I just got my hands on the red herring prospectus of MOIL Limited (formerly Manganese Ore (India) Limited), so I’m not quite ready to do a full post yet, but a quick glance shows that the company is on pretty sound footing.

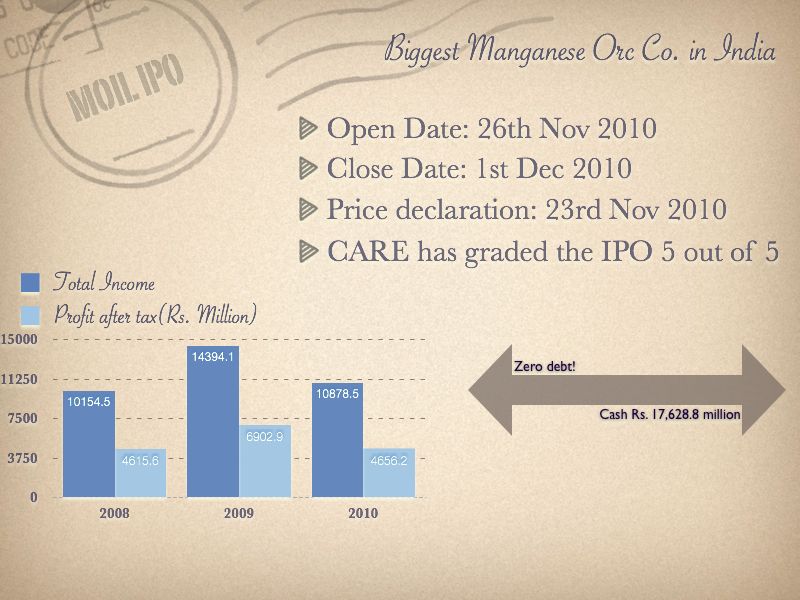

It is the biggest producer of Manganese Ore in India, which is used for steel production, and is a profitable company with zero debt. The MOIL IPO will open on the 26th November 2010, and close on 1st December 2010 for retail investors. The pricing has not been decided yet, and will be declared on the 23rd November.

Here are some vital stats of the MOIL Limited IPO.

I will try and do a full review later, but it will probably make more sense to wait till the pricing is out because other than that the company looks to be in pretty good shape.

Update: Since the pricing is out, I did a more detailed post on MOIL IPO here.

Hi Manshu,

The company is first of it’s kind to be listed on the bourses . Hence it is not straight forward to compare MOIL’s performance with it’s peers.But is it a fair idea to compare the company’s growth with the steel industry as the steel industry is a major market for manganese ore?Finally is the price of the share fair ?

Regards,

G

I guess one could do that, the EPS for last year has been ~ 27 bucks so that makes it a P/E of about 14. The market is a bit volatile these days, so if the broader market falls then that will obviously have an impact on MOIL’s price post listing.

So you need to think about these things before investing. If I see any good article stating their position on what you should do with the IPO I will share it with you, but I personally don’t get into that kind of thing here.

Is this IPO priced good?

Anyhow considering COIL, it is worth to go for this.