Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

Update: There has been a change in terms, and you can now invest in these bonds in physical form also. Here is the link to relevant IFCI page.

The issue has been extended till January 12 2011

The IFCI Infrastructure bonds are the latest infrastructure bonds to be issued with the 80CCF benefits, and are the second tranche from IFCI, which issued them earlier this year as well.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

The issue has been rated “BWR AA†by “BRICKWORK RATINGS INDIA PVT LIMITED†which means that they are rated as instruments with high credit quality.

Here are some other details about them.

IFCI Infra Bond Options

There are 4 series that you can choose from with a combination of getting interest paid annually, cumulatively, and having a buyback or not.

Here are the details of the 4 series.

| Options | I

Buyback & Non – Cumulative |

II

Buyback & Cumulative |

III

Non Buyback & Non – Cumulative |

IV

Non – Buyback & Cumulative |

| Face Value | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 |

| Buy Back Option | Yes | Yes | No | No |

| Coupon | 8.00% per annum | 8.00% compounded annually | 8.25% | 8.25% to be compounded annually |

| Redemption Amount | Rs. 5.000 | Rs. 10,795 | Rs. 5,000 | Rs. 11,047 |

| Buyback allowed after | 5 years | 5 years | NA | NA |

As you probably noticed IFCI didn’t show yields in the same manner as L&T and IDFC, where they took the tax benefits based on various slabs and showed yields at different tax slabs and interest payments. This is probably a good idea given the various limitations of the way those yields were calculated.

How does the IFCI infrastructure bond buyback option work?

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

Open and Close Date of the IFCI Infra Bond

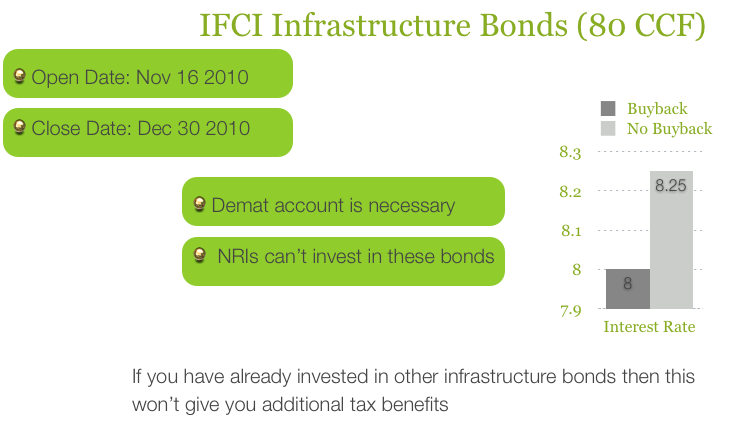

Opening date of the issue: November 16th, 2010 and Closing date of the Issue: December 31st ,2010. They can close earlier as well if their entire demand is met.

Is a Demat account necessary to apply for the IFCI Infra Bond?

Yes, right now it is necessary to have a demat account to apply for these bonds as they won’t be issued in physical format. Even the IDFC bonds started out as Demat only, and were later on changed to allow physical forms also. The target sum to be raised by IFCI bonds are much lesser than the IDFC ones, so they might not feel the need to change and include the physical format as well.

Will tax be deducted at source from the interest payment?

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

Will the bonds list in a stock exchange?

Yes, IFCI plans to list these bonds on the Bombay Stock Exchange (BSE), but from reading the information memorandum it seems to me that you can only sell these bonds after the lock in period of 5 years.

Can NRIs invest in the IFCI Infrastructure bonds?

NRI customers are not eligible to apply for the issue.

What if you have already bought another infrastructure bond?

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

How can you buy the IFCI infrastructure bonds?

You can buy these bonds through your broker like ICICI Direct, or can submit an application form in one of the bank branches that are accepting them. The information memorandum lists down a large number of HDFC bank branches so you can go to one near your house, and they might be selling the bonds or can at least tell you where you will get them.

Should you wait for another issue?

This issue is 50 basis points, or half a percentage higher than similar L&T bonds issued earlier, and reader Amit Khandelia actually left a comment about LIC coming up with a future issue, and possibly even offering term insurance free with their offer.

