IDFC Infrastructure Bonds FAQ

Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

The IDFC Infrastructure Bond post has thrown up some interesting questions from readers which were not part of the post itself, and while I am replying to them in comments – I thought I’d do a fresh post with 5 questions that I thought deserved a post of their own.

1. Is opening a demat account compulsory for investing in the IDFC Infrastructure bonds?

No, it is not.

When this scheme opened there was just the option to invest in it if you had a demat account, but some changes have been made (pdf) and opening a demat account is not compulsory now. You can buy them in physical form also. Their website tells you how to do this.

You can also subscribe to the Bonds in physical form by following these simple steps:

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

2. Is the interest earned from the IDFC Infrastructure bond tax-free?

While IDFC Infrastructure bonds may not attract TDS – the interest itself is not tax – free. It’s only the Rs. 20,000 you get reduced from your taxable salary that helps save tax.

3. Has the closing date to invest in IDFC Bonds extended?

Yes, the closing date has been extended from 18th October to 22nd October.

4. When do the bonds start trading in the stock exchange?

After the initial lock – in period of 5 years is over, the bonds will list on the NSE and BSE, and start trading there.

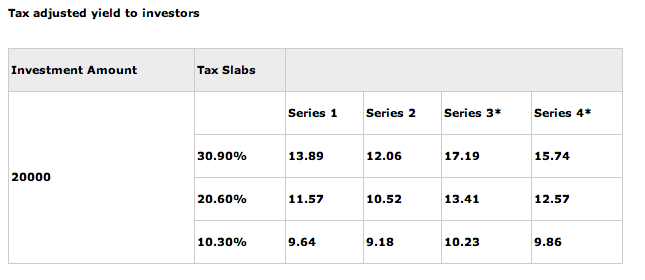

5. Which option has the highest yield?

Yield table from the website. Now keep in mind this is just the yield, the lock in periods differ between various series, and that needs to be taken into account while making your decision, however since my earlier post didn’t have this yield table I am including it here.

Click here to read the earlier review of the IDFC Infrastructure Bond.

Hi Manshu,

Thanks for posting much needed information. Looking at the yield table, it appears like option 3 earns better yield. But how does one really choose which option is the best? I asked the HDFC rep who was issuing the application forms, but he didn’t have any convincing answer.

Here’s how I would go thinking about it. The biggest benefit of this scheme is the tax that it saves.

Given that this is the biggest benefit, and the interest rate itself is comparable to other schemes, I’d like to get my principal back earliest so that if interest rates rise, I’m able to invest in something else. So, given that line of thought I myself will be okay forgoing the extra 0.5% in favor of getting my money back 5 years earlier. That means going for the series that doesn’t have the ten year lock in period.

The next question is whether I’d like to get interest paid every year or get the whole thing compounded annually and paid a bigger sum at the end. Personally, I’d prefer to get the interest annually to have the option to invest somewhere else or just to get an edge over the inflation which is more than 7.5%.

Given all this, if I had to invest here, I would choose the one option that gets me my money back fastest as well as pays out interest annually. That will be my thought process.

If anyone else has any other ideas then please share, and let’s hear about it.

Thank you so much Manshu. This detailed explaination makes it easier for investors to choose the right option.

Here you have talked about the buyback from the company. However the bonds are supposed to be traded on the exchanges at the end of the lockin period of 5 years. In such a situation won’t the series 1 bonds become more lucrative or return oriented given that they have:

a) 8% coupon rate

b) They can be sold at the end of the 5 year lockin.

c) If the interest rate is lower at the time of lockin tenure(5yrs) then they sell at a premium.

c)In case the interest rate increases(least likely) then one might have to keep them for the whole tenure or sell at a discount.

Please throw more light on this and revise your suggestion if any.

I am not familiar with how bond listings actually work, so I’m unable to say anything about that. In SBI thread there are two schools of thought – one that says the SBI bonds should list at a small premium of ~2% and another that says the premium should be ~10%, so I see that there are differing opinions on this, as you can probably expect with nature of these things. Given all that, I don’t know what to make of listing.

how does the yield for the annual interest payment scheme is more than the cumulative payment scheme, can u please do the calculation……

Okay, let me see if I can explain this now, it kind of scares me actually….but here goes.

Let’s first take the example of Series 4 for a person with a 20.6% tax rate who invested 5,000. The key thing here is that since you get your taxable income reduced by 5,000 using these bonds, and your tax slab is 20.6%, your purchase price goes down.

Here is how that looks like:

Investment 5000

Reduction in taxable income: 5000

Tax Saved @ 20.6% 1030

Net Investment 3970

Buyback amount after 5 years 7180

Compounded Annual Growth Rate 12.58%

I calculated CAGR using the calculator on my site that you can use here:

https://www.onemint.com/2008/10/09/cagr-calculator/

So, this was the easy one and you saw how yield of 12.58% came. Now let’s try Series 3 which is slightly more tricky.

In this case you get interest paid out to you every year, so you use a concept called Yield To Maturity (YTM). This formula takes into account the discounted cash flow, effectively seeing how much money you will get in total, and what it’s worth today. It also assumes that whatever money you get will be reinvested with the coupon rate or 7.5% in this case.

Plug the Series 3 numbers in the YTM calculator found on this link http://www.moneychimp.com/calculator/popup/calculator.htm?mode=calc_bondytm

you will see that it gives you a YTM of 13.417% which is what it becomes worth.

The Current Price is 3970, Par Value 5000, Coupon 7.5%, Years to Maturity 5.

I don’t know how much sense I made and you can read more about YTM and IRR elsewhere to get a better understand. If I myself go any deeper then I’ll have nightmares which I am trying to avoid 🙂

If anyone else has a better way of explaining or thinks I’ve made a mistake somewhere then please let us know.

Thank you for detailed info on series 2 & 3 bonds. What are series 3 & series 4 provisions? I need to decide by Monday which series to invest into. So can someone please guide me?

The Series 3 & 4 provisions are that both of them have the buyback facility so you can sell your bonds after 5 years, and don’t have to keep them for ten years.

Series 3 will pay you out an interest per annum, while Series 4 will not pay an annual but on redemption – you will get 7,180 for each bond. As opposed to this Series 3 will be redeemed at Rs. 5,000 itself (as interest gets paid every year).

The yield is higher in Series 3, but one of the assumptions in calculating this higher yield is that you will re-invest the interest amount earned by you in an instrument that pays you 7.5% interest.

Tax will of course be saved in all series, so you can think about all this, and make your decision.

i want to sell the IDFC injfra bonds on commision basis to my cliental group. please issue me neccesary guidilines in this regards. or to whom i may contact for the issueance of license

Hi,

Will the IDFC issue any bond certificate to me, if I apply thru online brokerages viz sharekhan, ICICI direct etc?

I don’t think you’ll get a physical certificate if you invest online Keshav.

But some form of proof of investment should be there right? after all we have to show it to IT/Fin Dept.

