Yesterday someone left a comment about a fixed deposit with a co-operative bank called Mogaveera. Here is what he said.

Mogaveera Co-Op Bank is offering 10.25% for normal customers and 10.50% for senior citizens. These are for a tenure of 13-18 months. Excelent yied of around 10.93% and 11.21% respectively.

They do have some Tax benifit scheem.

These guys are in the market since 1946 and are doing well.

This isn’t really that great an interest rate, and some banks are giving interest rates close to this. We have also seen that some NCDs have also been offering interest rates around this number.

In general, my perception is that trouble with co-operative banks is much more common than trouble with other banks, and at present I can’t think of any reason why I would want to bank with a co-operative bank.

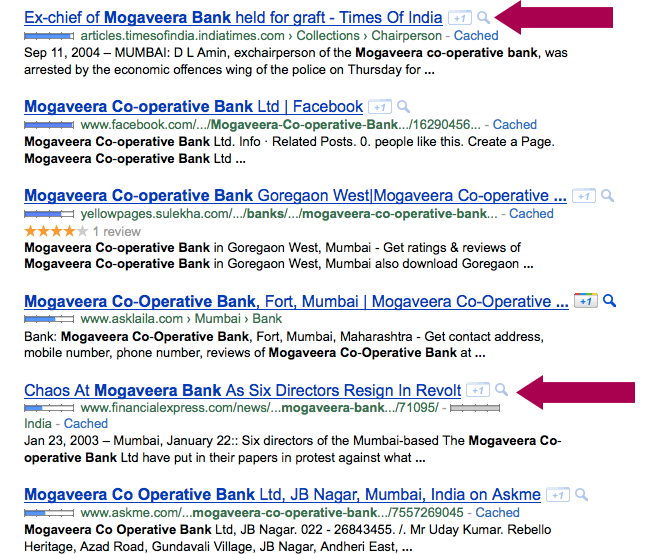

This perception was only made stronger when I Googled Mogaveera co-operative, and found these results.

In 2003, 6 directors resigned against activities of the then chairman, then in 2004, the same chairman was arrested by the police for duping the bank of Rs. 7.9 crores. In 2006, RBI fined the bank Rs. 5 lacs because they were giving advances to the relatives of the promoters.

Admittedly, these are old stories, and I didn’t research more to see what happened of the cases, or what became of the people who had deposits in the banks, but if you were going to put your money in a bank you should be aware of such things.

If you have dealings with co-operative banks then another good thing to be aware of are the press releases issued by RBI on action it takes against co-operative banks. Recently it has penalized Mehsana Urban Co-operative Bank and Kodagu District Co-opearative bank. These penalties can act as an early warning system, and you can either search for them at the RBI website periodically, or create Google alerts for them, and have the notification sent to you if they come in the news. Creating Google alerts is probably more practical, and efficient as you will get the news in real time.

I have banked with Mogaveera, Andheri w (veera desai) for almost 20 years now , and my parents have been banking for almost 25+ years..There havnt been any issues with the money ever. Whatever rate they quote they offer. They need to get tech savy for sure! They still have no net banking, Their ATM cards are operational only in their ATM machines and cant be used as debit cards (which started a year back).

Otherwise a good bank!

Sir, Tirupati CoOperative bank Limited in andhra Pradesh is offering fixed/term deposits with high interest rates 10%(10.5% for senior ccitizens) for two to three years from 22 Feb 2011 on fixed/term deposits. This is one of the bank best interest rates offered. How for it is gunienue and why this deferentation on interest rates compaaring with national/private banks and post offices. Thanks. With regards. KR Raja Reddy, Tirupati, AP.

ndhra Pradesh is offering fixed/term deposits with high interest rates 10%(10.5% for senior ccitizens) for two to three years from 22 Feb 2011 on fixed/term deposits. This is one of the bank best interest rates offered. How for it is gunienue and why this deferentation on interest rates compaaring with national/private banks and post offices. Thanks. With regards. KR Raja Reddy, Tirupati, AP.

The only person I know who has an account in co-operative banks is they have that account inherited from his Dada i.e. grand parent.

I feel its because the personal touch they give to services. Other banks employees keep on changing, they wont know who you are, how long you are associated with this bank…

I didn’t think of that now, do you have an account with a co-op bank?

As I understand RBI insures deposits upto 1 Lakh per person per bank. Does it apply for co-operative banks also? Does it apply to all branches of co-operative banks? Should we inquire with the bank about this before depositing?

Yes, RBI does insure co-operative banks, and the sum is Rs. 1 lacs per person too. They total your money from all of a bank branches, and cover you till a maximum of a Rs. 1 lacs.

Always, a good idea to check before opening the account, and I’m also curious to know why you want to open an account in a co-op bank? Is it convenience or something else?

Let’s wait for RBI to increase it to 5 lakhs(you should be aware of that proposal) One can invest in good co-operative banks. There are co-op banks like Saraswat bank that are well managed and larger than some small PSU banks(though not as safe of course) I think within the limit of the DICGC insurance, one could go with co-op banks- after some preliminary research as you say – and invest for a slightly higher yield.

Hi Manshu,

Why people go to co-operative banks in first place? is it worth creating a poll on onemint on this?

What I would think is possibly due to

1. lower min account balance or Quarterly account balance criteria as imposed by private banks. 2. Their are not enough branches in villages/remote areas

3. people are having their account in co-operative banks since long time.

Hi Subodh,

Even I think people just continue with them due to long association or because they don’t have access to other banks in the area that they live. Can’t imagine why else would you want that.

This topic will probably be not of interest to a wider audience so the poll might just fizzle, but it has been long since I conducted a poll, and any ideas for that is welcome.