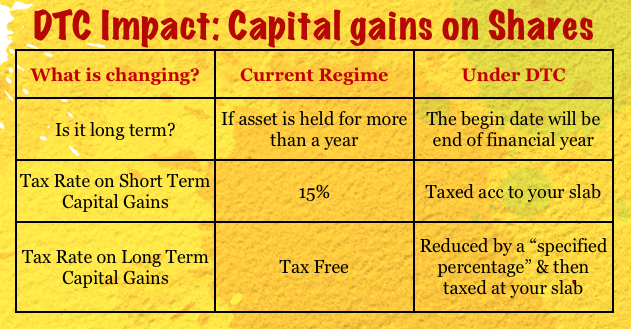

The DTC (Direct Tax Code) will change the way capital gains are taxed on shares, and although still not finalized, here is my understanding on how capital gains will be imposed under the new DTC regime.

Short term or long term under DTC

The revised DTC discussion paper says that assets will no longer be treated as short term investment or long term investment based on how long you hold them, but the calculation will be done from the end of the financial year in which you own the asset.

Right now, if I buy a share on April 1 2011, and sell it on April 2nd 2012 – it will be treated as a long term capital asset, and the gains will be tax free.

With the introduction of DTC – the holding period will be calculated from the end of the financial year in which it was acquired, so in my example – the holding period will be calculated from March 31st 2012 and I will have to pay short term capital gains on it.

This will probably have the most impact on FMPs that are issued in March of this year to be redeemed in April of the next year to get benefit of double indexation.

Under the new regime this won’t be possible.

(Source: Revised Discussion Paper: Chapter V Section 3.2)

Tax Rate on Capital Gains on Shares under DTC

Currently, long term capital gains on shares are tax free, while short term capital gains are charged at 15%. In the new DTC regime – capital gains will be added to the income of the individual and will be taxed at the rate applicable to the taxpayer.

Short term capital gains on shares under DTC

Short term capital gains will be taxed on the tax slab of the investor. Your profit will be added to your income, and then you will be taxed based on whatever slab you fall under.

Long term capital gains on shares under DTC

This is where it becomes slightly complex. Currently you don’t have to pay any capital gains on long term capital gains but in the future you will have to pay tax on the capital gains – but not the whole amount.

The government will allow you to deduct a certain percentage from your capital gain based on some parameter which I think will be how long you held the share for.

So, say you make Rs. 1,000 in gains for shares you held for a year, and the government says that for one year you’re allowed to deduct 50% from your capital gains for the purpose of tax -Â then instead of adding Rs. 1,000 to your taxable income, you will only have to add Rs. 500 to your taxable income.

This will then be taxed at your tax slab.

As far as I know the method of computing the deduction has not been out yet, and the discussion paper only gives examples.

Final Words

I have been holding off on writing about this because there is still some way to go and not everything has been finalized but there’s a lot of interest in the subject and I think it’s better to at least get started on this topic here.

The source of my article has been this revised discussion paper here, but if you know of a revision after that version, then do let me know and I’ll update my post.

http://www.myaccounting.co.in

has simulator for capital gain calculation.

http://www.myaccounting.co.in/

http://www.myaccounting.co.in/blog/cgtax1.html

Still confusing on DTC

Assume I bought 1 share @100 on 01/04/2011

On 31/03/2012 it is quoting @200

I will sell it on 01/04/2012 @250

So DTC will be calculated on 200-250 = 50*50% = 25? OR

100-200 = 100*50% = 50?

(the holding period will be calculated from March 31st 2012 and I will have to pay short term capital gains on it.

Taxing Dividend income at 5% under prpoposed DTC (Which is presently exempt) is probably the best move. Till now, the said dividend was tax free in hands of the receipient. The company declaring dividend was liable to pay Div Distribution Tax. But, as what i understand as per foregoing discussion, the dividend will be now taxed in hands of receipient. This will be major blow for the corporate promoters holding larger stakes in the company, since the alone dividend income will occupy a major chunk of therir total icnome their personal return. Furthre, the same will also shorten the gap between high income people and low income group people to some extent. It wil also ensure proper dissamination of the income accross the country, which is prestly the major economic problems in our county. (i.e. Rich people get richer and poor people get mroe poor).

Thanks dear.. really worthy information… and probabaly very less known yet….

hello,

What is the treatment for sale of equity held in private companies in terms of long term and short term capital gains?

Thanks,

Ram

Don’t know about it – sorry.

Thanks, Manshu.