Yes Sanket – you are right, my initial impression was that there’d be no certificate, but people have told me that ICICI Direct has conveyed to them about sending a physical certificate, and I think others will do it as well.

So, I stand corrected, and I am sorry about my earlier comment stating there won’t be a physical certificate.

Dear Manshu ji,

What is buyback facility in IDFC Infrastrucsture Bonds? Can I invest Rs.20,000/- in series 4 or series 3? Is it better to invest more than Rs.20,000/- in these bonds?

Dear Sunil,

Series 3 & 4 have a buyback after 5 years. I’d say that since the big benefit of investing in this type of bond is getting the extra tax saving, there isn’t that much merit in investing more than 20k.

As for Series 3 or 4, one gets you interest paid out every year, while the other gives you a slightly larger amount at the end without paying anything in between so you can evaluate based on that.

Hi,

My question are

1. Can we opt for nominee or not ? If yes then how.

2. What is the mean of More than one applicant..

Thanks,

Anuj

There is a facility for nomination Anuj, but I don’t know about the rest of your questions. Sorry, I hope someone else can answer.

Manshu Ji,

If I apply L&T Infrastructure/IDFC Bonds in the name of my wife and make the payment from my side, shall my wife will get the tax benefit U/S 80CCF ?

Dear Sunil,

As far as I know the bondholder should get the tax benefit, so that way I’d expect your wife to get the deduction.

If anyone knows any different then please leave a comment.

Dear Sir / Madam,

As per information

You can buy them in physical form also.

You can also subscribe to the Bonds in physical form by following these simple steps:

Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

However I was told you have to submit original cancelled cheque along with application form and not self attested copy of cancelled cheque. Without original cancelled cheque your application will be rejected.

Kindly advice was this correct.

Jeffrey

Dear Jeffrey,

The issue got over on the 22nd, but based on my knowledge they do require original canceled checks, and can’t do with an attested copy. If anyone else has been able to apply with an attested copy then please leave a comment and let us know.

I have applied IDFC bonds thru icici direct online. Will i get any physical copy of the bond from IDFC, if not what document i need to use for tax saving proof purposes??

I had the same query. I called Icici to know that “one should be receiving the physical bond certificates on approval which I should be using for tax purpose. This should take some 4 weeks after cutoff date. ”

Now, like you, I am also wondering that the physical would have been better that the receipt would have been awailable immediately. Let us all know if you heard something else from them.

Thanks for replying Ajay. I originally thought that they wouldn’t send a certificate based on what I read but if ICICI Direct told you they are going to send you a certificate then that must be the case.

Wouldn’t buying online make it easier to hold and sell the funds at a later date though? The need for the proof is still not there for another 5 or 6 months so as long as they don’t goof up sending it – it’s okay.

I wanted to purchase infra structure bonds of Land T or any other firm, bur last date for L and T infra structure bond is over. Will it again launch Infra structure bond or will any other firm launch the same for this financial year?

Yes Uday – the IDFC issue didn’t get a good response, and they have said that they will issue these bonds again before March 2011. You might even get a higher rate.

Yes you are right. Also there are new companies like LIC and SBI coming up with the bond issues. So definately there are lot of options and a lot of time ( 5 months) so there would be more issues to come.

When these bonds will appear of Demat A/c, I have applied and still not received?

Mine also, the same case

Nothing in ICICIDIRECT account yet….. If anybody has got, please update.

I have a few simple queries:

1. Do I need to pay money every year in order to get tax savings every year on IDFC bonds or is it just one time affair that closed on 22 Oct 2010?

2. Do I get a physical Bond certificate from Sharekhan or IDFC for issuance of bond to me or will it reflect in my online demat account?

3. In case I dont get a physical (Paper) bond, how do I claim tax savings?

Thanks in Advance

Hi Sandeep,

1. It’s just one time for this year.

2 & 3. You will see it online in your demat account, and folks who’ve called ICICI Direct for tax proof have been told that they’ll get a physical cert. that can be used, so you can check with Sharekhan.

Hi Manshu,

Thanks for the info.

Thanks a lot for replying Sandeep, and if possible, could you please leave a comment here when you receive the physical certificate.

There are quite a few people here waiting for it, so that way we will know that people have started receiving it.

After how much day will the bond come

More than twentydays have passed since the closing of the infra bond. When is it going to be allotted and why is this delay

Hi,

I applied for IDFC bond thorugh ICICI direct. But did not get any single share. Infact order histiory says that share allocated=0. Was the process for bond same as IPO.

Please advice if I will be getting bonds or not.

Hi Vikram,

The process for allotting IPO and bonds are different, and in the case of these bonds the allotment hasn’t been done for anyone yet, so you are not the only one. When the dates are declared or allotment is done I will update the post or leave a comment here, and request others who applied for it to leave a comment when they see allotment in their accounts, so that everyone else knows. Thanks!

whether allotment of bonds completed ? IF NOT, WHEN WILL BE ALLOTMENT DONE ?

I HAD NOT RECEIVED BONDS IN MY D-MAT ACCOUNT

No one has reported that they have got the bond yet, so you’re not alone. I don’t think there has been any news on when the allotment will be done, and when they declare the dates I’ll update this or when someone receives these bonds they will probably leave a comment here, and everyone will know.

IDFC infrastructure bonds have been allotted to demat account today 13/11/2010. The deemed date of allottment is 12/11/2010 and it has been locked-in till 12/11/2015.

Thanks for letting us know Loney! Really appreciate it; a lot of people were concerned about not seeing the bonds allotted so this info will come handy.

i have applied for Rs 20K bond by cheque.The money has been debited but demat account has not been credited with bond.can u explain?

Shatadru, not everyone has gotten the bonds yet, so you might have to wait a bit. As far as I know there isn’t any communication about when they will credit it, so everything is guesswork as of now.

Loney seems to be the only guy receiving. I applied in ICICIDIRECT but don’t see the bonds.

-Ajay

I guess they’re not appearing at the same time for everyone, and there is some process where they are getting allocated gradually to people who applied. Let’s hope everyone gets this quickly Ajay.

Ajay could you please check now and see if you got it because Subhro used ICICI Direct and he seems to have gotten the bonds now?

I have also applied for the bonds but still I didn’t get those in my demat account. When can I expect that to be alloted to me?

I don’t think anyone knows the exact date because it’s not been communicated but based on the fact that people have started seeing the security in their demat account I’d expect it to appear this month.

I received the SMS from NSDL today (15/11) informing credit of IDFC bonds to my demat account on 13/11. I am not yet seeing the bonds in my demat (using IIFL), but I think they will be there in a few days.

Thanks for the info Satish.

I see the IDFC bonds listed online under DP Holdings (IIFL)

INE043D07260 IDFC LTD 4.00

I had applied through HDFC, they had given me the acknowledgement copy of the form, May i know when i will get the IDFC Bond Certificate, Will it come through post?

