National Highway Authority of India (NHAI) is usually known for issuing Section 54EC bonds, but for the first time they are issuing tax free bonds as well.

Now, a lot of people confuse tax savings or no TDS with tax free, but these are truly tax free bonds, which means that the interest from these bonds is tax exempt – you don’t have to pay any tax on the interest regardless of your income tax bracket.

The bonds will list on the BSE and NSE, and if you sell them on the exchange and make capital gains on them, then that will be taxable. Listing of the bonds doesn’t however mean that the bonds will be issued in dematerialized form only and you will compulsorily need a demat account.

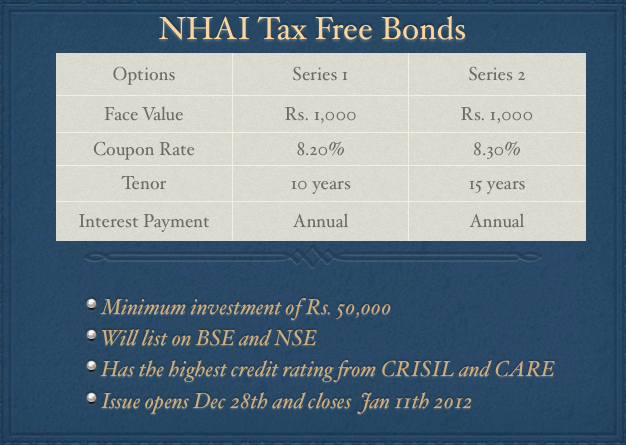

NHAI bonds will be issued in both physical and demat form, so people who don’t have demat accounts can also buy these bonds. There are two series of bonds – one with a ten year maturity, and the other with a 15 year maturity. The first series has an interest rate of 8.20% and the second series has an interest rate of 8.30%, both the series will pay interest annually.

Since some of the best bank interest rates are at 10% right now – you can see that for people in the 30% or 20% tax bracket – this issue has got great yield.

NHAI tax free bonds have been rated CRISIL AAA/Stable, CARE AAA, and Fitch AAA by CRISIL, CARE and Fitch respectively. These are very high ratings, and although NHAI has made losses in the last three years – it’s easy to see how these credit agencies assigned these bonds the highest rating.

This is a secured issue from a company that comes under the Government of India, and as such it’s hard to see how NHAI could default on its debt obligation.

I think this is a good issue especially for people in the 30% tax bracket, and won’t be surprised if it gets over subscribed in the first few days itself. This is especially so because interest rates can’t remain this high forever and this issue allows you to lock on to these high rates for 10 or 15 years, which is quite a good return for a safe debt instrument. And even NRIs can invest in these bonds, so to the extent they can manage the application process, this will be an attractive offer for them as well.

SBI Capital Markets, AK Capital Services, MCS Limited, ICICI Securities and Kotak Mahindra Capital are the lead managers to the issue so you should find the application forms in their offices. Other investment firms like Karvy should also have the application forms, and I think some of these companies will also enable it so that you can apply for the NHAI tax free bonds online, but I don’t have a definite list yet.

I’m sure as more information comes in – you will leave comments and I’ll update the post with where exactly you can find the application forms etc. at the time.

Meanwhile, many thanks to Rakesh Jain who let me know about this issue much in advance, and let’s hear any other questions or observations you have about the NHAI issue in the comments.

Application Form of NHAI Tax Free Bonds

Update: Deleted the part about allotment being on a first come first serve basis per Shiv’s comment below.

Wish to invest in NHA1 bonds

what do you advice through icici bk

where we have an account or through icici bk demat

look forward to your advice

It is always better to have a demat account to invest in these kind of bonds.

To buy NHA bonds which is the best route

through icici bank or directly through demat account in icici bank

this year I have not received ant interest despite 1st October is due date. last year it was made on first October itself. why delay?

I have received the interest via ECS, proably you should check with your bank and then NHAI

I have also received the interest on 1st October.

Hi Shiv, What is ISIN number & YTM of these bonds currently if one intend to purchase from secondary market. Thanks, Ajay

ISIN Number is INE906B07CB9 and the YTM must be around 8.20% (Price is Rs. 1017.95).

http://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=NHAI&series=N2

NHAI tax-free bonds have gone “ex-interest” today. Interest Payment Date is October 1st, 2013.

Dear Sir,

i want to know that Nhai Tax free bonds 2011-12 are gift tax free or not?

I am Having N H A I Tax free bonds in physical form and i want to gift it to my freind . Is gift tax is applicable or not.

Gift Tax on Bonds/Debentures/NCDs: As per section 56(2)(vii) of the I.T. Act, in case where individual or HUF receives bond from any person on or after 1st October, 2009, it shall be taxable as the income of the recipient, if it is

A. without any consideration and the aggregate fair market value of which exceeds Rs. 50,000, then the whole of the aggregate fair market value of such bonds/debentures would be taxable.

