This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

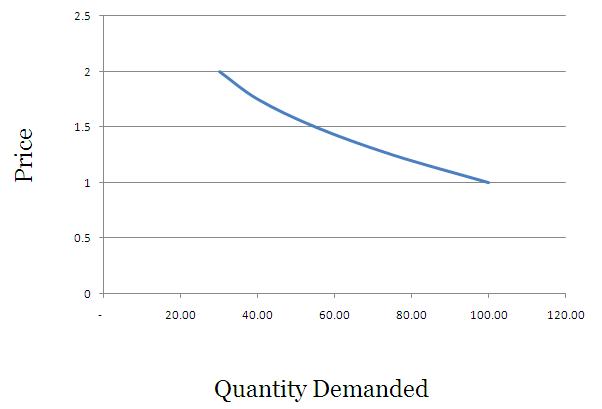

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

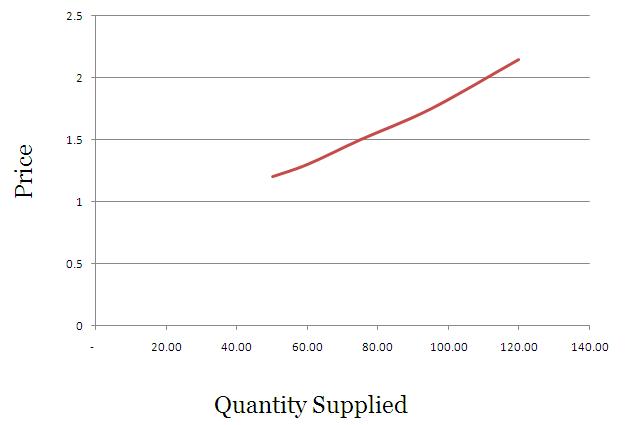

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

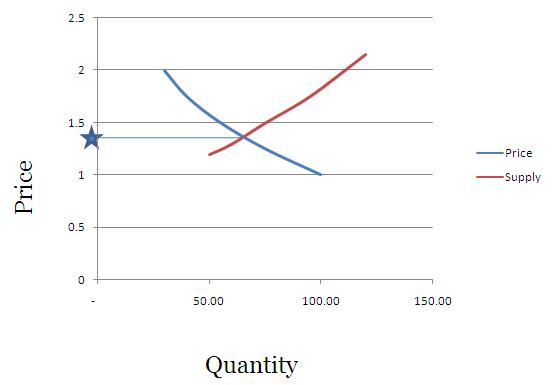

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

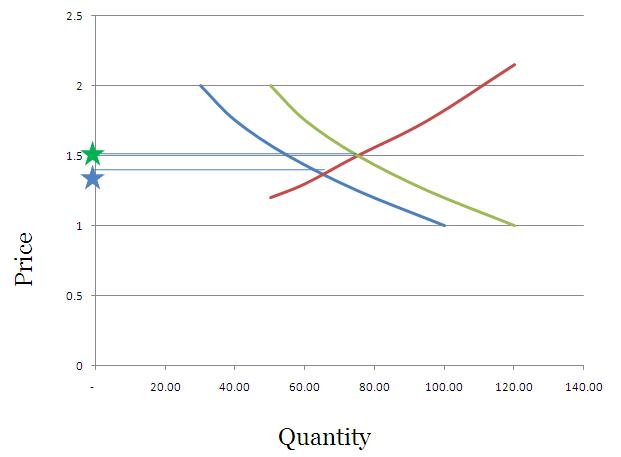

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

Nice Article..thanks a ton..!! 🙂

I had previously raised a doubt(21-12-2012) about USA printing money. Let me say it again.USA has been pumping paper money in to its economy at an alarming rate.Many experts view this as a big disaster as it would lead to fuelling inflation.Yet since the last two years the CPI inflation rate remains at 2%.Why please.This doubt has not been answered so far.Can I expect some responses?

I believe I have answered this question earlier but maybe that was not satisfactory. Here is a link with someone else’s perspective that you may find useful.

http://netrightdaily.com/2012/10/why-hasnt-the-feds-quantitative-easing-led-to-high-inflation/

Hi,

I have read the article and also the comments. Can any body please explain me, if any country can print how much currency it wants and if that causes inflation then why cant a country like India with immense poverty print just a little extra money and distribute it to the poor to at least reduce poverty and at the same time keep inflation under control.

It is actually the same thing, and if you see a scheme like NREGA that’s what the government is doing, and that’s at least partly responsible for the inflation that you have seen in the past few years.

hi,

my doubt is , why can’t issue more currency to buy goods from other countries(ie, imports)…not allowing currency to circulate domestically in the country …this way inflation can be prevented..

plz c;arify,,

Because other countries don’t accept INR from India, they usually demand payments in USD and India can’t print USD.

i mean, why can’t india buy USD with INR from the monetory market??..

When they buy USD from the market which happens every so often when oil companies need to make payments, the price of the USD actually goes up because the demand increases for that.

>>>the price of the USD actually goes up because the demand increases for that<<<

***************************************************************************

is 'USD price hike' against INR alone or against all the currency in the world???

in the 2nd case, india can take advantage of it ..right?

Manshu,

Could you please revert for the Shihab’s last question.

>>>the price of the USD actually goes up because the demand increases for that<<<

***************************************************************************

Is this 'USD price hike' against INR alone or against all the currency in the world???

plse avoid this type of innocent knowledge…..

