Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

“Beti Bachao, Beti Padhao” is the mantra with which Prime Minister Narendra Modi launched Sukanya Samriddhi Yojana on January 22nd this year. Later on, the government issued a notification to allow 80C exemption equal to the amount invested in the scheme up to Rs. 1,50,000, which is also the maximum amount one can invest in this scheme in a financial year.

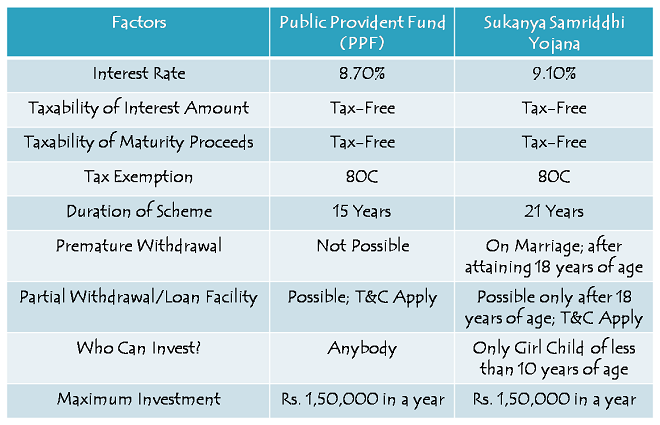

Now, the Finance Minister in his budget speech has proposed to make the interest component as well as the maturity proceeds as tax-free. I think this proposal has made this scheme to be the best small savings scheme available to the Indian investors. Yes, even better than our golden scheme of Public Provident Fund (PPF). So, what is this scheme all about? Let’s check.

Sukanya Samriddhi Yojana is a small savings scheme which can be opened by the parents or a legal guardian of a girl child in any post office or authorised branches of some of the commercial banks. The girl child is called the “Account Holder” and the guardian is called the “Depositor” in this scheme.

Before I compare this scheme with PPF, let us first check the important features of this scheme.

Salient Features of Sukanya Samriddhi Yojana

Who can open this account? – Parents or a legal guardian of a girl child who is 10 years of age or younger than that, can open this account in the name of the child. For initial operations of the scheme, one year grace period has been provided to make it 11 years of age. With this one year grace period in age, which is valid up to December 1, 2015, you can get this account opened for a girl child who is born between December 2, 2003 and December 1, 2004.

9.1% Tax-Free Rate of Interest – This scheme has been flagged off with a 9.1% rate of interest, higher than that of PPF which stands at 8.7%. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year like all other small savings schemes, including PPF.

Prior to the budget announcement, 9.1% annual return seemed unattractive, but not anymore, as it has been made tax exempt now. Interest amount gets added to your balance amount in the account and compounded either monthly or annually, as per your choice. Monthly interest compounding will be done only on your balance amount on completed thousands.

Duration of the Scheme – The scheme will mature on completion of 21 years from the date of opening of the account. If the account is not closed on maturity after 21 years, the balance amount will continue to earn interest as specified for the scheme every year. In case the marriage of your daughter takes place before the maturity date i.e. completion of 21 years, the operation of this account will not be permitted beyond the date of her marriage and no interest will be payable beyond the date of marriage.

Deposit for 14 years only – Though the scheme has a duration of 21 years, you are required to make contributions only for the first 14 years, after which you need not deposit any further amount and your account will keep earning the interest rate applicable for the remaining 7 years.

Premature Closure – The account can also be closed prematurely as your daughter completes 18 years of age provided she gets married before the withdrawal. As the maximum permissible age of the girl child is set as 10 years, the scheme effectively carries a minimum duration of 8 years i.e. 18 years of exit age – 10 years of entry age.

Partial Withdrawal – It is also allowed to withdraw 50% of the balance standing at the end of the preceding financial year, but only after your daughter attains the age of 18 years. So, effectively it has a complete lock-in period of at least 8 years, before which you cannot take out any money for any purposes.

Minimum/Maximum Investment – You need to deposit a minimum of Rs. 1,000 in a financial year to keep your account active. Failure to do so will make your account inactive and it could be revived only after paying a penalty of Rs. 50 along with the minimum amount required to be deposited for that year, which currently stands at Rs. 1,000.

Also, you can invest a maximum of up to Rs. 1,50,000 in a financial year. You can make your contribution to this account in as many number of times as you like.

How many accounts can be opened? – You can open only one account in the name of one girl child and a maximum of two accounts in the name of two different children. However, you can open three accounts if you are blessed with twin girls on the second occasion or if the first birth itself results into three girl children.

Nomination Facility – Nomination facility is not available in this scheme. In an unfortunate event of the death of the girl child, the account will be closed immediately and the balance will be paid to the guardian of the account holder.

Documents Required – Birth Certificate of the girl child, along with the identity proof and residence proof of the guardian, are the mandatory documents required to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

Sukanya Samriddhi Yojana vs. Public Provident Fund (PPF)

Budget 2015 has made this scheme quite attractive for the investors. If you’ve already exhausted your PPF deposit limit, want to save for your girl child’s marriage or higher education and have spare money to invest in this scheme, then this scheme provides you one more excellent avenue of safe investment with high returns. You can wait for the next financial year’s rate of interest to get announced anytime this month, if it remains higher than PPF, just go for it.

Application Form to open a Sukanya Samriddhi Account

List of authorised commercial banks where you can get this account opened

thanks for sharing this information.

I am just wondering if govt. is keeping money between 14-21 years, not it would fetch less money than combination of RD(0-14years)+FD(14-21 years).

also there will be no strings like male child, infinite renewals ( 5 years terms).would be great if you can just compare with RD +FD combination in the light of tax implications.thanks.

Thanks Omprakash!

No, the government is not keeping your money between 14-21 years for free. It is going to pay interest for these 7 years as well. No combination in fixed income investments can yield better than this Exempt-Exempt-Exempt (EEE) investment. This is the best guaranteed fixed income investment available right now.

So basically if a girl child is above 10 years,then no point in looking at this scheme ? Correct ?

Yes, that’s correct. But, there is a grace period of 1 year till December 1, 2015, which makes it 11 years of age.

The best part of this scheme is that this is also a EEE scheme. Means one can invest in this scheme without worrying about future taxation. But interest rate could be a worry, whether the high interest rate will be able to sustain for long term or not.

I have visited Post office and few banks recently to know where exactly they are aware about Sukanya Samriddhi Scheme. The fact is only post-office is allowing to open this account. Banks don’t have much clarity about this scheme. Anyway this is beginning, we will see many changes in coming days.

Could be another biggest hit Govt scheme like PPF in coming years.

I agree with you Santanu, this scheme has the potential of becoming another popular scheme like PPF. I think the government will try to keep its interest rate equal to that of PPF. I think the government will also try to keep its real rate of interest above 2%, over and above the rate of inflation.

Definitely a great scheme aimed at the Girl Child. Govt should work to make all sections of society aware of it.In lower sections we see people making gambles on chit funds for their girl child’s future, this is a good and safe alternative.

I agree!

suggestions on adlabs imagica ipo should we subscribe or not

Will review it on this long weekend.

Who gets the proceeds of this account when the girl turns 21? is the parent or the girl child? Any clarity on this issue?

Maturity proceeds will be paid to the account holder i.e. to the daughter.

Any clarity yet on which are the banks mandated to open the Sukanya Samridhi account? I visited SBI today to enquire and they aren’t yet opening the account.

Further, the grace period of 1 year is available right upto 1 Dec 2015 correct? for children born on on after 2 Dec 2003 which is 11 years as on the date of announcement of the scheme which is 2 Dec 2014. Is my understanding correct?

Which means that for a child born on say, 17 Jan 2004, I can still open the account even on 1 Dec 2015 even though she may be well beyond 11 years. Is that correct?

Thanks,

Hi,

I am working on one more post having the list of banks where you can open this account. The post will also have the application form and the circular of this scheme.

The language of the circular suggests that this account can be opened in the name of a girl child who is born on or after December 2, 2013, irrespective of her age whether she is below 10, 11 or even 11+. Further clarity will be provided by the finance ministry.

My baby girl was born on 2 February 2015.After one year we can open her account.

You can get the account opened anytime you want before she attains the age of 10, you need not wait for one year to open the account.

unfortunately parent death then what is next ,family not able to paid annual amount.account is closed or running still girl at age of 18yrs

You can make a request to prematurely close the account and withdraw the amount under special circumstances.

