This is a very common question here, and I feel rather exasperated when I encounter this question but I’ve never actually written a detailed post on why that is.

Since, the new year will come soon, and a common variation of this question: Which is the best place to invest in 2012 will be asked a lot – I thought this is a good time to do a post on this subject.

First, you need to define what you mean by the best place to invest. Obviously, you’re not thinking of the safest place to invest because almost all of us treat our bank deposits as ultra safe and backed by the government implicitly so I assume that you wouldn’t bother to ask this question if safety of money was your primary concern.

Returns are what most people have in mind when they ask about the best place to invest, and the real question is what will give me the highest return without any risk of losing money?

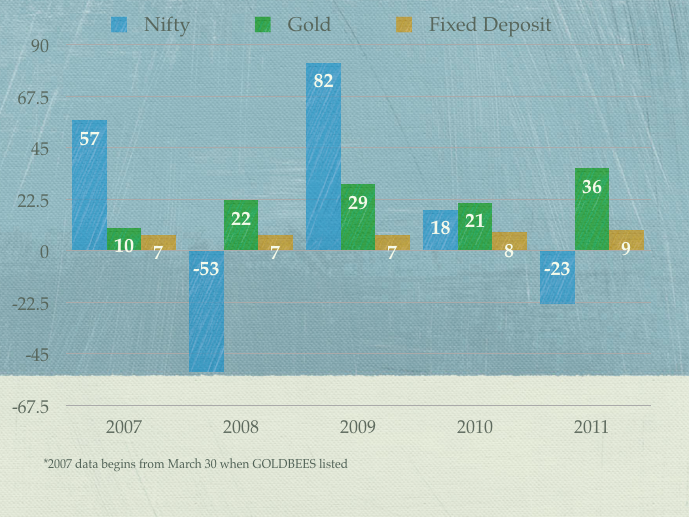

Let’s take a look at the returns of gold (GoldBeeS ETF), equities (Nifty) and fixed deposit for the last 5 calendar years. I’ve taken year to date returns for 2011, and I’ve taken data from April onwards for 2007 since that’s when GoldBeeS listed.

Now, one look at the above chart tells you what the best investment for 2011 would have been – gold of course.

And 2010 – that’s gold too. But look at 2009 – whoa! Look at the Nifty skyscraper shoot through to the sky – if you missed being in equities in 2009 – you missed that skyscraper and certainly a lot of people missed that because of what happened in 2008.

And 2008? Well, your first instinct is to say that gold did the best in 2008, but I would say someone who sold Nifty Futures did far better than people who held gold in 2008.

So, the best investment in 2008 was short Nifty.

And look at 2007 – there you go – Nifty makes massive gains again and outperforms everyone.

Now, these are just three investment classes, but there are plenty more options like real estate and silver, and then within equities you have sectoral mutual funds, and the way you slice and dice the investment options are just endless.

In my mind, the big idea that emerges from this chart is that every year something else is the best, and that’s also true for a slightly longer periods of 3 – 5 years as well.

There is simply no way to tell what’s the best investment for the next year or the next 3 – 5 years.

If you keep getting in and out from one asset class to another in the hopes of chasing the best returns – you will easily miss out rallies and burn your fingers because the time you enter a new asset is usually the time when a lot of euphoria surrounds that asset and it actually falls in value. That hasn’t happened to gold yet, but I won’t be surprised if that happens in the near future, as near as next year.

I would never put all my eggs in one basket, and risk the chance of seeing a 50% crash in the value of my money or get out of the market completely and see it rocket its way to the top.

There is no such thing as “best investment” just like there is no such thing as return without risk.

In rising market, everyone agrees/wants to invest for long term. By looking at last 10 years return, long term investments looks more attractive , but when stock market doesnot move or gives negative return in next 2-3 years, the definition of long term changes.

Before understanding where to invest and when to invest , my view is one should know “Why to invest”? One should be very clear on his /her goals. Goals provide the time horizon of investment which leads to the selection of asset class. Asset allocation is the key. Understand the basics of investing and how asset classes moves in the long/short term and then move ahead. Where to invest these days, suggest something newetc. all these question actually depicts that you want to capture the current trend but this behavior will surely lead people into trouble. Read : http://goodmoneying.com/financial-planning/investment-questions

Data and stats here were very useful, specially for a newbie like me. Was just curious to know that if all this is still applicable in 2012-2013 investments.

Hi Virendra

The basic rules of investment never change.

Just as common sense is not so common, as pointed by Anilji basic rules of investment never change. Catch is we are not taught the basics of money, savings, investment etc. We do not allow people to drive without a license test but allow them to enter complex financial world without much financial education

So Virendra you have taken the first step right by joining the forum like onemint.com. This article tries to question , quoting from article Returns are what most people have in mind when they ask about the best place to invest, and the real question is what will give me the highest return without any risk of losing money?

As Manshu has said in article There is simply no way to tell what’s the best investment for the next year or the next 3 – 5 years.

