Petrol prices have been in the limelight for quite a few days now, and people are naturally concerned about the rise in prices. While no one denies that if international crude prices go up, India has no option but to raise prices, a lot of people feel frustrated with the high taxation that is present in petrol prices.

The petrol pricing structure is so convoluted that it is hard to understand how all the pieces fit together, and I’ve tried to answer some questions that help take a holistic view of the situation.

How big is the subsidy?

Reuters reported a few days ago that the total fuel subsidy is Rs. 1.38 trillion this year, and the budget said that the total subsidies are going to be Rs. 1.90 trillion so you feel that the fuel subsidy is about 73% of the total subsidy bill of the government. However, this percentage is not accurate because the government doesn’t bear all the subsidies. The upstream oil companies will bear 40% of these and we’ll talk about them in detail later on.

How does this Rs. 1.38 trillion number compare to revenues? The total tax revenue for this fiscal is expected to be Rs. 7.7 trillion so the subsidy is about 18% of the total tax revenue.

This is huge of course, and leaves no doubt that this problem is very real and not an eyewash by the government.

The under recoveries on oil products makes a huge hole in the government’s pocket that has to be filled up some how and to understand how it is filled, we need to look at the four major players in this equation. First, the two type of oil companies.

Upstream and Downstream Oil Companies

You will normally hear of oil companies as either upstream companies or downstream companies. Upstream companies are involved in the exploration and extraction of crude oil and downstream companies are involved in selling and distribution of oil products to end customers, these are also called oil marketing companies.

The oil marketing companies – Indian Oil (the biggest of the lot), HPCL (Hindustan Petroleum Corporation) and BPCL (Bharat Petroleum Corporation Limited) buy crude from downstream companies and then sell that at discounted rates, and in the process they incur huge losses.

These losses are subsidized by the government directly in the form of cash subsidy, and grants and by upstream oil companies – OIL (Oil India Limited), ONGC (Oil and Natural Gas Corporation) and GAIL (Gas Authority of India Limited). There is no fixed formula for deciding any of this, and periodic announcements tell people what the subsidy is going to be and who is going to share how much.

If you’re worried that the oil companies are screwing you, well, Indian Oil is India’s biggest company by sales, and it couldn’t even make a profit if it weren’t for the government grants, well that’s true for all oil marketing companies.

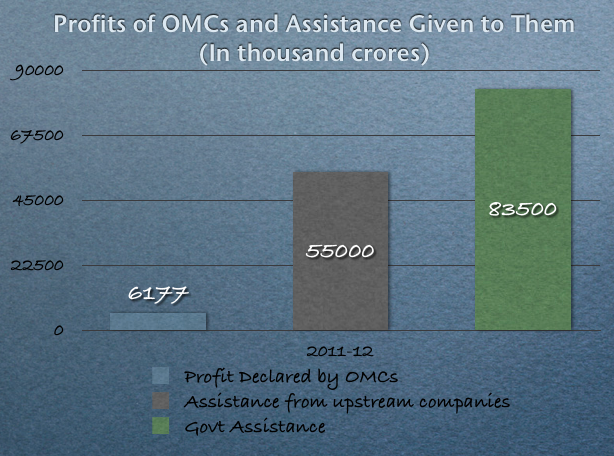

In fact, here is a chart based on data from IOC press release that details out how much profit oil marketing companies made last year, and how much assistance they got. The numbers speak for themselves.

Now, let’s look at the other two players.

Central and State Governments

The central and state governments come into play because of the taxes on petrol. There are many different forms of taxes, and I’m listing below the ones I could find. There may be others.

