Motilal Oswal has come up with an interesting product in the crowded space of gold ETFs with its MOSt Gold shares ETF. The new fund offer for this opened on March 02 2012 and will close on the March 16 2012.

This is a gold ETF which means that the fund will buy physical gold as its underlying and trade on the stock market. It will trade on both the NSE and the BSE. In this respect, it is similar to every other gold ETF that exists in the market right now; what makes it different from all the other funds is that in this ETF you can actually redeem your units and get delivery of physical gold.

I’ve seen numerous comments from people who have said that they want to be able to redeem their gold ETFs with physical gold and Motilal Oswal has sensed this opportunity and brought out this unique product to cater to it.

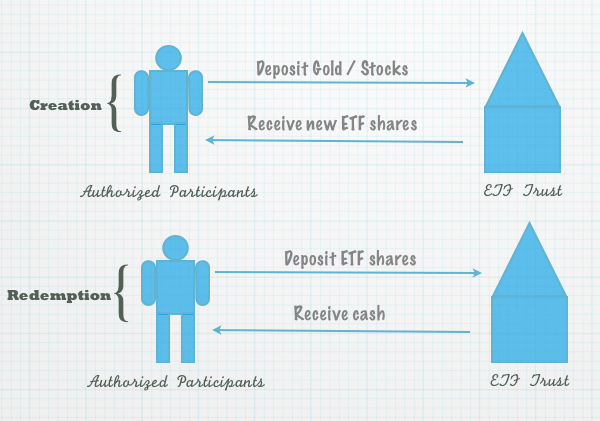

If you remember the post about the difference between mutual funds and ETFs – I used this diagram there to show the process of creation and redemption of ETF units.

The same thing is applicable here as well, and the only difference is that they have made the redemption units really small by allowing investors to redeem just 10 grams of gold whereas for other ETFs this is a much larger number like a kilogram.

So, if you have 10 units which are equivalent to 10 grams of MOSt Goldshares you can ask Motilal to redeem your units for physical gold.

You don’t get exactly the price of 10 grams for 10 units because they will deduct transaction charges at the rate of Rs. 750 per 10 grams and Rs. 250 per 100 grams if you want to get physical gold (no charges for a kilo) and secondly the expenses of the scheme will be deducted from the NAV and as time progresses each unit will represent less than a gram.

MOSt Goldshares will charge 1.3% expense ratio which means that they will use up to 1.3% of the total assets under management to cover for their expenses. This money is reduced from the NAV so although one unit of gold ETF is supposed to represent one gram of gold – in reality it is always less than that. This is true for all gold ETFs, and in fact every other type of ETF also and that’s the reason you should always look for funds with the lowest expense ratios.

In this regard, there are a lot of funds with much lower expense ratios than MOSt gold ETF and these Motilal Goldshares fare worse than them as far as charging expenses to investors are concerned.

However, based on what people have reported here I think you will still get gold coins cheaper from them than you get them from banks – a good way to find out if that is true is to compare the NAV after this ETF lists to the daily prices of gold coins sold by banks and post offices and see how much of a difference is there.

To conclude, I think for someone who is looking to invest in gold electronically, a gold ETF with lower expense and higher liquidity is much better than this fund, but I know from comments here that there is a segment of people who are only interested in buying a gold ETF if it promises to redeem that unit into physical gold and I believe this is a good option for them. The one thing you will have to figure out is after you redeem this for gold units where will you sell them for cash because if you have to take those gold bars or coins to a jeweler and he charges you a deduction again (which they normally do) then you are stuck with yet another expense and it lowers your returns.

I just want to know that whether the short term capital gain on gold ETF Bonds be adjusted in short term capital loss and long term capital loss?????

Have written a blog which compares Gold ETF with Gold Fund Of Funds.

Following is the link

http://goldetfvsgoldfof.blogspot.in/

There are in all 9 points which differentiates the two and helps one decide which avenue to invest in

I think that conversion of ETF to physical gold in bars or coins will be popular with small investors as well, though transaction charges @ 750 per 10 grams, is on the higher side in comparison with charges @ 250 per 100 grams.

I’m really confused on the strategy. If I redeem my fund with the physical gold, in what form I get the physical gold (i.e, biscuit, coin or ornaments)? If the redeemed physical gold is either a biscuit or coin, then you have to sell that in the market and buy/design the required jewel ornament with wastage costs extra included in case you jewel ornaments required. So we have to always bear in mind that the conversion fees, selling cost of physical gold and buying an ornament.

I hope you can give me a more clarification on my confusion.

They will give you gold in biscuit form and if your goal is to make jewellery out of it then you will incur wastage on it as you say. This is probably more beneficial for people who have bought gold coins from banks and are looking for a cheaper option.

But yeah, your question is valid and I think if I were in your situation I wouldn’t get into this product either.

