This is another post from the Suggest a Topic page, and this time we’re going to take a look at the difference between debt and equity products, and some examples of both.

What is equity?

Equity refers to part ownership in a company, and in the Indian context – equity and shares are used inter-changeably.

So, if OneMint were a company that had 100 shares in the market, and if you bought 1 share of OneMint – you would be the owner of 1% of OneMint.

If OneMint was valued at 1 lakh rupees today, then your share would be worth Rs. 1,000.

If 5 years from now – OneMint were valued at Rs. 10 lacs then your share would be worth Rs. 10,000.

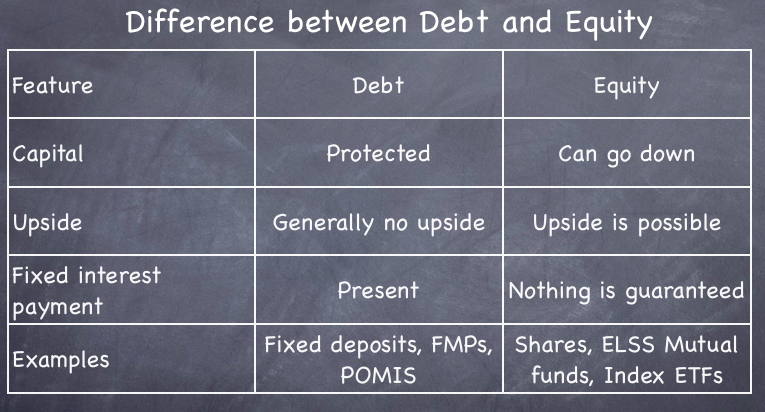

If however, the company went bankrupt then your share would be worth nothing. Equity products are generally considered to be high risk – high return products for this reason.

Examples of equity products:

Shares: Shares trading on the stock exchange are the most direct examples of equity products.

Equity Mutual Funds: Mutual funds that own shares are another example of equity products. ELSS mutual funds that are eligible for 80C tax savings are a popular example of equity mutual funds.

Equity based ETFs: ETFs that are based on shares like Nifty Index Funds are also an example of equity products.

What is debt?

Debt is loan, and carries a fixed rate of interest, and a promise to repay. Debt is generally safer than equity, and there is generally no upside in it. You get paid the promised interest, and as long as the company (or country) is not bankrupt – you’re safe.

For example – OneMint could issue debt of Rs. 1 lac at an interest rate of 15% per annum, and as long as OneMint is not bankrupt – you can expect your interest repayment, and also the repayment of your principal.

If OneMint goes bankrupt, then first the shareholders are wiped out, which means that your shares in OneMint are worth nothing now, and then the debt is paid off according to the hierarchy of creditors.

A secured debt is debt that is secured against a collateral like a building, land, machinery etc. and they have a higher repayment priority than an unsecured debt, which is not secured against any collateral.

Examples of debt products:

Fixed Deposits with banks are the prime example of debt products. They are extremely safe investments, which have a pre-determined interest rate. The stock of SBI may have wild swings but your fixed deposit with SBI is safe, and won’t be affected till something really serious happens.

Infrastructure bonds that have recently been launched are another type of debt product as they pay you a fixed interest rate, and the principal is protected as well. They are not as safe as bank fixed deposits, but if any infrastructure company defaults on their debt – that would be an exception rather than the norm.

FMPs – These are a special type of mutual funds that have become popular in the past few years, and work like fixed deposits (though not as safe as them). They have become popular due to favorable tax treatment when compared with a fixed deposit, so people don’t mind taking the little bit of extra risk.

POMIS: Post Office schemes are also debt schemes as they pay a fixed interest, and are also guaranteed. These are very safe instruments.

Provident Funds: This is also a debt product, which is quite safe and pays a fixed rate of interest.

These are some of the key things that come to my mind when explaining the difference between a debt and an equity product – feel free to add anything that I have missed, and as always – comments are welcome.

does SIP and SWP also be used in deposits like FD and RD?? I mean they say if you have a FD then there is a provision to get the interest on quaterly basis…not mnthly..so is there anythIng that can give me income monthly?

Not on a FD as far as I know.

first of all i’l like to say that post was awsmmmm..now cming to my doubts..what are SIP and SWP?also wud like to know what are the taxes implement on the debt mutual fund?as am a newcomer to whole of this am so eager to learn about all…waiting for answer thanks 🙂

Thank you Mukesh.

