I’ve been asked to write a post about the best mutual funds in India several times, and I’ve been avoiding that exercise for long because it’s just so difficult to nail the right parameters, and get information on the fund managers and things like that. However, I’ve decided to take a crack on giving my opinion on the best mutual funds since there have been quite a few emails about it, but before that let’s take a look at why any such analysis from me or anyone else should be viewed with a little bit of skepticism.

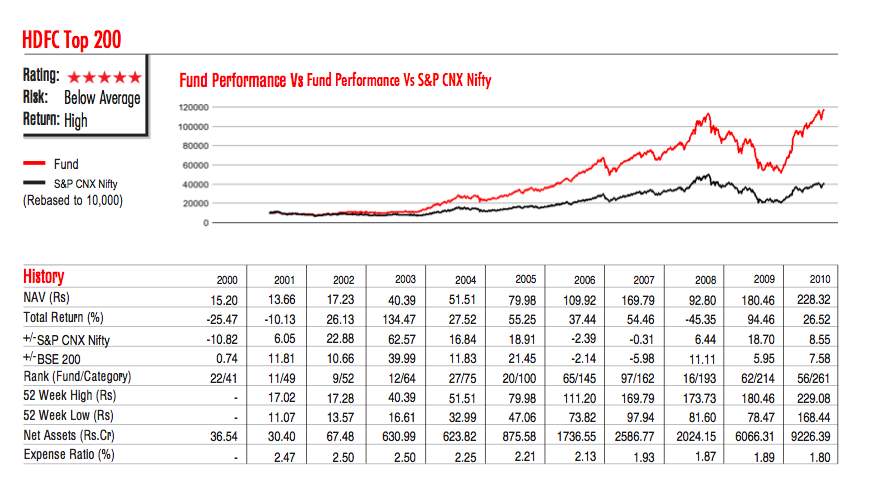

The HDFC Top 200 Mutual Fund is one of the better mutual funds in India. It has a very long track record as it was started in 1996, and has done tremendously well during that time. A snapshot from Value Research’s fund assessment very clearly shows why it is such a favorite.

Just look at the red line go – isn’t it wonderful?

A closer look at the numbers reveal that the fund is a consistent performer, and has done better than its benchmarks consistently, and is quite a good fund. Even in 2008 when there was blood on the streets this fund managed to do slightly better than the benchmark. The fund has returned 26.48% since inception, and for a fund that has been around since 1996 this is quite a great number.

There is just one thing I’d like to point out with these returns. Look at the Total Returns (%) row and then look at the number for 2003 – the fund hit a jackpot in 2003 with a 134.47% returns, which was 62.57% better than the benchmarks, and that has had a great role in helping its great returns since inception number. Make no mistake – the fund has done better even without that great jump, and has returned a pretty good 26.56% CAGR in the past 5 years without having a big bump in a single year.

But the point I am trying to make here is that even with consistent performers a good or bad year can really impact the overall profit, so when you consider investing in a mutual fund please keep in mind that there may not be a bumper year in your holding period, or the mutual fund may suffer a bad year when you hold it, and that may impact your returns adversely.

The mutual fund has a NAV of Rs. 230 or thereabouts today, but if I replace that one great return in 2003 with a slightly less magnficient number say Rs. 30 (which is arbitrary but still quite high) instead of 17.23 to 40.39 – the NAV today would only be about Rs. 170 or so.

| Year |

NAV |

Total Return |

| 2000 |

15.2 |

|

| 2001 |

13.66 |

-10.13 |

| 2002 |

17.23 |

26.13 |

| 2003 |

30 |

Reduced from 134 |

| 2004 |

38.25 |

27.53 |

| 2005 |

59.40 |

55.27 |

| 2006 |

81.64 |

37.43 |

| 2007 |

126.06 |

54.40 |

| 2008 |

68.92 |

-45.32 |

| 2009 |

134.03 |

94.46 |

| 2010 |

169.58 |

26.52 |

Now even that is a good number, but not as spectacular as its actual returns.

And this, my friends was the longest – past returns are no guarantee of future returns disclaimer you’ve ever read.

Don’t you people just love that you know me.

wow. Thank you sharing such helpful information.

It is worth to be shared. Thank you.

dear Manish

Excellent analysis. very useful.

awaiting your analysis on best balanced mutual fund also.

thanks.

Ramesh

Thanks for your comment Ramesh – I had actually forgotten all about this, thanks for the reminder.

As always another great blog post. If people want to know more about the fund manager behind the HDFC 200, Forbes India just recently published an article about Prashant Jain:

http://business.in.com/article/boardroom/what-is-prashant-jains-secret/15812/1

As always another great post. If people want to know more about the fund manager behind the HDFC 200, Forbes India just recently published an article about Prashant Jain:

http://business.in.com/article/boardroom/what-is-prashant-jains-secret/15812/1

Thanks for sharing that profile Manish; makes for a very interesting read, and also good to see that he is concerned about size yet.