National Highway Authority of India (NHAI) is usually known for issuing Section 54EC bonds, but for the first time they are issuing tax free bonds as well.

Now, a lot of people confuse tax savings or no TDS with tax free, but these are truly tax free bonds, which means that the interest from these bonds is tax exempt – you don’t have to pay any tax on the interest regardless of your income tax bracket.

The bonds will list on the BSE and NSE, and if you sell them on the exchange and make capital gains on them, then that will be taxable. Listing of the bonds doesn’t however mean that the bonds will be issued in dematerialized form only and you will compulsorily need a demat account.

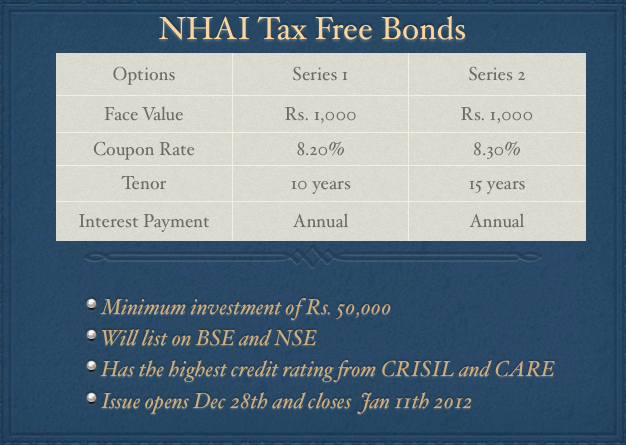

NHAI bonds will be issued in both physical and demat form, so people who don’t have demat accounts can also buy these bonds. There are two series of bonds – one with a ten year maturity, and the other with a 15 year maturity. The first series has an interest rate of 8.20% and the second series has an interest rate of 8.30%, both the series will pay interest annually.

Since some of the best bank interest rates are at 10% right now – you can see that for people in the 30% or 20% tax bracket – this issue has got great yield.

NHAI tax free bonds have been rated CRISIL AAA/Stable, CARE AAA, and Fitch AAA by CRISIL, CARE and Fitch respectively. These are very high ratings, and although NHAI has made losses in the last three years – it’s easy to see how these credit agencies assigned these bonds the highest rating.

This is a secured issue from a company that comes under the Government of India, and as such it’s hard to see how NHAI could default on its debt obligation.

I think this is a good issue especially for people in the 30% tax bracket, and won’t be surprised if it gets over subscribed in the first few days itself. This is especially so because interest rates can’t remain this high forever and this issue allows you to lock on to these high rates for 10 or 15 years, which is quite a good return for a safe debt instrument. And even NRIs can invest in these bonds, so to the extent they can manage the application process, this will be an attractive offer for them as well.

SBI Capital Markets, AK Capital Services, MCS Limited, ICICI Securities and Kotak Mahindra Capital are the lead managers to the issue so you should find the application forms in their offices. Other investment firms like Karvy should also have the application forms, and I think some of these companies will also enable it so that you can apply for the NHAI tax free bonds online, but I don’t have a definite list yet.

I’m sure as more information comes in – you will leave comments and I’ll update the post with where exactly you can find the application forms etc. at the time.

Meanwhile, many thanks to Rakesh Jain who let me know about this issue much in advance, and let’s hear any other questions or observations you have about the NHAI issue in the comments.

Application Form of NHAI Tax Free Bonds

Update: Deleted the part about allotment being on a first come first serve basis per Shiv’s comment below.

Hi… The issue pre-closes on Wednesday, January 5th. Remarkable participation by all the investor categories!!

Dear Shiv,

Thanks to you I invested to my fullest capacity in this issue. Do you have any information about how many times this issue got over-subscribed in retail segment ?

Thank you very much

Hi TCB… It is Rs. 1510 Crore in the Retail Segment, as per some reliable sources but not confirmed by NHAI.

Hi ,

I am clear that the returns on these bonds are tax-free.

But does these NHAI bonds come under infrastructure bonds , if not then do they have tax benefit on my income , i mean can i save income tax like i can save through infrastructure bonds upto 20,000.

