There are two types of Options that you can trade in – Call Options and Put Options. You buy Call Options when you think a share is going to go up in value and you buy Put options when you think a share is going to go down in value. This means that the value of your Calls go up as the stock rises, while the value of your Puts go up when your share falls.

For a retail investor, there are three common reasons for owning an Option.

Why own an Option?

1. Speculation: Options are a way to take a short term speculative position given that they can’t be held for very long.

2. Going Short: You can’t borrow and short sell shares in India, so along with selling Futures, buying a Put Option or selling a Call Option (without owning it first) is a way to go short a share or index.

3. Leverage your position: Buying a Call Option is the same as buying a share in the sense that you profit from both the trades when the share price rises then why buy a Call Option at all? Options can leverage your positions which means that you can gain or lose a lot more with the same amount of money using Options than you can by taking cash positions. This is akin to trading on the margin, and has the same effect.

Hedging is a popular reason given for owning Options but I don’t think it is all that applicable when talking about small investors, especially with a product that expires in a short time. But theoretically, hedging is also one reason to own Options.

Popular Definition and Key Terms of a Call Option

Let’s get to the popular definition of Call Options now which I will use to give an example and explain them in detail.

Call Option: A Call is a right, not an obligation to buy an underlying asset at a predetermined date at a predetermined price by paying a certain amount upfront.

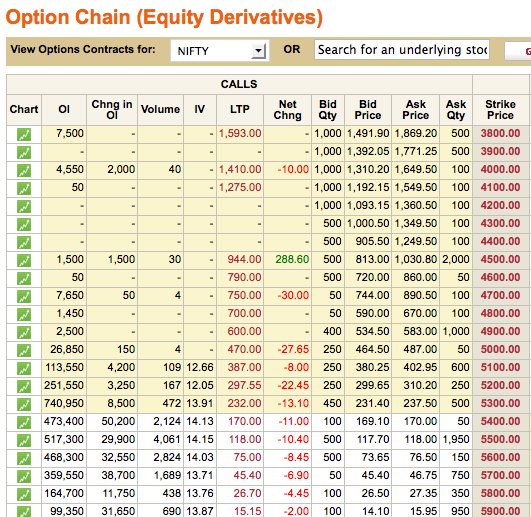

Now, look at this picture below and let’s take that example to understand Call Options a little better.

I took this screenshot from the Options chain section of the NSE website, and this shows the Call Option details for NIFTY which expires on 25th October 2012. Every Option has an expiry date and the Option becomes worthless on that expiry date. The expiry date is the predetermined date in the definition.

This is a Call option to buy components of the Nifty, so the Nifty is the underlying asset from the definition.

The Strike Price which is the right most column in this image shows at what price you will be buying Nifty. If you look at the first row that’s a price of Rs. 3,800 and then it increases by Rs. 100 at every row, and this is the predetermined price from the earlier definition.

Now, if you look at the sixth column from the left of this picture – that’s “LTP” which stands for “Last Traded Price” and this shows you at what cost per unit the last transaction happened for this contract. A Nifty Call Option is made of 50 units, so you pay 50 times whatever is listed in the LTP column.

The Nifty closed at 5,392 this week, and let’s look at the last highlighted row in this picture which is for the strike price of 5,300 and see how that fits our definition.

This Call is a right, not an obligation to buy Nifty at a predetermined date of October 25th 2012 at a predetermined price of Rs. 5,300 by paying Rs. 232 per unit upfront.

So if you bought this contract today, you will have to pay Rs. 232 and in return you will have the right to buy a Nifty contract at Rs. 5,300 on October 25th 2012. If Nifty is at say 6,000 on that date, then your Call option will be worth a lot more than Rs. 232 because you can buy it at 5,300 and then sell it at 6,000. That’s also why in the image above you see that the price of the Options keep increasing as the Strike Price keeps going down.

If the Nifty closes below 5,300, the Option will expire worthless because why would you buy Nifty at 5,300 when you can buy it for lower in the market. The part of the definition where it says that the Option is a “right but not an obligation” comes into play here because if Nifty closes below what you paid for it then you don’t have to do anything at all as it is your right to buy, but you aren’t obligated to buy.

This means that when you buy a Call Option your loss is defined to what you paid for it. You can’t lose more than that on the transaction.

The seller of the Call however who is known as the person who writes the option doesn’t have a cap on how much he loses and can lose an unlimited amount (theoretically) in the transaction. This is because the person who writes the option has an obligation to sell you the underlying asset at the price decided in the contract.