Excise Duty

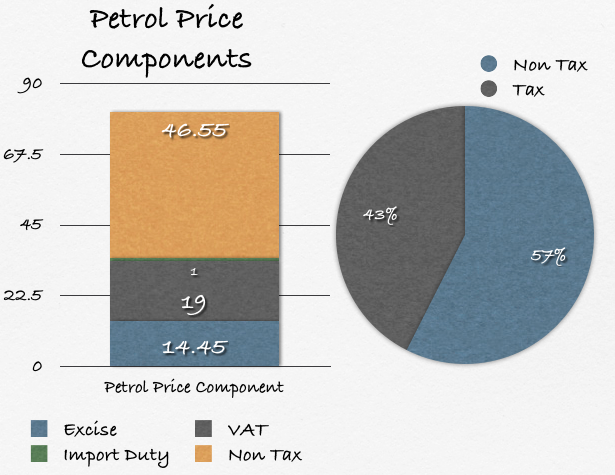

There is excise duty which is Rs. 14.45 per liter regardless of price of petrol and there were some noises earlier that the government might reduce excise duty to bring down the price of petrol but that never materialized.

VAT / Sales Tax

There is VAT as well which depends from one state to the other and Goa reduced this by Rs. 11 or the entire 20% in March this year. Then there is Sales tax and Entry tax in some states and I found a link which says that these amount to Rs. 19 in Karnataka. The rate of Sales tax / VAT which varies from 15% to 33% on the states.

Customs Duty

There used to be a 5% Customs duty on crude oil but that was eliminated last year due to the heavy under recoveries faced by the oil companies.

Import Duty

There is however a 2.5% Import duty that is levied on crude oil which was reduced from 5% to 2.5% two years ago, and there were some murmurs that it will be reduced to zero but that didn’t happen.

Here is a chart that shows how much do taxes roughly account for as price of petrol.

Before you go on to say the taxes are very high, keep in mind that the government is running huge deficits, and if they reduce taxes they have to raise money from somewhere else, so it’s not a conspiracy by the government but a stark reality that the money has to come from somewhere. Having said that, with only 3% of the people paying taxes and huge under reporting going on in tax payments everywhere, petrol is not the only place where this money can come from. There are several other sources as well.

Conclusion

We have a very unusual and complex environment where diesel, LPG and Kerosene are hugely subsidized, cause a lot of losses to oil companies but it’s hard to decontrol their prices because of the “poor people” argument which it is quite hard to see how much of that is true, especially when you see pricy luxury diesel cars plying the road.

Then there are these companies that would have been making losses had it not been for government grants, but incredibly enough, they pay dividends too! The government gives them grants, and then they pay out dividends, and it has all gotten incredibly messy and hard to understand.

It doesn’t help that petrol is taxed so much and that can create an illusion that the government is stuffing people with these high prices.

I think it is best to look at all these players as separate entities if you really want to understand the situation rather than just lumping them together and calling them the big bad evil government.

Read your article but still do not understand why our government does not encourage the production of alternate field such as ethanol production from sugar beets, methane production from waste green leaves of vegetables and plants

Manshu Good work buddy, but why you have mentioned losses where the term is “UNDER RECOVERY”, this is a fake theory no OMC is making losses look at their balance sheet, you know in america average prices of a dozen Eggs are 5$, now if Indian poultry farmer will say if you import eggs from US it will cost you say 55*8=440 Rs. and we are selling it at Rs. 40 so our loss is Rs. 400 per dozen. I think in this situation government have to pay trillions of Rs to Egg producers.

Manshu i am a Financial Research Analyst with a great company i cant name, but i would like to know your opinion and others too, do you really believe this Under recovery theory. If yes then i will send your a real story behind the OMC and their so called losses.

Sanjeev

I agree with this but The Govt. can come out with other ideas like merging’s and amalgamations with other country oil companies and make a suitable plan…

I am not bale to understand, Why the Oil companies engaged no profit & no loss type business continue in India?

What are your views on the companies discussed as long term investments?

Should one go for downstream or upstream companies?

Actually both upstream and downstream are coming in at the same side of coin, negative to government policies and crude oil prices. One can await clarity on fuel price deregulation and crude oil price trajectory before taking an investment call.

Neither.

I am not bale to understand, Why the Oil companies bear the subsidy?

Upstream Oil companies bear subsidy since they get the upside of high crude oil prices (i.e. before bearing the under-recovery). But after sharing the under-recovery, their own upside turns into downside. 🙁

Great article Manshu.

