The latest company to come out with a NCD is Religare Finvest, and this is the fully owned subsidiary of Religare.

The NCD opens for subscription on the 9th September 2011, and closes on the September 26th 2011. The Religare NCD is going to give 12.5% for 5 years which is the maximum that any NCD has offered yet. They plan to raise Rs. 8 billion from this issue. The issue has been raised ICRA AA- (stable) by ICRA and Care AA- by CARE. These ratings indicate a high degree of safety regarding timely servicing of financial obligations and carrying low credit risk meaning they are very likely to pay interest on time, and unlikely to default on their debt.

The company has a gross loan portfolio of Rs. 79,346.21 million and 91% of that is backed by collateral. The company has grown at a very high rate in the past few years growing from a loan book of Rs 5.66 billion in 2007 to a loan book for Rs. 89.6 billion last year.

The total income grew from Rs. 973.25 million to Rs. 11,631.50 million in the same period. So the loan book grew at a CAGR of 73.75% and income by 64.24%.

The one thing that has lowered during this time is the Capital Adequacy Ratio which was 64.27% in 2009, 21.67% in 2010, and is down to 16.16% in 2011. I think this is one of the lower ones seen when compared with the other NCDs that have been recently issued.

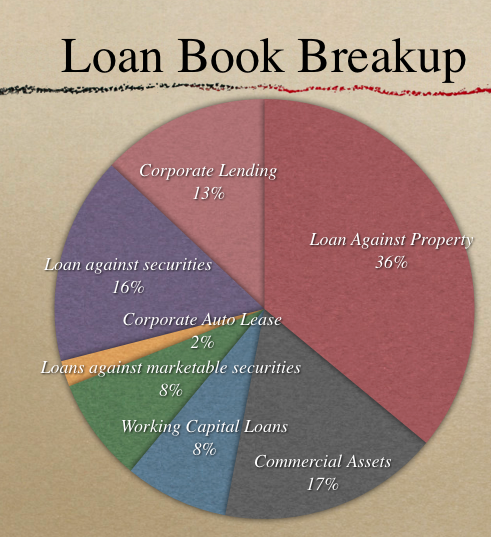

Religare Finvest caters to the Small and Medium Enterprises as well as the retail segment for its business, but the biggest segment of its loan book is the loan against properties it gives out to the small and medium enterprises.

Here is the breakup in its loan book as on June 30 2011.

- SME Financing: Loan Against Property 36

- SME Financing: Commercial Assets 17

- SME Financing: Working Capital Loans 8

- SME Financing: Loans against marketable securities 8

- Corporate Auto Lease 2

- Retail Capital Market Finance: Loan against securities 16

- Corporate Lending 13

If you look at this mix then this seems to be a lot better than the other NCDs we’ve seen before. Mannapuram was of course all gold, India Infoline had a lot of real estate and stocks, and Shriram City Union had more than a quarter in gold, and 9% in personal loans as well. Â On the other hand, Religare Finvest’s Capital Adequacy Ratio at 16.16% is lower than the other companies we have seen come out with NCDs.

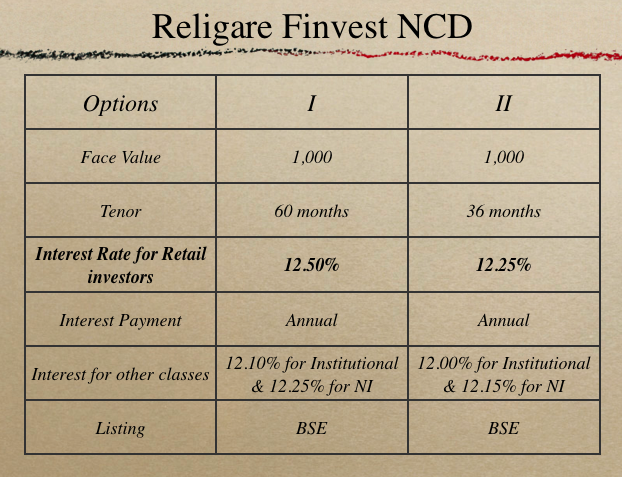

Now let’s take a look at the terms of the issue itself.

Terms of the Religare Finvest NCD

The minimum investment required is Rs. 10,000 and the issue opens from September 9th 2011 and closes on September 26th 2011.

There are two series – one for 3 years, and the other one for 5 years, and both of them pay interest annually. The interest rate for retail investors is 12.50% for the 5 year series which is the highest coupon rate any NCD has offered yet. Here are the other details.

There are bound to be questions on whether there will be listing gains or not, and I’m 100% confident that I have absolutely no clue about it. But I do have a feeling that the retail part will be over subscribed so if you do decide to invest in them it will be a good idea to apply quickly, as the NCDs will be offered first come first serve basis.