ICICI Direct has told one of our readers that they will send the certificate so I’d expect HDFC to do that as well. Please call them and check with them Basha, as that would give you the most concrete answer.

I can see that IDFC bonds (4 in number) are credited to my demat account. I have checked this online (reliancemoney). I don’t know when/will I get physical bond copies or anything such for claiming exemption

Thanks for the info Nageswara – you’re one of the lucky ones to get the bonds already 🙂 Appreciate your comment.

Nageswar… Can you please tell me where did you see them under Reliance Money… was it under holdings or any other place

Hello ALL,

I got an SMS stating that I have received 4 bonds of IDFC. I am waiting to see when it will reflect in my DEMAT (sharekhan) account. I am sure it will be done soon. Will keep u all updated.

Cheers.

Thanks Sandeep,

Please do let us know when it appears in sharekhan and under what screen. I have applied through sharekhan, but got no sms.

Thanks

Ashutosh

Ashutosh,

I too got an SMS yesterday that I have received the bonds. Do note that the SMS came from NSDL and not Sharekhan, So i don’t think that Sharekhan will send any SMS. I don’t see them in my demat account yet. I will post here when they hit my demat.

BTW, does anyone know if we will get any proof of investment from sharekhan. Some folks here have mentioned ICICIdirect will provide some proof, anything on Sharekhan

Go to Reports->Transaction Reports->DP Tab->DP Statement of Holding. Click Show button against your client ID.

Thank you for taking the time out to post this message here and let everyone know Sandeep!

I have applied for IDFC infra bonds but i cannot see them in my IIFL demat account. when I contacted the IndiaInfoline they have no clue. The amount has been deducted from my account. i am worried. Can anyone suggest what should be done. thanks.

As you might have noticed a lot of people haven’t got the bonds in their demat yet, so best thing is to wait and watch. Don’t get worried yet.

For people who are wondering why they can not see the bonds even after receiving the SMS, I have an update. I applied through ICICI Direct. My ICICI Bank account is linked with the ICICI Direct trading account. I can see the bonds credited in demat section of the bank account.

Thanks Subhro, this will be helpful for guys here. When was the first time you started seeing them – today?

Have received the bonds in the demat account finally :()) however still to receive the receipt or physical certificates for claiming Tax cut.

Awesome man – one down – another to go! 🙂

Applied through ICICI direct….Yet to get the bond allocated.

my bonds also not reflecting in my demat

Hi

If any body has been allocated the bonds (through icicidirect), can you please tell me under which screen, are the bonds showing?

Hi Boarders,

You can see IDFC bond allotment status to your sharekhan account itself via “Reports” => “Transaction Report” => DP => NSDL Holdings => Show.

But I hope they give us a Physical certificate that can be used for tax purposes.

Thanks

Ashutosh

Hey Subhro,

Where do you see those bonds in demat. I applied through icici direct and i dont see it till date. I am looking under section IPO –> Demat Allocation –> Allocate.

Hi,

Could you please let us know how to see the IDFC allotted bonds in ICICIDIRECT.

Under which screen?

For the clients of ICICIDIRECT, the bonds will appear in your DEMAT account at the icicibank login to your account. So check in ICICIBANK.com.

However you need documents for tax cut purpose. Ask IDFC or write to idfc at the following address:

Investor Contact

The Company Secretary

Infrastructure Development Finance Company Limited

Naman Chambers, 6th Floor,

C-32, G-Block,

Bandra Kurla Complex,

Bandra (East), Mumbai – 400 051

022 – 42222016/ 42222000

022 – 26540354

[email protected]

[email protected]

Thanks a lot Ajay! This is certainly helpful!

Do people need to write in to get the tax proof? Wouldn’t this be sent automatically, or are you taking the better safe than sorry approach?

You are right: “Better safe than sorry “.

In fact they should have send the docs by now, but no one has received yet. So please write to let them know that we need the receipts…… :))

That’s a clever idea 🙂

I purchased the bonds throguh JM Financial and have not received any communication as of now regarding the certificated. I also tried the get informmation by sending them email at [email protected], [email protected] but there is no response.

Guys,

For Sharekhan demat holders, you will not see the bonds in the DP/SR report where you see the usual demat held scrips. You will see it in NSDL holdings report as Ashutosh correctly pointed out.

I also checked with Sharekhan and they are not going to give any documents for tax proof. They are advicing to use the NSDL holdings report as tax proof.

Will IDFC give for sure? Can someone confirm?

Hi,

Let me know if anyone has received the IDFC bonds in IDBI DMAT account, I’m still waiting 🙁

Had applied to the IDFC Tax Free bonds through SMC in the physical Form, but yet to receive any communication. Could any one update if anyone applying in the Physical form has recived the communication.

Thanks…

Had applied to the IDFC Tax Free bonds through Enam-Axis Bank in the physical Form, but yet to receive any communication. Can anyone give a clue where I can get the Status

I HAD APPLIED FOR 4 IDFC INFRA BONDS ON THE BASIS OF JOINT D MAT ACCOUNT WITH MY HUSBAND WHO ALSO APPLIED FOR THE SAME NUMBER.

WHILE 4 NOS. BONDS WERE CREDITED TO OUR D MAT ACCOUNT ON 13.11.10

THE STATUS OF THE OTHER 4 IS NOT KNOWN. IT IS PRESUMED THAT MY APPLICATION MIGHT NOT HAVE BEEN CONSIDERED BEING SECONDE NAME IN THE DEMAT ACCOUNT. IN WHICH CASE EITHER I SHOULD GET THE PHYSICAL CERTIFICATE OR REFUND OF MONEY. MY HUSBAND HAS ALSO NOT RECEIVED ANY COMMUNICATION FOR CLAIMING TAX EXEMPTION. PLEASE LET ME KNOW THE NEXT COURSE OF ACTION I HAVE TO TAKE WITH FULL PARTICULARS OF ADDRESS, PHONE NO, E MAIL OF IDFC CONCERNED DEPARTMENT SINCE MY MONEY IS LYING IDLE. PLEASE ALSO LET ME KNOW WHETHER FEW MORE BONDS ARE IN THE PIPELINE LIKE LIC, ETC.

I HAVE MISPLACED MY ACKNOWLEDGEMENT OF APPLICATION OF THE IDFC BONDS AND SEARCHING FOR THE SAME.

Dear Mrs. Lokamatha,

I’d say the next course of action will be to contact the agent / broker who sold you this and find from them if there was anything wrong with the form because of which your application has been rejected, and when you will receive the refund.

There will be future issues from IDFC and others of the same type of bonds.

had applied thru HDFC, yet to receive any certs 🙁 . the bank agent is also unable to say anythng.has any1 received the bonds in physical form??

Have not Recieved IDFC bonds in Reliance DMat A/C. Although my Application# 41811529 on Karvy site shows allotment of 4 number. Can one help me where they are gone ?

Can you please let me know where i can see the allotment on kary website.