If yes , then these are under what section , are they under 1 lack limit of savings (where we have NSc, ppf n all) or is it some other benefit .

please can someone make the tax benefit part on income tax more clear(apart from returns from this bond)

No these do not fall under long term infrastructure bonds (Section 80CCF). Those are tax SAVING bonds and this one is tax FREE bond. So that means Interest from Bond does not form part of Total Income.

My two cents on tax related issues for these bonds.. Quoting the various income tax related stuff regarding these tax free bonds as per taxguru.in: NHAI Tax Free Bond – Tax benefit and effects under the Income Tax Act, Wealth Tax Act and Direct Tax Code

Interest from Bond do not form part of Total Income so it tax free. Since the interest Income on these bonds is exempt, no Tax Deduction at Source is required.

Under section 2 (29A) of the I.T. Act, read with section 2 (42A) of the I.T. Act, a listed Bond is treated as a long term capital asset if the same is held for more than 12 months immediately preceding the date of its transfer.

Short-term capital gains on the transfer of listed bonds, where bonds are held for a period of not more than 12 months would be taxed at the normal rates of tax in accordance with and subject to the provision of the I.T. Act.

Long term capital gain tax can be considered 10% on listed bonds without indexation. Securities Transaction Tax (“STTâ€) is a tax being levied on all transactions in specified securities done on the stock exchanges at rates prescribed by the Central Government from time to time. STT is not applicable on transactions in the Bonds.

Note:20% of long term capital gains calculated after reducing indexed cost of acquisition is not available for these bonds.

Wealth-tax is not levied on investment in bond under section 2(ea) of the Wealth-tax Act, 1957.

If there are some discrepancy or misinterpretion please correct.

Hi,

Would there be any difference in the way the interest & maturity amount is paid back; depending on whether the NHAI bonds are held in Demat form or physical form?

More specifically – Does the interest & maturity proceeds would be done ‘automatically’ to the linked savings account without any manual intervention if the bond is held in Demat form (say ICICI Bank savings account linked to ICICI Direct account in which bond are held in demat form); but if the bond are held in physical form then physical cheques for each year would be mailed at beginning of each year & the physical bond needs to be mailed to NHAI at the end of subscription period to get the maturity amount cheque . Is this correct?

From what I read in the application form – it appears that they are going to try to make payment electronically first and only if they are unable to do that because the bank MICR or IFSC code is incorrect or something then that will make them send you the check.

So it does not matter if the bond is held in physical for or Demat – the interest & maturiy payout would be done in same manner? And what at the time of maturity? Do we have to send the bond to NHAI with instructions one month before maturity in case the bond is held in physical form?

[Thanks for all your informed inputs and discussions] Regards.

Yes because if you have them in Demat then you don’t have to worry about anything at all and you have the opportunity to sell them on the exchange as well. If you have the Demat already then that’s a lot better in my opinion.

Hi Manshu,

Thanks always for your inputs; always helpful in making informed decisions.

I think I got my answer. Nevertheless, here are the details. Bulk of the EMI goes towards interest.

Loan Amount: 28 Lakhs (LIC Hsg Fin)

Tenure: 20 yrs

Commencement: Dec 09

Interest: Locked for 8.9% for 3 yrs (until Nov 12) and market rate thereupon

Current Interest: 8.9%

EMIs paid till date (in months): 24

Regards,

Sandriano

Thanks Sandriano – let me try to do a post with these numbers in detail – I have never done such a comparison so it will be a first time for me and sharing it here with a wider audience might get some good perspective from some people who have done similar comparisons.

Hi Manshu,

Thanks for the reply.

It would be helpful if the post is on what are better investing options compared to repaying the housing loan. In addition to the above scenario, one other option that I was pondering was whether it is a wise idea to repay the housing loan (with above mentioned details) or to invest the same repayment amount in PPF which has an interest rate of 8.6% pa. I think such a post will be very useful. I recently observed that a lot of my friends are investing upto 70,000 pa in PPF when, at the same time, they are servicing a housing loan at over 10% pa. It did not look like a sound financial decision. Here I am assuming that they are in early stages of housing loan repayment which in all probability is true.

Regards,

Sandriano

Hi Manshu,

Thanks for this post. Very useful to lot of folks always. I wish you a happy new year as well.

