This post is written by Shiv Kukreja.

The first quarter of calendar Yyear 2012 saw a big number of public sector undertakings (PSUs) issuing tax-free bonds. NHAI, PFC, IRFC, HUDCO and REC – they all came within a span of 70-75 days and took away approximately Rs. 28,000 Crores from the markets.

These bonds were quite attractive and offered very good tax-free returns of over 8%. mutual funds, insurance companies, other financial institutions, corporates, FIIs, NRIs, trusts etc. – all participated in these issues and many of these issues got oversubscribed on the first day itself.

Retail investors were slow to begin with but they also participated in these issues but in a wrong manner and at a wrong time. Over a period of last 30-45 days, I’ve observed their attractiveness increasing and a large number of my clients asking me more details about these bonds and investing in them.

NHAI was the first one to offer an attractive rate of tax-free return of 8.30%. I still remember I sent quite a good number of emails to all my clients and personally made calls to a few clients in an effort to make them understand the terms of the NHAI bonds issue and why it made sense to invest in these bonds at the time of its public offering itself.

But as always, clients took their own time to understand its benefits and when these bonds actually listed at a premium of 4% on the exchanges, they remained quiet because they had nobody to blame for this notional loss or opportunity lost but themselves. If I had made no efforts in informing them then they would have caught me for not putting proactive efforts. 🙂

NHAI bonds came into the limelight when Indian Railways Finance Corporation (IRFC) came out with its bond issue and due to a rosy picture shown to the investors by the broker community, investors flocked to apply for IRFC bonds. Brokers even provided funding to their clients to apply in this issue. But I knew IRFC bonds were not as attractive as the NHAI bonds were because of its “step-down interest†feature i.e. the rate of interest gets reduced to 8.10% if a buyer purchases these bonds from the original allottee in the secondary markets.

During the subscription period, IRFC bonds issue got a huge response in an expectation of a bumper listing like the NHAI issue had. But that did not materialize and IRFC bonds gave only 1-1.5% listing gains and that too were taken away by the brokers who funded the investment. HUDCO tax free bonds issue also opened for subscription on the same date i.e. January 27th but due to its lower rating of AA+ and not so heard of name, it could not be fully subscribed and listed at a significant discount of 4-5%.

REC was the last to come up with its AAA-rated tax-free bond issue in the first week of March and got a reasonable response also. But again its listing was poor with 2-3% discount due to a huge number of sellers and a very few investors showing any interest to buy. There has been no such issue hitting the street since then, despite of the fact that Finance Minister has doubled the quota for these bonds to Rs. 60,000 crore in this year’s budget.

What makes these bonds attractive?

Higher effective after-tax returns: Suppose you fall in 30% tax bracket and have invested Rs. 5,00,000 in a fixed deposit with HDFC Bank for 5 Years earning 9.25% p.a. interest. The after-tax effective rate of interest on this FD would be 6.39% (9.25%*(1-0.309)). You can also look at it as tax-free equivalent rate of interest. On the other hand, these tax-free bonds offer you 8.30% interest, which is equivalent to 12.01% effective before-tax rate of interest. So, you can either compare 9.25% with 12.01% or 6.39% with 8.30%. This comparison makes tax-free bonds a clear winner as far as the rate of interest is concerned. In actual terms, you’ll end up having Rs. 31959 as the interest with your FD after one year as compared to Rs. 41500 with tax-free bonds, a difference of Rs. 9541 every year.

Scope of capital appreciation: Then comes the capital appreciation factor. We all know India is struggling with a high inflation rate and the interest rates are ruling on a higher side. But there is a strong possibility that one or two years down the line both the inflation as well as the interest rates might cool down. Also, whenever the interest rates come down, bond prices go up. In that scenario, there is no scope for FDs to result in any capital appreciation because your FDs are not trade-able and you cannot transfer the title of these FDs in the market. At the same time, capital appreciation is possible with tax-free bonds as and when the inflation and interest rates cool down. These bonds are tradeable and freely transferable to any of the interested prospective buyer on the exchanges where these bonds are listed.

Liquidity: One more attractive feature of these bonds is their liquidity. When you break your FD before the tenure gets completed, the bank either levies a premature withdrawal penalty or gives the applicable rate of interest for the period you hold the FD for. Tax-Free Bonds score over FDs in this department also. You can sell these bonds in the secondary market whenever you want, given there is a buyer for these bonds. Till date the liquidity has not been a big negative factor for all of these issues, though at times the buyers have benefited quite a lot due to a huge number of sellers selling around listing time without thinking that they were selling these bonds at unreasonable prices.

