issued so far in the current FY 2015-16?

Hi Mr. Jain,

You can check the bonds listed on the NSE and the BSE from the below pasted links – http://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

http://www.bseindia.com/markets/debt/tradereport.aspx?expandable=0

HUDCO tax-free bonds issue update:

Issue opens – 27th January

Issue closes – 10th February

Base Issue Size – Rs. 500 crore

Total Issue Size – Rs. 1,711.50 crore

Interest Rates for Retail Individual investors investing upto Rs. 10 lacs:

10 years – 7.27% p.a.

15 years – 7.64% p.a.

HUDCO 7.64% Tax-Free Bonds Review – https://www.onemint.com/2016/01/21/hudco-7-64-tax-free-bonds-tranche-i-january-2016-issue/

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.