Sorry, I didn’t understand what you said.

USA is pumping in money prompting many experts to warn that it would lead to disaster.But,the consumer inflation rate is steady at about 2% since the past 3 years.Any comments please?

Hi all thanks for your valuable coments on Money. But my doubt is still not clear that how a country decides that how much money is to be printed…. At what interval is to be printed..daily, weekly, monthly or yearly? I m sure that lot of people asks this question themselves? Pse let us know

COUNTRY GROWTH SPECIALLY INDIA.

Bro U r wrong, there is term known as Fed Reserve Bank. I guess u might know it. If possible der is a documentary on National Geographic Channel about the Concept of Money Plz have a look and If possible search on Youtube Bras stack: Speacker: Zaid Hameed.

the federal reserve bank is a private company owed by the Rothschild family. research “Rothschild”, the system we have under the federal reserve is the same system used around the world today.

here is an excellent video about the history of money.

http://www.youtube.com/watch?v=Zx0vrR2BFp8

countries don’t really print money though. they borrow it from the corrupt banking system and pay back with interest. presidents have died attempting to print money. if countries could print money they wouldn’t have any debt. the real question is why has such a powerful institution been allowed to operate for centuries? the men behind the worlds banking system are the real terrorists. do some research on the history of money and you will draw the same conclusion.

It is kind of balance one has to maintain in economy and whole system works around the theory of “demand and supply” balance.Suppose your income is increased and every member expanded their needs which used to be luxury earlier and hence it shifts the pressure on “demannd” aspect od this swing.Now if “demand” has to be met one has to the production of any commodity needs to be accelerated which in turn increases pressure on other services related to tht commodity (right from its procuring to delivery to the customers) and hence inflation rises with the rising consumption.

Also “rupee” is also a kind of commodity in international market….it is traded for different trading between the countries….if the supply of our “rupee” is abundant than value of our currency comes down and hence the whole trade market suffer.So one has to keep control in printing of the currency.

Thanks for the article. It was a very good read.

Great sharing, thanks

“Why can’t a country print money and get rich?”

Technically speaking, any country on this planet can print money and get rich. In the similar way, we can find out that any state can print money and not get rich. Yea, you read those sentences right indeed. It is all contingent on how the printed money is used. The utilization of money determines whether a country becomes rich owing to many reasons or becomes poor because of numerous reasons.

Check this out: http://theglobalecon.com/printing-of-money/

i think you are wrong.if that was the case,why dont prices of essential commodities go up.u see even if i had lot of money,i will still need only one ipad,and if the cost of the product will go up bcoz of more demand,ok,so print more money.If you can print money at your own will,then there is no fear of any product price increase.

Hi Roy, printing more money will create inflation. It will end up like Zimbabwe . Money is just a piece of paper, confidence, trust and faith is what is all about. The monetary system today depend on their GDP growth and productivity.

Perhaps some government may print money secretly without international acknowledgement. Once this secret is unfold, their currency may be damp by everyone. The whole country will be in chaos.

Hi Roy,

I’ll make it very simple.As he said when everyone are debitted with such a sum of money everyone will be capable of buying an i-pad .in the beginning the price of an ipad were say 25000…now everybody thinks that ipad is essential for them and starts buying an ipad…why cant the person selling it increase the price of it….even if he rises the price(30000) marginally the people wont bother about that ….

and thats how this causes inflation….

this is in the case of an ipad which is not so essential…but when it comes to our daily commodities think of what happens….???\

I believe commodities and fuel are right examples.(instead of ipads). Bcoz inflation is mainly based on daily essentials.

So with 1 crore in every person’s kitty people may purchase more cars and consume higher fuel which is limited commodity. This increases the fuel prices. Similar is the case with food articles such as rice and wheat.

This leads to higher inflation.

There is only one i-pad and 2 buyers. Who will get the I-pad? The one who is ready to pay more. Now, if both gets more and more money by printing, the price of I-Pad will also keep going up and up.

So, none of them is actually becoming rich by printing more money. They will become rich only if the I-Pad company supplies one more I-Pad and both of them can own the I-Pad. And that can happen even if no money extra money is printed.

Thanks all….!

great contribution from all of you to explore and share the knowledge Mr. Manshu has on the economics for the benefit of seekers like me….

would love to read more and more similar articles from Mr. Manshu and the team…

Thank you all a lot….!

Siva – thanks! There is a new article posted 6 days a week on the website and you can subscribe to the articles by clicking on this link:

http://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed&email

Subscription is free.

that’s very enlighting…

It is very nice explanation Manshu,

also we have to accept the fact that none of us will do as same as SA to get inflation rather we can spend to create jobs or to give subsidies for the industries and Factories to manufacture the goods as well as to create opportunities in conclusion everything was created for our well being in simple words “Government of the People, By the People, For the People”.

Hey there Manshu ! This is a really nice article. I am a commerce student and I am in my final year of C.A. I had a hard time understanding economics while I was in my junior college. I wish I had an article like yours at my disposal at that time. Then economics would be nothing but a piece of cake for me. Anyway it was a good one .

So I am a person living in India …… what if i want to invest my money some in foreign currency say GBP or so ??

You can buy currency futures on the NSE but they will be shorter term and you will have to continue to roll them over after they expire if you wanted to take a longer term position.

Any useful links where i can get some more info about it ?? ………. I’m a beginner so , I really need to get a lot more familiar with all these things before I can do something ……….