Have a query though. Is it a better idea to partly pay-off housing loan with 9% interest rate as compared to investing in NHAI bonds?

Regards,

Sandriano

Happy new year to you too Sandriano!

In my mind that will largely depend on how far away you are in your EMIs. If you are at a stage where the interest payments still make bulk of the EMI then it will probably be better to pay off the loan, if not then probably better to invest in this.

I think it will depend on all the terms of the loan and if you leave a comment with that I could try and take a look at all the detals.

Hi Mr. Shiv,

As you mentioned, In NHAI Bonds, apart from interest income, there is a scope of Capital Gains also. My question is, will there be any possibility to get Capital Loss?

No, I think a capital loss is impossible. My understanding of the reason behind capital gain is this: you get 82 Rs/1000, which is the committed rate of interest. Now, if the interest rates were to go down to 5%, you’ll have a lot of interest in getting this bond, as its offering an interest lot more than the interest rate. So, the price would rise to around 1600, which gives an interest of 82. That accounts for your capital gain.

Conversely, if the interest rates rise to 20%, then you are losing out. As per the market scenario, you wouldn’t have any takers for the bond above 400. So, theoretically, you’ve made a loss. But, remember, NHAI is bound to pay you the full 1000 rupees, so unless you have a necessity to sell, you’ll always be able to get your principal back.

Hi Sat.. Everything is possible on this earth, so in the Bond Markets. If I understood your query rightly, you are talking about Capital Loss happening on the listing day. Yes it is possible but I think with a very very low probability. If Category I & Category II investors are investing multiple times in this issue at Rs. 1000 Face Value, then I think they would go crazy for these bonds if they start trading at a discount. As I just mentioned above about SBI 9.95% Taxable Bonds and NHAI 8.3% Tax-Free Bonds – “At 9.5%, the effective after-tax yield works out to somewhere around 6.5% to 6.65%. As compared to 6.5% or 6.65%, NHAI Bond yield of 8.3% is quite attractive to me. I think that is the reason why Institutional Investors are lapping it up”.

Please let me know in case you’ve any further query.

I am planning to invest in these bonds. Since it is a substantial amount, I checked with one of the distributors about him passing on some of his commission back to me, but he declined stating that it is very nominal for bonds. Is that the case or is he pulling a fast one on me?

Agent passing a part of commission is a thing of past and I think punishable also.

Sharing the info I found on NHAI Tax Free Bond – Tax benefit and effects under the Income Tax Act, Wealth Tax Act and Direct Tax Code. Please verify, I am just quoting it.

Commission on sale.

i) in case of a public issue, the commission on sale shall be capped at a maximum of a flat fee of 1.25% of the issue size;

ii) in case of a private placement- (a) for bonds with a tenure of ten years, the commission on sale shall be capped at a maximum of a flat fee of 0.1% of the issue size; (b) for bonds with a tenure of fifteen years, the commission on sale shall be capped at a maximum of a flat fee of 0.2% of the issue size.

Why should it be illegal? It’s an incentive that the broker is passing on to get me to invest through him. As I see it, if I invest 5L, he gets 6250 (1.25%) for little more than just submitting the application form. If he passes on some of it to me, it’s a win-win for both of us.

Jagan,

Quoting from EconomicTimes article Sebi bans incentive payment in debt issues.

The Securities and Exchange Board of India (Sebi) on Monday banned payment of incentives to investors to bid in public sale of bonds as it considers the practice leads to an ‘unfair advantage’ to a select few and raises the cost to issuer.

Public bond sales are rising with many companies such as Rural Electrification Corp, National Highway Authority of India and others planning to raise thousands of crores from retail investors. To get a higher share, some brokers are offering incentives for investors to buy these bonds through them, which Sebi feels is not right.

Hi TCB… In the 10.3% Tax Bracket, the effective yield is 9.253% (8.30% – 15Year option), so, yield-wise, there is not much difference. But you cannot trade in FDs and hence there is no scope of Capital Gains. In NHAI Bonds, apart from interest income, there is a scope of Capital Gains also.

Observing the Category I & Category II response, I expect the Bonds to list at a premium of at least 2-4%. Surely you can invest in these bonds for listing gains but I think the longer an investor will remain invested in these bonds, the higher will be capital appreciation.

