I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

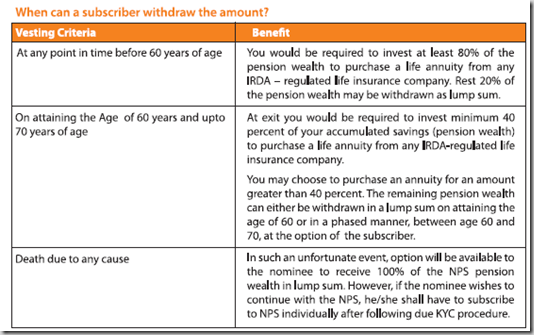

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

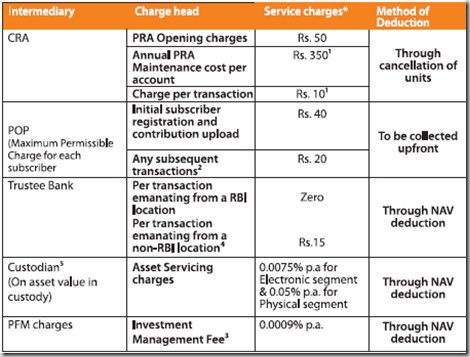

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

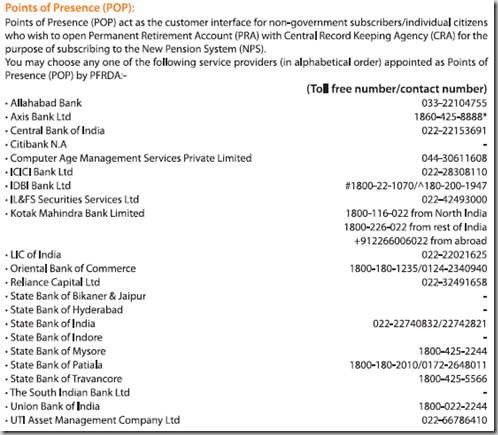

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

Hi,

I have got a few questions on NPS. They are as follows:

1. I am a Private Sector Employee and governed by EPS 95 scheme where out of the Employer’s matching EPF contribution, Rs. 6500 goes to the EPS 95 Account every year.

My question is whether I can open a NPS Account ?

2. In case, I am elligible to open a NPS Account, do I need to open Tier 1 Account first or can I open Tier 2 Account?

3. What is the benefit of opening a Tier 1 and Tier 2 Account both ?

4. As I am not a Govt Employee, would I get a matching contribution from the Government for my contribution in the Tier 1 Account?

Regards

D Ghosh

One of the exclusions listed on the site is as follows:

1. You are already covered by the Employees Provident Fund and Miscellaneous

Provisions Act, 1952 and any other special Acts governing these funds, or

Here is the link to that:

http://pfrda.org.in/faqdetails.asp?fid=228

I don’t know the answer specifically in your case, but I’d recommend calling their helpline and giving it a try. Number given by another reader above.

Manshu – you have got it wrong. What the PRFDA site states is that if you are covered under PF Act 1952, then you are not covered under the NPS scheme. So in such a case you can opt for a personal account under NPS.

Only, there will be no contribution from your employer to NPS. It will be just like a business man who opts to have a NPS account.

You haven’t read my comment Ravi – I’ve said that I don’t know the answer.

The text that I found also talks about any other special acts, and I don’t know what they are or what they’re referring to.

It’s likely that in his case he can open an account, but I’m not the one to say that he surely can.

I contrbuted to nps I up to mar’07 at gov schedule rate, now i working in different sector. Am i eligeble to getting back my contribution?

As far as I know you can’t withdraw the amount before 60 if its in your Tier 1 account.

I wanted to open a NPS in any bank in Gurgaon (haryana) . The bank people seem to be unfamiliar on it , although they have heard of it.

Please advise how this can be opened.

Hey Subhrajit – there is this link present in the PFRDA website that lists down locations – I see a SBI branch near Gurgaon – you could check that out. Other option is to do it through ICICI Direct of follow Dr. Shetti’s link that she’s given above.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

Dear,

I suggest if i would get pension after the age of 45 nice because nowdays 60 age very difficult to survive. Whatever food we are geting chemical or poision, air is polluted, then life is full of tension, water is contaminated or chemical used, etc., looking all these is there any gurantee survive till 60 age, as per my concern while living we should enjoy the pension.

Even if person survives at the age of 60, afterthat how many years he will enjoy?.

So please consider this points.

Hi,

I am 35 years old , Please let me know if i invest 12K per year , than what will be my pension per month after 60.

I am a IT professional and aged of 32. Can i be eligible for NPS.

Yes, you can open one.

please provide the best pension plan.i’m ready to invest 10 to 15 k annual premimum .

I’ve not done the research on best pension plans, so not in a position to recommend one to you. Sorry.