Finally found the link where the allotment status can be checked

http://mis.karvycomputershare.com/ipo/

Finally Received the Bond certificate through UPC on Saturday 20/11/10.

Cheers 🙂

Awesome! 🙂

Ajay,

Did you receive the BOND certificate after any follow-up with IDFC, or they are sending to everyone. I got 4 bonds alloted thru ICICI.

-Santhosh

if ur address was correct, you shd get bond advice through UPC post. Askur postman.

Dear All,

I had applied in the physical form through idbi bank till now i dont know any status about the bond can any one suggest me what to do now or where to check the status

Regards

Dixon

For those who applied for the bonds in demat form, no physical certificates would be issued. But, you will be sent a letter of allotment from IDBI, which can be used to claim tax exemption. You can expect the letter of allotment in another 4 weeks.

Typo

My previous post should be

For those who applied for the bonds in demat form, no physical certificates would be issued. But, you will be sent a letter of allotment from Karvy Computershare, the Registrars to the issue, which can be used to claim tax exemption. Everyone should receive the letter of allotment within 6 weeks from the close of the issue according to SEBI guidelines.

Thanks Loney, that’s useful info.

I check through this link http://mis.karvycomputershare.com/ipo/ my applilcation no, its showing me bounds allocated to me, but anybody have idea when I can get the Certificate for same ?

Even the same in my case. Let me know when I’ll be getting the Certificate for the alloted IDFC Infrastructure bond. When contacted the karvy computer share directly, they informed the physical certificates were dispatched through registered post on 15th Nov, but still i haven’t got any. Do you anyone have update on it.

any1 applyin thru HDFC has gt da allotment cert?? plz lemme know as my bank is not able to tell anythng.am anxious

Got the Allotment letter stating that BONDs shall go to DMAT

Thanks for your comment Bharat. Appreciate it.

Hi,

I have not received physical copy of my certificates. Anyone got the certificates yet????

Same here. I have bought the IDFC and L&T infra bonds through my HDFC demat. And know when i have to file IT proof i have yet not received the allotment letters from either of them, HDFC is also reluctant to help saying as a DP they are not authorised etc etc…..

Please does anybody know the references where to enquire about the allotment certificates for L&T and IDFC infrabonds?

Rohan,

For IDFC you can go to this link, input your application number, and get the scanned copy of the allotment advice letter:

http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

For L&T you can use the following contact:

For scanned copy of allotment advice (L& T Infrastructure bond), you can write to [email protected] or contact them at 022 6772 0400/6772 0300.

Thanks to Shubho & Vinutha for sharing this info.

Thanks Manshu for this very important information. I was able to get my allotment certificate.

Appreciate the fact that you took the time out to comment Pankaj, and many thanks to Shubho who shared this link initially.

Great, I got exactly what I was looking for. Many thanks Manshu!

Awesome! Appreciate your response.

This helped me bigtime. Thanks for sharing this information

You’re welcome Prashant.

Please let me know how to invest in infrastructure bonds?

Krishna, IFCI is the infrastructure bond that’s currently open so you can talk to your broker to see if they can help you buy this, or call an HDFC bank branch, and they might be able to help you as well.

I have applied for IDFC bond . I have not got credit in my D- Mat account, pl advice procedure to be followed to obtain Credit.

If you didn’t get the bonds then there was probably an error in the application, and please contact your agent to help you out on this.

I have applied for 4 nos of bond in physical form because i dont have any demat a/c. Till date i did not received the bonds. Although Karvy shows, that I have alloted the same. Can anyone tell me how to see the detailed allotment status or delivery status of the same

I don’t know of a way to look at the delivery status Sumit. Maybe someone else who knows better can answer your question.

I wish to purchase infrastructure bond for tax saving purchase.

I am residing in Dimapur Nagaland.

I have no demat account

Can I purchase & How?

The current IFCI issue requires a demat so you won’t be able to buy that without a demat. Maybe another issue in the future might come which doesn’t require a demat and then you can subscribe to that. So, that’s something you can watch out for. The only issue is that future issues might also need the demat account compulsorily, and there is no way to tell which way that will turn out.

Really good information. Thanks to all for the comments.

I have applied by submitting the pplication at ICICI bank. 15 Days back I was able to see the BONDS creditted in my DEMAT a/c. It is appearing only by icici.com( I have linked DMAT a/c with my savings a/c). I am unable to see the same info through icicidirect.com.

I spoke to karvy regarding physical form of the BOND, they told me that if we can apply in the form of DMAT, they will not provide any physical bond. Is this correct?

Are we going to recieve any Bond or document for tax proof?

Some other folks have been told that they can use the print out of the demat holding page if they haven’t received the physical certificate so you can also try using that Chinna.

Regarding the demat allocation at http://www.icicidirect.com, As the units are under Lock in period you would be unable to view the same. However, you would be able to view your holdings in IDFC bonds by following the below mentioned path.

1. Log in to http://www.icicidirect.com.

2. Click on FD/Savings.

3. Click on hyper link FD/Savings Demat balance.

Also regarding the document for tax proofs, IDFC will mail a physical allotment advice letter.

Thanks for your detailed response Brine!

I have applied for IDFC bond . I have not got credit in my D- Mat account,there is no information about allotment of bond to me.From where I can get information ?

Its really late and you should have got them credited by now. Please contact your agent to see what went wrong and when you will get the refund. Also there is an IFCI bond of similar nature open for subscription right now that you can use.

I have applied for IDFC bond . I have not got credit in my D- Mat account, pl advice procedure to be followed to obtain Credit. Money already debited from account on 14th Oct, 2010.

Please contact your agent at the earliest to get the refund back, as it has been already quite some time that the bonds were allotted.

In indiainfoline demat account, it is not visible under “holding” till date.

So , please try the following navigation.

Under Depository , use ” transaction” menu and figure out the credit by giving from and to date of transaction. The bonds have been credited on 13/11.

ideasmoney.blogspot.com

There is no response from IDFC or Kaveri about the bond issue. I am yet to get the physical bonds yet from them inspite of repeated mails there is no response.

M.Ramakumar

Try to find the status of ur bond at http://mis.karvycomputershare.com/ipo/

Write a mail to [email protected] to know the status of your bonds. If you aplied in electrinic mode they will issue only Allotment Advice letter(no Physical bond)

My friend and I had bought IDFC Bonds from the HDFC Bank Branch at Anand Vihar, New Delhi. We had bought bonds worth Rs. 20000/- each. We both had opted for 4 bonds each of Series 2. We had bought the bonds in paper form, since we do not have Demat Account. We are yet to receive the bond certificates. The Money has been debited from our respective accounts.

We have written mails to the following ids and we get read receipts but there is no response:

[email protected]

[email protected]

[email protected]

[email protected]

[email protected]

[email protected]

The following site does not show the status of our application

http://mis.karvycomputershare.com/ipo/

No one picks up on the number 1-800-3454-001 or the Delhi contact number +91.11.43681700 of Karvy Computer Share Pvt. Ltd.

