Vikrant commented on the Perfios post last Friday on how easy it was to register and file taxes on the Income Tax India website if you have income from only one source viz. salary, and that it took him only 10 minutes to file his own taxes this way.

I’m not familiar with this process, so I asked him if he would share his experience and he replied very promptly with the steps involved in this process.

Here are the instructions that he gave me (slightly edited).

It’s very simple, especially for people like me who have only one source of income which is salary income.

1. Go to https://incometaxindiaefiling.

2. You need to register first, and that’s done by clicking on the Register link that’s present on the right side of the screen, and supplying your PAN.

3. Once registered, enter your PAN number and password to login.

4.  After you login, you will find a page where you can choose to file return for this year or previous year, Let’s take an example of this year. When you point your mouse to E-Filing A.Y.2012-13 it would prompt: “Individual, HUF” as shown below.

Click on the “Individual, HUF” link.

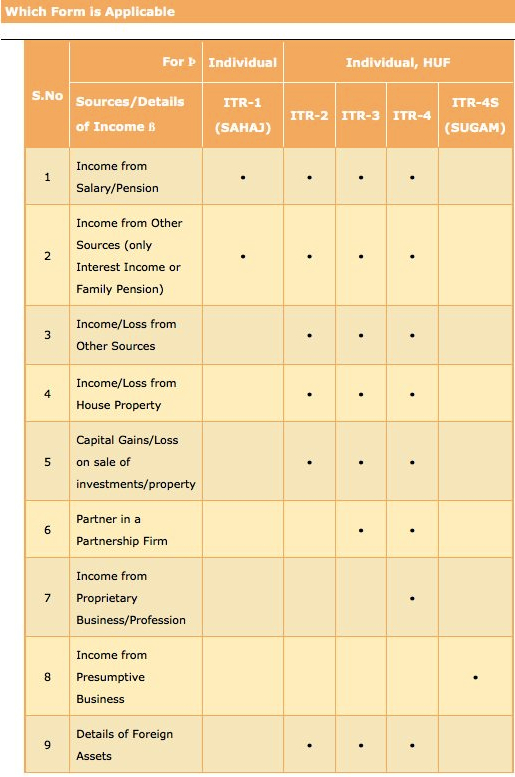

5. The next page has a set of instructions on which form you should use for your tax filing. These are fairly detailed instructions, and you can easily make out which form you should use based on the details given there.

Here is a screenshot of the instructions.

If you look at this page, it will tell you what which ITR form you need to use. Based on the kind of income you have, you will need to use the respective form like ITR1 , ITR2 and so on.

As I said, I will use ITR 1 as example as I come under Income from Salary/Pension .

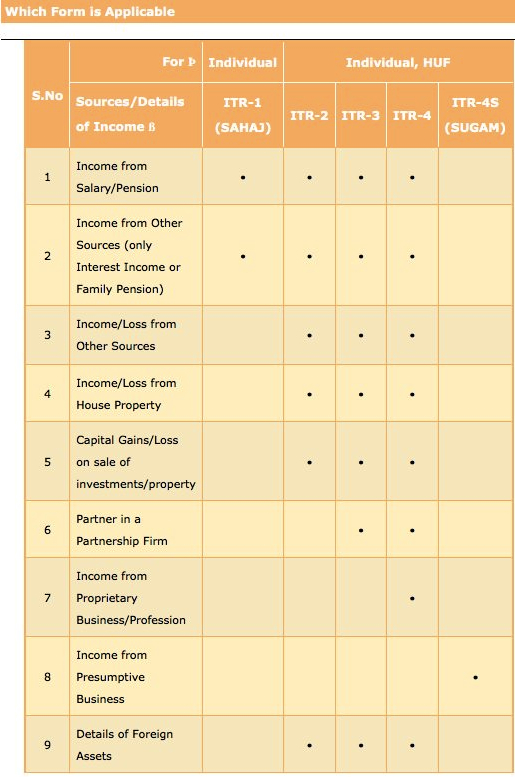

6. Click on the Excel Utility (Version 1.0) for ITR 1 and similarly for other ITR whichever is applicable to you.

7. Fill this form based on the information present in form 16 and validate that.

8. Once you have filled the form (there are 4 pages you need to fill; all those which are applicable). Click on validate and then click on Generate. This will generate a XML file which would be saved automatically in the same location where you had saved the excel file that you downloaded.