For current gold ETFs, how would I know 1 unit of ETF is representing how much gram of gold ? Do ETF mention number of units held by investor and count of grams of gold held in custody by ETF?

How can I compare two different ETF – say UTI gold ETF and NIFTY gold ETF – whether I am getting price advantage in any ETF? I am aware that it is unlikely that I will get any price advantage because market corrects itself.

If I want to know whether I am getting a fair deal, how would I know?

This info is present in the annual report of the fund. However, the best way to ensure that you pay money that’s close to the real value of the ETF is by looking at the declared NAV that is present on the website of the ETFs and you could look to buy them at the declared price.

Some more info from Hindu Business Line

The scheme offers you an option to redeem your ETF units for physical gold of a minimum quantity of 10 grams in bars. Gold delivery is being promised across 22 cities in the country, with a tie-up of RiddiSiddhi Bullions, one of the largest bullion dealers in the country.

The listed gold ETFs in the market offer to deliver gold only for an order above one kilogram, and have very few delivery centres.

E-gold of National Spot Exchange gives delivery of gold starting from one gram, but the disadvantage is that the holdings here are subject to wealth tax, and capital gain is taxed at the slab rate when sold before 36 months.

Excellent analysis. Thanks for pointing out that the expenses in Motilal Oswal Gold ETF are higher than the others. Before reading this article I had the opinion that this is a winner than other ETFs but now it is clear that one has to to more due diligence.

Comments such as these making writing worthwhile 🙂

Please give the tax treatment.Will conversion attract tax?

The tax treatment on capital gains at the time of redeeming the units is similar to that of a debt scheme. Wealth tax won’t be applicable at the time of holding the ETFs.

But he is only converting units into gold or Conversion is only possible on redemption

I think conversion is only possible on redemption..Please correct me if I am wrong!

Hi,

The physical delivery here happens through redemption of units hence the taxation will be of Gold ETF.This is what CEO said ““The redemption of the units in minimum 10 gm gold bars will be done in association with RiddiSiddhi Bullions (RSBL), acting as primary authorised participants and market makers”.

My point was if they allow conversion and gold was used for self sonsumption capital gain tax could be avoided .

I don’t think you will be charged capital gains when you convert the units from ETF to physical gold coins because you are not realizing the gain at that time. However, I’m not sure of this and couldn’t find anything about this in the documents.

My two cents on why capital gains would be charged.

Quoting from Rediff’s:How gold ETFs are taxed(2009)

Gold ETFs represent a class of mutual fund where the scheme displays the features of both – funds and stocks. Just like a share, the scheme is listed on the stock exchanges. But it has features of a mutual fund too. Its value is dependent on the underlying asset in the form of a net asset value (NAV).

The underlying asset to which the price of the scheme is linked is gold. So there will be a corresponding movement between gold prices and the NAV of the scheme. Due to this, the investor can use the scheme as a proxy for the price of gold and, consequently, undertake investments in gold ETFs to gain from the price changes in gold.

TAX ASPECT

There are a few questions that arise with respect to the tax on these schemes. The prominent one is whether these are considered as equity-oriented or debt-oriented schemes. Mutual funds are classified into two categories – equity or debt. A scheme is classified as an equity-oriented scheme if it has holdings in the equity of domestic companies, amounting to 65 per cent or more, on an average, during the year. A scheme that does not fulfill this condition is considered as a debt-oriented scheme.

A gold ETF has features that are similar to equity. But when it comes to the actual investment, this is done in gold itself. Since gold is not equity, the scheme is classified as a debt-oriented scheme. The conditions that apply a debt scheme applies to the investors of gold ETF too.

CAPITAL GAINS

There will definitely be a specific tax implication on an investment in a gold ETF, if the investor records gains in the scheme. If the holding period is less than 12 months, then the gains will be called short-term capital gains. But if it is more than 12 months, then the gains will be classified as long-term capital gains.

Harish,

The conversion will happen only with redemption of ETF units.You have an option of either taking cash or physical gold.So capital gains will arise in either case and you cannot avoid capital gains tax here.

I’n familiar with that BMA but don’t interpret it to mean that tax should be paid even if person doesn’t get any cash 🙂 It’s a bit unfair to ask people to pay if they aren’t getting any cash regardless. Again, I’m not saying this is correct, just that I think it should be this way.

I was wondering about your comment about no capital gains. Went through your old GOLD ETF’s posts just to verify(given later) . Sorry I misunderstood the intention behind the comment. Maybe someday this will come true. Remembered a quote about tax

The government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it. ~Ronald Reagan

Quoting from your post How to buy a gold ETF?

Capital gains are also treated differently – shares attract a short term capital gains of 15% whereas short term capital gains on gold ETFs will be added to your income and then taxed according to your slab.

Long term capital gains are tax free for shares, but you will have to pay 10% without indexation or 20% with indexation whichever is lower plus surcharge and cess in the case of gold ETFs. Gold ETFs are still more tax efficient than holding physical gold.