Dear Shiv,

Thanks for the reply. Is the NHAI issue still open ? Can I invest on Monday ?

If yes, which of the two NHAI or PFC should I apply to get more allotment ?

Can I get higher listing price of NHAI as it is listing on NSE also and as its issue size is more than PFC ?

Thanks

Hi TCB.. NHAI issue is still open. As per some unofficial sources, Category III subscription figure has crossed some 1500 Crore against Rs. 3000 Crore reserved. So, I think the issue would remain open at least till Monday.

NHAI’s issue size of Rs. 10000 Crore and its listing on both NSE & BSE would have some positive effect on the volumes traded and probably on the listing price also. I would personally go for the NHAI issue.

Dear Shiv,

Thanks a lot for your reply.

In one of your earlier posts, you had mentioned that PFC and HUDCO had launched tax-free bonds earlier. Were these bonds listed ? From where can I get the prices ?

I am asking this, as I wanted to know the yields at which the old bonds are quoting. This will give me a fairly accurate idea of listing price of present bonds.

If the old PFC and HUDCO bonds are not listed, please tell me which is the nearest comparable debt instrument that is listed and at what yield is it traded.

The above infomation is necessary for me to take decision about investing in the present bond issue. Hope you will give the details as sooon as possible.

Thanks

Hi Mr. TCB… I’ve not been able to check their listing as I got extremely busy in the last 30-40 days due to various reasons. I would personally compare these bonds with SBI 9.95% taxable Bonds issue which came in February 2011 & is trading around Rs. 11100 against the issue price of Rs. 10000, yielding around 9.5%.

Though not strictly comparable, the issue size in both the cases is Rs. 10000 Crore each and both are quite reputed Govt. institutions. At 9.5%, the effective after-tax yield works out to somewhere around 6.5% to 6.65%. As compared to 6.5% or 6.65%, NHAI Bond yield of 8.3% is quite attractive to me. I think that is the reason why Institutional Investors are lapping it up.

Dear Shiv,

If the post-tax yield of SBI bonds is 6.65%, then NHAI bonds should list at more than Rs. 1200 to be at par with SBI Bonds in terms of yield. This is more than 20% premium to its issue price. Is this correct or am I making some mistake ?

If the above is correct, why do you expect the listing to be only 2-3% higher and not more ?

Thankful to you as always

Hi TCB… Both these bonds are not strictly comparable. If NHAI Bonds lists at 20% premium then you’ll find only sellers in the market with no buyers. I said at least 2-3% and probably I’m a bit conservative. But to be on safer side, I still want to quote the same “at least 2-3% premium”. Whatever more premium the investors get, it will be a bonus.

Dear Shiv,

SBI Bonds had taken about one and half months to list. Same with NHAI ? When is listing expected ?

Thanks

Hi TCB… SBI issue closed on February 28th and the listing happened on March 21st. I think NHAI Bonds should list by the last week of January.

Dear Shiv,

In addition to the above querry, I would be grateful if you can clarify the following :

I have read somewhere that the ceiling for coupan for tax-free bonds is previous month’s G-sec yield minus 50 basis points. i.e. a company issuing tax-free bonds cannot offer coupan higher than previous month’s 10 year G-sec yield minus 50 basis points.

If this is so, 10 year G-sec yield is likely to be higher than yields offered on tax-free bonds. My questions are :

1) Can retail investors buy G-secs ? If yes, are there any negatives about G-secs compared to tax-free bonds like NHAI ?

2) Can institutions, QIBs, HNIs etc. (i.e. non-retail investors) buy G-secs ? If yes, why are they investing in present issue of NHAI bonds at lower yield ?

Myself and many other readers will benefit if you can clarify the above.

Thanks a lot

Hi.. If I’m not wrong, Yes, the Retail Investors can invest in G-Secs and the minimum investment required is Rs. 5 Crore. I don’t know how many retail investors have Rs. 5 Crore to invest in G-Secs. They can also invest in G-Secs through Mutual Fund Gilt Schemes.

