I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

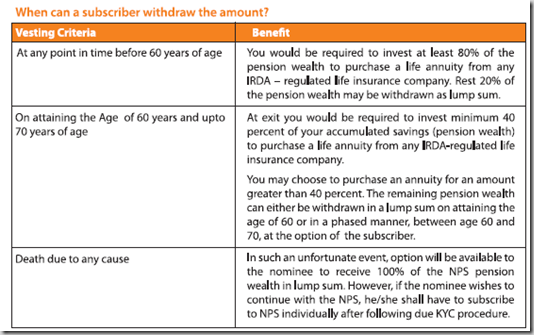

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

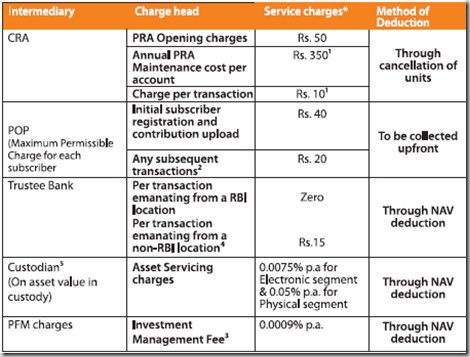

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

How can I open a NPS account?

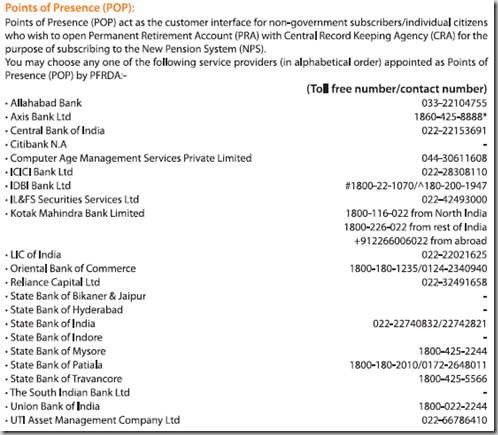

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

Dear Manshu

Great Initiatiives and information, i had a big discussion in office on your posts 🙂

Is there any information on the total corpus invested in NPS as of today. Also how transparent these schemes are to the investors in terms fn where they are investing and kind of returns that are generated by them.

WOW – that’s quite incredible Shilpi – I’m really amazed and I think first time I’ve heard about a discussion of OneMint in the offline world 🙂

I don’t know about total corpus or where the fund managers invest the money, but they do publish the NAV regularly, so one can compare from there. That’s actually quite an interesting question – I’ll research that more.

i did not got the card of i pin for last 6 years

Can you please elaborate a little?

if i want to discontinue the NPS after 4-5 years from the date of joining NPS the what is the plan of this scheme

You can withdraw money from the Tier 2 account, but there is no provision for that in the Tier 1 account.

Hi–This is great information indeed. Would you have any updates on the performance of the fund managers? Thanks a lot for your wonderful posts.

No, sorry I haven’t seen this info but it’s a good idea and I’ll see if this is available anywhere.

Sir i want know about nps tier II account.

Sir i serving in BSF my NPS tier I account is already opened and invest monthly amt.as per central govt. Policy but i try to open my NPS TIER II account, but my dept says to me ad all serving person to this scheme therew is no any addprovision to open NPS tier II account.

Sir pse suggest me regaeding this type of account in to my email id.

Sorry not sure about this.

i want to open a NPS a/c with SBI , what the proceesure for that , can you give me the details???

Sushama – You will have to go to a SBI branch and get the details from there. I’d like to mention here that awareness is a little low here so you may not get a positive response right away.

i visit d one of the SBI Branch…they are not aware about the NPS…its create a difficulty to open an accout…what should i do????

I want to join New Pension Scheme (Govt. of India)

In the Almora Uttarakhand district, what is the channel for join to new pension scheme please tell me.

You will have to check with a bank near your place to see how to open an account or if you have an account with ICICI DIrect then you can open that online with them.

I have already opened a nps account with SIB. Can I remit money to this account directly through online. Kindly clarify.

Regards.

Raeba

As far as I know there is ECS facility – how are you making payments right now? Going to the South Indian Bank branch?

yes

this is very sad to describe how such good schemes like new pension schemes are out of reach to the people, but one must know why this is not so popular like other investments schemes …the original fact is that government can depute employees even can make bodies but cant put up a proper strategy for development for such welfare plans , because our politicians do not get benefit from such schemes there is no way to have benefit from this schemes otherwise our so mean politicians must have intervene and would have developed a way to have some money from this schemes, no doubt scheme is awful lucrative but when it does not approach to needy people what does it mean whether its a gold or coal . founder of this scheme can derive a product good for people but they cant do it in a manner to be useful for the people because this is not in their nature, they must do something which must be lucrative for them like infrastructure, bridges, dams , tenders .. because it helps them to collect the fund in form of bribes for the approval they provide for contractors. sometimes i think what and how such a huge amount of bribed money would be used by all corrupt politicians, all this must be punished severally and should be hanged perhaps .