Hi,

Now, I am 25 years old. If I invest NPS 5000 yearly from the age of 60 years, After 60 years how much pension I will get every month.

hi

i want a pension of 50 k per month at the age of 50 , now i am 30 years old . how much i need to invest in this scheme.

akhilesh

I am 1958 born. can i contribute to NPS a/c a lumpsum amount , instead over a period of next 7 yrs ? if yes, what would be the one time contribute sum to fetch a monthly pension to the tune of INR 10K ?

NPS puts restriction on where you can invest your money after maturity, and if you are thinking about a lumpsum then I’d say instead of selecting NPS invest that independently so that you have more control on where you can invest the maturity proceeds.

NPS is a good tool for people who have a long way to go and are looking for regular investing.

i am investing 5000 Rs. per month from the age 55 till 60 . so how much i will get as pension per month from the age of 60?

Hi,

I have recently opened the NPS accout with SBI and got the PRAN card lastweek only. Now, how can I make payments to NPS account? Is it possible to do fund transfers from SBI/ICICI banks etc. Could you please let me know the details.

Thanks

Bharat

I think they do have the auto debit facility so you can check with the bank on how to activate that.

sufficiant information

NPS – The Cheaper Option

Shown below is a projection of how an investment of Rs. 1 lakh per annum would behave over a period of 30 years. This is considering that all three options give similar returns at the rate of 10% p.a. For the sake of this projection we have considered funds that would match the asset allocation pattern followed by the aggressive portfolio under NPS.

NPS

Insurance Pension Plans (ULIP Based)

Mutual Fund Pension Plan

Investment amount per year

NPS 100000

ULIP 100000

MUTUAL FUND100000

Charges per year (Initial period)*

NPS925

ULIP 13200

MF 1250

Charges per year (5 years to 10 years)*

NPS 388

ULIP 6000

MF 1250

Charges per year (11 years to 15 years)*

NPS455

ULIP 3000

MF 1250

Charges per year (16 years+)*

NPS455

ULIP 0

MF 1250

Fund Management

NPS 0.0009%

ULIP1.25%

MF 1.25%

Age limit for annuity

NPS60

ULIP Flexible

MF58

Assume CAGR

NPS 10%

ULIP 10%

MF 10%

Maturity proceeds after 30 years

NPS 1.8 Crore

ULIP1.3 Crore

MF 1.39 Crore

*Premium allocation charge and policy administration charges are calculated at the end of the year. Typically, these charges are computed on premium at the beginning of the year/month. Important Note: The projection shown above takes an investment of Rs 1 lakh every year because this is where the charges under ULIPs based pension policies and MF pension plans are at the lowest.

Superb illustration .. pl. give me links of similar things so that I can enhance knowledge of investment..

is their a pension plan for business man…

please reply……..

Yes Rahul – even businessmen can open a NPS account.

but how we can………

As Dr. Shetti has mentioned in her comments you can find a CAMS branch. OR you can do it through ICICI DIrect if you have an online account with them. The other option would be to check with your regular bank to see if they can allow you to open one.

Iam employer of Central government and I have pension in my office . Apart from that I can join NPS SCHEME.

PLEASE REPLY

Acc. to the exclusions on this page you can’t.

http://pfrda.org.in/faqdetails.asp?fid=228

You can also double check by calling the phone number shared on this thread.

Mr. Manshu

Yes, that is the help line of PFDRA. You may call them for any clarification.

V.K. Singh

Thank you for your response!

Dear Mr. Manshu

Alongwith you I am also updating my knowledge abourt NPS. The very first thing is that now there is no New Pension Scheme i.e. Now it has become New Pension System as available on the website of Pension Fund Development and Regulatory Authority of India, secondly every body who is below the age of 60, can join NPS. A 14 pages brochure is also available on the website of PFDRA which is quite useful. Also, clarification may be made over phone no.011-26892417 the enquiry counter of PFDRA.

Thanks

V.K. Singh

Dear Mr. Vijay – thank you for your comment – this is certainly new info that I wasn’t aware of. Do you have any personal experience of calling up the helpline?

If i were to choose amongst services providers for NPS ..What will be your suggestion amongst , LIC , Kotak , SBI and Reliance Capital and why . It will be great if you can help me to draw comparisions …Regards Avnish

I don’t have any recommendation on that Avnish since I don’t have any special insight on them. They have not been around for long for one to compare the historical record and I’m not aware of any other reasonable way to measure them.

in above reply returns on your contribution for 7 yrs have not been taken into account beacuse period is very short and return may not add much in only 7 yrs

Thanks for taking the trouble to and replying in such a comprehensive manner!

I am 30 yrs old now. Is there any calculator to know how much one need to invest to get amount as pension based on certain assumptions/factors.

Lets say.. I want 50k per month after 30 yrs..so how much I should invest now onwards.