Respest girls and save girl child jai hind….and I want to say our government that most of the poor people don’t knw about this scheme … bt this type of scheme should advertise in media so people can knw about this scheme… our government provide many scheme bt poor people didn’t get all this.. so hope people get information about this scheme…

This scheme has got all the ingredients to get the required popularity on its own and you’ll definitely have many takers for this scheme. Though I think the government is not required to market this scheme, I am confident that the government will surely play its role to give this scheme its due credit and poor people will get its benefits.

With all respect, I understand a scheme is required for girl’s child marriage. But in my mind, education is the higher priority. Is there a similar scheme for girl’s /boy’s education? Especially the cost of higher education is sky high now and it is growing more than the actual rate of inflation. Hope we get a scheme for education as well.

50% of the corpus could be used for any purpose as a girl child attains 18 years of age. So, this amount could well be used for higher education. Expecting so many schemes from government for different purposes is like asking for too much.

can I open Sukanya Samriddhi Yojana account in the name of my grand daughter who is holder of OCI status

Clarity is still required as far as NRI/OCI investment is concerned. So, you’ll have to wait some more time for your investment. As NRI investment is not allowed in PPF, I am assuming that the government will not allow it for this scheme as well.

Hi Sir,

Its mentioned as 9.1% annum but when we checked the table the interest amount shows as 592 instead of 1092 the first year. Could you please explain the calculation part.

Thank You

Hi Sriram,

Which interest rate table are you talking about? Can you please share the link to the table.

as per above statement “If you’ve already exhausted your PPF deposit limit,want to save for your girl child’s marriage

or higher education and have spare money

to invest in this scheme, then this scheme

provides you one more excellent avenue of

safe investment with high returns.”…..does it mean a person can invest 1.5 lkh on his ppf account and 1.5 lkh on girl account , with total investment of 3.0 lks and with intrest as tax free.

Yes, that’s right, you can do that. The only thing to consider is that you’ll get tax exemption u/s. 80C limited to Rs. 1.5 lakhs only.

i wants to invest for my daughter.. but already my father-in-law opened in her name in some other state. is it possible for me to open again in her name in some other branch?

Hi,

You cannot open two accounts in a single name. However, you can transfer your account from one city to another city and from one post office/bank branch to another post office/bank branch.

Dear sir

When this scheme will be start? Our post office told the scheme is not start yet. plz give mi all details

Dear Mohammad,

This scheme got announced in July 2014, notified in January 2015, got 80C exemption in February and got announced as tax-free in the budget. If even after such a long time the scheme has not started, then when can anybody expect the scheme to get started. Nithya mentioned in her comment above that her father-in-law got an account opened sometime back which means that this scheme is already active.

“you can get this account opened for a girl child who is born between December 2, 2003 and December 1, 2004.”

As it is quoted so what about the girl who born after these two years. Please clarify.

The quoted line has been mentioned in the context of one year grace period. Otherwise, the scheme is open for all girl children of less than 10 years of age.

My only daughter born on 26th of oct 2003. Is thre any option to open an account for her. Pl let me know as esrlier as possible.

As of now, I don’t think there is any such provision to open an account in your daughter’s name.

can we deposit Rs.150000/- each in both accounts (i.e Rs.300000/-).PPF & Sukanya -Samriddhi account, we know that only 150000/- will be allowed

under 80C, but if we deposited 150000/-each (300000/-) shall we get benefit of Tax free Interest and maturity amount in both the acounts.

please clarify correct position.

Yes, you’ll get tax-free interest and maturity amount in both the accounts. In fact, the maturity proceeds in Sukanya Samriddhi Account will be given to the girl child and it will be tax-free for her.

MY DAUGHTERS DATE OF BIRTH IS 22-04-2004 & IS ELIGIBLE FOR THIS SCHEME

Yes, she is eligible for this scheme. Congrats!

Hi,

Quick question?

Do i need to invest max of 1.5 L per annum or for the whole tenure the investment should be 1.5L

Hi Shekar,

It is maximum 1.5 lakh. You can deposit any amount between Rs. 1,000 and Rs. 1,50,000 in a financial year.

Very nice scheme & good initiative by H’ble PM Modi.

To boost “Beti Bachao, Beti Padhao”, along with a/c holder contribution, government should also contribute the equivalent amount (as done in EPF schemes)

Yes, it is a great scheme. EPF is for the employees & not for the general public, an employer contributes to EPF and not the government. I think the government should focus only on efficient implementation of its policies and generation of jobs/income for its citizens. We do not require subsidies/contribution from the government for our day to day living. God has given all of us enough opportunities to move our bodies and earn our livelihood.

What vl be mature amount my daughter vl get if I deposit rs5000 yearly….

Hi Harish,

It is not possible to calculate the maturity amount in this manner as it’ll really depend on the rate of interest and time of your investment every year. But, based on certain assumptions and 9.1% rate of interest, it should be Rs. 2,63,025 after 21 years.

Hi Shiv,

What is a better option in terms of intrest to pay the full 1.5 l or monthly ?

Hi Vishal,

It is better to invest the full 1.5 lakh in one go to get higher maturity value.

Can NRI citizen can also do investment for their daughter’s. even though they are not looking for any tax benefits from the scheme and can they pay from NRI accounts.

Hi Mahesh,

So far there is no option for NRI’s to open this account. We have to wait for few more time as this is too early to expect many things.

It is still not clear whether NRIs can invest in this scheme or not. So, you’ll have to wait some more time for your investment. I think NRI investment will not be allowed as it is not allowed in PPF as well.

sir my bro’s daughter born on 18-12-2015 is she eligible for this scheme

Hi Rakesh,

I think you mean 2014 and not 2015, right? If it is December 18, 2014, then yes, it is possible to open an account in her name.

sir my sister in law born on 18-11-2003 is she eligible for this scheme

As your kid born before December 2, 2003, I think she is not eligible. Although the max age of opening the account is 10 years, but this year people will get a grace period till Dec 1, 2015. But your case is not passing that also.

No, she is not eligible for this scheme.

Hello Sir,

We live in abroad, and very much interested in this scheme, my daughter is born here but her nationality is indian. canyou please advice if we can open an account for her?

Thanks.

Hi Shivika,

You’ll have to provide these documents to open an account – Birth Certificate of the girl child and the identity proof & residence proof of the guardian for KYC process. KYC stands for Know Your Client.

If the government doesn’t allow NRIs/OCIs to open this account, then I think you might not be able to get through the KYC process for residents.

Sir, if for one year I will deposit 10,000/- , next year should I invest 20,000/-….. Pls reply

Hi Pinkesh,

You can deposit any amount between Rs. 1,000 and Rs. 1,50,000 in a single financial year.

Dear sir

Kindly tell us 9,01% is just because it is a new scheme ir it will be continue it will be remain us.

Hi Rajiv,

9.10% is applicable for the current financial year only. It will be reviewed again this month itself for the next financial year and there will be a revision every financial year. The revised rates will be effective from April 1 every year.

Want to know more abt this scheme

If you have any specific query, please share it share. There is already enough info shared on this page.

Can you please tell me whether hdfc bank n icici bank support this schem? I have a girl child who was born in 24 Sep 2011… I think she is eligible but need to check which all banks support this apart from post office.

Hi,

Even we are not sure whether HDFC Bank and ICICI Bank will service this scheme or not. We’ll have to wait for more information to pour in before confirming it to you.

Meri beti

18/04/2015 me two year ki hogi kya uska account open ho sakta h.

Please reply .

Thanks

Yes, aapki beti ka account open ho sakta hai.

Really this is a good scheme with the highest secured interest rate which helps the persons to save money for their girl child. Is it possible to deposit money daily 0r weekly or intermittently as per the availability of money for the benefit of daily wages people.

Yes it is possible. Consider it as a bank savings account only. After opening this account you will get a passbook like bank account. After that as you want you can deposit money. But the maximum deposit limit in a year is 1.5 lakh.

Great job sir..

meta ek sawal h sir ..agar mai is yojna me 1000 annually invest krun to policy mature hone par kitna dhan mile ga.

If you consider the interest rate 9.1% for next 21 years, then it will be around 52,605. But remember that interest rate will not be 9.1% every year, it may increase or come down as it is not fixed in case of SSA account.

I won’t open my baby and dotar ppf and ssa

Don’t you find these schemes attractive?

