I wrote about PFC infrastructure bonds earlier in the week, and today it is the turn of the IFCI 80CCF infrastructure bonds.

The terms of the IFCI issue are exactly the same as the PFC one, and the issue has already opened on the September 21 2011, and will close on the November 14 2011. However, the bond issue itself is an unsecured one whereas the issue was a secured one in the case of PFC.

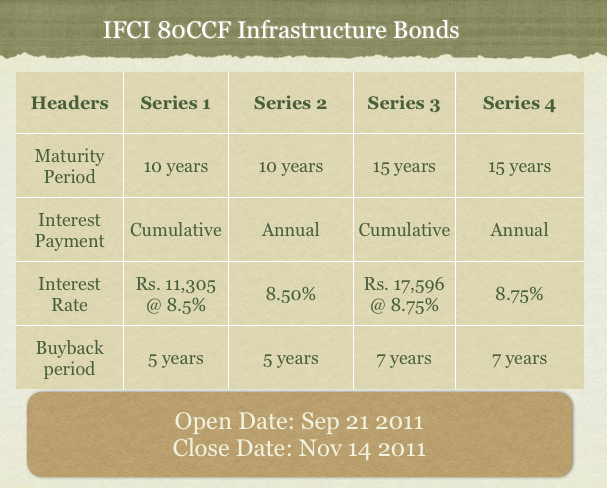

Here are the major terms of the IFCI 80CCF bonds.

I didn’t explain the buyback option in the PFC 80CCF post, and there was a question on that so let me address that topic here.

The buyback will be initiated at your choice, and if you tell IFCI that you want to sell back the bonds to them after 5 / 7 years then they will redeem your bonds at that time.

So, in that sense even though these bonds mature in 10 and 15 years, the maturity comes down to 5 and 7 years because you can ask the company to redeem them early.

You will be paid full interest and this is more of a facility to you than anything else. It is not necessary to initiate the buyback at the end of either the 5 or 7 year period rather you can initiate any time after that time period.

Also, bear in mind that after the lock in period these bonds will be listed on the stock exchange so if interest rates are lower at the time then you should be able to sell the bonds at a higher price in the market and can take that route instead of selling it back to the company.

I can’t think of anything more to add to this IFCI bond review, and if you have any questions or comments please leave them below and we can discuss.

If you haven’t already read it then please read my PFC Infrastructure Bond Review here.

buyback option is available now on ifci . should one continue investment or redeem them

Thanks Manshu !

Hi,

Will it be possible for you to let me know various sharia compliant alternative investments – under various sections of 80C as well as for normal investment opportunities. “Sharia compliant” would mean “no interest”, “debt” or “fixed return” and could be alternatives of 100% equity investments.

Hi Jaffer,

If i might answer the Q on Manshu’s behalf, you may go through the Volume 45 15 September 2011 issue of Money Mantra to read the article ‘In line with rules of Islam’ by Mr.Alok Dwivedi wherein the various avenues for Shariah compliant investment have been discussed in detail. I could not find any means of Shariah compliant investment offering benefits under 80C.The GIST of the article is as follows.

1.What is not allowed?

Savings Bank Deposits, FD, Postal Savings, Debentures, Bonds

Stocks of companies whose Business activity is Haram – Conventional interest based banks, NBFC, Insurance cos, Stock Brokers, Alcoholic Beverages, Pork & Non Halal food products

Security trading in derivatives and Day trading in Stocks

Short selling

Traditional MF

2.What is allowed?

Real estate cos

Commodities like Gold, Platinum, Silver etc

Shariah compliant stocks (915 out of 3400 as on Dec.2010)

BSE TASIS Shariah 50 Index, S & P CNX Nifty Shariah Index, S & P CNX 500 Shariah Index

Shariah BeES MF

Taurus Ethical Fund

Shariah Index ETF

Investment in E-Gold

Shariah compliant PMS incl. Bonanza Portfolio & Pragmatic Wealth Management Pvt Ltd & HSBC Amanah India Shariah Portfolio

Investment in shares and ‘purification’ of income thus obtained by giving it as ‘Zakkat’ to the needy

Thanks for posting that response Vijay – that was a very good and comprehensive reply, and I learned a lot from there myself. I have never done any research on Shariah topics before but it looks like I should write something on that topic also.