As far as Options trading in real life is concerned you don’t actually buy and sell the underlying asset but pocket the difference between the price you paid for the Option and the price at which you sold the Option.

One last thing about this is that Call Options that are lower in value than the underlying asset or are profitable are called “In the Money” and in the image above these are highlighted in yellow. Other Options are called “Out of the Money”

Now, let’s move on to the Put option.

Popular Definition and Key Terms of a Put Option

Let’s look at how a Put option is defined now.

Put Option: A Put is a right, not an obligation to sell an underlying asset at a predetermined date at a predetermined price by paying a certain price upfront.

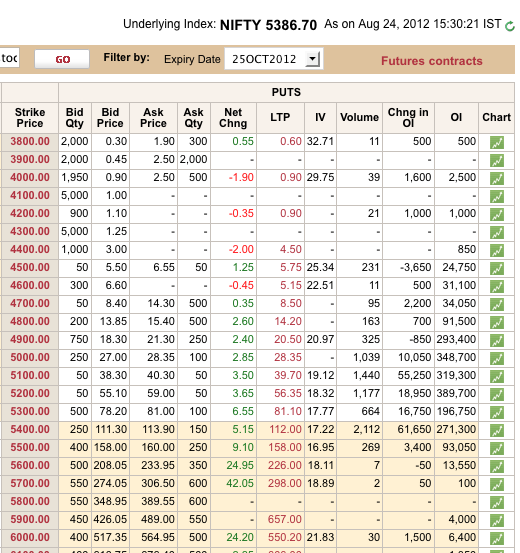

Now, look at this picture below and let’s take that example to understand Put Options a little better.

This screenshot is also from the Options chain section of the NSE website, and this shows the Put Option details for NIFTY which expires on 25th October 2012.

Since this is similar to Call Option but in a Put you have the right to sell instead of the right to buy, let’s look at the first highlighted row and see if we can define it the way we defined the Call Option.

This Put is a right, not an obligation to sell Nifty at a predetermined date of October 25th 2012 at a predetermined price of Rs. 5,300 by paying Rs. 81.10 per unit upfront.

So if you bought this contract today, you will have to pay Rs. 81.10 and in return you will have the right to sell a Nifty contract at Rs. 5,300 on October 25th 2012.

If Nifty is at say 4,800 on that date, then your Put option will be worth a lot more than Rs. 81.10 because you can buy it at 4,800 from the market and sell it at 5,300.

So, in the case of a Put option, you benefit from the contract when the price of the underlying goes down because you have the right to sell it at a much higher price.

Like Calls, you benefit from Puts by pocketing the difference between the price you paid and the price the Put is currently trading at – you don’t have to actually own the underlying asset and then sell it to profit.

And like Calls, Puts also limit your maximum loss to what you paid when you bought the contract. You can’t lose more money than that and this makes it a good way to go bearish on something because the other alternative is by selling a Futures contract and you can stand to lose a lot of money very quickly there if the market turns against you.

Conclusion

Options are a fascinating subject and I’ve spent many hours researching and looking at different Options strategies and trades because of this. For someone who is coming across them for the first time, they can seem a bit intimidating but once you get the hang of it they are fairly easy to understand and build positions with.

If you have any questions about this post, or any other observations, please leave a comment and I’ll answer them.

- Part 1: Introduction to Futures and Options

- Part 2: How do Futures Work?

- Part 3: How do Options work?

Edit: Lot size corrected.Â

Thanks Umesh for the reply.

I will take your words of advice. I am doing just that, learning all and everything about Options before diving in. I am a little skeptical about Futures but Options seem to be logical once you have full knowledge

Must say the article from Manshu is very informative

But be careful while trading options

If you do not have knowledge of option trading, then do not trade option without gaining knowledge.

Trading options without knowledge can blow off your trading account.

Hi Manshu,

Sorry for a a very novice question , but can i square off and take profits on a Call\Put Option the same day that i buy the Call\Put. Or like cash equity , i have to wait for T+2 days for the holding to come to my demat account ?

Same day!!

Why wait for a day.

Next momemt

Yes, you can square off your position (buy/sell) next moment

No involvement of demat etc being a derivative.

aditya . look you seem to be confused about the cash counter ( cash equity / also known as delivery ) as well .

look . if u buy abc company shares on monday in cash equity.

you share broker might give you delivery of the same at T +2

but that does not mean you cannot sell the same before T +2

mind it brother .

continuing on the same.

you bought abc shares at 10 AM at price 300 per qty

and u see a rate of 305 five minutes later .

u can sell the same too .

u need not to wait for T+2 and then sell …

plz take a note of this point .

good wishes

– Anuj

Hi Anuj

You too are not very clear on sale of equity.