Hi Shiv…thx for all the useful info…can you please share the calculation part..i.e. of 52,000 when invested Rs. 1000 per year.

Hi Priyanka,

Rs. 1,000 invested every year would result in Rs. 28593, which would compound to Rs. 52,605 on maturity.

Sir, any scheme available for male child. Pls tell me

You can opt for PPF for your child.

Shiv sir my daughter date of birth21-2-2015 my sukanya samrufdhi yojanya my daugter ya scheme ah sakthi ha ka

Ji Imran Bhai, beshak aap is scheme mein invest kar sakte ho.

Hi Shiva, Happy to know this news have a query; could I invest 1 lakh at once instead of months 2 go

Yes Suma, you can deposit Rs. 1 lakh in one go.

sir kya har month deposit karna hoga ya ek sal me ek bar………

Saal mein ek baar karna zaroori hai, har mahine karna zaroori nahin hai.

Dear sir

Please let me know simply, If one deposits 6000 thousand annual , what amount would be received by the a/c holder at the maturity

Approximately Rs. 3,15,630, if the rate of interest remains 9.1% for all 21 years.

Hi Shiv,

Any clarity yet on the list of banks / branches where one can open the account?

Thanks,

No, not yet.

sir

kindly confirm this is monthly investment plan it means we have to deposit same amount on every month.( yes or no ) , 2 if yes than i some time i will not able to pay for some month that what will be penalty. 3 is there is ECS available or not ?

Hi Rohit,

1 & 2. No, this is not a monthly investment plan. You need to deposit a minimum of Rs. 1,000 only once a year.

3. It is still not clear whether any kind of ECS facility will be there or not.

Sir I want know how much money Will receive after 18year when deposit yearly 1000 rupya..for my daughter. When I stardeposit. 1/4 /15…please reply… I waiting..

.

This scheme is for 21 years and not 18 years. After 21 years, you’ll get approximately Rs. 52,605, if interest rate remains 9.1% throughout this period.

Sir ,provide link for form.this scheme

Here you have the post in which the link is also there – https://www.onemint.com/2015/03/04/sukanya-samriddhi-yojana-application-form-list-of-banks-to-open-an-account/

Hi Shiv,

My Daughter is 2007 born, so if I open an a/c now till what time will it remain operational and yield interest, which of the below does it pertain to.

a. Till she attains the age of 21.

b. Untill she gets married irrespective of the age.

c. Scheme is operational for a period of 21 years irrespective of her marriage.

d. Any other scenario other than the ones mentoned above.

Hi Prasun,

It is a mix of b. & c. Maximum duration of the scheme is 21 years from the date of opening the account or till your daughter gets married, whichever is earlier.

Hey Shiv,

Thanks a lot for the information.

One last thing, if I intend to invest 60K annually for 15 yrs, is this scheme a better scheme or equity option s better.

It varies from individual to individual. Personally, I’ll opt for equity mutual funds. Thanks!

Sir

My daughter date of brith 10/04/12 ki hai to kiya mein ya yojana khol sakta hu our sir ya year mein ek baar he dhenaa hoga

Yes Rajeshji, aap apni beti ka account khulwa sakte ho. Aur saal mein ek hi baar deposit karna hoga.

Hi’ may we know wat happens if the depositor or guardian who is in charge of the savings die?

You can make a request to prematurely close the account and withdraw the amount under special circumstances.

Dear Shiv

Hope you are doing good. I can see your good work is continuing . I am a NRI but planning to relocate back to India this year. My family is still resident Indian. My question is after shifting back how much time i need to wait before opening an account for my daughter?? Also, is it possible for a resident Indian To have a PPF a/c for self, PPF a/c for Child & this samridhi a/c for child and contribute around 4.5 lakh annually (tax deduction of only 1.5 is OK).

Regards

Kunal

Thanks Kunal,

A resident Indian can open this account anytime he/she wants. So, when your residential status changes back to that of a Resident Indian, you can open this account. For PPF, the total amount that you can invest in your account and your child’s account both put together is only Rs. 1.5 lakh. Additionally, you can invest Rs. 1.5 lakh in this scheme. So, total Rs. 3 lakh, instead of Rs. 4.5 lakh as planned.

Hi, My baby is 8th month old i am going to invest on this scheme, But before i invest i want to ask you something, Does this scheme runs the same though if the Government Changes from BJP- congress – or any other Party ?? will we get the same Benefit as this scheme has Promised please clear this as soon as possible i want to go for this today it self

Hi,

Interest rate is subject to a change every year on April 1. However, I have no idea whether any of the political parties would change the terms of this scheme in future or not. Personally, I don’t think they would do any such thing. Rest it is your decision.

Hi Shiva,

Good work, thanks for sharing a lot of information on this good scheme.

Thanks Rajesh for your kind words! 🙂

I am really very thankful of Government for this Perfect Aadhar for every Indian who having Girl child. I want to know about Only 2 things. That if I opened. An account of my daughter. And suppose in between I Died. Then what happen. Is this account will run by government? Like Lic Child plan. … and 2nd thing is… can I get ready recner calculation of this skim.

Hi Riyaz,

No, the government will not fund your child’s account in your absence. You can make a request to prematurely close the account and withdraw the amount under special circumstances. Moreover, ready reckoner calculation is still not available for this scheme.

hi,

I wanted a clarification. I want to invest in my neice’s name though I am not her legal guardian.And if I invest around 3ooo p.a what would be the maturity amount. she will be turning 1 yr this April

Hi,

You cannot invest in your niece’s name if you are not her legal guardian.

Hi,

My child DOB 30/12/2003 I am eligible for this account.

Hi,

Yes, you girl child is eligible for this scheme.

My child DOB 30/12/2014 I am eligible for this account

Hi,

Yes, you girl child is eligible for this scheme.

Can i deposit 1.5 lakh each in my ppf account and also in sukanya samriddih yojna

Thanks

Yes, you can do that.

Dear shiv,

Thanks for the use full information.

Can u please share me the calculation part that how the maturity amount is calculated.

Hi Mukesh,

Rs. 1,000 invested every year would result in Rs. 28593, which would compound to Rs. 52,605 on maturity. This is an approximate maturity amount and certain assumptions have been made.

Meri bachika age 5 yer har sal my 50000 hajar diposit karuga tho 14 sal ke bad kitna Ayega

Ye scheme 21 saal ke liye hai, 14 saal ke liye nahin.

ho bharu aami vrshala 1000 …pn 21 vrsha nantar kay milnar???? babaji ka thulu….please details

My Daughter is born on 27/02/2006, Now she is 9 year old. If I Start Sukanya Samriddhi Account, In the year 2024 she will become 18 year old girl, In the year 2027 she will become 21 year old. In the year 2027 She will get amount of Rs.6,50,000. Please confirm because I am Confuse how it works…

This scheme is for 21 years (and not that the girl child attains 21 years of age). So, if you start it today, it will run till March 2036 or till the date when your daughter gets married, whichever is earlier. Also, maturity amount is not fixed, it will vary as per your contribution, timing & the rate of interest.

Hi,

My daughter’s DOB is 21.09.2003. Can i open the Sukanya Samriddhi Account in her name? Kindly confirm.

Regards,

Amit Kaushik

Hi Amit,

No, your daughter is not eligible for this scheme.

Hi,

My child DOB 23/12/2015I am eligible for this account.

Hi Ranbir,

You mean 23/12/2014? If yes, then your daughter is eligible.

Hi,

My Child DOB is 23.12.2015. Can i open the Sukanya Samriddhi Account in her name? Kindly confirm.

Regards,

Ranbir Singh

hi

weather the amount i deposited in this account will come in tax saving (80c) or only the interest what we will get is tax free ?

Hi Venkat,

Yes, the deposited amount is eligible for 80C deduction as well. Interest received is also tax exempt.

ye accout sirf post office me hai ya bank me bhi chalega kon si bank me chalega pl

Please check this post – https://www.onemint.com/2015/03/04/sukanya-samriddhi-yojana-application-form-list-of-banks-to-open-an-account/

now my child dob is 5 july 2013 . if i open acccount starting from 1000 annually. so what can i get for her maturity time ..

Based on certain assumptions and 9.1% rate of interest, it should be Rs. 52,605 after 21 years.

