This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

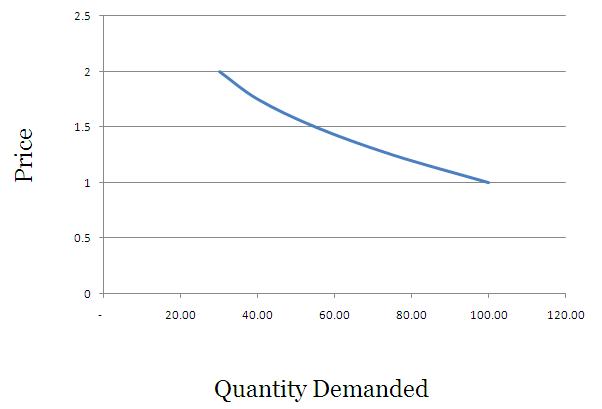

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

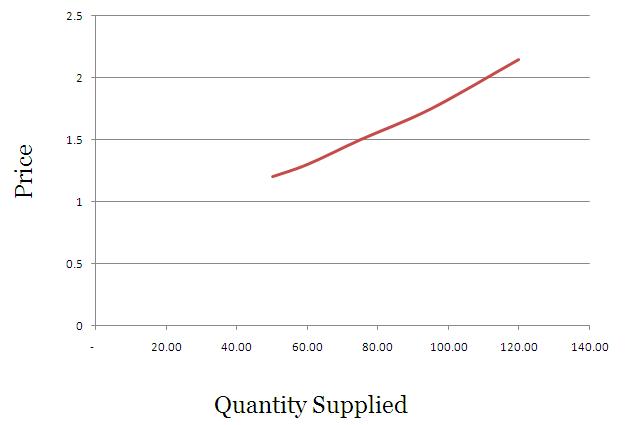

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

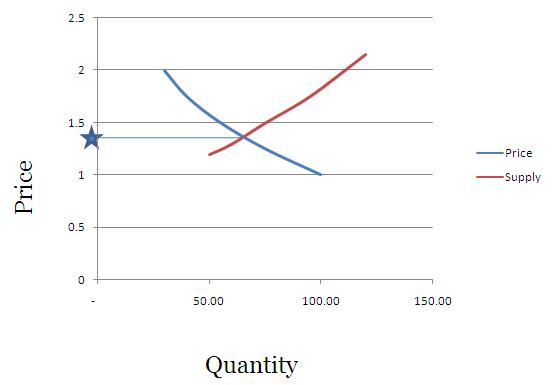

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

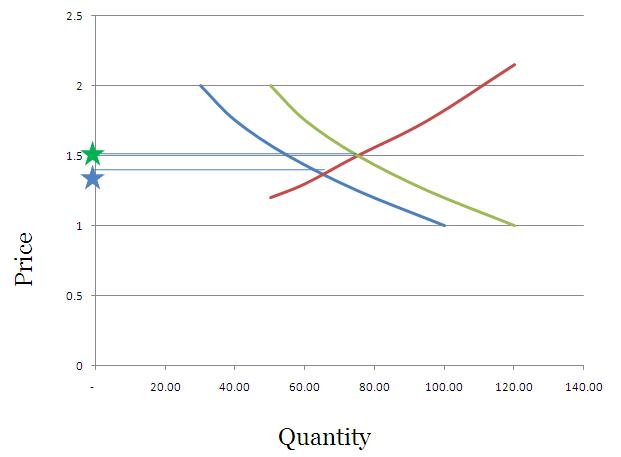

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

hey, guys anybody can give practical answer on why country cant print money as they want?

If we print money and give it to all then everybody will be rich and will stop to work.Apart from doing this , we can pay and imports oil.Then we will be rich.But we dont do that.Why ?

Please i want simple practical answer.No more long theory.

Dear roy

To alleviate poverty you require, among other things,money.All this post is telling you is ,printing money does not alleviate poverty.

So where is the question of modern day economics fooling people please?

So,in short,we need to be poor and then there wont be any huge demand , so there wont be any inflation, what a ridiculous explanation. what i am asking is why should everyone not have access to healthy food, clothing and shelter and why should some accumulate wealth beyond their capacity to spend in their lifetime. So,modern day economics is just fooling people.

Best ever explaination I’ve ever come across. All my queries in this subject almost clarified. It’ll help me a lot.

Thanks

what if govt. prints money and use it for imports (oil). and not giving it to people??

In brief,

govt shall print money and witout giving it to public,( to avoid inflation). y can’t they use it only for purchasing from other countries??

Muthu

Other countries will not accept Indian rupees.They want dollars.

Hey Ram,

Thanks for your quick response.

Could you please revert on the below,

I have copied this question from Shahib’s post early this year.