Similar to petrol subsidy, I always felt getting rid of the diesel subsidy too is very important for investements to flow in the country.

So when we say goverment bails the oil companies or pays for the subsidy. This money comes from RBI right ? As if this is true then this could leads to higher interest rates for the consumers.

Let me know what you think on this.

Thanks,

Amit

Very informative article. Thanks for putting this up. Do you have a simple comparison chart of international crude prices vs. petrol prices (normalized using constant dollar rate)?

I do not understand the subsidy mechanism completely. If the govt. is taxing petrol, how much does that contribute to actual subsidy? What if govt. reduce taxes as well as subsidy to bring the prices closer to international market prices?

Another point is that the oil marketing companies as well as Reliance have huge refineries and they also export finished products and make money on that. How does the domestic business compare with export business?

Lastly I hear that all the upstream as well as downstream marketing companies and OMCs pay well to the staff as well as they spend a lot. Being govt. companies, how do they fare against corporate sector on operational parameters and how much scope do they have to optimize their expenses, salaries and increase margins?

Its refinery business which helps the downstream companies scape through. Although people also consider overall profit/loss (refinery profit + marketing loss), one should consider them separately, since the highly capital intensive refinery business needs to cover its cost of capital on an independent basis. As far as i know, PSU oil companies mostly consume their own refined oil. While, RIL is primarily exporting. Now, even the GRMs have come under pressure due to global slowdown. Atleasts the value addition portion there, helps the country in terms of foreign exchange.

Btw when these giant OMCs raise short term from bank/debt markets (to fund losses); it heavily increases credit growth, which is another misleading indicator, our banking sector is boasting of. Credit growth due to capital investments is much sustainable indicator, rather than working capital borrowings or worse to fund losses. We have seen what money is being wasted on funding toxic debt of Power distribution/SEBs (and leading to NPAs). The more we keep subsidising energy prices, more we are running hole into Govt finances in the name of misdirected subsidies for political gimmicks. By transmission of market determined energy and fuel prices you can lead to conservation and responsible consumption patterns, which can not only reduce import volumes but also contain oil prices worldwide.

As your analysis correctly points out, for petrol central govt on an average makes lesser thru taxes (its flat tax in ruppees per litre) than the state govts (where its ad valorem, VAT increases with increase in price). Btw as far as i know import duty on crude oil is “Nil”.

That’s a good point you bring in, I wasn’t aware of the credit growth relationship. Thanks!

Great analysis dude..btw i really like the new look of the website. The Government is only subsidising the car manufacturers by keeping diesel prices artificially low, as latter have taken a half of the consumer’s break even spread (b/w diesel vs petrol) by hiking diesel car prices. This is an example of highly misdirected subsidy mechanism. Secondly, the subsidy dues are much different than actually subsidy disbursements, the result is ever increasing backlogs hurting the regulated sectors. For instance, Fertilizer subsidy due for FY12 is estimated at around 95,000 crore, Actual disbursements would be 66,000 crore. This is another untouched topic, which common people are hardly aware of.

Thanks, new look was due for quite some time now. Finally got it done last week.

Now, what is the political reason to keep the diesel subsidy? Is there a big lobby present here?

Actually keeping diesel subsidised has its own merit in terms of controlling inflation, but implementation is whats the problem. The result is unintended benefit is to diesel car owners (specially the much maligned SUV owners :-0). As people point out, better would be to impose tax on diesel cars, so that auto companies and diesel car owners do not unnecessarily benefit and also Government covers up large portion of its deficit. The auto companies and SIAM have been lobbying with Government to avoid this. As it is they were under pressure in recent times.

Very nice and informative article. But I still don’t understand this –

1. Govt. does not bear all subsidy and upstream companies bear 40% of the subsidy. Then who compensates these upstream companies for subsidizing? What is the other way upstream companies looking to compensate this loss?

2. We say that Govt. has decontrolled petrol prices, but then oil marketting companies are still not able to decide market price and under pressure form govt always. Can we say it is really deregularized ?