Dear Mr. Kukreja

Thanks a ton for sharing such a wonderful information

Pls. let me know if I open the account my 11 yrs daughter today, then after how much time 50% of the amount can be withdrawn…..is it after 7 years ie when she will be 18 yrs…..or correct me if i m wrong

Yes, that is correct, after 7 years when your daughter turns 18, you can withdraw 50% of the balance.

Hi,

My Daughter age 1yr, if I can start now this scheme with annually 50000 what is the amount after complettionof scheme please conform.

Hi,

Based on certain assumptions and 9.1% rate of interest, it should be Rs. 26,30,250 after 21 years.

Hello Sir,

I already have opened Sukanya Samriddhi Account in the name of my daughter. But the name of the Guardian mentioned in the A/c is my wife’s name.

Now, I just want to know whether it is possible to change the name of the Guardian after opening the Sukanya Samriddhi Account! I want it in my name such that I can get the benefit under Sec. 80(C).

If yes, kindly let us know the process.

Regards,

Hi Prabhakar,

I have no idea how to change the name of the guardian in this scheme, you’ll have to approach the post office to get the required info.

can i pay through online payment

sir i have an account in post office . is there opction to pay online payment

I don’t think Post Offices provide online payment facility.

wat is the calculation for the deposit amount of Rs.1000 per annum and return amount is approx 600,000/- six lacs only .

Based on certain assumptions and 9.1% rate of interest, it should be Rs. 52,605 after 21 years against deposit of Rs. 1,000 every year.

What will be the maturity value for this scheem for investment of Rs.1000/pa. Please inform. Really it is a good plan by BJP Govt. Hoping other Govt. will not Spoil it.

Ramakrishna VN

9845460580

Based on certain assumptions and 9.1% rate of interest, it should be Rs. 52,605 after 21 years.

Sir my daugter will b 8 years of age in may 2015. If invest 150000 per annum wat shall b maturity amount. Thanking u in anticipation

hi sir

my daughter was born on 29.9.2008

if I invest 500 rupees per month .

how much of amount can I get at the age of 21 years of my child from right now

my daughter dob is sept2014 and if i invest 2000 pa so for how much i have to pay in total what i get after the maturity.

There should be a compulsory to deposit same amount per annum.. Can i deposit ammount according to my savings..

Yes, you can do that.

Sir,

I have 3 question.

1. How this interest is compounded quarterly on rest / half yearly on rest?

2. Under which section interest earned is exempted from tax ?

3. Can the deposit amount be different in different years or a fixed amount need to be deposited every year ?

Hi,

1. Interest is compounded annually or monthly, as per your choice.

2. Interest will be tax exempt under a new section 10(11A) of the Income Tax Act.

3. Deposit amount can be different every year.

Hi,

My daughter’s DOB is 10.11.2003. Can i open the Sukanya Samriddhi Account in her name? Kindly confirm.

Regards,

JITENDRA RAJ

Hi,

No, you cannot open an account for your daughter.

We have belong to hr than can i open an account in delhi bank braches.

Yes, you can do that.

Ye form milne start ho gye he kya ?? Mtlb ki ye scheme kb se start hogi or hm kb form fill up kr skte he ??

Forms is link pe available hain – https://www.onemint.com/2015/03/04/sukanya-samriddhi-yojana-application-form-list-of-banks-to-open-an-account/

Account khulwane ke liye apne nazdeeki post office ya bank branch se sampark karen.

Dear sir

my daughte’s dob is 29/9/2004.can i open the sukanya samriddhi account in her name.

Kindly confirm

Yes, you can get it opened.

Hi,

Good afternoon

Which one is best ppf or say.?

Or lic child money back

I think PPF is better.

sir

once direct money deposited 12000 at a time then remaining 11 moths not deposited is it possible or not??

Yes, it is allowed.

Hi my 8 month old niece is in abroad with her father and mother. Can her grand parents open account for that kid.

If the grandparents are legal guardian, the account can be opened. But, whether this scheme is open to NRIs/OCIs/PIOs, it is not yet confirmed.

Are you confirm that interest in this scheme is tax free (like ppf).

Yes, it is confirmed.

hi

sir what is the calculation for the deposit amount of Rs.1000 per annum a and how much money return after 21 year

Hi,

Please check this post – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Hi

My baby is 6months and she’s born in Germany as my husband works there and now I have come here for vacation so heard about the scheme and thought to invest , is it possible that I can invest ? We all hold Indian passport and it’s been 3years that we are staying in Germany.

Hi Jyothi,

It is still not clear whether a child girl born outside India is eligible for this scheme or not, so you’ll have to wait for some more time for further clarity regarding this.

My sincere thanks to BJP govt. for the S.S.Y…… I am having two girl child, whose DOB is 2/1/13 and 1/3/2015 respectively. If i will invest Rs.100o per child per month, what will be the maturity value after 21 years…..

Once again thanks to Modi jii

with regards,

Dr. Biswajit Dutta

Dr. Navalakhi H. Dutta

Please check this post – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Sir

Good Morning, I thank you very much for your efforts in improving financial literacy for the people of India.

I would liket o have clarification on few points wrt SSA as per the wordings mentioed in Notification.

1- “Deposits in an account may be made till completeion of fourteen years, form the date of opening of the account. ”

My daughter has completed six yeras it means i can deposit the amount till she complete 20 (14 +6) years of age. It means If I will open account in April 2015, I can deposit till Mar 2029. It does not have any relation to the completeion of 14 years of age of my daughter.

2- “The account shall mature on completion of twenty one years from date of opening of the account. ”

It means If I will open account in April 2015 the account will mature in Mar 2036. It does not have any relation to the completeion of 21 years of age of my daughter.

Plz clarify.

Regards

Piyush

Thanks Piyush for your kind words! 🙂

1. Your understanding is correct.

2. Your understanding is correct; however, you cannot continue with this account beyond the date of your daughter’s marriage and no interest will be paid after that.

If i wish to invest 3000 per month how much will i get at the time of maturity…..

Please check this post – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

My daughter DOB is 15 jan 2004.is it possible to open account

Yes, it is allowed with one year grace period.

Can someone help me with an application form for ‘Sukanya Samiriddi Yogana’

You can download the form from this post – https://www.onemint.com/2015/03/04/sukanya-samriddhi-yojana-application-form-list-of-banks-to-open-an-account/

hi sir,

I have two girls first girl date of birth is 30/03/2007 and another date of birth

is 19/07/2009 if i deposit 30,000 yearly for both of them can you tell me maturity amount

Hi Manish,

Please check this post for your requirements – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Hi Sir/Madam,

If i pay monthly Rs.2000/- for 14 years how much i will take it back.. Please confirm???

Please check this post – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

my daughter DOB is 08/03/2014 can i open the account for her… m i eligible for it

Yes, you can do that.

I have a daughter her d.o.b is 13 .07.14 can I take ssy plan

Yes, you can do that.

I have a daughter her d.o.b is 21.04.2014 can I take ssy plan

Yes, you can do that.

Hi

On maturity – who can withdraw the amount- parent or child

who will get the money

Girl Child

Hi,

Can I claim this deposit in F.Y. 2014-15? Pleae reply asap.

Yes, you can do that.

Hi Shiv,

Thanks for the valuable info. Below are some facts about this scheme.

1. I am more interested to open in Banks due to online transition facilities.

2. No Bank is interested to open this account.

3. I am based in Janak Puri, Delhi. I have visited all SBI, PNB and BOB branches nearby but everyone said they are not authorised.

4. Only Post Office is opening the accounts.

Government is launching couple of schemes but on the ground level, no support providing to the people. They should launch some helpline no. to address concerns.

Best Wishes,

Kanwal Jayot

Thanks,

1. Even I would do the same for my brother’s daughter.

2. I know; probably they haven’t received the required guidelines.

I hope the government will soon provide the necessary basic infrastructure to open these accounts.

Sir,

Gudevening!

Thanks for giving us a excellent saving scheme of S.S.V.

My daughter is 3months,can we eligible for this scheme&pls suggest.

Hi Krishna, Good Evening!

Yes, you can open an account for your daughter.

Hi Shiv,

Thanks for your Information. I would like to know for SSY in one year(12 months) how many times the depositor can deposit the money in an account?

Thanks,

Hi Sanjeev,

There is no such limit, you can deposit money in this account as many times as you want.

Hello Sir , Thank you for sharing the features of SSY , many young parents are welcoming this initiative by our PM.