SIP is Systematic Investment Plan which means you invest a fixed amount every month. SWP is Systematic Withdrawal Plan which means you redeem some of your investments every month and thus earn a regular income.

thanks manshu,actually am about to invest a lumsum amt very sOon so am studying all about these funds n all..on the way whIle i was studying about stocks n all i also read about RD and FD am jus so shocked to see how govt make us fOol.In FD if your interest exceeds 10,000 annually there is a 10% TDS but on the other hand they say if your going for RD you will get everything as FD, (which is also not true) and there is no TDS now the point is whenever we get out amt after maturity period trust me if u deposited a lumsum in RD yoi will find yourself already in 30 or 40 bracket of slab …in FD u pay 10% TDS and then remaining 20% cut acc to slab and in RD you dnt have to pay TDS but 30% acc to slab also there is less interest in RD as compared to FD….manshu see i know thats aload to ask,but i found thIs blog pretty useful so jus waitin fo ur reply…. 🙂

I read your comment a few times but I’m not sure what the question is. Yes, you have to pay tax at 30% in both these cases, there is no way to avoid that if that’s what you are asking.

THANKS.

Which is better equity or debt in the capital structure ?

Simple explanation for beginners but just wondering how would Debt mutual funds figure in?

Not sure if I understand the question, debt mutual funds will be a debt product, no?

Very good explanation. I was about to start a SIP and wanted to know the diff btwn Debt and Equity. You explained it very well…

Thanks.. 🙂

That’s great to hear – thanks! If you have any questions or anything, just leave a comment and I’m sure that either me or someone will answer that as well.

These 2 terms always stumped me, till now I must admit this is the best and simple explanation of them. Thanks again

That’s great to hear – thank you!

how can i create TPIN AND CPIN

What is this and why is it needed?

Thanks for this article. That was really helpful

I always had this phobia about these financial jargons, but this article explained things with subtle examples….

Thanks for sharing this wonderful piece of information in such a simple way 🙂

Excellent! Glad to hear that and thanks for your comment!

Great job Mr.Manshu…u explained it very well.Thank u:-)

Thanks for the information Mr Manshu….it was explained well.

Manshu Thanks for the information, especially very valuable points from Loney, Ramesh & Vinay

Thanks and appreciate your comment!

Thanks Manshu for the valuable article. Its very nice 🙂

Great to hear – thanks!

Thanks for shearing the good things and best knowledge with me thatnks again for that .

You’re welcome Satish.

yes both accounts are separately insured if both banks fail. alternatively you can have separate accounts for each of your family member or several joint accounts of more than one individual even if they are in the same branch as long as the order of their names appear in a different order say ABC, ACB, BAC, CBAetc. each would be separately insured for a balance upto 1 lakh!

please correct me if I am wrong.

Thanks Ramesh – your explanation sounds correct. Here is the link to the RBI guideline on this:

http://www.rbi.org.in/scripts/FAQView.aspx?Id=64

Hi,

You should mention about the insurance cover in FDs (up to Rs.1 lac per depositor per bank).

So, even if a bank fails (worst case), there is a high chance of getting back the money in FD.

That’s a good point Vinay – thanks for bringing it up. If a person splits their deposits across banks, are all the deposits covered with the insurance?

Thanks Manshu. You explained it very nicely. Good Job again!

Thanks for your comment Shilpa – good to see that you found it useful.

Hi Manshu,

I would like to ask one thing. how post office generating income to pay interest for their schemes.

Regards

Mohan R

Good question Mohan – I actually don’t know about this. Will try to dig up the info though, and also a good topic to ask on the forum.

Hi

All post office schemes are soverign in nature, meaning they are guaranteed by the Govt. of India. All the money paid to post-office schemes is utilized by the Govt. of India for various schemes (infrastructure, education, public welfare, etc.,) In other words, they work on the lines of GoI bonds. The GoI pays the interest. Post office schemes are the safest instruments in India and they are rated as Soverign.

Thanks Loney.

I never got these two wrongly and i don’t see how one could get confused by these two terms, seems very elementary to me.

Everyone has to start somewhere and in the beginning you need some explanation for elementary terms as well.

I recently got a Macbook and have searched for a lot of basic stuff like where is the shut down button, how to get to the desktop etc. I’m glad others took the time out to post such things online else I would’ve been stuck and unable to perform simple operations which are obviously elementary for pros.

Very nicely put sir!

Thanks