This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

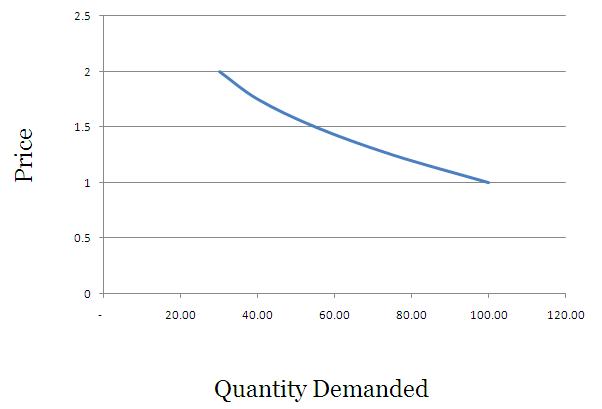

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

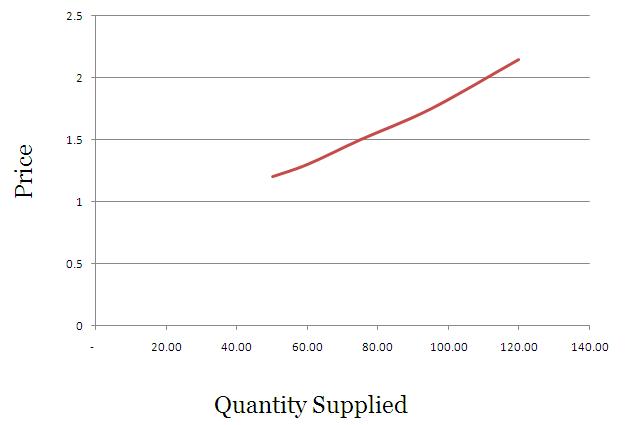

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

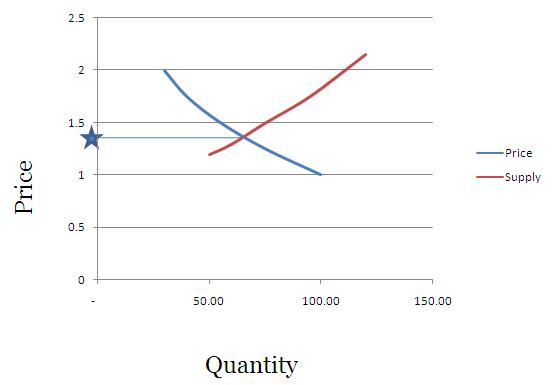

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

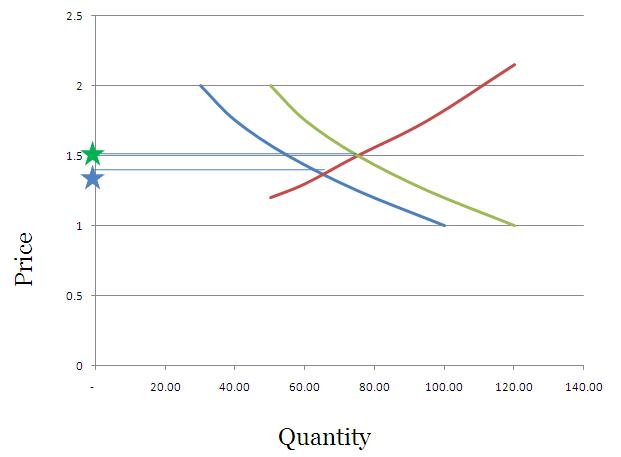

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

Nice article

thank u manshu sir you have given great informations …. it is very usfull

Thank you for your comment.

hi , so this article i read so question is that now if our country print a hell more currency notes instead of giving to our peoples we use this money outside our country so there will b no inflation in our country and we can bring all needed items to our country ,,, so what is the explanation for this ….

Outside our country no one accepts Indian Rupees for exactly the reason that you mention because then everyone will be just busy printing notes and handing it to others.