The interest earned by these MFs on G-Secs is taxable, so the effective yield is lower than the quoted Coupon Rate. If you compare after-tax return what MFs earn on G-Secs with these NHAI Tax-Free Bonds, then yields are way higher in NHAI Bonds. That is the reason why Institutional Investors including MFs, Insurance Cos., Trusts, Corporates, FIIs etc. and also NRI/HNIs lapped these bonds up on the first day itself.

The only difference is that G-Secs are issued by the RBI on behalf of the Govt. for the latter’s various kind of expenditures, so, in a way, issued by the Govt. itself. Whereas, the NHAI Bonds are issued by NHAI for its own planned expenditures. That is why the effective after-tax yield is higher in case of NHAI at 8.3%.

I hope it would clarify your doubts.

Dear Shiv,

I am not able to find words to express my gratitude to you. Your level of knowledge and selfless desire to help others are extremely rare these days.

Earlier I was under the impression that interest from G-secs is tax-free for all investors. So I was directly comparing yields of G-secs to yields of NHAI bonds. But from your reply I understood that QIBs, FIIs, MFs, Insurance companies, Trusts, Corporates, HNIs etc. have to pay tax on the interest which they receive from G-secs. So their post-tax yield of G-secs is lower than yield of NHAI bonds. Is my understanding correct ?

Thanks a lot

Hi TCB.. .Thanks a lot for these kind words!!

Yes, you understood it rightly, interest earned on G-Secs is taxable, that is why Financial Institutions are running after this Tax-Free Bond issue as the effective yield is higher.

Hi ,

I am clear that the returns on these bonds are tax-free.

But does these NHAI bonds come under infrastructure bonds , if not then do they have tax benefit on my income , i mean can i save income tax like i can save through infrastructure bonds upto 20,000.

If yes , then these are under what section , are they under 1 lack limit of savings (where we have NSc) or is it some other benefit .

please can someone make the tax benefit part on income tax more clear(apart from returns from this bond)

Why people are rushing in for these bonds.

1. There is volatility in the equity markets

2. Rate cut expectation in next 3-6 months with the interest rate at its peak,(tentatively)

3. AAA rated, tax free government backed paper giving a return of 8+% (though some have said pre-tax return of 11.7% for those taxed in the 30% bracket )

In the present scenario is seems a good option worth considering. And it also helps to do asset diversification.

Newspapers, Financial magazines, mail boxes, mobiles are bombarded with these offers. Infact a friend of mine who was out of station for last two days thought he cannot apply as bonds have been over subscribed. (Retail portion of the bond was not fully subscribed till yesterday )

Assuming one has a financial plan -Before one invests one needs to check if this option fits into the financial plan and then consider the option and see if it fits in.

But if one doesn’t have a financial plan then..I shall anecdote from “Alice in Wonderland†book

One day Alice came to a fork in the road and saw a Cheshire cat in a tree.

“Which road do I take? she asked.

Where do you want to go? was his response. I don’t know, Alice answered.

Then, said the cat, it doesn’t matter.â€

Dear Shiv & Manshu,

For people like me who fall under 10% tax slab, what is the effective yield for these tax-free bonds ? Is it better for me to invest in these tax-free bonds versus SBI FD giving 9.25% for 10 years ?

Considering the response from Institutions / HNIs do you expect these bonds to list at a premium ? Can I invest in these bonds only for listing gains ?

Please reply as soon as possible

Thanks

Anupma I think you have fair chance of getting allotment as over subscription is mostly from institutions or People with lots of money. The retail part is not even fully subscribed. If you want to invest then hurry up!

Quoting from TOI NHAI awaits retail bids to close bond issue

The National Highways Authority of India’s tax free bonds have seen bids for almost Rs 22,500 crore from high net worth individuals (HNIs) and institutional investors, raising expectations of the issue closing well before January 11, the scheduled date of close. But the issue managers and the issuer have a small problem at hand. So far, the Rs 5,000 crore bond issue has generated bids for only Rs 622 crore from retail investors against the quota of Rs 1,000 crore.

While banking sources are confident of getting individuals too on board, they are not sure by when. “Typically, retail investors wait till the last day to put in their bids, and the experience will be similar for NHAI bonds too,” said a source.

Already, the buzz in the market is that fresh bids from HNIs and institutional investors are not being entertained and the NHAI issue could close by Monday. “As soon as NHAI achieves the retail quota, the issue will be closed,” said a government official.

now that issue is already two days old..what are the chances that i would get full allotment on my application money?