Can you please guide us to someone who can guide us on the same.

What’s the message that you see at the Karvy link Shubhabrata – I think there was some error in your application or something, and it didn’t get allotted.

You need to check with the person at the bank who helped you apply for the bond to get your money refunded.

Manshu,

I do not see any message. The money was deducted from our accounts and it has not been credited back.

Shubho

To me it really looks like a case of an erroneous application Shubho….try and grab a hold of the agent or person who sold you this and inquire about the refund. I’m sorry that I can’t be any more assistance than that.

Hi Manshu,

finally a good soul called back and has confirmed that my Bonds have been allocated and I am able to see them on the site too. Just wanted to keep you informed.

Shubho

I really appreciate that Shubho, and I’m glad that I was wrong about your getting the allotment. Awesome! 🙂

Same problem. money has been deducted from my account. till now i am not able to see my allotement status in karvy site of my IDFC bonds. i applied through online. i have demat account too. Please help me with the information to whom do i contact. thanks a lot for your help on this

I’ve shared the link in the above thread a few times, so please go ahead and browse through the comments and you’ll find it.

Not yet received the physical copy, No reply from any IDFC mail ID. Dont know what to do. Has anyone received physical copy of IDFC infra bonds yet??

Most people have received it Vikas, so I think you should check at the Karvy link shared above to see if you got the bonds allotted or not.

if I get bond in demate how can i claim for tax rebate

Mohan,

People have been advised by their brokerages that they can use the print outs of Demat page that shows the bond allocation, and if they happen to send you an allocation advice form or something then you can use that as well.

got reply from [email protected] saying

“We have perused the record and pleased to inform that your application was successful

in getting allotment of bonds which have since been credited to your following de-mat

account. and physical bond certificate has been despatched to you on 12/11/2010”

you can also write and get confirmation from them. Its different issue that I am still in waiting to get physical copy

Thanks for your comment Vikram – much appreciated.

i was applied for idfc bond, i have received the same, but there is some mistake in applicant name

printed name is manui taneja but correct name is manvi taneja, wt i have to do in this case , plz help me

Hi Munish,

I think you need to send your Identity & residence proof again to address given the letter which you must have received from Karvy comp. Pvt. Ltd.

Thanks

Vinay

I have seen from the site that I have been allotted the bonds applied for. But yet to get the same Can IDFC help ????

i got bond allotment advice on december 7 th , i applied physically soon you will also get it

You can check out this post I did to see how people are dealing with this issue.

after tring many time finally karvy’s people pick up the call, and mention that in the last i need to submit some document again. My Questiong to them they the hell they not contact me. in the last moment they asking for doucment which i already submit along with the application.

🙁

now again

That sucks man. Hope you have a better experience this time.

I have been allotted IDFC bonds for Rs 20000. My Accounts deptt needs proof of investment . As I have done all transactions through HDFC securities account on Telephone,, how do I get physical copy of as investment proof from IDFC ?

You can see this post for how people are dealing with this issue:

https://www.onemint.com/2010/12/06/email-question-tax-proof-for-demat-infrastructure-bonds/

Hi,

I have not received physical copy of my certificates. Anyone got the certificates yet????

Hi Meena,

I got the allotment letter & certificate. I think you should follow up with the agent or karvy Comp. Pvt. Ltd.

You can also check the status of the application on

http://mis.karvycomputershare.com/ipo/

Thanks

Vinay

Hi. I purchased IDFC infra bond through sharekhna. i am very new to sharekhan. Can anyone help me to find how and where I can check my infra bond on sharekhan. Thanks in advance

Dear sir,

I have applied for the infrastructure bond through HDFC bank, I dont have D-mat account, for the same the amount of 20000 has been deducted from my account, Ok but i doesent get any receipt or allotment copy or any proof for the same, please help.

You applied for IDFC? Because if that’s the case then you should have gotten something long time ago as many people have received the allotment advice letter. If you have the application number then try this link which was shared by a user to see if you got something or not. And please do contact IDFC for the certificate.

hi, i have applied idfc bond wor 20000rs ,i dont have demat account , till now ihave not recived physical certificate, please let me what is happening

The best thing to do is to find the nearest Karvy computershare office (http://www.karvycomputershare.com/) and call them up. You can also check your application status on the site http://mis.karvycomputershare.com/ipo/ using your Eight (8) digit IDFC Long term infrastructure bond application number. this should be on the top right corner of the receipt of the application you got from your Agent. You can also try calling up Toll free 1-800-3454-001 or +91.22.43422885.

Hope this helps,

Shubho

IFCI infrastructure bond is closing on december 31 2010. It is a very good opportunity to claim tax exemption on additional Rs 20,000. Infra bond is better option than SIP for 5 years.

I have not got the broken interest from the time of applying to the allotment date,please clarify,I have sent many e mail to Karvy but no reply.

I have received my bonds in one of the Demat accounts that i hold. I now wish to close that demat account and transfer the bonds to my another demat account. My DP participant says that he cant do so since the bond has a lock in period of 5 yrs. Is this true? Is it possible to transfer the bonds from one of my demat account to another? Pl clarify!! I think it can be done….

Sorry, but I’m not aware of a way to transfer them from one DP to another. What you could do is talk to the new DP that you’re about to open the account with because they are going to be much keener to get your business, and may find a way for you to do them. Also ask them if there is a way to turn this demat holding into physical holding.

I have no proof for income tax purpose except demat account statement.

Please provide me any proof for income tax purpose.

Please read the comment thread Ashok, as this issue has been addressed quite a few times already. Thanks.

How can I buyt Infrastructure bonds without a Demat account? Please provide the relevant information.

Regards

Bhaskar

Bhaskar – you can buy the form or download it online, and then submit it at a bank branch that’s accepting them along with some other residence and personal proof documents. IDFC issue is now over, but you can subscribe to IFCI or wait for another issue to come out in the future.

I had applied for idfc bonds in physical form and had filled the correct present residential address with proper proof. Since I was not receiving the hard copy, I made an enquiry upon which soft pdf copy of the bond was e-mailed to me. It is showing my old residence address. I don’t know from where ‘Karvy’ or ‘IDFC’ has got the same and I also want to know why they have sent the same to my old address. Please let me know as to who’s going to compensate me for the loss of time in my having the address changed due to no fault of mine.

I am facing the same issue. My address has been entered wrong there. Do not how to get it updated so that i can receive the certificate.

For starters – you can get the allotment advice letter for tax proof with the way that Shubho has mentioned. Here is the link for the letter:

http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

Check the address associated with your demat account Karishma – that is one place where it might have not changed, and you may want to change that. If you find out that that was indeed the case do leave a comment, so that others can benefit from your knowledge. Thanks.

