A couple of days ago @gkjohn Tweeted this out:

Has there ever been a parallel in consumer electronic history to Apple’s growth in the last decade?

My first reaction to this question was probably Sony. When I thought about consumer electronics, the most successful company I could think of was Sony, and I thought they might have done something close to what Apple had done in the last decade.

Now, I’m not sure what GK John had in mind, but I was narrowly looking at this from the point of view of stock returns. Google Finance tells us that Apple returned an awesome 3,776% in the last decade!

Has Sony ever done this?

A quick search in Google Finance showed me that in no decade did Sony perform such a feat.

That made me think if anyone else has ever done this, and I started looking for the best performing stocks in the last decade. For this exercise I stuck to US stocks just because Apple is an American company.

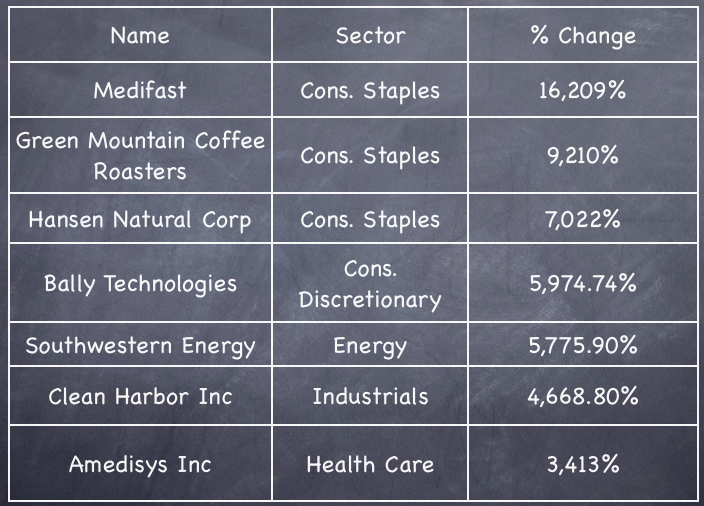

A quick search brought up this Bespoke research which shows the best performing stock for the decade ending 2009.

These companies are not as big as Apple, but some of them have market capitalization of over a billion dollars, so they aren’t exactly small either.

Again, there is no question that they don’t have anywhere near as powerful a brand as Apple, but if you were just looking for stock returns – there were other companies that could have done it for you.

Last, I wondered if Microsoft has ever had such a great decade in its life? It’s been going downhill for a few years, but surely in its history it must have done something spectacular like this?

In the last 10 years Microsoft has gone down 21%, but from Jan 05 1990 to Mar 31 2000 it rose a staggering 8,883%!

Now, isn’t that something?

Now, question for you – Is Microsoft most like Apple? And is this a good lead to write a post about the Recency Effect?

While Microsoft grew tremendously in the 90s, the end of that decade was also the end of the tech bubble. The $45 levels were never reached again by MS. Therefore, nothing to take away from your points, the figure 8,883% is slightly misguiding.

That’s a very good point you bring in and I completely agree with that. While the 90’s may have been MSFTs heyday their stock price was also helped by the tech bubble. When looking at that return, giving that context is important.

I just found it amusing that they had a much better decade than Apple not too long ago 🙂

It is definitely amusing. And yeah, I find Apple and Facebook a bit of a fad. They have good cool products, but are not necessary for businesses, unlike the original golden boys Microsoft and Google.

If we are talking about brand value, then yes, no company has ever matched the cult following that Apple enjoys – that is also perhaps a reason behind the stock performance. Apple has been a premium brand and with smartphones that are essentially a premium gadget now finding mass acceptance, the growth has to happen.

But Apple for most part is a bubble – their board may not agree, but I don’t see this growth continuing to happen after Steve Jobs. Most of Apple fans are primarily Steve Jobs fan and after the man retires (has started to happen almost), they will find the flaws in their devices; things that they were blind to all the while.

Those are good points, and the fact that he was fired twice from the company, and then brought back to resurrect probably adds a lot of weight to it as well. Let’s see what the next decade holds for them, and how far they reach from here.