Can you imagine a situation where India accepts payments for its exports in Zimbabwe Dollars. The same principle applies to INR although to a lesser degree.

Very simple and with clarity! I think more the questions, the better there will clarity!

Thanks………

thanks for above information.

now tell that why does indian govt. borrow money from another country.

and how it is used in india or u may say how it is changed in indian currency…….

what is done with those foregin currency.

It was very much informative……i think most of the people having their doubt on this topic…..

But it seems doubts have been cleared….This ques. & ans. was also cleared some more……

Although your article was very good, but i still have some doubts as a result of your explanation.

Consider a case for example – Indian Gov. prints 1 crore ruppes and instead of distributing it to public, it simply buys US $. Then, as a result India’s ruppe value should increase.

But this is not true.

Can y9ou explain this please? What is the factor that decides the value of a currency with respect to each other?

Looking forward to you answer.

If you buy dollars then the value of dollars will increase right? Because that’s what you’re demanding…whatever has the greater demand will have the greater value also. Do you understand this?

Excellent Article. Its really cleared most of my doubts.

Really informative………

You explain it in such a simple manner, Manshu! Great!

Thanks Anusha!

I always use to wonder on this topic, thanks for this clear enplanation. But on what basis the currency is printed, what is the calculation behind this ? we always here that the RBI or the Govt will bail out this or the other sector, does that mean they will be printing more currency to support the bail out or they will be adjusting from the treasury.

It depends on many factors like inflation, growth, and sentiment in the economy. They need to take everything into account. Bailouts are not simply a matter of printing money and giving it to the company, they are much more complex than that and depend on many factors.

Dear manshu,

But still in any circumstances if the Govt decides to bail out, so will they print new notes to support that or just adjust it from the treasuary.

It’s not that simple that the government asks RBI to print currency and then gives it to someone. Take the Air India bailout for example, the government asked the PSU banks to modify contract terms with them and give them necessary financing. It’s a complex process.

Good job…

Good Article!

I have a query: What prevents any government in indulging in a scam wherein they print loads of extra currency for themselves? How can that ever get detected? After all, its the government that controls the currency printing facilities. So whichever government is in power can print a lot of currency notes and stash them for themselves. Why do they need to indulge in other scams, why not just print some extra currency and keep for themselves. It would also be extremely hard to get noticed, etc.

That’s not possible…RBI prints money and printing money is really just a figure of speech. This is all electronic and it is not possible to carry it out in the way you are describing it.

Simplicity in explaining concepts is at the heart of this article. Really informative.

Gr8 one:)

Just Print more money and give it to Petroleum companaies to recover their losses…

Supply petrol at 40/liter

As simple as it can be explained…….good artice…

So,its the consumers and government who drove the price of units in your case.The suppliers,in order to keep up with the increasing demands started to raise the price because they now require more money to produce more goods.Am i right?

hii….i want to knw dat if lets assume dat there is 7 percent growth in g.d.p and there is 7 percent rate of inflation….then is the country really growing or it is only an illusion….?

The GDP numbers that are reported are adjusted for inflation so the number that you hear like 5.9% last quarter is the growth after taking into account inflation.

very nice topic

i would like to have few clarification

on what basis a country print money?(i,e amt of money that can be printed for circulation)

who monitors this?

if a country would like to print money whom they need to seek approval?

in that petrol eg you said

when the government subsidizes petrol they incur a deficit since their revenues are less than their expenses and to fund that deficit they have to borrow money which in turn causes inflation.

to meet out that deficit why do we borrow money why not we print money?

A simple and an informative article. However, i did not understand the point that “at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30″. Are you trying to emphasize that with the production remaining the same, if people have more money to buy, then the quantity that they get for the same amount of money before and after(inflation) is less”.

The demand and price relationship Arun. At a lower price, people demand more of something, and at a higher price people demand less of it.