I have two demat accounts, at one of the places i have not changed the address since i am no longer using the same and in the other one it correct i.e. the new address. What I want to know is that if I have applied for physical bonds and i have submitted address proofs – driving license etc then why is the demat account address (that too old one) put on my idfc bond?

I’m not saying that it is the cause, just that I thought it might be a possible source of info for them. I don’t know how that aspect works though.

Hi Manshu,

Here is how one can generate an online Certificate for their IDFC long term infrastructure Bonds. Karvy people have been pathetic with the data entries and you will be shocked to see the addresses they have entered. But all you need is your 8 DIGIT IDFC Long Term Infrastructure Bond Application Number. The steps are given below:

* Go to http://karisma.karvy.com

* Click on the Link that says “Click for Karisma Home Page”

* On the page that open click on the image “New! IDFC Bonds – Allotment Advice”

* In the new page that opens, enter you Application number and Submit

You should have your certificate. Hope this helps all the people.

Shubho

Thanks Shubho for sharing this – I’m sure this is helpful to a lot of folks.

I had applied for IDFC bond on 19.10.2010 for 20000 and i didnt got hard copy of bond also i didnt understood the series 1,2,3,4 in that and after maturity how to get maturity amount i didnt mentioned any bank details also in that and the address what is in application form i had given got changed in your scanned copy my bank (from which cheque i had given)address is there can that be changed?please clarify my doubts my contact no 9448519609 (karnataka) in bangalore any of your branch office is there pl give contact no details

Hi,

I got alloted with IDFC infra Bonds, and also it is refelecting in my DEMAT account, But I am yet to get the physical copy, as the address which I submitted chnaged recently,

SO whom should I contact to get the physical copy send to my new address, I hav only my demat account#, I do not have the application number alos..

Pls advs

I have appiled through HDFC bank in physical form.

my payment advice and deduction is as follow :

Details of transaction of 20,000 through A/C Number –deleted–.

Transaction to IDFC Bond has done on 22nd October 2010 as follow :

22/10/10 Chq Paid-TRANSFER IN-IDFC INDRA BONDS–deleted– 22/10/10 20,000.00

I did not received any allotment advice. I didnot have application number as it was filled in by HDFC -Vanijya Kunj- Gurgaon ( Haryana) by Deputy Manager – Priyanka Gautam.

Unfortunately the HDFC guy is unable to help me.

Is there a way to address above issue ?

How can I get IDFC bond advice letter delivered to my address as mentioned in the application.

PLease advise action. as Being slalried class person I need to submit Investment details for finanacil year 2011-2012

Regards,

Naresh Dholakiya

9911855839

Gurgaon

I’m sorry to hear your situation Naresh, and it looks like you don’t have any evidence that you bought the bond? Did you receive anything at all? I don’t know of a way to resolve this; I hope someone more knowledgeable can leave a reply to you.

You could try talking to IDFC reps, though I think you might have tried that route earlier.

P.S. I have deleted check and bank account details from your comment.

Hi,

I applied for the IDFC Infrastructure bonds and got 2 bonds allotted, but i have not received the physical bonds yet. Before 14th Jan, 2011 i need to furnish the investment details to the company. I would like to get the soft copy or Information slip to furnish the details to company. please help me out!!

Regards

B N Raju

Hi,

I applied for the IDFC Infrastructure bonds and got 2 bonds allotted, but i have not received the physical bonds yet. Before 14th Jan, 2011 i need to furnish the investment details to the company. I would like to get the soft copy or Information slip to furnish the details to company. please help me out!!

Application No : 53637244

Cheque No : 928988

Amount : Rs 10,000.

Regards

B N Raju

Dear B. N Raju

You can check on the following

Here is how you can generate an online Certificate for their IDFC long term infrastructure Bonds. Karvy people have been pathetic with the data entries and you will be shocked to see the addresses they have entered. But all you need is your 8 DIGIT IDFC Long Term Infrastructure Bond Application Number. The steps are given below:

* Go to http://karisma.karvy.com

* Click on the Link that says “Click for Karisma Home Pageâ€

* On the page that open click on the image “New! IDFC Bonds – Allotment Adviceâ€

* In the new page that opens, enter you Application number and Submit

You should have your certificate. Hope this helps all the people.

Regards,

Naresh B Dholakiya

Thanks Naresh.

Thank Naresh and Manshu for your information. I checked my status and found 2 bonds are allotted but they have mention my previous address from where i have made my PAN card, rite now am staying in Bangalore and mention current address in registration form… plz guide me!!

So, since you have the allotment advice that will serve as tax proof, and now are you looking for guidance to change address on PAN card?

Here are the instructions to do that:

https://onlineservices.tin.nsdl.com

i hve received IDFC tax saving bond in my demat a/c , i wnt bond certificate for income tax purpose …….How to get it??? plz suggest

Take a look at this comment Santosh:

https://www.onemint.com/2010/10/12/idfc-infrastructure-bonds-faq/comment-page-2/#comment-117158

This describes how youc an get the allotment advice.

Hi,

I have invested in IDFC infrastructure bonds using my DMAT account with Sharekhan. I have applied it online and I did not get any application number for the same. How can I get a soft copy of bond certificates?

By entring the PAN number at the link http://mis.karvycomputershare.com/ipo/

it gives error.

Please Advise.

Thanks!!!

I have puchased 4 no. IDFC Infrastructure bond (80CCF) on dt. 18th , october ‘2010 for amount of rs. 20,000/- through demate a/c no. 8501171819 of icicidirect.com vide transaction ID no. INE043D07278 my application no. is kindly proved my bond certificate proof for onward submission to my office for tax benifit through e-mail add. [email protected]

tanks I received my IDFC bond certificate by your suggetion

Appreciate your reply Vijay, and thanks to Shubho for sharing this link.

Mr.Inder,

Kindly get in touch with Sharekhan,as you have to get an allotment or an acknowledgement no. when you apply whether online or physically.

New IDFC bond has started from today. Can I avail tax benefit and how I can get certificate for this bonds.

Yes, you can avail tax benefit Vikramjit. To buy you will have to contact an agent, go to a bank branch selling it or go to an agent.

i m also want to take IDFC band . how can i get that?

Anuj

Through a trading account like ICICI Direct, from a branch that’s selling it or an agent who is selling it. If you don’t have a trading account then try out a HDFC or ICICI branch close to your home to see if they have it there, or they’d at least be able to tell you where to go.

Thanks Manshu

Does people who applied to these bonds through their demat accounts get hard copy of the bond or do they get only the allotment advice?

They get the allotment advice in their mail Suresh. As good as the hard copy I’d say.

Can I avail tax benefits if I invest these IDFC bonds in my wife’s name. Thanks

I’m no tax expert Arvind, but so far I haven’t come across any evidence that shows that tax benefits can be availed even when bought on wife’s name. So, I’m not sure what the answer to that is.