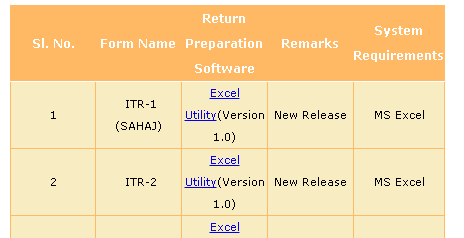

9. Once the XML is generated, all you need to do is, click on the > Select assessment year on the left hand side of the web page and select the year assessment year, which would be AY12-13 for this year.

10.Once you click on AY 12 – 13  you will find this page.

Select the option accordingly, like I have done here and click next

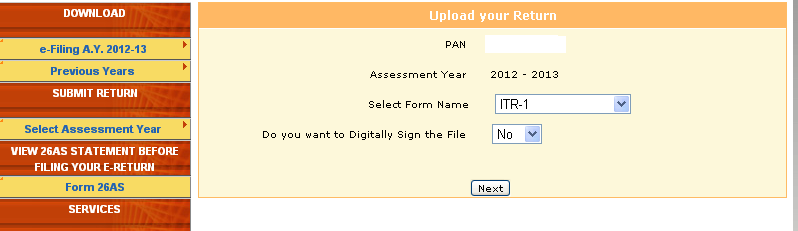

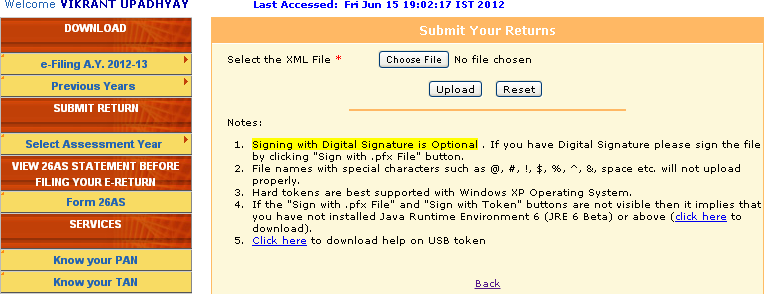

11.Once you click next you will find another page that looks like this.

Click on Choose file and select the XML file that got saved when you generated the XML. And click upload.

12. You will get an email from income tax office that will have a PDF file called ITRV. Take a print out, sign on the form and send it to the address mentioned on the file by ordinary post or speed post.

It’s all done! It’s a very simple process if you have income from only one source.

Conclusion

Vikrant’s instructions are fairly detailed and it looks like a simple process by the looks of it. Many thanks to him for sharing these with everyone here!

Has anyone else tried this and if so what is your experience?

Hi Manu

You were required to send the document within 120 days of filing the income tax return.

In case you forgot to send the ITR-V document so generated, it would be deemed that you never filed your Income Tax Return.

In this case, you would be again required to file your Income Tax Return and follow the same procedure as done earlier

Hi

I did file the return online the same way but forgot the send the document through post..what should i do now?

I have an no income but central pension of Rs 20000 PM.

Only regular monthly withdrawals. No Savings in any branch of the bank – SBI.

How much TDS regularly every month all through the year please …!

Is Rs 200 reasonable?

Regards

—

SHS

===

hello sir,

i am useing ITR1 but its not convert in xml formate. i trying somany times but its not possible fro me. let me how i do it.

tnx

Vikash

Hi Vikash… I think you need to enable the macros in Microsoft Excel from the tools option. Macro setting should be low or medium.

Follow these steps if you are using MS Office 2003: Tools –> Macros –> Security –> Low or Medium

Follow these steps if you are using MS Office 2007: Excel Options –> Trust Centre –> Trust Centre Settings –> Macro Settings –> Enable all macros

Save the excel-utility and re-open it.

If you have some basic knowledge of filing returns and have done so before (using physical form process) then you will not find it difficult to use website. If you have some knowledge of computer and submitted forms on internet before then it is even easier. Of course if your sources of income are complicated then the filing process will be complicated irrespective of where you use the form or do it online. in this case it is best to consult a CA to avoid mistakes.

My employer has deducted a total tax of Rs 24637. But as per the ITR excel tool, payable tax on my income is coming out to be Rs 24636.

When i generate the XML it says,

Please correct tax status on sheet: income details

verify tax computation by clicking on calculate tax and check tax status

Please suggest me the way to rectify this.