TDS on FDs: Fourth factor which goes against FDs is that your FDs allow the banks to cut tax whenever they pay you more than Rs. 10,000 interest in a year. Needless to say tax-free bonds attract no tax so no scope of any TDS.

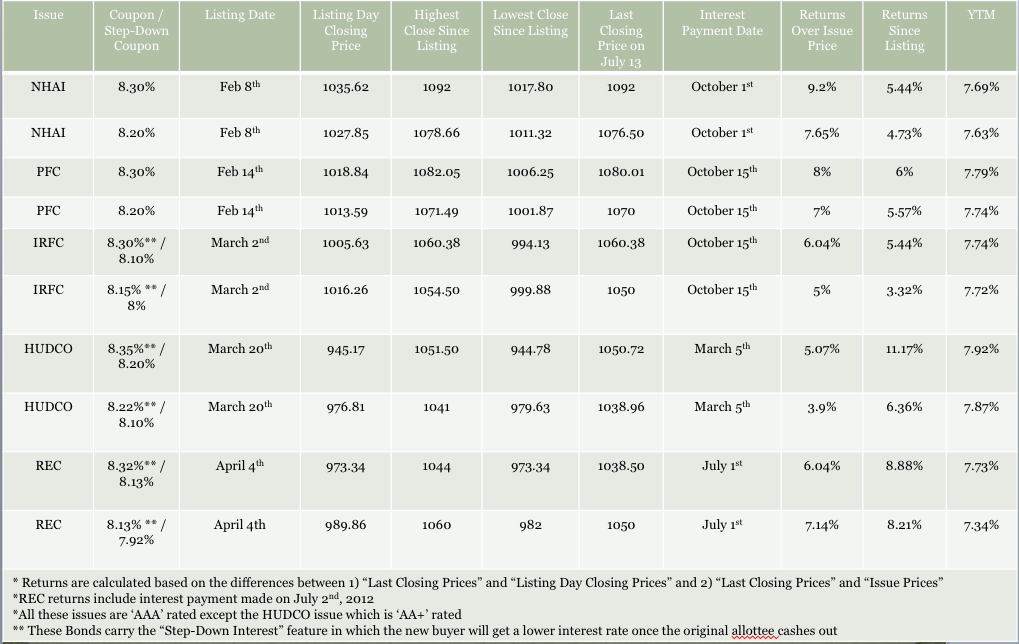

So after the first six months of this calendar year are gone, what is the current state of these bonds? – This table will tell you: (click to enlarge)

Since listing, some wise investors have bought in these bonds citing an opportunity due to weaker hands (retail investors) selling to encash their investments. These investors have made some decent returns since then. You can observe two kind of returns from the table – one is “Returns Over Issue Price†which shows the returns earned if somebody had applied for these bonds during the initial offer period. The other one is “Returns Since Listing†which shows the returns earned if somebody had bought these bonds from the secondary markets (stock exchanges where these bonds are listed like NSE or BSE).

HUDCO bonds have given 11.17% returns since listing in less than 4 months i.e. an annualized return of over 34%. Similarly, REC bonds have given 8.88% returns in just over 3 months i.e. an annualized return of over 30%. But, it would be highly unfair to expect a similar performance from these issues going forward. I would say it would be great if these bonds deliver some 10-12% returns over next one to two years, if interest rates come down.

What investors should do now?

It depends on what kind of investor you are, the reasons for which you want to invest in these bonds and the overall interest rate and inflation scenario in the country going forward. If you are in a 30% or 20% tax bracket, want to invest in these bonds from a long-term point of view i.e. more than one year, and believe that the inflation as well as the interest rates are headed lower, then you should definitely go for these bonds. You need to focus on their “Coupons†(interest rates on these issues) as well as the “Yield to Maturity†(or YTM). Coupon is the interest payment you are going to get every year on the “Interest Payment Date†over the issue price.

If you want to invest in these bonds for a very long period of time, say till maturity, then you need to focus only on the YTMs because you are going to get precisely this much yield on an annual basis till maturity considering the price you are paying over the issue price (premium in all these cases) and the remaining coupon payments.

If you want to invest in these bonds from a short-term point of view i.e. less than a year, then your returns will depend on the inflation and the interest rates over that period of time. If the interest rates fall more than expected, then your returns will be higher than the YTM and vice-versa.

I think people in the 10% tax bracket can also consider investing in these bonds considering there is no scope to have any capital appreciation in fixed deposits or post office schemes etc. but at the same time these bonds yield less to these investors or to those who need not pay any tax at all.