IDFC has also indicated interest in coming up with a future issue, so they might come up with another issue too.

The advantage with waiting is that you may get a slightly higher interest rate, maybe half a percentage or one percentage more, but as I said earlier if you’re able to wait and get a bond which offers a percentage higher, and you invest the maximum Rs. 20,000 in it – that means an additional 200 bucks extra in a year; what is that worth to you? How many hours of Googling and speculating is it really worth?

The advantage of getting it now is that you can get this one thing done with, and have plenty of time to receive the certificates for tax proofs or whatever else you need.

This is a personal decision really, but something worth keeping in mind the next time you speculate on whether you should wait or go ahead with it.

Please leave a comment if you have any questions or observations.

Does anyone know if the earlier bonds from L&T and IDFC were sucured? IFCI bonds state that “Unsecured” Bonds.

Even the rating AA- (Investible) is provided by new organisation BRIC work Rating India. Is this a new Rating orgn? Why havent they done by reputed organisations like ICRA / Crisil or any other famous organisations.

Please suggest.

The earlier bonds were also unsecured, and is quite likely that future issues of these type of infrastructure bonds be unsecured as well.

As for the second part of your question – I don’t know the answer to that.

There will be more issues in the future, so you can wait for them if you’re not comfortable with this one.

I have a demat account in SBI which I am using for online share transactions.Can I use the same for infrastructure or shuld I create a new account in HDFC .What will be the am ount to start demat account

Yes you can use the same demat account, in fact you shouldn’t spend more money on adding another demat account for anything now. Just one will do for these or any other bonds that come out in the future.

Here is a post about Demat account basics in case you’re interested:

http://www.onemint.com/2010/12/03/what-is-a-demat-account-and-how-can-you-open-one/

Pl clarify the following points:

What is the maturity amount I would get on an investment of Rs.5,000 with cumulative and buy-back option after 5 years?

How to get the Application form for this scheme?

A C S Kumar

Rs. 7,347 in case of buyback at the end of 5 years.

If you use a broker like ICICI Direct then you can apply through them. Else go to the bottom of this page and you will be able to see links of application forms, and other details:

http://www.ifciltd.com/IFCIBonds/InfrastructureBonds/CurrentIssue/tabid/218/Default.aspx

But it is mentioned redemption amount as Rs.10795 after 5 years as against your figure of Rs.7347 . Which is correct and how ?

Pls clarify

10,795 is the redemption amount, and the redemption will happen at the end of 10 years.

After 5 years, they allow a buy back, and if you exercise the buyback after 5 years then you’ll get 7,347, so that’s the difference VeeTee.

1)What is the maturity amount I would get on an investment of Rs.5,000 with cumulative and buy-back option after 5 years?

2)How to get the Application form for this scheme?

I looked at icicidirect and the IFCI bonds all have maturity date as 31-jAN -2021 but you have mentioned Series 1 and Series 2 have a buyback option of 5 years. Whats the difference. Also if I opt for cumulative option Series 2 do I have to wait 10 years to get my maturity amount.

How does this work? Quite confusing

Series 1 & 2 have a slightly lower rate of interest, and that’s because they give you an option to sell your bonds back at the end of 5 years.

This is just an option, so if you don’t exercise it, your bonds will mature in ten years as you mention in your comment. In lieu of a lower interest rate you get an option to get your money back faster.

You will have this option if you opt for Series 2 also; the only difference is that you will not be paid interest annually, and of course your maturity amount will depend on how many years have lapsed.

So this means that amount would be taxable as long term capital gain, so accordingly we will get the benefit of indexation as well?

That’s my understanding, but I’m no tax expert, and since I didn’t find anything about this specifically I am not sure about it.

In case of non buy back and cumulative option, whether tax on interest has to be paid on yearly basis or after the expiry of ten years

Since you won’t get any interest on an annual basis, you won’t have to pay tax on it annually Deepika. At the end of the tenure you will have to pay capital gains taxes, but I’m not entirely certain about how this will work, and what the rates will be.