Dear Mr. SHIV,

IS THERE ANY LOCK IN PERIOD? I suppose no lock in period as these are going to be quoted & traded on NSE & BSE. Please Clarfy.

Mahesh.

No lock in period is there.

Please clarify whether the investment made in this NHAI bond can be claimed under 80CCF (in the Rs.20000/- additional exemption limit)

No, this is not the 80CCF bond.

Hi Experts,

I’m asking this question with less knowledge in FDs and bonds. Few banks (Central Bank of India, Union Bank of India etc.,) offering FD to double money in 7.5 yrs giving annualised yeild of 13.33%. If we consider these FD’s, which one would be most beneficial compared to NHAI tax free bonds?

Its very difficult to compare FDs and NHAI bonds as both of these have features which may benefit to some investors while may not matter to most. NHAI bonds are listed on exchange and so one has opportunity of earning capital gains.There is no such benefit on FDs.On other hand FDs have a high liquidity feature physically which is not the case with NHAI bonds.Similarly NHAI bonds carry reinvestment risk which is captured by an FD.

Hence if your objective is investment for capital gains then you can consider NHAI bonds otherwise FD might be more advisable option.Avoid catchy words like Double your money.Instead calculate net returns by taking tax into consideration and then make a decision.

Thannks much Jitendra.

🙂 addressing you as ‘Mr.’ is a pre-requisite of a Civilsed World and I respect & follow that. When I know you well and become friendly with you like I’ve become with Manshu, I’ll start addressing you with your name.

Moving ahead, you can transfer these bonds or for that matter any of your securities held in ICICI Demat account to any online/offline brokerage firm of your choice. You can freely do so. It is like moving your money from one Bank Savings account to another, in case you decide to close the first Savings A/C. or get another Demat A/C. opened & keep both active.

Hi:

Good job Shiv and others who are sincere in answering people’s question. It is very vital. I have 3 questions that I wanted the gurus to advice, 1.) Is the interest payable on yearly basis or compounded to the principal? 2.) Also does this give relief under any 80 C/D categories? The reason I am asking is, If I fall under the 30% + tax bracket and I am already covered on EMI + Interest paid towards housing loans under 80 C Categories, Do I have to still opt for taking this? if not, I would like to put it in floater FD which gives couple of % less, but gives me an option to withdraw money during need. Finally, 3.) If I have to opt between investing in this verusus paying back part of a house loan for which the interest is around 10.75%, Which one would be the best decision?

Thanks

Srikanth

Thank You Mr. Srikanth for this encouragement !! This really works wonders for us.

Answers to your queries:

1) Interest of 8.30% or 8.20% is payable annually, there is no compounding option at all.

2) It does NOT give any tax deduction under any section of I-T Act, be it 80C or 80CCF or 80D or 54 EC. The interest you will receive annually is absolutely Tax-Free and you are not liable to add it to your taxable income while filing your tax return. This will come under exempt income.

If you have a Demat account and take these bonds in the Demat form, you will get the desired liquidity as these bonds are going to list on NSE/BSE upon listing (Listing should happen by the last week of January). During the entire tenure of 15 years or 10 years, the trading will remain open and you can liquidate your investment at any point of time.

I would advise these bonds for all those investor who fall in the 30.9% or 20.6% Tax Bracket and pay their taxes honestly. In the 30.9% tax bracket, the effective yield is 12.01% and in the 20.6% tax bracket, the effective yield is 10.45%. You can compare the FD returns with these returns. Easy liquidity without any penalty is a big bonus.

3) If your tax-benefit adjusted cost of home loan is more than 8.3% and on an average you expect it to remain like this, for a considerable period of next 10 to 15 years, then you should pay back your home loan first. Please consider pre-payment penalty part also (if it is still there even after RBI notifications).

Manshu, please share your thoughts.

Beautiful(Didnt like the ‘Mr.’ Part though…) . Thanks. One last question. IF I take this thru Demat in ICICI, should I stay with them for 10 years or I can still opt online and then transferto any online brokerage firm? It would be very difficult for me to stay with ICICI for next 10 years….

Srikanth