Also, in the “pre-XML Ckeck†tab it states with a column header — “Validate data before generating XMLâ€. And the same column under this heading have 3 things– TDS on Salary, TDS on Interest and Tax Payment. Under the same, it again shows a header with red colour saying “Verification†and under that it shows my details which are all correct. Do I need to worry anything about all these in the “pre-XML Ckeck†tab?

is there any one to help me out thank u

My employer has deducted a total tax of Rs 24637. But as per the ITR excel tool, payable tax on my income is coming out to be Rs 24636.

When i generate the XML it says,

Please correct tax status on sheet: income details

verify tax computation by clicking on calculate tax and check tax status

Please suggest me the way to rectify this.

Also, in the “pre-XML Ckeck†tab it states with a column header — “Validate data before generating XMLâ€. And the same column under this heading have 3 things– TDS on Salary, TDS on Interest and Tax Payment. Under the same, it again shows a header with red colour saying “Verification†and under that it shows my details which are all correct. Do I need to worry anything about all these in the “pre-XML Ckeck†tab?

Hi,

My employer has deducted a total tax of Rs 24637. But as per the ITR excel tool, payable tax on my income is coming out to be Rs 24636.

When i generate the XML it says,

Please correct tax status on sheet: income details

verify tax computation by clicking on calculate tax and check tax status

Please suggest me the way to rectify this.

Also, in the “pre-XML Ckeck” tab it states with a column header — “Validate data before generating XML”. And the same column under this heading have 3 things– TDS on Salary, TDS on Interest and Tax Payment. Under the same, it again shows a header with red colour saying “Verification” and under that it shows my details which are all correct. Do I need to worry anything about all these in the “pre-XML Ckeck” tab?

Thanks,

Suresh.

Dear Manshu, Thank you for posting this information. It is indeed very easy to submit the Indian taxes online.

That is an informative article that you have have shared with us.

What do you think about?

http://www.taxsmile

Because I filed my taxes over this online income tax filing portal where I can describe it as “One stop solution”.

Dear Sir

i get income from salary only,i read your article and i understand but i have doubt in fillup itr-1 i.e is i download itr-1 excel form and fillup income details my annual salary Rs.169000/-so iam not fillup other sheets like tds,taxes paid and verfication and 80g.my company not provide any tds form like 16.my question is in ITR-1 we required to fillup all sheets mandatory or not,if mandatory how can i fillup all the forms without 16form.i need to fillup itr-1 form for future purpose. please give your valuable information

Respected Sir,

I can’t fill the ITR-4 under 44af, when i fill the return & i goes to 44af section but i can’t put the data 44af column, the 44af totally deem, please give me advice how i possible

sir i want to efile it return of me and my brother. i had download the required form ITR 1 and ITR 2. in case of ITR 1 all my fields are validated but it is not generated into xml file. please guide me to convert it.

in ITR 2 i filled all the field in red in part 2 but it is still not vallidated. please help me

babita sharma

regarding ITR1: if you are using Excel 2007, save the file as Excel Macro-enabled Workbook… now try generating XML file… i was facing the same issue and it worked for me with this method…

As pointed out by Koti, enabling the macros in the excel utility is very important without which your Income Tax Return wont be generated

Try enabling the Macros and then try to generate the XML

This conversation reminds me of the story

Nikola Tesla visited Henry Ford at his factory, which was having some kind of difficulty. Ford asked Tesla if he could help identify the problem area. Tesla walked up to a wall of boilerplate and made a small X in chalk on one of the plates. Ford was thrilled, and told him to send an invoice.

The bill arrived, for $10,000. Ford asked for a breakdown. Tesla sent another invoice, indicating a $1 charge for marking the wall with an X, and $9,999 for knowing where to put it.

After seeing so many questions on various sites regarding filling ITR and my personal experience my view is:

How to fill the ITR online -easy

What to fill in appropriate columns – not so easy!

ex: take case of queries above

Dividend for birla tax saving fund

My employer has given me the Form 16, but he hasn’t considered the home loan exemption for calculations. I now want to take that into account. What’s the right way to do it ?

On my blog there are many queries on Fixed Deposit interest.

To each his own. How do I do mine: Submit it to CA , understand calculations he has come up, he fills in the ITR I ask him questions once both of us are satisfied I e-file it. It might be monetarily slightly expensive but it’s small price I pay for peace of my mind. And it helps me to explain it to others through my blog posts. Ex: with sample and images

Filling ITR-1 : Bank Details, Exempt Income, TDS Details

Yes…taxation is complicated issue..If one is not sure then its always better to have advice of qualified person from this field.