Hi Arvind.. You cannot claim the tax benefit by investing in IDFC/REC Infra Bonds as only that person can claim the tax benefit in whose name these bonds are.. You can make your wife as the second holder though for this investment.. If I’m not wrong “Life Insurance” is the only place of investment where something of this sort is allowed.. 🙂

For more info about IDFC/REC Infra Bonds, the tax benefits u/s. 80CCF or to invest (Delhi, Gurgaon & Noida only plz) you can call us at 9811797407

Dear all,

I have an query:- I have demat accounts in India Bulls and Reliancemoney. My question is weather i can buy these bonds directly through these platforms online without going to the vendor for purchasing these bonds.

Pl suggest

Ram Kumar

Ram – You can directly buy them through ICICI Direct, – I don’t know if India Bulls or Reliance Money provide that feature or not. You can call the helpline and see. If they don’t then you can fill up an application at a bank branch and submit it there. I think by vendor you mean an agent or IFA (Independent Financial Adviser), and buying them through a bank branch will help you do that.

Thanks for your kind reply. I’ ll contact to the service provider then.

i want to invest in infrastructure bonds, please guide me, and offer available in the month of jan/feb 2011

REC & IDFC Tranche 2 are open, so you can invest in either of them based on your need and availability of these bonds to you.

i want to invest in infrastructure bonds, guide me, about bonds available in coming months jan/feb 2011

Ashok: In the coming months, you can expect bonds from LIC, but then, there has been no announcement on their opening date yet. REC is already open till 28th March and IDFC is supposed to close on 4th Feb.

In my opinion , since LIC , if it does come out with infra bonds will not be offering anything more than the current series of bonds are offering.

Not sure about LIC but PFC, IIFCL, IDFC (again in March), probably L&T (again in February) are planning to come up with Infra Bonds in the coming months… So its raining Infra Bonds in the next two months… 🙂

But plz dont remain sleeping till the last time as its not going to help you in any ways. Is it ?? Just get up, do your tax maths now & determine whether you need to invest in these bonds to save tax or not. If you need to, then just go for it as it is a good tax saving investment especially for people falling in 30.9% or 20.6% tax bracket as it adds at least 6.18% p. a. (30.9%/5) or 4.12% p.a. (20.6%/5) to already quoted 8% interest rate. It makes the returns to be over 14% or 12%, but that is before you pay tax on interest earned or Capital Gains Tax to be paid if you sell these bonds on NSE/BSE after 5 years.

For more info about IDFC/REC Infra Bonds, the tax benefits u/s. 80CCF or to invest (Delhi, Gurgaon & Noida) you can call us at 9811797407

Dear sir i have invested IDFC infrabonds four numbers vide application no 52593832 vide cheque no 109678 drawn on ICICI bank visakhapatnam branch till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

my address,

VMCH VINAYA KUMARI,

Lecturer-chemistry govt polytechnic NARSIPATNAM,VSP DT,

pin 531116

You can see the link where you can obtain your statement in comments above. No one here is going to send you the bond certificates. You can use that link to do it yourself.

if any body required Infra Bonds processing, please call me at 9241545354 (for bangalore only).

Manshu do you expect Tranch 3 for IDFC ?

Yeah, I think they I read that they are going to come out with a new issue in March.

VMCH VINAYA KUMARI January 28, 2011 at 7:20 am

Dear sir i have invested IDFC infrabonds four numbers vide application no 52593832 vide cheque no 109678 drawn on ICICI bank visakhapatnam branch till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

my address,

VMCH VINAYA KUMARI,

Lecturer-chemistry govt polytechnic NARSIPATNAM,VSP DT,

pin 531116

Dear All,

See the pathetic face of the KARVY, I have requested trough mail ,lot of times to send me physical cetifcates. They informed that it is sent thtough registred posts, I have checked with PO but PO didnot receive any posts. In this case I have not have certificates nor post offcie have then where it has gone ?.

In registered post if somebody didnot not receive the post will go automatically to the sender, but KARVY didnot have returned post/Certificates.

Afetr so many mails, they sent me format typing information on Rs 100 -Indemnity Bond. Now question is that why should I pay and do these exercise . It is missed by KARVY and not me and KARVY is at fault..

I want to consult the authority which addresses such cases, please advise as I want KARVY should learn a lesson for such misdeed.

Regards,

NARESH

Naresh – do you have your application number? Karvy had this link where you could enter the application and download your allotment advice, so you really don’t have to go through all these hassles if you have that.

Try this link out:

http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

Manshu- That link does not work for Tranche 2, it seems.

That was originally meant for tranche 1, and I don’t know if they have released something else for Tranche 2 yet.

Manshi, I searched with my Application no, no result after that i tried with my PAN then i got error like “file does not begin with ‘%PDF-‘ “

Thank Manshu, the link is very helful

Hi,

I have applied thru Demat 4 earlier transche in oct 2010 and got them in my demat form [sharekhan brkerage]

Now can I convert them into physical form, as 5yrs is too long 4 me to continue my demat acct. Is there any prcedure 2 infrm Karvy/IDFC

Yeah there is an option to rematerialize them and you can go to Karvy to get the necessary paper work done.

Thank you Mansu,

I have downloded the copy from the site as suggegested long ago. Now concern is that after 5 years I may need original one for redeeming the bonds. At that time Photo copy may not be valid.

Do you have any idea?Please let me know.

As KARVY has not sent me the physical bonds, now without my fault I have to go for trouble.

Regards,

Naresh Dholakiya

They should redeem it at the time and credit your bank account (the one in which they pay the interest annually). I’m not sure if you really need the physical certificate for anything at all.

Please check with the Karvy guy to be sure though.

i have invested in IDFC infra bond in 2/2/11 but i couldn’t get the certificate till now.secondly i am not living at the place which i have mentioned in the application form what should i do in the situation if the certificate return back.please guide me

Do you have the application number Aaakash – you can just download it online if you have that.

invest in IDFC infrastructure bonds.

interest rate of 8.25%

tax deduction u/s 80 CCF

For details & subscription in PUNE contact me on 9762847432 (Rishiraj)

I had submitted one application for IDFC Infrastructure Bond valued Rs 20000/- in the month of OCT-10, to ICICI Bank, Vashi. The amount has been debited from my SBI, Konkan Bhavan S/B A/C on 25th Oct,10; however till date i have not received any bond/ certificate from IDFC. Unfortunately i have missed out the application serial no. On checking at ICICI Bank, Vashi, they had informed their position being to be just of a receiver and forwarder, and they are of course right. Meanwhile i have also sent a mail to IDFC Manager, informing my predicament. What can be the pragmatic solution; incidentally also have to deposit copy of bond / certificate to my employer in order to claim the I-T exemption for the amount, which actually is now overdue.

So, is this for Demat or physical copy? In case this is for Demat then you can look at your Demat account and see if it has been credited there.

If it’s for the physical form then that makes it complicated but I think one way of dealing with this is to approach Karvy, and establish communication with them. They might be able to pull it out from your PAN number.