>>>the price of the USD actually goes up because the demand increases for that<<<

***************************************************************************

is 'USD price hike' against INR alone or against all the currency in the world???

I think the only exception to this is USD. I have heard that since all global trade esp Oil is in dollar that gives US liberty to print dollars without increasing inflation.

Can someone plz explain in detail how ?

Somehow you ignore entirely the role of the Banks which print the money.They pay just the cost price of production,and generally then sell or lend(since no Government can afford to buy their own money outright, its always a debt incurred to the privately owned printers)Usually the money is repaid ,not its cost plus a percentage mark up, but at its face valued incurring enormous dents to the Government /Nation especially when they require more and more .The Governments then need to repay the loan via taxes and charges,so the people really have to buy their money ,which they actually borrowed without knowing it.And its global.And the printers are indeterminate,but private,hidden behind lots of fronts.Without factoring that debt into the equation you really are giving a simplistic and quite unrealistic explanation of the whole debt ,cost of money business.And of course how many countries do you really think can ever actually pay face value for their money to the supplier?

Why are you talking about history. People in ancient times used to barter. Then gold was used as a medium for exchange. Paper Money is being printed since the last 300-400 years. The first central bank was founded in 1694 by William patterson The Bank of England. The gold coins were heavy and to overcome this drawback Gold certificate were issued instead of Gold coins. This started the tradition of paper money. The bankers soon realized that they could issue more gold certificates than there were gold reserves. They issued ten times more certificates then there was gold. It increased to 20 times. The same system was implement throughout the globe. Now there is only a fraction of gold to back up the printed money. Centrals banks are printing money out of thin air. Fiat Money. So the RBI can print more money for internal growth. India can be rich only when the Indian currency is strong just like all western countries. One rupee should be one dollar. Indian currency is devalued due to the previous conditionalities of the IMF and the market forces after World Bank agent Manmohan Singh passed Globalization , Liberalization and Neoliberalization policies. These IFIs like the World Bank , IMF , WTO , BIS are created for the hegemony of western countries.

Printing money causes inflation. We are living in a low inflation peroid for too long and started to take things for granted. Now we have S&P trading at a all time high, Fed Chairman Ben understand the danger and the word ‘Taper’ start appearing everyday. If printing money is so simple, there will be no poor man on the street. Generation never experience high morgtage payment will never understand the pain.

This guy is making a fool of you. First of all the demand and supply curve he shows you applies for products and money is not a product but a medieam of exchange. Second if we take a look at his arguments that 1 crore is given to everyone then it including those carrying out production and services. Hence the producers and service providers will increase the quality of their products and services using that money. They will charge more money from the consumers because they are providing better and improved quality of products and services and the consumers would be able to pay off due to their increased income. Hence an equilibrium would be created between demand and supply of goods and services. The increase in printing of money wouldnt have any negative effects on the economy. Infact it will result in better facilities and higher standards of living. For example a bus service provider would use the extra money to add A.C and better seating conditions to his bus and chargf more on the tickets. The consumer will pay more as he is no longer poor and has the power of the purse.

Lance,the man whom you refer as “this guy” has not created this Blog to make fools of others.

He is not making any money out of this from gullible fools.

Coming to your argument you are presuming that all people who receive a dole of Rs 1crore will use that money in creating productive assets.In fact this was the intention with which Federal Bank of USA started pumping money into the sagging US economy.The money went into Stock Market.

Let me give you another example.Number of car owners will shoot up resulting in huge serge of demand for Petrol.More petrol has to be imported for which you have to pay in Dollars.From where do the dollars come?Dont forget.India imports much more than what it exports.So,a dollar may cost Rs 1000 as against Rs60. All the additional rupees the Govt has printed may be used up in paying for Petrol.What is left?Print more?

You didnt addressed on the question that money aint a commodity but a medium of exchange. Second why did the people invest in stock market ? ? Btw Thats consumer behaviour which differs from place to place. Indian wont do that nevertheless taking your car arguement. Well i think you didnt understood what i meant. The prices of other products would increase because there quality would increase. Hence people wouldnt accumulate enough money to buy more cars.

So Lance, if it is as simple as printing money, and getting rich then why hasn’t any government anywhere in the world in the history of the world done it and improved the lot of their people?

Lance,you seem to agree that indiscriminate and repeated release of printed money into the economy will result in hyperinflation because you say people will not be able to buy a Car even with what remains out of 1crore cash.

Am I right?

Coming to your reaction to Manshu,s comment, whatever are the causes which lead to high depreciation of Re ,at least now Govt has to take action to see that it will not depreciate furthur.Do you think printing money will do this job?