When discussing with few experienced people , one concern raised is whether the SSY will remain the same way if the existing government changes .

Could you throw some light on this matter.

Regards

Hi Rahul,

My guess would be as good as yours Rahul. Nobody knows what is going to happen tomorrow, so how can I predict what is going to happen four-five years down the line. If this government stays, then this scheme might remain operational for the next 10 years or probably more. So, I think we should just focus on the scheme based on its current features only.

Hello sir,

Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child. How much amount we can get after 21 years.

Hello Mr. Sriram,

Please check this post for maturity amount – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Hiiii Shiv sir…

Is sakim k tahat 21yrs by birth

ya fir hm jab iss account ko kholenge tab se count kenge plzzz sir reply krna.

Hi Surenderji,

Jis date se aap account kholenge, us date se 21 saal count honge.

Hello sir,

My daughter is 12 years old can i follow this scheme.

Hi Renuka,

If your daughter’s date of birth falls before December 2, 2003, then she is not eligible to invest in this scheme.

Hello Sir , Thank you for sharing the features of SSY. I already have a ppf Account in SBI in my daughter’s name. Can { open a SSY account for her and deposit money in it also?

Hi Aravind,

Yes, you can do that.

Hello sir,

Thanks for the info on SSY, if the child girl is 10 years old the minimum duration of the scheme will be 8years in case the marriage of girl. Then how much amount will get in closing if RS.1000 paid per month…

Hi Jaya,

Based on certain assumptions and 9.1% rate of interest, it should be Rs. 1,41,538 after 8 years.

hello sir,

my doughyer’s birthdate is 31 jan 2004.

can we open aaccount for her.

Yes, you can do so.

Hello sir.

My daughter date of birth is18.08.2009 can i join this scheme if i need 2 scheme its possible or not

Thank you

Hi Stalin,

Yes, you can get an account opened in your daughter’s name. You can open only one account in a girl child’s name and a maximum of two accounts in two daughters’ names.

dear sir my daughter dob is 31-01- 2009 if she married before 21 years then she can eligable to take amt after 21 yrs

Hi Praveena,

You will have to close your daughter’s account as & when she gets married, whether she gets married before attaining the age of 21 years or after.

Hello sir ,applicable any last date please reply

Hi,

There is no last date for this scheme. You can invest whenever you want.

Hi sir ,

If my Daughters D.O.B is 12.9.2002 can i use the scheme or not!!!!!!!!!!

Hi Mr. Gupta,

No, your daughter is not eligible to invest in this scheme.

hello sir

iam amit from himachal mt suster have a girl child she live with us right know so i wants to open account for girl child right know she is 3 year and 6 months only do we eligible or not .

Hi Amit,

Your niece is eligible for this scheme. Your sister can get an account opened for her.

Hi Sir,

my daughter’s birthdate is 10-03-2009.

can we open account for her.

Hi Awadhesh,

Yes, you can do that.

my daughters dob is 03-11-2003 is she is eligible for this scheme

No, your daughter is not eligible for this scheme.

hello

i want know if i would deposit rs 1000 per month how mutch i will get complet the 21 years…

Hi Mukesh,

Please check this post to know the maturity value after 21 years – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Hello shiv Ji,

1)Plz tell me the exact figure that I recieve after 21 years if I deposit 150000 rs per year for 14 yrs.

2) If I deposit 12000 per year then how you give the exact figure of 641092 rs that you mention in the vouchers after 21yrs

Hi Mr. Kulwinder,

1. Please check this post to check the tentative maturity amount you’ll get after 21 years – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

2. Nobody can predict the exact maturity figure after 21 years. Whatever has been mentioned is only tentative, based on certain assumptions.

My daughter d.o.f is 10th November 2003 can I apply of this scheme

No, your daughter is not eligible for this scheme.

My daughter d.o.f is 06th November 2013 can I apply of this scheme

Plz send me reply to my mail id.

Hi Akhil,

Your daughter is eligible for you to get an account opened for her.

hi, I have three daughters(triplets). now they are 6 years n 9 months old. one son also there for us aged 4 years. please suggest

1.How much amount to be paid maximum for three account totally in a year in ssa, ?

2.If I take 50% of amount after their 18 years for education, what will be the exact amount I can get after 21 years for one account, eg: im investing rs.150000 yearly?

3.can I open ppf for my son under my wife name?

4.any other investments for my son for his education and marriage?

Hi Mani,

1. Rs. 4.5 lakh is the maximum amount you can contribute in three of your SSA accounts.

2. Calculating the exact amount is not possible, so it is only a tentative figure which can be calculated.

3. Yes, you can open a PPF account for your son. But, maximum contribution in PPF is limited to Rs. 1.5 lakh for son & the guardian.

4. We do not entertain individual personal queries here on this forum. We provide financial planning services to interested individuals – https://www.onemint.com/services/

thanks for the reply

You are welcome!

Hello sir,

I want to know will ssf provide any benefit to income tax

Hello sir,

I want to know will it give benefit in income tax

Hi Vaishali,

Yes, your contribution will be eligible for tax deduction u/s 80C.

Sir

Can father and mother open 2 different account for same girl child.

No, only one account per girl child.

hi,

my girl child borned in 2007 oct , is she eligible?

Hi Sri,

Yes, she is eligible.

Sir.

Meri beti ki age 15-jan-16 ko 10 yrs ki hogi kya ssy le sakta hun.jab yo 21 ki hogi uski sadi me 500 ke hisab se kitne amt milegi.

Hi Ganesh,

Aap apni beti ke liye SSY account khol sakte ho. Maturity ka paisa rate of interest aur deposit month pe depend karega.

Sir,

How much money required to pay per year

Hi Pushkar,

It is minimum Rs. 1,000 and maximum Rs. 1.5 lakh.

Are you telling us that the girl child scheme provides an additional Rs 150,000 deduction under 80c ?

i.e.

PPF Rs 150,000

+

SSY Rs 150,000.

I think it is PPF + SSY <=150,000

please confirm.

No Chirag, 80C deduction is limited up to Rs. 1,50,000 only.

Hi,

Will we get the full amount?.Is it tax free?

Hi Baiju,

Yes, it is tax-free.

Sir greetings,

Myself santosh singh,

I wanted to know the amount that I have to invest and how many times I have to pay until the scheme come up to maturity.

In other word basic detail of the scheme so that I can plan this for my two years daughter. What is the maturity amount I will receive when I can plan to invest 1000 per month.

Hope u will reply soon.

Thanks

Santosh

Hi Santosh,

All the details have been mentioned above in the article. You can invest a minimum of Rs. 1,000 and a maximum of Rs. 1.5 lakh. You need to deposit money only once a year and there is no cap on the number of deposits.

Please check this post for the maturity amount after 21 years – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Good morning sir,

my reletives very poor so-

main jaana chahta hu ki_ wo year main 1000rs. hi deposite ker sakti hain,

1- so minimum amount jo 1000rs. h se account open kerne k baad v unhe kya us year me 1000rs(minimum yearly amount) alag se deposite kerna hoga,

2- unki 4 daughters me se two daughters ten year k under age h so kya wo dono k lea is scheme me account open ket sakti h.

3- ak daughter 8 year ki h to or maan lo ki uski marriage 10 saal baad yani uske 18 year me kerna h to kya uske k lea 10 year baad Account close ker full amount withdrew ker sakte h.

pls reply sir….

Very vary Thank you..

Hi Rohit,

1. Nahin, ek saal mein bas ek deposit karna hoga.

2. Haan, das saal se neeche account open kar sakte hain.

3. Haan, marriage hone par account close kar sakte hain.

Hi Shiv Sir,

will the partial withdrawal be tax free?

Hi Vinay,

Yes, the partial withdrawal will also be tax-free.

Hi Shiv, nice presentation and of course it is one of the best saving scheme. As on date, since Banks are not opening this (I am more interested to open in bank for easy in online transfer), I will try to open in nearest post office and may be in future, Govt may come up with bank-post office transfer facility.

I am searching but could not get the answer on “insurance protection”. What happens if the depositor (suppose the sole earning member of the family) dies and the family unable to continue the scheme? Will the Govt waive the future payments or the account will be inactive in the due course? I think the “inactive” answer is correct?