Given the stickiness of inflation and interest rates, the returns given by these bonds are not bad from any angle. How these bonds perform over the next year or two will depend on the inflation numbers, our fiscal deficit, current account deficit, interest rates scenario and most importantly how these companies themselves perform. I hope to see more such opportunities striking our doors in the next 8-9 odd months.

I have a silly question, NHAI taxfree bonds—8.2% maturity 2022 and 8.3%.maturity 2025. I have been watching the trades and typically the 8.2% bond are between 1040- 1050, while 8.3% is around 1070.

The difference would be on account of the interest rates and longer maturity or am I missing something here?

Hi austere… I would say it is mainly because of the interest rate differential and then demand & supply factors. Longer maturity also matters but not much. A few days back when these bonds went ex-interest, the price of 8.30% bonds actually went below the price of 8.20% bonds for a couple of days.

Hi Shiv,

Do you have any updates about the dates of issue of these bonds this year ? Please share the info.

Thanks,

Karthik

No update as yet Mr. Karthik. I’ll share it here once I have any.

Has any TAX FREE Bonds issue been annocnced for this month/Quarter /or Finiancial Year.

Last year most issues came out in NOV_JAN period.

Pl update me.

Reagrds

Dilip Bedekar

No info as yet Mr. Dilip. I’ll share it here once I have any.

Dear Shiva,

Is any way i can get ur contact number to talk to you..I need some advise – pls help me out

My phone number 09246290085 – i work for TCS

What is the best or cheapest way of buying these Tax free bonds?. Brokerages like ICICI Direct charges 1% + while buying and selling, eroding all the gains. Pl suggest alternatives.

It is unfair that ICICI Direct is charging such a high brokerage on bonds/NCDs. You should try out other cheaper broking houses to buy these bonds from the secondary markets or wait for public issues to come to invest directly.

PFC tax-free bonds also went “ex-interest†yesterday. Interest payment date is October 15th.

IRFC tax-free bonds are trading “ex-interest†today. Interest payment date is October 15th.

Dear Shiv,

I have transferred my IRFC bonds (8.3%) from one demat account to other by off-line transfer. Both these demat accounts are in my name. Will I get 8.3% interest or 8.1% ?

Thanks

TCB

Dear TCB… You’ll get 8.30% interest.

I also want to transfer these bonds from one account of mine to another. I also want to transfer bonds of REC etc. from one account to another. All these bonds have clause which says only original allottees will get higher coupon rate.

This was probably the only article which addressed this question.

Just to reconfirm, what was the actual interest recd.?

Hi Anuj… you want to know the exact interest amount ?? & if yes, on which bond(s) ?

I also want to transfer these bonds from one account of mine to another. I also want to transfer bonds of REC etc. from one account to another. All these bonds have clause which says only original allottees will get higher coupon rate.

This was probably the only article which addressed this question.

Just to reconfirm, what was the actual interest recd.?

Can you tell me how much dividend will i get for NHAI tax free bonds with coupen rate of 8.2%?

It should be Rs. 55.94 for each bond of Rs. 1000.

Hi Shiv,

I didn’t understand – since coupon rate is 8.2%, shouldn’t NHAI pay out Rs 82 as interest ?

Secondly, can you suggest when the dividend should show up in my saving account ? The payment date was Oct 1st, but it is still not credited …

Thanks,

Ayush

Hi Ayush… The bonds got issued on January 25, 2012 and hence, they are yet to celebrate their 1st anniversary. The interest has been paid for 250 days since then.

I have got the interest paid for my family’s investments and all my clients’ investments on October 1st itself. Please contact the Registrar if you have not got the interest as yet.

Why has the price of NHAI tax free bonds fallen Rs. 53/- in a single day today? Was yesterday the last day for deciding whom should the dividend be given?

I was expecting it to fall around Rs. 55/- on October 1 when it gives out its annual dividend.

NHAI tax-free bonds are trading “ex-interest” today. Interest payment date is October 1st.

Can somebody help me understand these calculations?

http://www.firstpost.com/investing/nhai-tax-free-heres-a-bond-that-will-give-you-50-return-446166.html#disqus_thread

I think I have written about this somewhere earlier, this whole idea of annualizing yields when you pretty much know you can’t make that money 12 times over or whatever other time frame there is.

This is shocking and highly irresponsible reporting! In the past companies had resorted to such practices to sell their financial products and SEBI banned all such practices. I dont understand why this columnist is trying to sensationalise the headline of his article.

I guess as far as the world of finance is concerned, it’s every person to himself, can’t rely on anyone.