Let me cite your words: if u buy abc company shares on monday in cash equity.

you share broker might give you delivery of the same at T +2 but that does not mean you cannot sell the same before T +2

Now there are 3 days – T (Monday), T+1 (Tuesday) and T+2 (Wednesday) and you said that one can sell the same before T+2. This implies that you can sell those shares on T (Monday) and T+1 (Tuesday), as well, which is not correct. You can sell those shares on T (Monday)(the day of purchase) but not on T+1 (Tuesday) or even after unless you get delivery in your demat account. And if you sell before receiving delivery then you may/have to incur heavy loss, because of auction sell etc.

HI, Mashu… Thank you for Detailed explaination. I would like to know that how LTP changes when underlying price reaches strike price either in call/put option . How can we know maximum LTP for that praticular strike price. For Ex :-

I brought SBI -1450 PE option at ( Rs 3/- X 125 (lot)= Rs 375 /- ) when underlying price is 1625/- Here my question is underlying price reaches to my strike price , then LTP (3/-)will increase at some extent ( for example 12/-) .how i can expect maximum difference. If underlying price reaches 1300 . How would be LTP implies…?

Hi,

I just started trading Nifty Call & Put. I noticed that towards expiry irrespective of the nifty futures position, the Put prices go down considerable to almost nothing. Is it advisable to sell Put rather than buy is and then buy it as the prices drop around expiry?

Another question: when buying Call Options is it advisable to buy above or below the nifty? For example if nifty futures is at 5847, and the market looks upward should I buy Nifty CE5900 or is there more volatility in Nifty CE 5700?

Very insightful article and comments! thank you everyone for this contribution 🙂

Hi sir, Can u explain how prices of options decided; i mean what factor decide price of option/

To close out an open position in option, you need to square it off. Here meaning of squaring off is similar to futures.

If you have bought an option then you will square it off by selling the same strike with same expiry at current market price. So no question of unlimited loss, (as you do not have any position.)

You close your position and the difference in buy and sell is your gain/loss.

To close out an open position in option, we need to square it off or exercise.

For ex, i have bought a call option and now to square off means i will be selling the call options at same strike price with same expiry but at the current market price.

As most of us now, seller of an option is subject to unlimited losses but limited gain.

So, square off is also going to be put us in same situation of unlimited losses?

Please clarify.

I know that it is not the case, i.e., positions will be closed and the difference in trades is the gain/loss but haven’t understood exactly how square off works.

Friends

If you have a query on options, please post here, I will try to answer, to the best of my knowledge.

But before posting your queries, please go through previous posts on this page.

Hi Anil

I do not think if there is any such terms like carry forward is prevalent in options like in futures. Even in futures you closes your this month position and open a NEW position in next months future.

In options, your (bought) out of money (OTM) option expires worthless that is their value is zero on close of expiry. (it is pure loss in case you have bought options, but a pure profit in case you have sold options) So no question of carry forward arises. You will have to buy (or sell) an option of the same or different strike rate if you want to want to enter a new trade.

if the call option is out of the money and we are in loss ,can we carry forward our position further after the expiry of the contract,will be their any penalty for it,please guide me iam new to the market,if the stike price in which we purchased the premium doesn’t reaches then we can carry forward our position further or not,will be their any penalty for carryforwarding our position further if it is not in the money .

Hi Manshu

Thanks for replies.

Please do write on the 4th part as and when time permits, but do not forget to complete the series.

Yes, Saumya. I will.

Hi Manshu

I just want to know that when you are posting the 4th part of this series. Please do include a few option strategies that one usually use for trade. Though I have read about these strategies but a bit confused to choose the useful one.

Thanks

Hi Saumya,

I had quite forgotten about this. I am not sure if I’ll be writing anything on this topic in the near future as I haven’t thought of it in quite some time.

Hi Manshu

Can you please elaborate the term “excercising option”. As our options are European type. that can be excercised only on expiry day.

But when we can buy, short sell, sell (squaring off holding) then what is this “to excercise option”, what is its need and what is special about it that one will wait till expiry day for it and that too if it is ITM only.

Exercising the option means you actually take delivery or sell the stock that’s underlying your option. As far as I know, you can’t do that in India. You always pocket the difference. If anyone knows differently, then please correct me.

The significance is when you actually want to hedge your risk and you entered the transaction with the intention of getting or paying the price that exists today at a future date.

Can we sell it before expiry.

What kind of options are traded in India. Are these american options or European type.

