I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

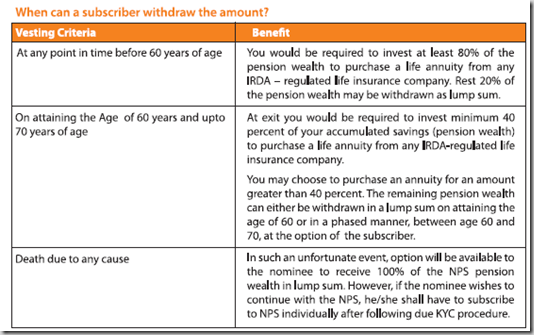

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

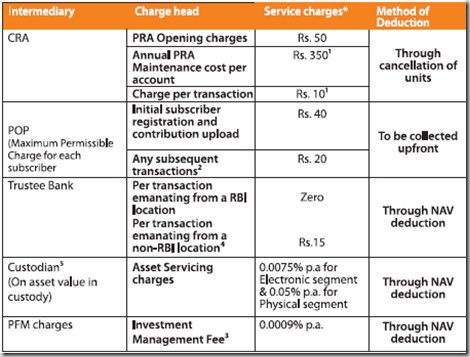

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

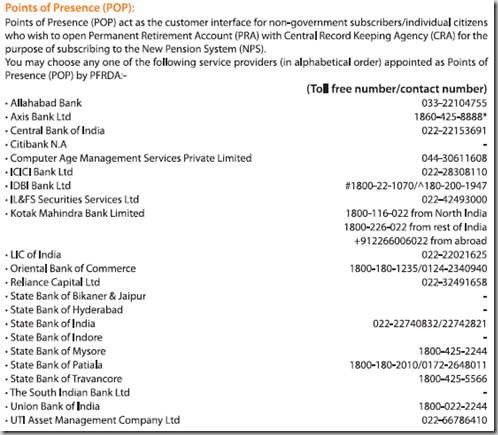

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

aap mujhe nps infomation give

i want to know what kind of returns i can earn in this scheme

What are the returns expected .

Yasir, the returns will depend on the performance of fund manager and asset class where you have invested your money in.

Hi Manshu

As per NPS, it can take all three versions. i.e., Matching contribution from employer and employee, unequal contribution from employer and employee and contribution either only from employer or employee. Companies like BHEL has finalized without asking for employees contribution. IOC has finalized by taking 3% contribution from employee and giving whatever they are supposed to give within 30%. My question: This being the background, is matching contribution mandatory on the part of employee in a PSU? Is there any specific guideline from DPE with regard to this? Any website where I can find the rules pertaining to contribution?

Thanks

Hai Manshu,

As per NPS it can take all the three variations, i.e matching contribution from employer and employee, unequal contribution from employer and employee & contribution either only from employer or employee. Some companies like IOC are collecting employee contribution of 3% only while the Co. gives the residual of 30%(like 8 or 9%). My question : Is it mandatory on the part of PSU employee to contribute matching contribution? What does the DPE guidelines say about this? Any web site regarding this?

Regards,

K.V. RAMESH

aap mujhe nps ki puri information give

What is the Return, except tax saving ?

Not fixed, It all depends on the performance of respective asset class , you have parked money with.

Hi Manshu

As per rule for Tier II Account

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What is the min and max limit of 4 contributions in a year? Also Is it mandatory.

Dheeraj , In TIER 2 a/c Minimum number of contribution required is 1 per year and Minimum amount per transaction is Rs 250/-.

Hi Manshu,

Seen a lot of mixed reviews about the NPS across forums. Some parts of this scheme are appealing (to me 🙂 ) and others I agree are real big drawbacks. But I am interested in going for NPS not as the only form of retirement investment, but as a part of it if possible. So really hoping the negatives with this do get ironed out gradually.

If there have been any recent changes to this scheme – positive or negative – would be great if you could update the article. Understanding it in english is simpler before trying to dive into their actual offer document 🙂

Thanks,

Anita

Hi Anita,

The only thing to add is that the funds that are under NPS are all index funds but their performance is quite different from one another so it is probably better to choose one that has already done well. All the best.

thanks for this info

it really helped

very easy to understand the whole scheme

This is inform you that I sri Atanu Das, have New Pension Scheme account holder, account no-00056261and PPAN NO-2006500201400661 . But i was resigned the job on 31.062008 and my resignation has been accepted dated 31.06.2008 & Joined a state govt. college . Now i am not contribute any money in my NPS account ,i want to withdrawal the money which was deducted during my service period,So I kindly request to you please give in details regarding the withdrawal system of new pension scheme, thank you and waiting for your positive reply

Hi manshu,

I am with IDBI bank which is govt bank and they have forced us to join NPS although the implementation in banking is from 31-04-2010 they have implemented it from 01-04-2008 . As my joining is before this date.