3. The primary raw material is crude oil which is refined to produce petrol. We know the price of imported crude oil. But what is the criteria for upstream companies to compute the real price of producing individual fuels (petrol, diesel, kerosene, gas, wax etc.) especially when using the same infrastrucure to refine all of them ?

Upstream companies take a hit on their realisations, for eg even if global crude oil price is $110/bl, ONGC sells to IOC at $55/bl, the remaining $55/bl is its underrecovery sharing. Further ONGC shares subsidy burden for entire crude oil imported into country, not only on what they sell to IOC/localn refineries. Therefore, ONGC’s profits have negative correlation with Crude oil prices, what a pitty for an upstream company.

Its actually the Refining division of the OMCs who makes petrol, diesel, kerosene. So its a inter divisional transfer to their marketing division between them at CRUDE + prevailing GRM (gross refining margin). Under-recoveries are not final losses for IOC (as refining division also makes some profits); but opportunity loss, which also factors in loss of marketing margin apart from real cost loss, and does not factor in profit made in refinery division. The subsidy sharing mechanism is so opaque, only after the end of the year, Government tells them how much they will reimburse them, how much Upstream companies will reimburse. Meanwhile, these giants, drain the liquidity in the banking/debt markets, in turn pushing the interest costs of common people.

Thanks for your comment.

I think you might have gotten even better holistic view, if you would have seen that documentary. Please see it. Anyway nice article.

http://topdocumentaryfilms.com/gashole/

Manshu, why there is difference in oil prices across different countries and why is it higher in India, when the oil supplying countries are actually closer to us geographically?

Radhika, I am no expert but I think all oil importing countries pay the same base price to import but the local govt taxes/subsidies levied result in the different rates. Remember that political and economic situations varies from country to country, and therefore so does the govt actions.

There is a price difference in everything from apples to petrol because of demand supply, exchange rates, availability of the product, quality of infrastructure to transport it, taxation, there are a lot of reasons….

oh yea. I confused ‘barrel’ with ‘gallon’.

if only a barrel were that much 🙂

“I know this to be true for

US because a gallon there is

about $4 and gallon is 3.78 liters

so at current rates Rs.220 / 3.78

or Rs. 58 / liter.”

I doubt this. Please confirm.

I guess the only aspect of this you can doubt is the price itself. Here is a site that shows price range in Atlanta which is one city in US.

http://www.atlantagasprices.com/

Let me know if you have any other questions please.

While central govt. has to levi tax to subsidize diesel etc., as far as I know state govt. don’t help in subsidizing that. So, what’s the reason they collect this much tax?

The government is taxing petrol and crude and other things for revenues that they need for doing civic work and then other things that they need to spend on. They are not taxing petrol to then subsidize it and that’s why state governments tax them, to raise money that they need.

Does that answer your question? I hope I understood it correctly.

Very thoughtful of you to write this post. It’s very useful.

One question. How does oil price in India compare with price in other countries. Do we pay more or less?

Thanks Radhika. Good to see your comment after such a long time.

I think if we were to compare prices with other developed countries, we would be paying more. I know this to be true for US because a gallon there is about $4 and gallon is 3.78 liters so at current rates Rs.220 / 3.78 or Rs. 58 / liter.

Good research!

What’s your take on corruption and black money?

Let us assume a situation of corrupt free India. I have a gutt feeling that if it happens, more subsidies could be provided on fuel leading to a fall in price of fuel + the oil companies would enjoy abnormal profits.

If there is no corruption then the country will no doubt grow at a much greater pace than today and people will have a lot better standard of living. I would say that in such a situation there may not even be a need for subsidy because competition brings down prices, or efficiencies in other things like food supply chain brings down the prices of fruits and vegetables so that the real income of consumers rise.

Wow..Hats off to the article. You have explained the concept in very simple terms. Links to related sites are so helpful. Article Shows the research that you have done in writing it.

Thanks! I think this is the article that took me longest to write in recent memory. I’m quite happy with the result so it was time well spent.