Hi Manshu,

Trust all is well with you. A query: Read on value research site that it would be prudent to invest in the growth option in mutual funds because of the proposed DTC from next year, which will tax dividend payouts. But even the growth option will be taxed on redemption, isn’t it? Except in the dividend option, there will be tax on each payout plus at redemption. But in case there aren’t so many payouts, then both will still be taxed whenever redeemed? Have I understood this right? Thanks!

Hi Sudha,

I’m doing good, and hope that things are alright with you as well!

Dividends from equity MFs are currently exempt, but with DTC, they will be taxed at 5%. And then capital gains will be applicable on both dividend & growth options in the same manner.

So, I think that’s why they’re recommending people to go to growth mutual funds, as the benefit of tax free dividends is no longer there.

Based on what you write, I think your description is correct.

Hope that answers your questions!

Manshu

So, when the DTC comes into vogue, I guess buying shares at (almost) end of current financial year is beneficial rt?

Yes Mike for ELSS funds since this is the last year that the tax benefit remains, so that equity investment is good to take advantage of this year.

Yes, thats what I was worried about..it does nor give any tax benefit for a long term investor in Equity, you lose the current advantage of taking all the money you make on the market over a long term. I hope atleast they give some relief to savings made consistenly over a period of time like in a SIP.

Although it’s not as good as the earlier situation where the profits were tax free – if you compare it with other tax rates – long term capital gains are still lower than other type of taxes, so there’s still that bit of incentive present.

Also, another thing to note is that hopefully you won’t withdraw all of your 1crore at the end of 10 years. You would withdraw only what you need for your life at that stage. This essentially means you need to plan better as to how you will use your funds now. Plan well, withdraw only what you need and stay within the income slab and utilize the monies.

Yes, you will end up paying something going forward where as now it was nil.

Manshu, Iam not saying if SIPS will make any differece to how it will be taxed. What Iam worried about is till now if you invest in Equities for a long term, that is more than a year, you dont pay any tax which works in favour of long term investment in Equities. But in the future if the taxing on that is changed, say for example, If I make a SIP or a bulk investment in Equities, which grows well and becomes substantial say around a crore after 20-30yrs, then when I plan to redeem that money, If Iam taxed as per the applicable tax slab I wil be paying substantial part of my returns as tax. Did I get that correct? Iam not sure how it works.

Okay reading your earlier stress on SIPs made me think that’s what you were saying.

Acc to current version of DTC what they will do is take your profit say you make 10 lacs in profit, and then reduce that by a specified percentage (that number is not fixed yet) but in their example they start from 50% so lets take that – they will reduce your profit by 50%, so now your taxable gain is 5 lacs. Then your slab is seen which let’s say is 30% and your 5 lacs are taxed at 30% viz. 1.5 lacs.

So where you would haven’t paid any tax you would now pay 1.5 lacs.

Many investment consultants and experts suggest people to invest in SIPs with a goal and in a disciplined way for the long term. Does anyone have any idea of how will SIPs, invested over a long period of time, be treated with DTC? Will it be a rude shock for someone expecting a nest egg and realising they have to pay taxes at the highest bracket? How does someone get any benefit for being desciplined and a long term systematic investor? Any thoughts on this?

Good question – SIP per-se won’t make any difference to tax calculation. While selling the mutual fund unit you will have to see whether you held those units for more than a year or less than a year and that will determine whether they attract long term or short term capital gains.

Then, you see whether they are equity oriented or not, and that will tell you at what rate they are going to get taxed.

So, as far as rude shocks are concerned, I’d say if you’re aware of these two things, and legislation doesn’t change drastically (which it shouldn’t) you shouldn’t get any rude shocks.

Hi Manshu,

Nice Post ..And yes DTC is actually a nice topic to touch upon…

I have a small related query…

When we trade in shares the brokerage firm charges STT(Securities transaction Tax) so is this STT separate from the short term and long term capital gains tax…

Any ideas whether the brokerage firms deduct this short term and long term capital gains tax in Advance like TDS?or we have to compute it and then file the return….

Which will be the appropriate form for short term and long term capital gains taxation…

Yes, this is a form of tax that is separate from short term and long term capital gains. This is loaded on to your purchase or sale and you should see this in your statement. You don’t need to pay it again.

Brokers don’t deduct capital gains like TDS – I mean how will they know how much gain you made? I think I’m not understanding the question correctly. But if you’re asking if you have to file this separately then yeah you have to file for capital gains yourself.

I’m not aware of what for has to be used.

Thank you for sharing this info.

Thanks for your note – I’ll be updating it from time to time as the laws get updated.