But when your interest from Fd is less than 10000 and no TDS is deducted by bank, how can we fill sch TDS2 in ITR1?

It is really very easy to e-file your IT returns through the income tax website, earlier I was using the services of a TRP but now no more. I have also written a post on it. Check it out – How to e-file your income tax (IT) returns online for free

12. You will get an […..] on the form and send it to the address mentioned on the file by ordinary post or speed post.

Postal authorities will not accept an article by speed post bearing post bag address. I faced this problem twice last year. Then I sent both times by deleting post bag line.

very good article.

till today i am paying much of money to CA for it.

but tell me one thing now how i can retrieve my password as it is with my CA.

Ask him for it.

Try to do as suggested in

http://www.fingyan.com/how-to-reset-password-for-efiling-of-income-tax-return-itr/

Hope this will help

The easiest way to retrieve your password is to click on Forgot Password and then click Efiling Acknowledgement Number

Then mention the efiling acknowledgement number of the previous year. It would be mentioned in you last year’s return.

There are other ways to retrieve password as well which are mentioned on the Income Tax Portal

Hi,

when i enter tax details in table 23 and 24 they add up and I become liable to receive returns which are twice the tax that i paid so far

If i dont update the table 23 and 24, XML doesnt get generated

pls help.

Hi Vidya

In ITR Form 1, Column No. 23 & 24 are for declaring the TDS Deducted

In case any TDS is deducted, you are required to furnish those details. In case no TDS has been deducted leave those columns blank and click on the Validate Button. If there is any problem in that sheet, it would be displayed and if there is no problem – it would say – “Sheet is Ok”

After you’ve validated all the Sheets, Click – “Generate XML” and it would be generated

In case, there is any problem – feel free to ask here

Yes Manshu, furnishing your Income Tax Return through the Income Tax Portal is a very easy job.

Its so easy that a common man can do it himself without going to a CA or using any other paid software. I somehow fail to understand why people opt for filing income tax returns through third party paid softwares when the Income Tax Dept has built such a useful and easy way of filing returns online

Amazing to see a CA say this 🙂

😉

Frankly speaking, we dont earn by filing ITR 1… Infact we consider ITR 1 as a burden as all we get by filing ITR 1 is Rs. 250

CA’s focus on targetting businessman as we can provide so many services to a person engaged in business as compared to a Salaried Employee.

BTW how much you are charging for filling ITR 4 for a salaried person trading in shares and derivatives (F&O), (normal trading say 10-15 lots of NIFTY per MONTH, say 1.5 – 2.0 lakhs of turnover per year and not heavy trading)

Hi Karan

Yes, it is not difficult but certainly not that “VERY EASY JOB” as said by you. It is very easy to you because it is a part of your job. If filling an ITR is difficult for a CA then to whom it will be easy.

I remember, once even our Finance Minister (I do not remember who he was) found it difficult to fill.

Still, filling ITR 1 is not that difficult, but what about ITR 2, 3 and 4. Are they easy to fill? Certainly not!!

Umesh, I agree with you that ITR 1 is easy to fill

As far as ITR 2, ITR 3 & ITR 4 are concerned, they arent difficult to submit either but its only that our Tax system is complicated and we are trying to move towards Direct Tax Code

Submitting ITR 2/ ITR 3/ ITR 4 is an easy job for someone who understands taxes. So if we can simplify taxes through DTC, Return filing would become an easy job

Hi Karan

As far as ITR is concerned, it is very well said by Bemoneyaware

“How to fill the ITR online – easy

What to fill in appropriate columns – not so easy!”

Do not know how much easier it will be in the DTC regime. It is a common experience that whenever our system simplify any taxation rule/procedure, they make it more difficult to understand and to follow by a common man, whether it is Income tax, Sales tax/VAT or the new GST. (I am not talking about you professionals but common man )

Hi Umesh

I agree with you, but I think the problem lies in the fact that Taxes are never taught to the Common Man. But the Govt has now started teaching Income Tax to School Students.

They’ve started small but intent to go big and explain the basics of Taxation to the Common Man as well

Hi,

Last financial year i have changed my job and got Superannuation from my last employer. Is superannuation amount fully taxable ? Do i add this amount under “Income from Salary/Pension’ in “Income Details” sheet?

For example, if superannuation amount is 1 lac, should I add 1 lac to ‘Income from Salary/Pension’ for tax calculation.

Thanks,

BDeb