Going by the queries and your patient replies what I conclude is-

1. There is yet to be a proper guideline for transfer of fund from govt to private.

2. 40% deposit on attaining the age of 60.

3. Employers contribution as income.

4. No guaranteed returns.

5. Returns MAY be like PF.

If this is the case then why not PF instead of NPS.

Kindly differentiate between NPS and PF/Govt. Pension.

Rajeev,

PF and NPS are both different avenues, although both are earmarked for retirement. NPS was launched by government to move to defined contribution system from defined benefit pension system.Through this option the fixed pension liability would not be there on government.PF option will stay there as it is.There is no liability of pension in PF and hence government is able to continue with the option.

My husband ws working with IIT Madras and he had some money in NPS.Then in March 2011 he switched jobs and joined a State university -Utkal University in Odisha.The NPS people have refused to transfer the NPS account money saying they have no government guidelines regarding transfer from Central Govt. job to state university.We dont know what to do.

It’s a terrible situation and I’ve seen a few other people comment about it here as well, but I’m sorry I don’t know what could be done to deal with this situation.

Rupali ,Raise the query with CRA call centre at 1800222080 , alternatively if you have IPIN allotted you may register your grievance at https://cra-nsdl.com. Whatever i have read about this product, this does not require any transfer, you just need to inform the PRAN to the new employer. Though i am also nt aware about the operational issues…so let’s start with raising concerns at grievance cell. Do keep posting the status. Will try to help as far as possible.

All tax advantages are fine. But I want to see some guarantee on my pension figures.

The compulsory annuity option for 40% of the fund is disappointing.

An investor ( say of age 35) who join NPS today, would not know how much pension he can expect when he is ready to retire at the age of 60. I understand the market risk involved and also the uncertainty and the reason why a figure can’t be guaranteed today.

But at the age of 60, when he is retiring, he will be given a annuity rate, which he may not like. But he has no option but to take the annuity. This is very wrong in my opinion. He should be compelled to buy something that he may not like.

He should have an option to invest anywhere he likes. If he wants to put money in a monthly income plan and take SWP, he should have option to do that. Why take away this important right from him in the name of tax savings.

If PPF and EPF gives him an option to close the account and take all money at retirement, why not NPS ? PFRDA is not consistent here.

I would not recommend NPS to anyone until this problem is fixed.

In my previous posting, there was a typo. It should read –

He should NOT be compelled to buy something that he may not like.

[ Not was missing ]

That’s a big issue in my opinion as well.

RRK, this is one of the major drawbacks in this scheme. Where the options like EPF/GPF/Mutual funds etc. options are already available in the market, which offers tax free returns and necessary liquidity with almost no obligation to use it as per the prescribed guidelines…this product loses shine as cmpared to them.

dear sir,

i just want to know that, i am a Pran card holder…

i just wanted to close the A/c. is it possible??? What are the charges ???

Can i withdraw my Tier-I A/C.

so, need help…

Please correct the information here. Minimum contributions fir tier I and tier II accounts are only 01 per year. This is as per latest offer document of NPS.

https://www.npscra.nsdl.co.in/download/NEW_OFFER_DOCUMENT8400461427.pdf

Hi,

This is a Copy-paste article for those who prefers summary. If you want the actual documents please go to NPS website.

This article is just a summary….. reader cannot find anything. No insight analysis. If you provide an analytical article, then the readers would be more beneficial.

Please analysis Pros and cons of it.

If someone invests Rs 10000 per year (start @ 35 Yrs) and continue for 25 years, then what should be the pension amt per month? (consider he don’t withdraw any amount)

Regards

Ami

Dear sir, i want to tack to details of pension found. give me mobile no.

i m 57 yrs old . How NPS is useful to me & what is the process. from where i can get my PRAN.

It is probably not very useful for you because the money won’t get much time to grow and you will have to invest in an annuity product and those aren’t very good right now. Better look for some other type of info.

Dear Mr Solanki

Thanks for your reply.

However my query related to withdrawal from tier 2 account.

What tax rate will be applicable when I withdraw.

Can i get long term tax gain benefit applicable for mutual funds.

Thanks

Hi

Please let me know if you found the answer to your question

Taxation is same as of TIER 1 a/c as explained by Jitendra.

What is tax rate on widrawal from nps tier 2 at present.

1. applicable to Mutual Gain with indexation benefit

or

2. gain will be added to income

Thanks

Amit

The NPS would follow the EET (Exempt – Exempt – Taxed) regime of taxation.

Means

Investment: Tax-deductible

Accumulation: Tax-free

Withdrawal: Taxed (The monthly pension is taxable)

Hence withdrawal are taxable by adding to your income.