It’s like forecasting the weather which may or maynot come out like prediction. (Usually when the forecaster says rain it doesn’t happen :-))

Taking an analogy :If we want to travel then the questions that come to our mind are: Where to? What for? How many days? What budget? Similarly is our financial life – we need to come up with a plan -what are mile stones, how much risk can I take, what would be the investment style( stocks, PPF etc)

Don’t think you are alone. We all have gone through this stage and I envy you that you are starting so early 🙂

I would suggest to learn the basics, try to follow such great forums, pick up some books on personal finance books, read personal finance magazines . My favorites books are: A Family’s Guide To Seven Steps To Financial Freedom by Monica Halan, I Can Do: Financial Planning by Swapna Mirashi, JagoInvestor:Change your relationship with money , magazine: outlook money

For information on these books and basics you can check out my articleBasics for beginners

Just as common sense is not so common, as pointed by Anilji basic rules of investment never change. Catch is we are not taught the basics of money, savings, investment etc. We do not allow people to drive without a license test but allow them to enter complex financial world without much financial education

So Virendra you have taken the first step right by joining the forum like onemint.com. This article tries to question , quoting from article Returns are what most people have in mind when they ask about the best place to invest, and the real question is what will give me the highest return without any risk of losing money?

As Manshu has said in article There is simply no way to tell what’s the best investment for the next year or the next 3 – 5 years.

It’s like forecasting the weather which may or maynot come out like prediction. (Usually when the forecaster says rain it doesn’t happen :-))

Taking an analogy :If we want to travel then the questions that come to our mind are: Where to? What for? How many days? What budget? Similarly is our financial life – we need to come up with a plan -what are mile stones, how much risk can I take, what would be the investment style( stocks, PPF etc)

Don’t think you are alone. We all have gone through this stage and I envy you that you are starting so early 🙂

I would suggest to learn the basics, try to follow such great forums, pick up some books on personal finance books, read personal finance magazines . My favorites books are: A Family’s Guide To Seven Steps To Financial Freedom by Monica Halan, I Can Do: Financial Planning by Swapna Mirashi, JagoInvestor:Change your relationship with money , magazine: outlook money

For information on these books and basics you can check out my articleBasics for beginners

If safety is not a concern and a person is ready to invest with a 5 year horizon, then some of Nifty stocks provide a great opportunity for long term investors to enter into the market.

Our analysis of Nifty stocks and there discounts from 2008 & 2011 highs can be found here –

http://www.stableinvestor.com/2011/11/large-cap-nifty-stocks-available-at.html

Yes, because who cares about safety right? 🙂

Hi Manshu

For me asset allocation is the most important thing. If one has taken care of proper asset allocation considering all factors such as age, income, expenses, dependents, risk profile etc one can never go wrong. Then investment is a dynamic process. You can not sit tight over your investments. You have to monitor your investments on a regular basis to take corrective action before it is too late.

That’s exactly right – asset allocation is the main thing that determines how much you make or lose, and chasing the “best” investment from a day to another will not work for anyone.

Excellent post and excellent timing.

Hindsight is always 20-20 and Past performance is no indicator of future performance. But we cannot ignore the past..we need to look at the past and understand the reason behind it so that we can predict what will happen in future and make sound judgement. We might go wrong..even Warren Buffet does but then we need to learn from it. Learning never finishes..

From the chart above it is clear in recent years Gold needs to be a part of one’s portfolio. Rational being that there is financial uncertainty all over the world..and gold is a safe haven.

Reason for Nifty losing in 2008 was the financial crisis and then as it had hit a bottom and world over recovered from the crisis we had great return in 2009. 2011 is bad for Nifty because of again first US and now Europe crisis. FD rates have increased slightly.

So what does future hold? Before crystal gazing we need to understand what are factors affecting the financial world:

1. Global uncertainty : Europe, US. Eurozone crisis has spilled over from Greece to Italy, could spread to France. Will have ripple effects in global markets. Today as I write Sensex is up 300 points because IMF might give loan to Italy but will it sustain if it is true..only time will tell.

2. High Inflation rate

3. Low economic activity

4. Falling rupee.

Now how an investor reacts to these macro conditions depends on his/her risk profile. Risk averse investors might be better staying in debt instruments. Aggressive investors can fish for value picks for long terms. One must know one’s financial strengths, weaknesses and risk profile which would decide his asset allocation.

As per Warren Buffett asset allocation, is pure nonsense. Though we might agree to disagree on it I agree with Buffet on “The best way to minimize risk, is to think.”

The times have changed and are volatile. Now we cannot make investments which we can forget for long time. So if one needs to make money through investments one needs to think!

I don’t think times have changed at all – there has always been uncertainty and there will always be uncertainty – people have to deal with it, and people have to deal with it when times are good and not when the market crashes a few hundred points.

Buffett has recently bought BAC preferred stock that he can’t sell for 5 years so he is still investing for a very long term and that’s something a lot of people can do.

I think Chandran’s comment on the averaging down post was a good example of that. He had a list of companies that shouldn’t go down to zero even if the situation were to become very grave, and he was willing to wait out a long time for them to grow. When your horizon becomes 5 – 7 years, you have a lot more comfort zone than otherwise.

I think this is one aspect where a small investor can emulate Buffett.

But, minimizing risk by improving understanding will not work for most people the same way it works for Buffett because we clearly don’t have the same level of understanding of these issues as he does.

It will work to a certain extent, after a certain time in market people stop playing penny stocks, stop paying unreasonable valuations and stay away from junk, so that’s also one way of minimizing risk – but to get to the other level of holding just a few things is very hard for regular folks.

For gold, I’ve been away from it all this time, and I’ll continue to do that because of all the frenzy around it. I don’t understand its appeal as safe haven or as a store of value.