When they do list, there will be six NCDs listing on the exchange, one for each maturity and coupon rate, and you can decide which one you want to buy at that time as well.

Those are some key things that caught my eye while going through the prospectus of this issue, and as always, Â questions and comments are welcome!

If you are a new reader and have some basic questions about NCDs then you will find these two posts about NCDs useful:Â

Hello Everyone,

Just seeking feedback from all of you invested in 2011 for 3 years, completing in 2014.

For Ones opting for Annual Interest 36 months- Have you been receiving interest on time periodically?

Did you receive the full FV amount in your demat account at the end of the period in Oct 2014?

Religare ncd interest was due 1st april. I have not received interest credit in my account. What to do

Religare NCD (5year) price is really spiking now. At 1042, its above its fair price of 1030. By far best NCD of the lot raised last year.

I learn that Religare NCD have been allotted to me. where do I view them in my demat account at icicidirect. I cannot view them at demat allocation. how do I sell them at icicidirect.

Does it show in your Demat account? Is it linked to ICICI Bank online account? I used to see the other holdings there and that should be visible under that section somewhere. You can sell this under the equity section using the correct symbol. That symbol will based on which series you bought.

I did not see any price changes on this ncd listing. Does this mean there have been no transactions for this ncd on the sensex? Any comments if this is good or bad.

I applied for religare ncd and did not get any ncd. i got full amount refund back from company. there was no reason mentioned in the refund order.

just want to know the allotment was on first come first serve basis or else?

also want to know the bse code for the ncd? i come to know from the financial express website that the ncd have been listed on bse. but i am not able to find the code on the bse for this ncd. the link for the news is given below:

http://www.financialexpress.com/news/religare-ncd-debuts-at-discount-joins-peers-in-struggle/852817/1

regards

lekhraj

Yes, I think they were first come first serve, although I’m speaking from memory and could be wrong.

As shared by another reader there are the codes:

The NCDs have listed today. Scrip codes are:

Option I:

934835

934836

934837

Option II:

934838

934839

934840

Here is another link that can help you see prices quicker:

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=L_TFINANCE-N2

Thanks Manshu. I was really looking for a data source for live YTMs and the link you have given summarizes the info on NCDs effectively.

Cheers!

AB

This is the best source i found so far AB – and now I feel a lot more confident in making a list of these since I don’t have to do any calculations myself.

The NCDs have listed today. Scrip codes are:

Option I:

934835

934836

934837

Option II:

934838

934839

934840

Hey AB – thanks a lot for sharing this. I think I found the best site to get the yields and prices for these NCDs – Edelweiss. Here’s the link, see if you find it useful as well.

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=L_TFINANCE-N2

Allotment of these NCDs have been done. I had applied for 50 and today I see 50 NCDs in my demat a/c

did u get interest credited on application money?

I have not received the interest. Any idea within how many days interest is generally credited?

Thanks for that info Aditya.

Hi Manshu,

Thanks for covering the NCD space well. I really like the discussion onemint and sincerely appriciate your dedication.

Please keep us updated of the allotment status and listing date; I’ll do it on my part if I get the info earlier.

Cheers!

AB

Thanks AB – that’s a lovely comment.

Hi,

Can I sell this ncd before the completion of their term that is before three year or five year?

If yes then how intrest will calculated?

Thanks,

Chandan

Yes, you can on the open market. Interest will not be paid pro rata or anything. It will be paid like dividend on stocks, if you own the bond on the record date you will get interest else you won’t.

Also, when you sell this in the open market then you will get market prices that can be above or below what you paid for the bond.

Strong promoter reputation makes me feel that this issue will do better than india infoline. One thing I wonder is if they borrow from market at peak @ 12.5%, how they will able to sustain their NIMs in future by paying this high fixed interest while their floating interest income on their assets would come down due to decline in interest rate

Hi Manshu.. It’s always a pleasure reading ur posts.. Had a couple of questions n it would be great if u would answer..

1) are these bonds secured or unsecured

2) how can I track the performance of bonds? For example, I have created a portfolio of stocks & MFs on moneycontrol.com, so is there is any wher I can get updates on it’s LTP.

3) how can I sell these bonds and what happens to interest? Do it get it on a pro-rata basis.

Thanks in advance…

Thanks Kunal – it is my pleasure to engage in discussion with smart folks, as for your questions – yes, they are secured, I’m glad you mentioned that, I usually do include that as part of the post, but somehow it slipped my attention this time.

2. At this time, I’m not aware of a way to do that. I’ll look a little deeper in MC and other tools and see if they have already included this option or if it can be done another way.

3. You can sell them on the exchange. When they list you can find them in the same place as you find other shares and sell them from there.

The interest is not paid pro rata. The owner of the bond on the record date gets the interest, much like the owner of a share on the record date gets the dividend.