I have been allotted four bonds and till date i have not received the Bonds.

The link,

“http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp”

is showing the bonds.

Will the same be considered as Bond or anything else will be posted to the mentioned Address.

I invested Rs.20k in IDFC Infrastructure bond on 22-Oct-10 & did not receive the bond certificate like many other, who posted their queries here. Through the Karvy site mentioned in the response by a gentlemen I got the details of my allotment, which I have downloaded & will submit to my employer in support of my declaration that I have invested Rs.20k in Infrastructure bond for taking benefit on IT.

On the pdf file which I got after submission of my application number, there is no mention of my address. So what I should do now to obtain the original copy of bond certificate. I have alse mailed to their concerned id, mentioned on their website, but there is no response. Please advise what I should do….

If this is in physical form then you should pursue this and get the address updated correctly. I’m not too sure if it will make a difference if the bonds are in demat form.

I WANT TO PURCHASE INFRA STRUCTURE BONDS NOW. WHAT TO DO ?

DWARKA,

NEW DELHI

Hi Mr. Anil Kumar

Just approach ING Vysya Bank, Janakpuri Branch for PFC Infra Bonds or contact any Investment Services Provider in Dwarka to apply for Infra Bonds of your choice.. If you can visit our office in Lajpat Nagar or any nearby place we’ll get it done for you.. For more info: # 9811797407

if any body required Infrastructure Bonds processing, please call me at 9241545354 (for bangalore only).

Hi, I purchased IDFC infrastructure bond last year through sharekhan. I am very new to sharekhna. Ca anyone guide me how to check my bonds on sharekhan side. Thanks in advance

IS IDFC A GOVT OWNED CO?

IS IDFC A GOVT OWNED CO?

Hello, I have applied for IDFC Tranche-I (Appl. no : 22666641) with demat option and I have got acknowledgement email. The amount Rs.20000/- has also been debited my IDBI account. But so far demat a/c is not been updated with these details and would like to know the status of this.

I also need to submit income tax proof in my company and how do I do as I applied with demat option. Do I get any physical copy of this even for demat option?

Pl help.

WILL WE REQUIRE DMAT FOR REDEMPTION OF INFRA BOND OR IS IT REQUIRE TO HAVE DAT FOR BUY BACK ACTIVITY?

No, you won’t need Demat if you bought the bonds in physical form in the first place.

Dear sir i have invested 20000Rs.in IDFC infrabonds four numbers vide application no 17998230by cheque no.000003 drawn on KOTAK MAHINDRA BANK,MATHURA (UP) branch on date-03.02.2011 till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

my address,

J.P.Sharma

BB/35, Chandanvan, Phase-1

Mathura (UP)

PIN 281001

Dear sir i have invested 20000Rs.in IDFC infrabonds vide application no 17506131 by draft no.777712 drawn on ING VYSYA Bank Ltd BHUBANESWAR branch on date-08.03.2011 till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

Name -BHAGABAN SAHOO (JE)

NH Sub Division,BOUDH

BOUDH

PIN- 762014

Mob- 9437136631

Mail [email protected]

Dear Sir,

Subject: Change the name of Bondholder

Bond Details: IDFC Long Term Infrastructure Bonds(2011-2012)-Tranche 1

Registered Folio No: IDD0236579

Certificate No: 236579

ISIN: INE043D07781

Name of Bondholder: PATEL DIPAKKUMAR MANEKLAL

No Of Bonds: 4

Distinctive No(s) : 0000139113-0000139116

My father was holding the above referred bond & i regret to inform u, he has expired on 21st September 2012, so now i would like to transfer bond in my favour.

Kindly inform me the procedure to under taken.

Should you need any further information or need any clarification,please do let me know.

Regards,

JAY DIPAKKUMAR PATEL ( Son of late shri PATEL DIPAKKUMAR MANEKLAL)

C-S/2 Rajvi Complex,

Sonal Cross Road,

Memnagar,Gurukul Road,

Ahmedabad-380052

Gujarat,India

Mo. No:-9558466750

I am sorry to hear about your loss, but I can’t help you. This website is like a newspaper. You have to contact IDFC to get this transferred to your name.

Can we maintain the records of INFRASTRUCTURE BONDS on one website say for e.g. MONEYCONTROL/ BLUECHIP?

Requst to ammend of IFSC code in my SB a/c recorded in L&Tifra St. bond 2011-12 (Application no.11319044 dated 08th Dec 2011) Sir i purchased 20Tranche 1 bonds with face value of Rs.1000/ total amt.Rs20000/ on 8/12/2011 during my posting in Mumbai,mentioning SB a/c no.20872143902 IFSC code ALLA211975.On my superannuation on 31/01/2013 I shifted to my native place SIKANDRABAD(UP west).Consequent upon which my SB a/c wes also tfd.to nearby (Bulandshar) branch resulting change in IFSC code.I therefore request your goodself to kindly amend IFSC coode from AllA211975 to ALLA0210259.reading SB a/c as 20872143902?IFSC code 0210259 to avoid inconvinence for making payment.Kindly favour at the eariest. Regards

I have IDFC bonds bought in 2010. When the same will be traded in exchange ??

I got IDFC Infra Bonds Trench2 & 3, I have to change my address. Please inform to whom I have to send (mailing address and contact No.)request to change my address.

Dear Sir,

I have received a message from CDSL TX that credit in account under CA arrangement on dated —. What does this means.I have checked with my broker who told me that bonds are still shown under lock and i think IDFC has redeem the bond before maturity date.

Please help to resolve my query

I HAVE BEEN ALLOTED 4 IDFC LONG TERM INFRA BONDS TR-1 SR1 2011-12 MY CLIENT ID IDD 0023146 & I RECEIVED BOND CERTIFICATE ALSO IN 2011-12 .

I GOT MARRIED IN 2015

MY PROBLEM IS HOW TO EFFECT CHANGE NAME ON BONDS ISSUED TO ME SINCE NAME CHANGE IS DUE TO MARRIAGE.

KINDLY LET ME KNOW FORMALITY & DOCUMENTATION REQUIRED

VIA MAIL TO ME

I have 4 bond with the application no 18389686. my beneficiary a/c is IDB025081. Please let me know the procedure to redeem the bond. i will be thankful i could receive the answer on my mail id.

thanks.

Hi,

I have 2 L&T Infra Bonds, which will mature in December 2016. Please let me know where and how I can redeem them.

There is no mention of how to redeem them.

regards,

Dilip

Dear sir

kindly send me the address of the IDFC infra bond office in Hyderabad where i have to send the papers redemption of the bonds

What is the procedure for getting Duplicate certificate of IDFC bond and what documents needs to be sent for getting the same ?

Dear Sir.

I had bought idfc bond 2011-12 tranche 3. Now if I have to redeem do I have to dematerialize the bond. And if I have to redeem on 2022 have to dematerialize?

Pl leave a copy of reply to mail also.

Thanks very much

Suresh