Why do you say they’re out of reach of people? They are not as easily accessible as one would like but they are not out of reach of anyone.

I was appointed as LDC in Doordarshan Kendra on 27-02-2004, but our office are deducting CPF No NPS pl suggest me & pl tell me difference of (contributed provident fund & New Pension scheme)

I’m not familiar with the details of CPF so can’t really say – sorry. You can try asking this at the forum and see if someone else answers it.

I agree with Manshu, that the earlier the better. Regular savings, with consistent upgrades whenever incomes rise, can fetch one a very good pension.

However, keeping in mind that there may be any number of urgent fund requirements for everybody, it would not be prudent to save money meant for pensions in any other savings vehicle, which allow free withdrawals. An element of compulsion goes a long way in ensuring that adequate corpus is created to purchase an annuity at the time of retirement.

Mr. Manshu – Thanks for the clarification. I am sorry , I am bit late to respond to your clarification. I am not understanding your explanantion “Since there isn’t a lot of time till retirement what you already have will play a bigger role rather than the sum contributed in the NPS because it doesn’t have that much time to grow”. Do you mean to say that what money I get after retirement will fetch me more returns from FD & other investments than investments done now in NPS ? In that case is it worth opening a NPS a/c for me at this stage? Kindly clarify at the earliest.

I was saying that NPS is better for people who have a long way to go for retirement and by saving a little every month can look at building a corpus that can be used for pension at the end of their career.

If I were in your position I’d much rather invest this money elsewhere so that at the end when I get the money I am not restricted by NPS rules on where I can invest the money, and can merge this with whatever other funds I have and invest it somewhere.

I am still not clear about the payouts. CAn any one explain giving an example

Manika – if you look at the orange table in the post – that explains how you can withdraw the money, and there are no limits on withdrawal on Tier 2.

Is this what you’re not clear about? Or are you not clear on how your money will grow during the time period?

hi sir, this is ravikanth from hyd , iam very much interested in opening the nps account, but most of the banks they are saying that we have not started yet, so pls tell me which bank is gud to open the account, and per annum how much i can invest, iam ready to invest ! one lakh per annum, so please suggest me iam in desperate to open the account, not only me all my family members are ready to open the account.

It’s up to you to see how much you should invest – I can’t comment on that but since ICICI Direct has an online platform I think you will have better luck in trying ICICI Bank.

Yes among all the fund managers ICICI are more proactive and at least they do open the account when asked. The individual need to go to their select branch to open the account. I do have ICICI direct and nowadays I get to see an option to open NPS. This is a good sign.

When I opened the account, ICICI was advising me that for payment into the NPS, everytime I had to visit the branch but it was six months back. Something good is happening.

That’s great – thanks for your comment.

Apart from ICICIDirect, is anybody else providing the online opening and maintaining facility

No Chris, not that I’m aware of.

I am 57 yrs old. I am left with 3 yrs of service. How much do I contribute per month for 3 yrs to get a pension of say Rs 10,000 pm ? Further I understand Tier I account is a must in NPS. Whether Tier II account opening will be of any use to me? Kindly reply at the earliest

Based on what Sandesh has shared above I see that you need about 10 lakhs to have a 7,800 monthly annuity, so you should aim at getting to a corpus which is higher than that in the 3 years that are left.

Since there isn’t a lot of time till retirement what you already have will play a bigger role rather than the sum contributed in the NPS because it doesn’t have that much time to grow.

I don’t see much merit in getting a Tier 2 account in your case.

Very lucid. If you can give an example how the money grows and become the big corpus at the age of 60 years. So that each one can plan accordingly.

I actually didn’t understand the question Umesh – I’m sorry about that. Can you give me an example of what you’re looking for please?

Explain in detail about NPS

I want to know is NPS based on Stock Exchange or not . what is the process to open an NPS account

Shamsher – There is an option that allows you to decide to include shares as a percentage through mutual funds. The best way to open is to go to a bank branch – look at any one listed in this article (in the table with orange header) and get it open from there.

Now, ICICI Direct is providing an option to open NPS account as well, so you can open one from there also if you already have an account.

Great article, thanks. Any idea about taxation on Tier II ?