You don’t think about currency exchange rates when you are buying gold because the two are generally not talked about together, and most people buying jewelery would perhaps be surprised to hear that the exchange rate has any bearing on gold prices at all.

However since India, and much of the rest of the world imports most of their gold for which they have to pay in a foreign currency, the price of gold domestically is impacted by the exchange rate much like the price of oil.

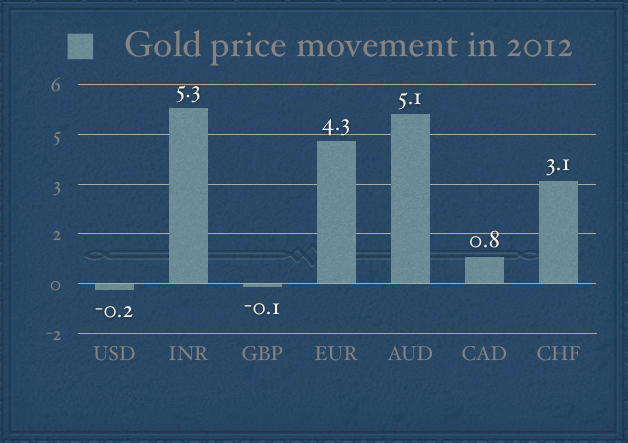

A good way to visualize this is to see how gold prices moved in 2012 priced in different currencies. (Data from GoldPrice)

Part of this price difference is exchange rate, and part of it is domestic demand and supply, but I think it is really hard, if not impossible to distinguish which is which.

I think the relationship between USD INR and gold prices is going to be talked about a lot in the next few years because the Rupee has become a floating currency and it will continue to move a lot and gold is becoming more of a financial asset than anything else and that will mean that the demand also depends on people’s appetite of gold as a financial asset instead of just jewelry.

Oh most people don’t realize the huge role INR depreciation has played in the domestic movement of gold prices… lets ask most ppl this question first –

What was the value of the rupee in 1982?

Correct answer – less than rupees 10 !!!!!

This isnt WTF… have a look here

http://www.tradingeconomics.com/chart.png?s=usdinr&d1=19730101&d2=20120531

Currently rupee trades at 55-56. So this means in 30 yrs time the domestic price of gold would have increase by a 5.5 times just due to the rupee depreciation leave alone gains in gold priced in USD.

This is also the major reason why most Indians have the blind belief that gold only goes up over time and not down because they really haven’t seen gold prices decline in any meaningful terms during their lifetimes.. The major selloff in gold happened in the second half of the 80’s.. and which period onwards our currency started depreciating sharply.. Effectively that meant that even while internationally prices might have come off a lot we would only have seen sideways movement for years.

And while I don’t have data regarding value of rupee or gold prices before that.. my assumption is that since we’ve had high inflation for decades our currency even before the rupee was established probably depreciated steadily for a long long time against other currencies … and thus domestic prices of gold only went up and up…

Quite interesting !!!!

And last year both happened.. .rupee depreciated… and gold went up…..thus the near 50% gain we saw last year…

You make several interesting points, I wish there were a way to get data and chart these two numbers – gold prices and INRUSD exchange rate.

Similarly Gold Etfs are impacted by exchange rates? Or they follow New York Gold Prices. Or is it just demand and supply of Gold etfs in the stock market.

Yes they are, they are affected and they affect gold prices, both things.