Hi Shiv,

Are official/tentative dates out for any upcoming issues?

Hi Saurabh… not yet, its been raining NCDs at present. When their quota will get exhausted, probably then Tax-Free Bonds will start raining. I’m expecting REC to come up with its tax-free issue in October-November. Let’s see. I’ll definitely share info here.

Hi Shiv, Any updates on REC tax-free bonds or others?

Hi Vikas… not yet.. these are government organisations, they take their own time to do things.

Price of NHAI Tax-Free Bonds touched Rs. 1102 in today’s trade. These bonds got allotted on January 25th and listed for trading on NSE/BSE on February 8th. This implies that these bonds have given its investors a return of 10.2% in around six months’ time.

This is a great return from a ‘AAA’ rated fixed income instrument issued by a wholly-owned government organisation and that too in a high-inflation & high-interest rates scenario.

I understand tax free return would be limited to the interest paid by these bonds periodically if anybody hold these bonds till maturity. however, incase the bonds are sold in open market the difference between purchase price and selling price would be taxed as cpaital gains -short term or long term as the case may be and taxed accordingly.

Your understanding is absolutely correct!

I WANT TO INVEST IN TAX FREE BONDS OF GOOD ORGANIZATIONS -GOVERNMENT CONTROLLED / LISTED.

WHEN IS THE NEXT ISSUE OR DO WE WAIT TILL DECEMBER

Hi Dilip… None of the organisations has offocially announced time period to issue these bonds but at least 3-4 issues will come between September to December.

Hi everyone, Any updates on tax free bonds coming up this year? I wanted to know if I should wait for them or invest elsewhere.

Hi VikasG… I’ve just one update – REC is planning to issue these tax free bonds in September-October period with a coupon rate of around 8% or less.

Thanks Shiv for the inside news.

Dear Shiv,

Can you please tell me how to calculate YTM ?

Thanks

Hi TCB… YTM is manually calculated using trial and error method but most people use financial calculators or excel to calculate it. Check this link to calculate YTM:

http://vindeep.com/Corporate/BondYTMCalculator.aspx

Great article. Thanks.

There have recently been many articles on individual bond issues on this blog, and I think this is absolutely super for common folk like us. I am happy to see the ending part of this post which talks about how one might consider investing in these for short term vs long term. I think the short term mark-t0-market gains/losses might not be well understood by retail investors new to trading bonds. I think the latter piece of this post could be expanded into a separate post which talks about what happens to the market price of a bond as a function of inflation and interest rates. Maybe that post has already been done and is not necessary, but I thought I’d mention it anyway given the recent discussion of individual bond issues. Investors should be aware of the advantages and risks at all time. Thanks.

Thanks DJ!

Your suggestions are most welcome! I’ll request Manshu to consider your suggestion if such an article has not yet been posted here. Please keep your inputs coming to help the readers.

I have subscribed for a few last year. Will you be able to project the dates of issue this year ?

Sorry Karthik, I wont be able project the timing of these issues but I’ve read somewhere that IIFCL wants to do it in this quarter and Airport Authority of India (AAI) has sought permission from the finance ministry to issue these bonds. Any further updates will get posted here.

Very useful article, I have been looking for something like this. Didnt really understand bonds when I subscribed for IRFC bonds now pricing makes sense.

Please can you also throw some light on the infra bonds some of us have been buying for 80ccf.

Thanks harinee!

Though there is little scope to write such an article providing an update on 80CCF Infra Bonds as they are not tradable as of now. But we’ll definitely try to write something on them so that readers can have access to all of them on a single page.

Shiv are they going to issue infrastructure bonds this year? My understanding was that during the budget they let the provision lapse and they won’t be issued now?

Yes, you are right Manshu. Infrastructure Bonds won’t be issued this year.

In my Demat account, for both of the 80CCF bonds I hold, it shows a market price.

For a IFCI bond bought in Oct 2011 (at face value 5000.00), it shows the last traded price of Rs. 10, 348. You can google this also for ISIN “INE039A08122”.

I was under the impression that these bonds are not tradeable but there seems to be some trades in this particular bond. But I can’t still allocate them for trading into my trading account ( ICICIDirect ), and all my dreams of making a 100 % profit within a year have turned to ashes 😉 .

For a L&T Infra bond ( INE691I07273 ) , it shows a 40% profit within less than a year.

🙂 :-)… IFCI bond hit an upper circuit of 20% on July 6th with 1 bond traded and it shows there is a bid for 2 bonds at Rs. 10368. L&T bonds did the same thing on April 16th. I think the same person must have bought one bond and sold the other one to book his profits… 😉