B. for a consideration (say Rs. 4 lakhs), which is less than the aggregate fair market value of the Bond (say Rs. 5 lakhs), by an amount exceeding Rs. 50,000, then the aggregate fair market value of such bonds/debentures as exceeds such consideration (Rs. 5 lakhs – Rs. 4 lakhs = Rs. 1 lakh in this example), would be taxable.

Provided further that this clause shall not apply to any sum of money or any property

received—

a) from any relative; or

b) on the occasion of the marriage of the individual; or

c) under a will or by way of inheritance; or

d) in contemplation of death of the payer or donor, as the case may be; or

e) from any local authority as defined in the Explanation to clause (20) of

section 10; or

f) from any fund or foundation or university or other educational institution or

hospital or other medical institution or any trust or institution referred to in

clause (23C) of section 10; or

g) from any trust or institution registered under section 12AA.

I am supposed to receive interest on my investment in tax free bonds of NHAI in October’ 2012. But I have not received the same. What shall I do? Whom shall I contact?

Hi P K Pattnaik… Please check your bank account if the interest has already been credited there. If it is not there, you need to contact the Registrar, MCS LIMITED, on 011-41406149 – 52 or [email protected] / [email protected]

Thank you so much for the guidance. Incidentally it has not been credited to the a/c.

You are most welcome!

Though interest was supposed to be paid on 1st October, 2012, I am yet to receive the same on my NHAI tax free bonds. Why so ? What’s the remedy?

pkpsbi

Annual interest on NHAI tax free bonds were expected on October 1st. But I have not received the same. Can anybody explain it? Or will it be available on next year October, i.e. 1st Oct, 2013?

Thanks again.

You are welcome!

You are welcome austere! You also had the same query, I think.

Yes. I have RBI bond proceeds and LIC proceeds to invest, I guess I need to wait till Oct 1 when the price should fall post the interest payout.

The price has already fallen, it won’t fall further on October 1st, the interest payment date. The price fell from Rs. 1103 to Rs. 1050 on September 13th.

Why has the price of NHAI tax free bonds fallen Rs. 53/- in a single day today? Was yesterday the last day for deciding whom should the dividend be given?

I was expecting it to fall around Rs. 55/- on October 1 when it gives out its annual dividend.

Hi Deepak… NHAI tax-free bonds have gone “ex-interest” today. Record date is September 15th and Interest Payment Date is October 1st. Even if somebody sells these bonds today, he is going to get interest on October 1st. But if you buy them today, you will not get any interest.

Thanks for the clarification, Shiv.

I had purchased these bonds on Monday but they are still not transferred to my account. They were in my Depository’s pool and are expected to be transferred to my account before tomorrow. I hope I will automatically get the interest on October 1. Can you please confirm?

If not, whom can I contact for the same?

Yes, you’ll get the interest, if the bonds are in your name in the records of the Registrar on the “Record Date” i.e. September 15th. Bonds purchased till yesterday will get the interest payments.

Thank you, Shiv.

sir

i want to buy listed bonds which i should buy . secondly indiainfoline ncd should i buy or not

Hi jiger… You should invest your money in a company whose management is good, financials are better than the industry average and business model has a bright future. Keeping in mind these things, you can invest in NCDs of good companies like SBI, NHAI, Shriram Transport Finance etc. From safety point of view, you can invest in NCDs of govt. cos. like SBI, IFCI, NHAI, IRFC, PFC, REC, HUDCO etc.

You can check the review of India Infoline Finance Limited NCD from this link:

http://www.onemint.com/2012/08/30/india-infoline-finance-limited-ncd-review/comment-page-1/#comment-252770

I have invested in NHAI bonds under 10 yr tenure. they had said that there is no lock in period and can be redeemed when listed in NSE/BSE ETC. What should i do now to encash the same now. pls guide me

Hi

If you’ve taken NHAI Bonds in your Demat A/c., then just simply sell them on NSE/BSE like you sell your equity shares either through your stock broker or online. 10 year bonds’ closing price today on NSE was Rs. 1034.

Or else, if you’ve these bonds in physical certificate form, then you first need to get them dematerialised & after that do the above mentioned.

APPLICATION NO 12057949,12057950,12057951

till date not received physical deliveery of bonds certificate

when it is expected?

please inform me?

Hi Mr. Goda… You can check the Allotment Statuts at the below pasted link:

http://www.mcsdel.com/index001.asp

For further communication you need to contact the Registrar to the Issue, MCS LIMITED, on 011-41406149 – 52 or [email protected] / [email protected]

This is to inform you that this is not NHAI’s back office.

our housing society is in need of artificialarrow houses nests feeders.which bird lover society can donate? phone no 99692o6046

I am doing BE civil branch

i am doingh be civil branch

i wantto know status of NHAI bond application No 11200864 under name of chandrakant Tokershi shah

Hi… You’ve been allotted 500 bonds in HUF’s name. Please use the below pasted link to check the status:

http://www.mcsdel.com/index001.asp

plaese print a format of application form of capital gains saving tax vizz;N H A I,R E C, etc etc