Second, I feel, this scheme runs like PPF and not like RD. I mean to say, in RD (Recurring Deposit), we commit to pay a fix amount per month whereas in PPF, there is no monthly commitment and the depositor is free to deposit amount of his choice subj to min of 500 and max of 150,000 in a year. To keep PPF account active, one has to do minimum 1 deposit in a year and subject to minimum of Rs. 500/- yearly deposit. If this is the case also in Sukanya account, I dont think Death of sole earning member causes any problem. Family can continue one deposit (1000/-) in a year and keep the account active.

Am I right in my thought?

Regards

Santosh

Thanks Santosh,

1. Migration facility will definitely be there once the scheme becomes fully operational.

2. There is no insurance protection clause in this scheme and the government will not waive any future payments. Under special circumstances, like death or medical support in life-threatening diseases etc., you can make a request to prematurely close the account and withdraw the amount.

3. This scheme is very much similar to PPF. You can keep the account active by depositing a minimum of Rs. 1,000 in a financial year. However, in case of guardian’s death, I think you’ll have to get the guardian’s name changed in the records of the post office/bank branch.

I have just posted an article having a sample duly filled application form, please check – https://www.onemint.com/2015/03/12/sukanya-samriddhi-yojana-sample-filled-application-form/

Hi Shiv, I saw the sample application form but it doesnt answer my query on “Insurance” and “Committed Deposit”.

Santosh

Hi sir i have two daughters can i open two

Hi Manju,

Yes, you can open two accounts.

hello sir,

my daughter is 2yrs old,so i will have pay for 14yrs under this scheme that means she turns 16.

i would like to no will the maturity amount wary according to your chart depending on the age of my daughter.

will acknowledge your reply.

Hi Samkit,

Maturity amount will vary as per the rate of interest, the amount of your contribution and the month of deposit. Your daughter’s age has no role to play in the maturity amount, if it is withdrawn after 21 years.

Hi,

My daughter is 9 yrs old ,if i have to pay for 14 yrs ,she will be 23 yrs.Or i have to pay till her age 21 yrs?Is it mandatory to pay for 14 yrs?

sir , I want to two(sukanya) child plan for only my two daughter. So please call me on my contact no 8303024758 and tell me about Sukanya girl child plan.

Hi Mukesh,

Sorry, we do not offer such kind of personalised services.

Hi,

I have a question, now my daughters age is 5yrs and if I start investment now , till when I have to invest, till 14 yrs of my daughter, or till 14 yrs from date of opening the account. Also let me know what if I skip payment for any month.

Thanks,

Rajesh

Hi Rajesh,

You will have to invest for 14 yrs from the date of opening this account. Also, it is not a monthly deposit scheme, you need to invest only once in a year in this scheme. If you do not deposit a minimum of Rs. 1,000 in this account in a financial year, then there is a penalty of Rs. 50 for each year you skip to deposit.

Sir,

please tel me can we open two accounts for a single girl child, one account is opended by her grand father and another account is opened by father. does it possible.

Hi Anusha,

No, it is not allowed to open two accounts in the name of a single girl child.

Hai sir

My daughters DOB 17 March 2005 can I apply for this scheme

Hi Sayyed,

Yes, she is eligible, you can get this account opened for her.

Sir, this schem is only valid for girls

Yes, only for girls.

Hi Shiv,

My daughter got birth on 4th december–2014, is she eligible for this scheme or not, can i open one account for her.

Thanks

Santosh

Hi Santosh,

Yes, you can get an account opened for your daughter.

my doughter date of birth 05/04/2003 she was able this sukanya scheme ?

No, your daughter is not eligible for this scheme.

Hello Sir,

Thanks for IMP info., i would also like to know under sukanya plan can we monthly deposit 10k since its difficult to pay 1,20,000 at a time?

And what will be the final amount to be receive at the age of 21 years?

Waiting for value adding guide.

Thanks Seema

Thanks Seema,

Yes, you can deposit Rs. 10,000 monthly or any amount for that matter. Please check this post for maturity values as per monthly/annual contributions – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Dear Sir,

If any unfortunate death occurs for parent/gardian. Then what about the account, whether it will be closed or matures at 21 yrs.

Under special circumstances, like death or medical support in life-threatening diseases etc., you can make a request to prematurely close the account and withdraw the amount.

Hello sir,

I am anil kalia from ludhiana my daughter’s date of birth is 8-feb-2013 . Is she able for sukhyana scheme.

Hi Mr. Anil,

Yes, your daughter is eligible for this scheme.

Dear all

Please clear one thing,some told me.

As per our new p m there is a new offer comes for girl child,where we give only 1000/- per year till 14 years(1000*14=14000/-) and after girl child age cross 21 years,we can rcvd 600000/- rs.

Is this reality or any fake news.

This information of Rs. 6 lakh is incorrect.

You have said in previous comments that 1.5lakh per daughter can be invested upto 2 children. Whereas on the other forums I find the cap is of 1.5Lkah per family for 2 daughters.

I wanted to invest 1.5 for 1daughter and my wife 1.5L for another daughter and we wanted to claim tax deduction individually.

If you can clarify it would be helpful.

What I have mentioned is as per the wordings of the Circular – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

Hi,

my daughters birth date is 25 August.2008 can we apply for this scheme.

Yes, you can get this account opened for her.

Its clear by words, parents or guardian of a girl child below 10 but grace of one year

Its clear by words, parent or guardian of a girl child below 10 but grace of one year can invest and gain benefit of taxes as applicable

Hi shiv kukreja sir. …. namaste

My daughter’s DOB 22 NOV 2003. for sukanya scheme she is eligible or not.

Please inform me.

Hi Gousiya Begum,

No, your daughter is not eligible.

I went to our Siliguri(Darjeeling)head post office qyary for this scheme. But they have no clearly deffination .

You should wait some more time for further clarity.

Hi Shiv,

Is there any end date to subscribe this scheme? Until when the scheme will be available?

Thanks

Dinesh

Hi Dinesh,

There is no end date as such, this scheme will remain open indefinitely like PPF.

Hello sir. My daughter’s DOB is 28 August 2007. Is she eligible for this scheme?

Hi Taqvi,

Yes, your daughter is eligible for this scheme.

Hi

When it start in west bengal.

Hi Tarak,

This scheme has already been launched all over India. Please check with the post office near your place.

if one invests the minimun amount i.e Rs 1000 per anum what will be aprox. net amout payable to Account Holder after successful complelation of 21 years period

Assuming 9.1% throughout 21 years & based on certain other assumptions, it should be Rs. 52,605.

https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Dear Shiv sir,

Thanks for the information (SSY)

You are welcome!

Hi Shiv,

Thanks for such good information and the way you are helping..

Just small question :

ONLINE : Can we transfer amount online or each time we have to go in post office and need to do payment of same.

Thanks in advance.

Thanks Rohan,

In a fews days time, commercial banks including SBI, ICICI, Axis etc. will start opening these accounts and with them you will definitely have online transfer facility.

can we increase the monthly installment later if we started by 1000 each month

Yes, you can do so. Also, it is not mandatory to make monthly contributions, one contribution in a year is good enough.

Hi sir,

Pls tell me, 1000 pay every month.ya every year

Minimum Rs. 1,000 once every year is required and not every month.

There are viral shares on social media claiming the maturiy amount of Rs. 6,00,000/- for Sukanya Suraksha scheme after 14 years. Does this have validity? I have calculated with Rs.1000/- principal every year with 9.1% p.a. interest compounded yearly for 14 years, followed by compound intererst for the next 7 years. This gives me maturiy amount of Rs. 52,602/-. Am I missing something?

By the way, thanks for educating the people!

sreekar

No, you are not missing anything & your calculation is correct. People are getting misguided with Rs. 6 lakh figure.

Moreover, thanks for your kind words!

Can you please explain how the interest is calculated for every year. For Example if im depositing 12000 per year, then if we calculate the interest for 12000 x 9.1%, it comes to 1092. Can you please explain me why im going wrong in this ?

Mr. Dinesh, your calculation is correct. Rs. 1,092 should be the first year’s interest if you deposit Rs. 12,000 in the beginning of the year and rate of interest is 9.10%. So, why are you asking that where are you getting wrong? You are nowhere wrong.

