Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

The IDFC Infrastructure Bond post has thrown up some interesting questions from readers which were not part of the post itself, and while I am replying to them in comments – I thought I’d do a fresh post with 5 questions that I thought deserved a post of their own.

1. Is opening a demat account compulsory for investing in the IDFC Infrastructure bonds?

No, it is not.

When this scheme opened there was just the option to invest in it if you had a demat account, but some changes have been made (pdf) and opening a demat account is not compulsory now. You can buy them in physical form also. Their website tells you how to do this.

You can also subscribe to the Bonds in physical form by following these simple steps:

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

2. Is the interest earned from the IDFC Infrastructure bond tax-free?

While IDFC Infrastructure bonds may not attract TDS – the interest itself is not tax – free. It’s only the Rs. 20,000 you get reduced from your taxable salary that helps save tax.

3. Has the closing date to invest in IDFC Bonds extended?

Yes, the closing date has been extended from 18th October to 22nd October.

4. When do the bonds start trading in the stock exchange?

After the initial lock – in period of 5 years is over, the bonds will list on the NSE and BSE, and start trading there.

5. Which option has the highest yield?

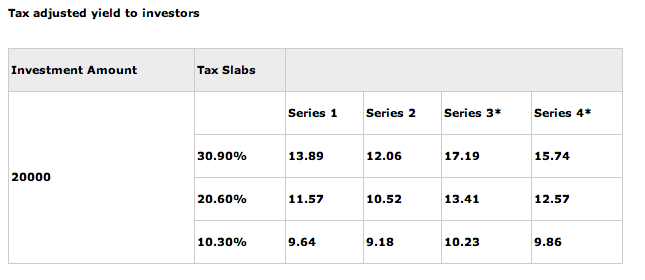

Yield table from the website. Now keep in mind this is just the yield, the lock in periods differ between various series, and that needs to be taken into account while making your decision, however since my earlier post didn’t have this yield table I am including it here.

Click here to read the earlier review of the IDFC Infrastructure Bond.

Dear Sir.

I had bought idfc bond 2011-12 tranche 3. Now if I have to redeem do I have to dematerialize the bond. And if I have to redeem on 2022 have to dematerialize?

Pl leave a copy of reply to mail also.

Thanks very much

Suresh

What is the procedure for getting Duplicate certificate of IDFC bond and what documents needs to be sent for getting the same ?

Dear sir

kindly send me the address of the IDFC infra bond office in Hyderabad where i have to send the papers redemption of the bonds

Hi,

I have 2 L&T Infra Bonds, which will mature in December 2016. Please let me know where and how I can redeem them.

There is no mention of how to redeem them.

regards,

Dilip

I have 4 bond with the application no 18389686. my beneficiary a/c is IDB025081. Please let me know the procedure to redeem the bond. i will be thankful i could receive the answer on my mail id.

thanks.

I HAVE BEEN ALLOTED 4 IDFC LONG TERM INFRA BONDS TR-1 SR1 2011-12 MY CLIENT ID IDD 0023146 & I RECEIVED BOND CERTIFICATE ALSO IN 2011-12 .

I GOT MARRIED IN 2015

MY PROBLEM IS HOW TO EFFECT CHANGE NAME ON BONDS ISSUED TO ME SINCE NAME CHANGE IS DUE TO MARRIAGE.

KINDLY LET ME KNOW FORMALITY & DOCUMENTATION REQUIRED

VIA MAIL TO ME

Dear Sir,

I have received a message from CDSL TX that credit in account under CA arrangement on dated —. What does this means.I have checked with my broker who told me that bonds are still shown under lock and i think IDFC has redeem the bond before maturity date.

Please help to resolve my query

I got IDFC Infra Bonds Trench2 & 3, I have to change my address. Please inform to whom I have to send (mailing address and contact No.)request to change my address.

I have IDFC bonds bought in 2010. When the same will be traded in exchange ??

Requst to ammend of IFSC code in my SB a/c recorded in L&Tifra St. bond 2011-12 (Application no.11319044 dated 08th Dec 2011) Sir i purchased 20Tranche 1 bonds with face value of Rs.1000/ total amt.Rs20000/ on 8/12/2011 during my posting in Mumbai,mentioning SB a/c no.20872143902 IFSC code ALLA211975.On my superannuation on 31/01/2013 I shifted to my native place SIKANDRABAD(UP west).Consequent upon which my SB a/c wes also tfd.to nearby (Bulandshar) branch resulting change in IFSC code.I therefore request your goodself to kindly amend IFSC coode from AllA211975 to ALLA0210259.reading SB a/c as 20872143902?IFSC code 0210259 to avoid inconvinence for making payment.Kindly favour at the eariest. Regards

Can we maintain the records of INFRASTRUCTURE BONDS on one website say for e.g. MONEYCONTROL/ BLUECHIP?

Dear Sir,

Subject: Change the name of Bondholder

Bond Details: IDFC Long Term Infrastructure Bonds(2011-2012)-Tranche 1

Registered Folio No: IDD0236579

Certificate No: 236579

ISIN: INE043D07781

Name of Bondholder: PATEL DIPAKKUMAR MANEKLAL

No Of Bonds: 4

Distinctive No(s) : 0000139113-0000139116

My father was holding the above referred bond & i regret to inform u, he has expired on 21st September 2012, so now i would like to transfer bond in my favour.

Kindly inform me the procedure to under taken.

Should you need any further information or need any clarification,please do let me know.

Regards,

JAY DIPAKKUMAR PATEL ( Son of late shri PATEL DIPAKKUMAR MANEKLAL)

C-S/2 Rajvi Complex,

Sonal Cross Road,

Memnagar,Gurukul Road,

Ahmedabad-380052

Gujarat,India

Mo. No:-9558466750

I am sorry to hear about your loss, but I can’t help you. This website is like a newspaper. You have to contact IDFC to get this transferred to your name.

Dear sir i have invested 20000Rs.in IDFC infrabonds vide application no 17506131 by draft no.777712 drawn on ING VYSYA Bank Ltd BHUBANESWAR branch on date-08.03.2011 till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

Name -BHAGABAN SAHOO (JE)

NH Sub Division,BOUDH

BOUDH

PIN- 762014

Mob- 9437136631

Mail [email protected]

Dear sir i have invested 20000Rs.in IDFC infrabonds four numbers vide application no 17998230by cheque no.000003 drawn on KOTAK MAHINDRA BANK,MATHURA (UP) branch on date-03.02.2011 till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

my address,

J.P.Sharma

BB/35, Chandanvan, Phase-1

Mathura (UP)

PIN 281001

WILL WE REQUIRE DMAT FOR REDEMPTION OF INFRA BOND OR IS IT REQUIRE TO HAVE DAT FOR BUY BACK ACTIVITY?

No, you won’t need Demat if you bought the bonds in physical form in the first place.

Hello, I have applied for IDFC Tranche-I (Appl. no : 22666641) with demat option and I have got acknowledgement email. The amount Rs.20000/- has also been debited my IDBI account. But so far demat a/c is not been updated with these details and would like to know the status of this.

I also need to submit income tax proof in my company and how do I do as I applied with demat option. Do I get any physical copy of this even for demat option?

Pl help.

IS IDFC A GOVT OWNED CO?

IS IDFC A GOVT OWNED CO?