In what seems to be a one way slide, India’s GDP growth slowed down yet again with both the quarterly and annual numbers coming out lower than last year’s comparable period.

This has been a sad story for quite a while now, and that the growth in the current fiscal is even worse than the 2008 – 09 period where the global economy was close to falling off a cliff shows that India’s growth story and the dreams of a demographic dividend are turning into a nightmare.

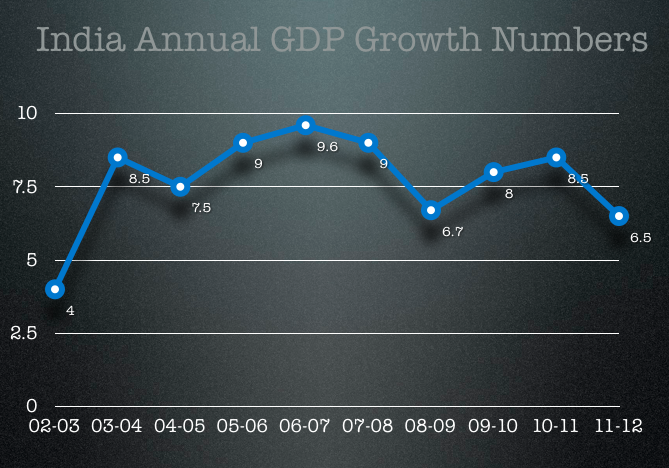

Here is a chart that shows the GDP growth from 2002 till date.

As you can see – the worst year in quite some time was 2008-09 when the sub-prime mortgage crisis in the US shook the whole world, and last year’s growth is even worse than that!

Imagine what would happen if the Euro crisis gets worse and the economy gets another shock from there – it won’t be surprising if the GDP growth for this year dips under 4% if that were to happen.

Today rbi keeps the crr n repo rates unchanged they said that interest rates r not the main contribution of the slowdown growth the marketa reacts badly towards this rbi move infact they increase the ecr facility to 50% from 15% which infuse 30000 crs whts ur thoughts abt this manshu r u agree with this statements of d subarao?

It’s an interesting ploy to tell the government to get something done because RBI can’t get rates lowered. I don’t think this will work but then it is worth a try to see what the government does in the next 6 months or so.

Thnks manshu

Dear manshu now a days I keep hearing the govt has introduced the focused market scheme in order to diversify the export.tht means they want to take the advantage of europe crisis I dont know how these gonna work I think this is the best topic for ur next post 🙂

Dear Manish, I’m not positive that such a scheme can make any meaningful difference, here is a small article that explains about this and you can read this to get a good idea of what it means

http://www.caclubindia.com/experts/what-is-focus-market-scheme–515165.asp#.T94s3fFv2EM

The current slowdown is an extended cyclical one; the demographic dividend is a structural strength of the economy which should emerge over the long term; provided adequate measures are taken by the Government. Unlike the all rosy and then sudden crash days of subprime crisis, European situation is one of permeating & subsisting impact and should not cause any surprise or sudden crash. Having said that, the current bottom growth of 5.3% for Q4, if extends to full year, would make growth number look quite embarissing.

Like the articles written on this site; however am caustic of this one! This is typical doomsday forecast or aphorism – yes I agree that there is merit in highlighting the black swan.

However – take a case for example – most Asian markets have corrected more than India in past few days; so even when Euro crises gets worst – I believe in resilience of Indian markets. There are millions of middle-class men like me who are willing to spend. This country’s economy is robust.

I would say -this is the time from when on – one should start investing in index or key stocks in the index.

I bought some stock myself today and I’ve been doing that during the darkest days of 2008 and then late last year as well. We can’t however close our eyes to the fact that all the economic numbers are really bad and if it continues this way then our stocks aren’t going to grow very much. You can look at the performance of the last 5 years to see what I mean.

Agreed with Mamshu Its not only numbers but at the same moment we have to acknowledge the fact there is no leadership in the country at this moment. How ever may be the land is fertile there is need for the farmer to produce crop and nurture it well.

Govt is only banking on the vote bank politics by giving subsidies, involved in scams by not understanding the power of natural resources, mis using the tas money and many things. The story is not for us but these is the picture that fII is getting from india.

So only thing read analyse wait and watch.

A lack of will to push through reforms and a volatile global environment , is hurting India. A closer look at the numbers shows a constant decline in investment activity. Investors are wary of investing and businesses are holding back investments, which is one of the key reasons for the fall in the growth rate. Stubbornly high inflation has led to high interest rates; the lack of any constructive policy action to cut the burgeoning subsidy bill has pushed investors and businesses into a corner.

As you rightly said This is worse than in 2008-2009 Because it was more an external crisis.

It might come as a consolation that India is still recording higher growth than most parts of the world

That’s probably the only consolation right now.