Please check this post for maturity value tables – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

First year for interest calculation ( 6.5 months deposits ) has been taken, the balance will be taken (5.5 months deposits) where added at 15th year, while the exact is matching with the chart given

Hi Shiv,

Thanks for your efforts on this forum. Today’s TOI edition carried an article on the SSY scheme where they say, the maximum cap is 1.5L per financial year per family of 2 children. I believe this is not correct because it would then render the cap of 2 accounts for 2 children meaningless. Please clarify if it is 1.5L per account upto a max of 2 accounts which means one could deposit upto 3L though the 80c limit would still be only 1.5L.

Further, have any banks started opening accounts as on date. Any info on this?

Thanks for your kind words!

What has been mentioned in the post above is based on the wordings of the Circular – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

So, I think what I have mentioned holds correct. As you rightly mentioned, Rs. 1.5 lakh split between two daughters will leave the maturity value significantly insufficient for meeting their future education & marriage expenses.

Hello sir,

my daughters birth date is 1jan.2008 can we apply for this scheme.

Yes, you can do that.

Hi,

my daughters birth date is 1jan.2008 can we apply for this scheme.

Yes, you can open the account.

Hi Sir,

You have mentioned that in case of daughter gets married before completion of 21 years of opening the account, operation of this account will not be permitted beyond the date of her marriage and no interest will be payable beyond the date of marriage.

Suppose my daughter age is 9 years now and i am opening the account, and she gets married at the age of 25, will the account be closed after 16 years? and how will they know when my daughter gets married? Do we need to submit marriage certificate?

Yes, the account will have to be closed as your daughter gets married after 16 years.Also, I am not sure what you would be required to produce as marriage proof, but I think a declaration from the girl child or the marriage certificate or wedding invitation card would work as a proof.

Sir,

Mera beti ka DOB 17.08.14 kya me ye kar sakta hu?post office me or bank me bi khata khulbana parega?purana bank me account hai to chalega?

Please reply sir

Tanmoyji, aap ye account khulwa sakte hain, aapki beti eligible hai. Post office or bank branch mein khata khul jaayega. Puraane bank mein khata khulega ya nahin, ye bank batayega.

Hello Mr Shiv.. is residencial proof from form is compulsory for government employees.they traveled one place by other places yearly or few years once.

Hi,

Yes, address proof is required for opening this account. You cannot open an account without providing it.

Hello sir my daughter born on 17 july 2005 and 20 july 2006 are they eligible for sukanya smridi scheeme

Yes, both are eligible for this account.

what is sukanya samruddi yajana how much pay inmonthly

Please check the post above.

Sir,

I have 2 daughters and both are below 10 years old. i want to invest in ssa(sukanya yozona) in post office but some confusion arises, please .can you give me the following questions–

1. My Aadhar card address is in Bihar but i am living with family in orissa(by work), If i open a ssa in orissa post office then in future , can i transfer this account to my native place(bihar)???

2. can i invest 1.5 lakh each of my 2 daughters ssa a/c?total= 3 lakh??

4.In the ssa post office form- what should i write in 1st depositor column — my name or daughter name??

1. Yes, you can transfer it to your native place in future.

2. There is no clarity in this matter. I am assuming it is Rs. 3 lakh (Rs. 1.5 lakh for each girl child).

3. “Your daughter’s name” followed by “under guardian” “your name”.

Can V open a SSY account in the name of my daughter who is a PIO card holder. I am a Indian National

Can I open a SSY a/ c for my PIO card holder daughter

It is still not clear whether PIO card holders will be eligible for this scheme or not. Most likely they will not be eligible for this scheme, but you’ll have to wait some more time for further clarity.

Sir is yojana me kitne saal k liye kitne rupye JMA karwane par kitne rupye milenge plz reply sir

Maturity value ke liye please ye post check keejiye – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Sir

Mene suna hai ki sukanya sammradhi yojana me post ofice me 1000 Rs 1saal ka14 saal tak bharne ke baad. 21Saal ke baad 6000lak milega

Jagdishji, ye information bilkul galat hai, aise logon pe bharosa mat keejiye.

6000Lak nahi sir 6lak

Sir to aap hi batao ki kitne saal tak pesa bhare or uske baad band kar de,or saal ka kitna pesa bhare ki 14saal,ya 21 Saal baad 6 lak mile

14 saal tak har saal Rs. 1,000 deposit karne pe aapko 21 saal baad approx. Rs. 52,605 milenge. Rs. 6 lakh ke liye aapko har saal Rs. 12,000 deposit karne padenge. Ye post check keejiye – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

To sir aap hi. Batao ki kitna pesa kitne saal tak bhare ki 6 laak mile

If two accounts are opened in the name of two daughters, what is the maximum limit on investment ? Is it 1.5 lakhs for each account or 1.5 lakhs total for both accounts ?

As per the wordings of the Government Notification – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

So, it seems that Rs. 1.5 lakh is for a single account. For two accounts, it should be Rs. 3 lakhs.

Hi Shiv ji,

Greetings!

I am planning to invest 15000-18000 per year and. Lets assume if its 18000 per year and I need to pay the premium for next 14 years. What will be the maturity amount I can withdraw on 21 years completion?

-Natesh

Hi Natesh,

Please check this post for maturity values, it is approximately Rs. 9,46,891 after 21 years – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

When I pay the premium of 12500/month, my annual contribution is obviously 150000/-.

When my monthly contribution is 12500, the accumulated balance after 14 years is 42,48,430 and after 21 years its 78,16,308

When my annual contribution is 1,50,000, the accumulated balance after 14 years is 42,88,898 and after 21 years its 78,90,762

why is that difference in accumulated balance for annual and monthly contribution for same value?

This is because you are investing Rs. 1,50,000 at the beginning of the year and your money would earn 9.1% interest for the whole year. With Rs. 12,500 per month, your earliest installment will earn higher interest for you as compared to the installment you deposit in March 2016. So, this is causing a difference in the interest earned in a financial year.

What is tool

I didn’t get your query.

mam my child was born on may 6 2011 and my second child was born on august 16 2014 whether both of my childrens are eligible to this scheme…

Yes Papitha, both of your children are eligible for this scheme.

Thank you so much sir. I would like to know more the necessary documents to get tax benefit from Sukanya Samriddhi Account.

You are welcome Nisha!

Required documents are – Birth Certificate of the girl child, along with the identity proof & residence proof and 2 photographs of the parents/legal guardian.

Dear sir. None of the banks are having details in this account.

Yes, I expected the banks to start accepting these forms from this week. But, it is very disappointing that they are still not helping the investors.

Nothing astonishing looks with this scheme. If government was really serious then it should have created new clause apart from 80C for this thing otherwise there is no much difference between PPF and SSY. And with growing school and college tuition fee we have already invested up to extent of 80 C.

I think 9.1% tax-free rate of interest, which is higher than PPF’s 8.7%, is the best thing about this scheme.

I just want to know whether tax exception under 80C is applicable in FY 2014-15. Meaning, If I’m opening an account today for 50K, would that 50K count towards my allowed 1.5 lakhs tax exception under 80 C for this financial year? I saw in other site that tax exception for the maturity amount and interest is applicable from next FY onwards.

Please respond ASAP since noone explicitely mention which FY onwards 80C is applicable.

Thanks in advance.

Yes, tax exemption for the interest amount on withdrawal/maturity is applicable w.e.f. the next financial year (FY 2015-16). But, the investment in this scheme is already eligible for tax exemption u/s 80C for the current financial year, FY 2014-15.

Thank you..Very helpful

You are welcome!

Sir is the multiple deposits to reach 12500 possible ? For ex two days once if we pay 1000 will be accumulated as 12500 per month… whether it is possible to select 150000 pa ?

Yes, multiple deposits are allowed. Rs. 1,50,000 once a year is also allowed.

Dear Sir,

I have two daughters i had doubt that can i open two account with my name as depositor and also for each one can i depoist 1.5 lakhs per annum?

Thanks

Yes, you can open 2 accounts and deposit Rs. 3 lakh in these two accounts.

Thank you so much sir

You are welcome!

Dear Sir,

Which one is best sir to open this account in post office or bank?

Thanks

I think it is better to open it with a bank which provides online transfer facility.

Hello,Sir My daughter’s Dob is 12 Dec 2004.can we apply for this schemescheme

Thank’s David

Assam

Yes David, your daughter is eligible for this scheme.

Hi Shiv,

Can I open an account now (March-2015), deposit 1.5 lakh and another 1.5 lakh after 1st April 2015 (for next financial year)?

