This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

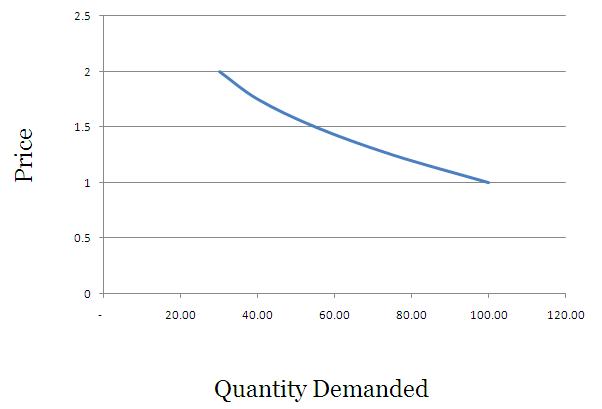

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

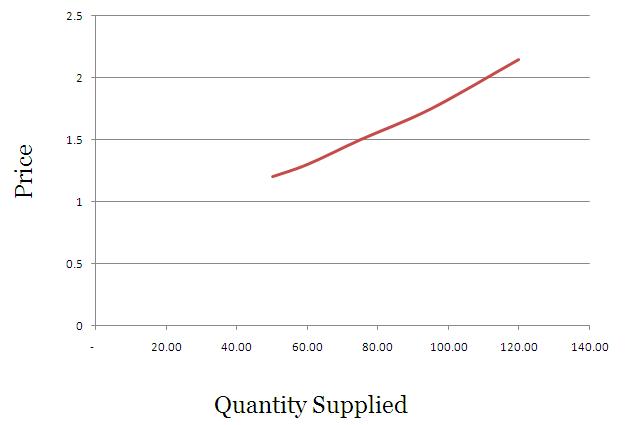

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

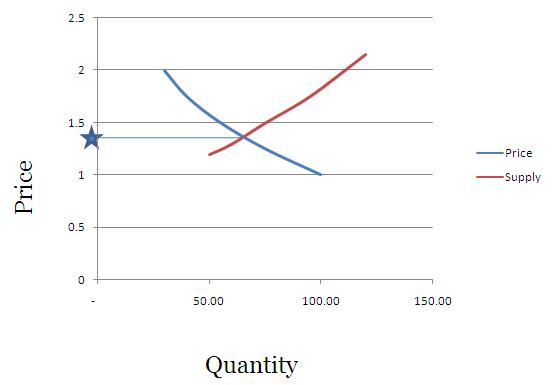

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

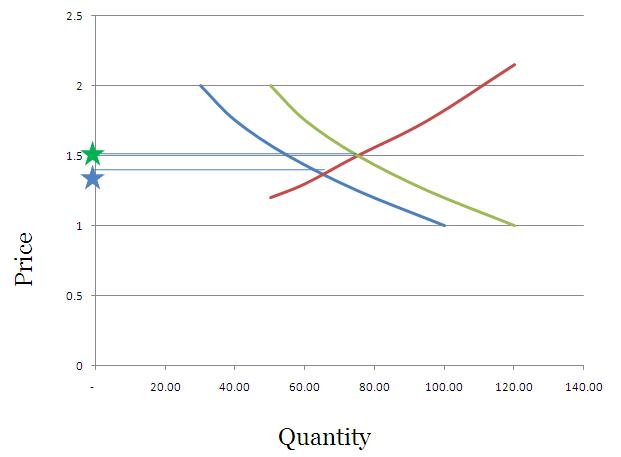

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

I LOVED IT VERY MUCH…THANKS….

You have clearly brought out how printing excessive money is counter productive, but not when it is excessive or how much should the government print. Please throw light on that.

Good idea for a future post. Thanks for the suggestion.

Very good article.

@Tanjil Kamal,

I agree with you. The amount of money supply increased should be equivalent to the goods and services produced in order to maintain the balance. For expanding economies like India and China, it is natural that money supply increases.

Noble laureate Milton Friedman has given “K-Percent rule” saying the the amount of money printing shall be equivalent to the GDP growth

Hi manshu,

this information has really helped me lot in understanding this demand supply and price.

thanks .