It is understood that for investing in your current infracture bonds, one needs to have a demat a/c. Further, I presume that the bonds will figure in the demat statement, along with shares of different companies, issued periodically by the demat agency. Now, under the buyback option, does one have to approach a share broker to dispose – off the bonds at the end of 5 yrs? If so, does’nt it involve payment of brokarage charges?

From reading through your comment it appears to me that you are mistaking this for the official IFCI website, so let me point out that this is not the IFCI website, but a blog not affiliated to them.

To your question – you don’t need to approach a share broker to exercise the buyback option – you can write to the company, and they will execute the transaction.

Here is the relevant text from the article:

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

My tax liability is 12,000/-. If I purchase 15,000 bonds, will it make my tax liability to nil? Or whether I have to purchase 20,000 bonds?

No Mr. Rao, that’s not how it works. The way this works is that the bond amount will be deducted from your taxable income only, and not your tax paid. So if you are in the 20% slab, and buy bonds worth Rs. 20,000 then that Rs. 20,000 will be deducted from your taxable income, which was going to be taxed at 20%, so you will save Rs. 4,000 if you buy bonds worth Rs. 20,000 if you are in the 20% slab.

If you have not done any other investments under the 80C limit then you can try exploring options like PPF also.

Good information.

@ Sriram – You should have got the bond certificate by now. Guess you can take a print of your demat statement from ICICI direct and use it for claim till you get the certificate. I’ll check if I can find the point of contact for IFCI bonds and pass on the info as soon as I get it.

If you wish to invest in these bonds please let me or feel free to connect with me.

-Imran

99200-67880

I applied 4 bonds in IFCI TAX EXEMPTION LONG TERM INFRASTRUCTRE BOND – SERIES I on Aug 2010. I am yet to receive bond certificates from IFCI. I applied through ICICI direct. They are saying IFCI will be sending to me for last 2 months. I don’t know when i will receive it. I have send an email to IFCI no response. I need bond certificate for payment of money and tax exemption claim. Please anybody guide on this aspect.

Regards

Sriram

Did you apply for physical bonds or for Demat? If it is for Demat, you won’t receive the physical certificates. You should receive the allotment advice though.

can i purchase the IFCI infrastructure bond II on my wife’s dmat account?

I think you’re interested in knowing if you can get a tax exemption, even if the bonds are bought in your wife’s name…is that correct?

I don’t think that’s possible though.

IFCI Tax Saving Long Term Infrastructure Bonds– SERIES II Save Tax u/s 80CCF — Pune

For More Details and visit on http://www.lifins.in or call on 9822403407 – Lifins Financial, Pune, Maharashtra, India.

our company is S C C L

Ask your company account to get his funda right. These bonds are tax exempt as per the Income Tax act. You company CA should clarify to the accounts department.

I have been invested Rs 20000 in your IDFC infra bonds in november 2010. But our company is not accepting 80ccf cliams/deductions. please stop all this type of cheating by IDFC

What exactly did your company say? This is a legitimate tax deduction that they should be able to get you when the tax return is filed.

Hi,

How is IFCI bond, as comparison to bonds issued by IDFC and L&T. I am talking comparison in perspective of rating, company overall, its future plans and projects.

I don’t know how to compare one with the other, but those issues were rated well by the credit agencies, and so is this one.

you mentioned that these bonds will be listed on BSE, but can only be sold after 5 years. then, what’s the point of listing these?

If you can sell it on the exchange then you don’t have to wait for November to exercise your buyback, and if the bond price is higher than the exercise price then you’ll benefit. If not, then you can just wait to exercise the buyback.

So, the benefit of listing becomes shows up when you compare it with what would have happened had these bonds not listed at all.

Are Buyback price fixed (inline with interset amount) or decided by them after lockin period?

Can the bond be sold BSE after lockin period, even if we have purchased it in physical form?

Yes Mayank, buyback prices are fixed, and that’s how they tell you indicative yields.

I don’t think you’ll be able to sell them on BSE if they are not dematerialized, but I’m not sure about it.