Hi Sarala,

Yes, you can do so.

Hi Shiv,

Is there an update yet on which are the banks and when will they start opening the SSY account?

Regards,

Hi,

Please check this post – https://www.onemint.com/2015/03/16/sukanya-samriddhi-yojana-updated-list-of-authorised-banks-to-open-an-account-specimen-application-form-passbook/

This is the latest I have about this scheme.

Hi! If a child is a PIO card holder, is he/she eligible for this scheme?

Hi,

It is still not clear whether PIO card holders will be eligible for this scheme or not. Most likely they will not be eligible for this scheme, but you’ll have to wait some more time for further clarity.

thanks for awareness sir

thanks sir

Thanks Sunil!

Hello sir. My daughter’s DOB is 16 November 2011. Is she eligible for this scheme and I want to deposit the amount Rs.1000/- for 14 year’s, how much amount i can get after 14 year’s

Yes, your daughter is eligible for this scheme. This scheme is for 21 years and not 14 years. So, you need to deposit money for 14 years, but you’ll get the maturity amount after 21 years.

my daughter’s DOB is 11-01-2010. is is eligible for the same. one more her birth certificate is submitted in school then how can i apply for the same.

regards

Hi Sonika,

Firstly, your daughter is eligible for this scheme. Moreover, you need to submit the copy of your daughter’s birth certificate. So, take a printout and submit that.

Dear Sir,

Can real uncle of a child open the Sukanya samridhi Account even if her father is alive but not financially capable?

Hi Deepak,

Yes, it is allowed.

Dear Sir,

Can real uncle of a child open the Sukanya samridhi Account and get tax benefits?

dear sir,

main agar 12000 per yearly account karu to monthly deposit kar sakta hu ya salana hi karne hoga

Monthly deposit bhi kar sakte hain.

dear sir,

i want to know that premium Rs 1000 per month deposit at a time or 12000 for quarterly

Yearly minimum deposit Rs. 1,000 and maximum Rs. 1,50,000.

kitna year tak deposit karna hai

14 years.

Sir mujhe bataye please ki agar maine 14 years tak rs.20,0000 ( Twenty thousand) deposit kie is scheme me, maturity pe kitna amount milega yearly 20,000 jama karne pe..

Regards

Please check this post, iske according aapko maturity pe Rs. 10,52,102 milenge – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

fist year i pay 15000/ after second third and fourth year ipay 60000 40000 70000 it is possible

Yes, it is allowed.

if i will discontinue after 3 years or more this due to some reason , can we will get the deposited amount at the time of 18 years of child

For every year of non-deposit, you’ll have to pay a penalty of Rs. 50 along with a minimum deposit amount of Rs. 1,000. You can withdraw the full balance only on maturity or when the girl child gets married, whichever is earlier.

sc st ke liye koi alag

sir sc st ke liye koi bises

Aapka question clear nahin hai.

Sir 1000 Rs mahine jama kerne per 21 year me kitna milega or yadi hum ekmust Rs 12000 ek year me ek baar jama kerte hai to 21 year me kitna milega. In dono me kuch fark hai ya nahi

Praveenji, ye post check keejiye, ismein different contributions ke according maturity values given hain – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

shiv ji pl. mujhe ye batai is yojna ki koi last date hai kya . or ager birth certificate nahi ho to kuch or option hai kya.

Nahin Mr. Pankaj, is yojana ki koi last date nahin hai. Birth certificate bhi mandatory hai.

shiv ji pl. mujhe ek aise rashi batai jasse mujhe 21 saal baad 10 lakh rs/mile or mai is rashi ke liye per month kitne paise jama karu.

Mr. Pankaj, ye post check keejiye, Rs. 10 lakh maturity value ke liye aapko approximately Rs. 1600-1700 monthly contribute karna hoga – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Sir 1000 Rs mahine jama kerne per 21 year me kitna milega or yadi hum ekmust Rs 12000 ek year me ek baar jama kerte hai to 21 year me kitna milega. In dono me kuch fark hai ya nahi

sir, is yojna me koi tex to nahi lagta aur bank or post office me koi fark h kya

Jagdishji, is scheme mein milne wale interest pe koi tax nahin lagega. Bank aur post office mein service quality ka difference ho sakta hai, scheme ke saare features same rahenge.

Agar main sukanya yojna me per year 12000 jama karta hun to mujhe 20 sal bad kitna amount mile ga

Maturity amount jaanne ke liye ye post check keejiye – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

sir agar me 1000/ month …deposit karta hun …18 year…me marrige ke liye t&c…apply karta hun to kitna milega…..plz…reply

Ramji, ye post check keejiye, aapko 21 saal baad maturity pe approx. Rs. 6,25,305 milenge – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Dear Sir

AGR mai per month 1000 jama karte hu to 14year me jama karate to 21 year me kitna mile ga.

Anantji, ye post check keejiye, aapko 21 saal baad maturity pe approx. Rs. 6,25,305 milenge – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Tpday iv visited boi but they said that this type circular not came in kaliyaganj.

Hi Sanjit, you should either wait some more time for the banks to start opening these accounts or get this account opened with a post office.

Hi Shivji,

Can NRI open Sukanya Samriddhi Yojana for their daughters ?? Please advise.

Hi Rajesh,

It is still not clear whether NRIs would be allowed to open these accounts or not. You’ll have to wait for further clarity on this matter.

Dear sir,

I want to know one thing. Whether the deduction under 80C of this Scheme will be in addition to the existing deduction available under 80C ? (i.e. Rs. 1,50,000.00) in a F.Y.

Hi Prabir,

No, the total exemption under section 80C including this scheme is Rs. 1,50,000 only.

Agar mujhe 21 saal baad 11,00,000 inr chahiye aur bichme jab meri beti ki age 18 saal ki ho tab mujhe 7,00,000 inr chahiye to mujhe monthly kitne inr jama karne honge post office me

Arunji, is scheme mein rate of interest fixed nahin hai, isliye main iski exact calculation nahin bata sakta.

Hi Sir,

Can i invest for my daughter in this Sukanya Samriddhi yojana?

She is 3 yrs old, But she is born in USA and holds US citizen.

Currently she is living in India on PIO visa.

Thanks,

Anand

Hi Anand,

It is still not clear whether PIO cardholders would be allowed to open these accounts or not. You’ll have to wait for further clarity on this matter.

Thanks Shiv. But are they going to provide clarification on this? How government will know that some PIO cardholders wants to invest in this scheme?

Regards,

Anand

Hi Anand,

Investors’ bodies or the RBI will put such queries to the government and the government/RBI will clarify in this regards or issue such notification.

sir main delhi main rehta hoon kya ye a/c delhi main bhi khul sakta hai or kaha jana padega.

Arunji, aap Lodhi Garden post office mein ye account khulwa sakte hain.

Sir me yeh sukanya samardhi schme kis karan 3ya 4 sal bhra es ke bad mein chod diya tomera paisa milegakya p/m 1000 aur kitna aur kab yedi mere ladki shadhi 18 sal tah hogato muje kitna paisa milega

Vilasji, jitne saal aap is scheme mein paisa nahin daalenge, utne baar aapko Rs. 50 penalty bharna padega aur Rs. 1,000 har saal ke hisaab se extra jama karna hoga. Paisa aapki beti ko uski shaadi ke time pe milega ya scheme ke 21 saal poore hone pe, jo pehle ho jaayega.

dear sir

agar mai kisi other steat ke post office me acount khulwa skata ho and kya bad me apne home ke pass wali post office me tranfar karwa sakata hoo plz.. reply sir

Chetakji, aap apna account baad mein transfer karwa sakte hain.

Hi,

Have any of the banks started opening the account? Can you please update, thanks!

Regards,

Hi,

There is no update as yet whether any of the banks has started opening these accounts.

I want to known last submission date of Sukanya samrudhi Yojana

awaiting for your reply

There is no last date for this scheme, it will continue beyond 31st March as well.

Dear sir,

My daughter age is 8 years 4months. If i open an account now, after 21 years she will be ~29 years by that time her marriage would also be over. If i want to take money for marriage can i take? and how much i will get(if i invest 12000/month). Is there will be any money loss.

Dear Mr. Kukreja,

i am very thankful to you for this valuable information, which are providing by you free of cost to the peoples. really you are doing great job.

I want to tell also the people who are again and again asking the same question, please read it carefully in the last few comments.