Keep posting.

Really good

Thanks.

Hi,

Thanks for this!Now i know understand why zimbabwe’s economy was in doldrums.But i have an issue here.You say if government prints more money demand will increase and eventually inflation would increase,but can’t government fix a price for all commodities a uniform,static price which would never change,so even if the demand increases the inflation wouldn’t increase it would remain constant.Why can’t government do that and become rich?Why should it let the market to dictate the terms?

Petrol prices are a good example of why this doesn’t work. If you look at petrol prices, they are fixed by the government and the government subsidizes a large part of that price since the price is less than market price. This is of course not a free lunch because when the government subsidizes this they incur a deficit since their revenues are less than their expenses and to fund that deficit they have to borrow money which in turn causes inflation.

i used to always wonder why this happens today its clear..thanks a lot

You’re welcome.

i liked the way of presenting the solution of this problem in a very easy n understandable form..now my cinfusion on this is tottaly removed

N if there ll be money thn inflation b ll der but it ll b not a loss to economy coz everyome ll rich

But thn wht ppl can make become rich n there ll b no poverty thn our country ll b developed country

Dear Friends,

Printing more money does not always create inflation and not makes price up. It depends on how the government distributes or spend the money on the economy. Printing or borrowing more money to create more jobs, infrastructure or cure poverty should be the main objective for all government of any country. Yes may be Zimbabwe printed more money but if they would have spend it rightly to produces more crops, job and basic living things then this country would have shine now. I lived in rich country like UK doing labor job for many years and earning around 6 to 7 pound an hour look very insufficient to live in this country. So how they say this one of the richest country of the world? Pound currency is so high? Does it mean everybody who live in this country is rich or well enough? Whereas i am rest of sure there is more wealth in this country’s economy is wasted or not properly distributed. If citizen earn or have less money then they do not buy too many things and all the business in the economy suffers loss and share prices can go down. So, finally if the government print more money to spend it rightly or distribute it properly then it will not create any inflation or price shot up. On the other hand, if the government does not print more money when it necessary the it creates more poverty like it is happening it western countries like UK, Europe & USA.

Many Thanks

If the US$ is as valuable a commodity as the oil and gold in the international market, that means the US can never get into debt!?

They simply need to print more greenbacks and float it into the int market.

ps: I think thats how they got out of the depression.

US did print currency a lot in last 25 years and that is how they have financed their debt , because US dollar is a reserve currency of the world they have misused this status from last 25 years, so US is having a free lunch at the cost of developing countries like India and china, while china already recognized it and are planning to launch yuan as a reserve currency and have been secretely buying gold as alternative to US dollar from last 10 years.

Thanks Manshu for a nice explanation…..but i have a question?

Circulating money in the economy after printing causes inflation because people’s disposable income goes up but if the government prints money and uses it to pay its debt to other countries/IMF, will it cause inflation if so then how?

so clearly explained! thank you!

hi i just want to ask that how can we calculate a money of country ?

according to its gold reserve?

according to the dollar standards?

Printing money does not create wealth, per se. That is fairly obvious.

On the other hand, when a nation under duress is facing either bankruptcy or usurious rates of interest, printing money may be the only way to go.

Abe Lincoln was faced with such a choice in 1861. He approached international bankers for money to finance the Northern Army in the Civil War, and they offered him interest rates in excess of 30%. Abe turned the bankers down and instead authorized Treasury to issue greenbacks. He printed debt-free money. This helped the North win the war. It also gave the nation a uniform currency, which became a very popular standard, replacing all manner of disparate bank notes which had made trade a nightmare.

A similar story can be told with respect to the American Revolution, when Congress authorized the printing of Continentals. Continentals served their purpose of financing the war, but were hyperinflated by the British an an attempt to undermine the revolution.

So, although money-printing does not create wealth, it may serve a valid purpose when a nation is in dire financial straits and in danger of collapse. If the nation survives and prospers, and the printed money is absorbed into the future economy, perhaps it is not so clear cut that the printing thereof did not create some wealth.