Yesterday we looked at the where the government gets its revenue from, and today we’re going to look at how this money is spent.

There are two heads for spending:

Plan Expenditure: This is the good stuff in the sense that it’s the money spent on building roads, irrigation systems etc.

Non Plan Expenditure: This is the money spent on defense, police, petroleum subsidy, postal deficit, and basically all the stuff that needs to sustain the country.

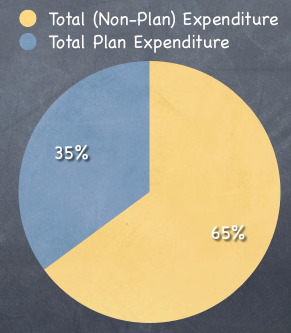

Like yesterday, let’s start off with how the two stand relative to one another.

As you can see the total non plan expenditure is way more than the plan expenditure, which means that we spend a fairly large amount on sustaining ourselves, and the larger that amount is – the lesser remains for spending on infrastructure building, and boosting growth.

Here is what the absolute numbers look like (pdf).

| Heads | In Rs. Cr. |

| Total Plan Expenditure | 441,547.00 |

| Total (Non-Plan) Expenditure | 816,182.00 |

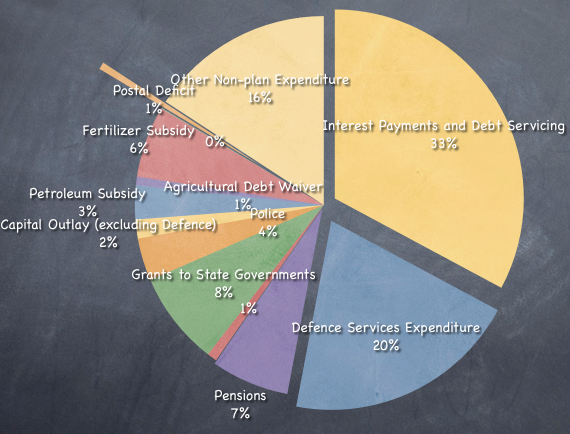

Now, let’s take a look at how we’re spending the money to sustain ourselves.

Look at how big the interest and debt servicing piece is! Defence is big as expected, and look at the petroleum subsidy piece as well. For all those who complain about the government not subsidizing enough – nothing comes for free, and what doesn’t go directly from your pocket goes indirectly because the government has to borrow to pay for it.

Here’s what the absolute numbers look like.

| Heads | Expenses |

| Interest Payments and Debt Servicing | 267,986.00 |

| Defence Services Expenditure | 164,415.00 |

| Pensions | 54,521.00 |

| Interest Subsidies | 6,868.00 |

| Grants to State Governments | 65,466.00 |

| Police | 29,685.00 |

| Capital Outlay (excluding Defence) | 13,212.00 |

| Petroleum Subsidy | 23,640.00 |

| Agricultural Debt Waiver | 6,000.00 |

| Fertilizer Subsidy | 49,998.00 |

| Grants and Loans to Public Enterprises | 514.00 |

| Postal Deficit | 5,018.00 |

| Other Non-plan Expenditure | 128,859.00 |

| Total (Non-Plan) Expenditure | 816,182.00 |

What is the fiscal deficit?

Now, let me build on the revenue and expenses data that we have so far seen and look at what the fiscal deficit is.

Simply put – it is the amount of money the government needs to borrow in any year.

The fiscal deficit is projected to be 4.60% of GDP for next year. The GDP is estimated to be Rs. 89,80,860 cr. (pdf) for next year, and based on that the fiscal deficit amounts to Rs. 4,13,119.56 crores.

This is roughly the sum of the Total Debt Receipts (Rs. 392,816.57 crores) and the Net Market Stabilization Scheme (Rs. 20,000 crores).

You can also arrive at this figure by taking all revenue figures from yesterday adding the net recoveries of loans and advances, and the misc. capital receipts and subtracting it from the total expenses.

So when you hear or read someone express their skepticism on the fiscal deficit number you can easily see why that is.

If there isn’t enough disinvestment then the fiscal deficit will suffer, if there aren’t enough tax collections then the fiscal deficit will suffer, even if the post office spends more the fiscal deficit suffers! These are all projected numbers, and any project going wrong unfavorably will mean a worse than predicted fiscal deficit.

Do all the pieces fit together now?

Looking at revenue and expenses figure, and especially the part where you see how much of the expenses are attributed to interest payments, and how that will further lead to borrowing more money shows why a government can’t fully subsidize petrol, or fertilizer or just give away food like that.

Ultimately if the government’s money is spent in paying interest instead of building roads then that’s bad for the entire nation.

For me, the biggest takeaway from this exercise was that like personal finance, there are no shortcuts for a country’s finance also – even if it has a printing press at its disposal.

Why can’t we restructure our debt by raising money from USA Bond Markets at 2% or refinancing existing loans with IMF 0% Loans or atleast seek an Interest Payment waiver period to stimulate economy.

I have been searching real meaning of Non-plan expenditure. You have explained in a very lucid manner with an honest opinion about its allocation.

Great …keep it up.

Thanks Swapnil – in this case our government gets all the credit or the finance department or whoever it is that publishes these documents – I’m sorry I’m not very clear with the distinction.

There are a lot of areas especially with respect to disseminating information that India is quite good at. Of course, the numerous other negatives kills any good things that are done elsewhere.

Another nice post.

I had one question regarding the expense. We have two types of expenses one is planned and other is unplanned. I understand that road development, infra and all others would be planned, but there are many unplanned activities that take place in a year. I was curious to know if previous year few unplanned activities, can they be moved into planned activity as now you realise that the money has to be set aside for that purpose in the coming year budget ?

Thanks Ams.

Plan and unplanned is not whether the expenditure was foreseen or not, but rather plan expenditure is money that’s spent specifically on building infrastructure, and non plan expenses are the expenses that are used to spend on sustaining things as I’d like to call them like defence or police.

So, that way it’s different from what the literal meaning of the word is, and also because of that sometimes you will hear or read that planned expenditure is good, and unplanned is bad – though I don’t agree with that statement.

Hi

Both your posts on the budget were real eye openers. It was a great effort. You have mentioned in both those posts that the budget numbers are only estimates and projections, however what i would also like is if someone can do an analysis of the last budget and show how the budget projections actually translated into figures at the end of the year- say both revenues and expenses !!

Hi Shankar – In the budget documents itself they have compared the past projections to what has been realized, and for deficit figures they have compared what the finance commission has recommended to what they have achieved.

In terms of that the government is doing better than what the finance commission has recommended in terms of controlling fiscal deficit. Of course the 3G spectrum has been a good windfall this year.