Seems Mr.Ramamurthy has a complex knowledge of working of an economy.someone gives the solution while Mr.Ramamurthy comes in with more probing questions.just like devil’s advocate.But it is good.though i have not understand much as I am not economic student but I am fairly interested in working of economics and will use it to my advantage someday.

A simple example that is answer of your question “Why can’t a country print money and become rich?”

you have a saving bank account that having balance of ? 20,000 & have a FDR of ? 50,000. you can print cheques only to the extant ?70,000, not more than this. so it is simple whatever backup you have, you can print cheque and encash it. you have cheque book, why you not write cheque and become rich. Same thing apply to government, they print currency as per their reserves (gold, deposits, etc.)

Hope it clear

I am sorry,Gopal.It is not clear.

crisp information to digest. no need to be an economist to understand. thanks.

AWESOME ILLUSTRATON..GR8

In spite of all heavy criticism Ben Bernanke has been pumping in more and more paper money into the financial economy of USA.Stock Market is up.Oil production is up.Corporates are doing well.All positive signs.Has Ben Won?

Do you agree that USA has succeeded in printing money AND also grown rich?

Yes, I agree that they have avoided major pain by doing what they did, but they can’t go on doing this forever.

I don’t have any knowledge but my brain says that there would any specific path through government would be able to print

by seeing some thing been produce by any individual for example someone make pot .. Now the pot have value in market according to value of same money would be printed and given to pot maker …pot would be taken from him some one who is ready to buy pot would given pot taken money…in this way money would be entering…..pls comment

No, sorry it doesn’t work like that.

I am sorry Manoj.I cant follow you. Can you please elaborate?

thanx for sharing this information

Dow Jones hit a new high recently of about 14500.This was attributed to the the financial policy of USA which poured a lot of money into the financial system of USA.The money which went in was supposed to trigger investment in productive assets leading to halt the increasing unemployment.In actual practise,it has been told, this did not happen and the money injected went into stock market leading to the soaring stock index.

My question is

How does the money get into the stock market?

Newspapers attribute any market move to anything. This shouldn’t be taken too seriously.

Then whom to believe.The reasons given are very credible.Can you please let me know whether USA,s economic position justify the DJ index.I know that Stock Market and country,s economic health need not have a positive correlation but such a negative correlation is surprising .It can be explained only by huge paper money going into the market.Do you have any other reason except telling dont believe what you read.

Why is the S&P still lower than its previous high? The Fed’s balance sheet has more than tripled in the last 6 years, why hasn’t the Dow tripled? The GDP makes a new nominal high every day, why doesn’t the stock market of every country everywhere hit a new high every day? Japan has been printing money for the last 30 years, why is its stock market 20% of its all time high?

Also do you know that the Dow is a price weighted index? The only big index today that is price weighted, why pay any attention to it at all? I’m a bit disappointed that you use this type of tone after I’ve answered so many of your questions in the past.

I deeply apologise if I have hurt you.I have many times told you how I appreciate the trouble taken by you in educating persons in their efforts to solve the doubts they have regarding personal finance and general practical economics..I do not know what has motivated you to undertake this job which must be eating into your valuable time.And unlike so many experts you dont expect any remunaration in return.Again my apologies.

Regarding DOW, my interest is only general.I read some articles about finance which is theoritical and if I dont understand the practical side I run to you for solution.

I still dont understand this. USA is pouring paper money into the monetary system expecting the system to use it in creating jobs.This is not happening as unemployment situation continues to be grim.Some of this money has apparently ended up in stock market.I just wonder how?Are the banks borrowing cheap money from Govt and lending it to speculators of stock?Is this permissable under law?Against what security do the Bankers lend?Will this cause a bubble like real estate lending did 3 years back?These are some of the questions I have?

Sir I am sorry for my harsh remark. I will do a full post on this subject, perhaps next week. I feel that we have a tendency to give the index a lot more weight than it deserves when it is up and even more when it is down. Not every move can be explained rationally and it shouldn’t be too. I will give reasons on my thinking in a full post. I’m sorry I should’ve refrained from making that comment and I will do a full post. Also, I do run ads on this blog and while they don’t make much money I am remunerated to that extent.

Thanks for the information.By price weighted index I thought it was inflation adjusted.It is not.I did a little probe.DJ is calculated on stock prices of 30 companies.It is not on the basis of market capitalisation. Hence it requires price adjustment to account for stock splits etc.

I also compared S&P 500 historical prices on 3rd March for last3 years with DJ.

Here are the results

Base Year 2003—100

S&P

2011—-113

2012—121

2013—135

DJ

2011—118

2012—-125

2013—136

I am sorry I cant put it into a Tabular form,though you have guided me how to do it.I am not too computer savvy to follow your guidance.

how Indian currency makes its value. In place of what Indian currency is made

in the 2nd case, india can take advantage of it ..right?