What i have heard is american options can be sold anytime before expiry date , whenever its in the money, while in European you cannot .

You have to sell it on the day of expiry date.

Hi Ashish

The answer to your queries are as under to the best of my knowledge. Actually your “sell” word is creating confusion in your query. Sell in F&O have 2 different meanings. One is you have an holding and you are selling out of it and the other sell, you do not own anything and will buy later to cover it, that is short sell. The treatment of the two “sell” are sometime different in options.

1. Can we sell it before expiry.

You can do anything, buy, sell, cover, square off before expiry like future or equity. But here your sell mean an exit of the holding or call/put writing. Though you can do both but for call/put writing you have to pay margin as in future. And I think you know the inherent risk in option writing.

2. The options traded in India are of European type, that why the suffix CE/PE. Normally the options are cash settled.

3. You can sell, buy, exit before expiry but you cannot exercise option before expiry, in European type.

4. Not necessary. If you have bought some options and are out of money (OTM) then you will/need not sell your holding on expiry because you are in a loss and you have already paid the premium (now loss) and if it is in the Money (ITM) that is in profit then you will certainly sell your holding to book the profit.

I will like to add few words here, if you are near the money that is near your strike rate then you should be more vigilant and watch expiry carefully, because if in the last moment your call/put turned out to be in the money and if you wont square off your holding then your holding which is ITM now, will be auto squared off and you will be charged with an higher STT, applicable for cash segment (and it is about 10 times higher than the applicable rate for f&o) and there can be an instance that you are in the money by re 1, that is, in a profit of 50 INR per lot and after paying STT on your trade, you end up with a loss of more than 300 INR per lot.

Hi saumya , thanks for the ans .

By seeeling I meant the One where I have an holding and are selling out or more precisely , excercising the option.

I generally trade in stocks, futures and MF’s. Options for some reason, I was away. This has given some insight. Let me try and see how I can make money thru options

Hi Manshu,

Thanks for the initiative of writing on Options, which is a complex topic. Though it can be understood by seasoned investors or investment professionals its difficult to explain it in simple terms.

I just wanted to share few views which you may or may not agree with.

1) In the point on “For a retail investor, the three common reasons for owning an option …..” the “leverage your position” may be more suited for traders rather than retail investors. Though a retail investor can pay premium and buy an option, its only suitable if the investor is very active enough to sell on an uptick in option price intraday or within few days. This theoretically sounds good like hedging but practically there are few conditions (like margins, portfolio size, etc) for it to work.

2) There are some text and articles which talk about option buying, writing, etc. but when it comes to real life you wont find any investment adviser recommending options. Brokers, experts or advisers who advise you to buy options are probably inducing you to trade/speculate (unless it is for purpose of hedging). Research has shown that majority of options approx. 75-80% expire worthless.

3) In continuation to point 2 and as you rightly mentioned option sellers/writers are the ones who are successful at option trading. The unlimited loss is to the maximum extent of strike price in case of Put Option and theoretically unlimited (to the extent of price rise) in case of Call Options. But in real world Option Writers are smart enough to control their losses, so the concept of unlimited loss is a myth.

The use of Option Chain is wonderful. Probably in future you can also explore Option Payoff diagrams which give an intuitive understanding of options and option strategies.

Lastly, I congratulate you for this initiative. I’ve seen many option articles, where examples are taken from western markets, however, your efforts in taking Indian example which people here can use is appreciated.

Correction in Point 1:

Please ignore margins, portfolio size, etc….its relevant for hedging only.

Leveraging by buying call option or put option can be a good strategy provided you are an active trader and have the ability to swiftly monitor and close positions, which most retail investors practically cant do. Doing this with ‘Out of Money’ Options is more risky because you only gain if the index comes closer to your strike price in the desired direction within a short span of time. If you wait for more time the option loses its value leading you to losses.

The theory of ‘limited loss’ to option buyer is true to an extent but if someone continuously buys options whose price doesn’t go up, then the losses or going to hurt a lot. On a lighter note its like buying more and more lottery tickets thinking that losses are limited………so in the end the lottery dealer (or the option writer) is the one who gains! Option buying is suited only for traders or for pure hedgers, not for small investors.

By retail investor, I’m thinking small investors, and not necessarily differentiating between traders and investors but yeah I see what you’re saying.

Secondly, it was not my intention to say that “option trader/writers are the ones who are successful at option trading”. Where does it indicate that? Could you tell me please – I’d like to reword that to make it neutral. I don’t agree with that and would like to make that clear.

Hi Manshu,

You didnt make a statement that option writers have a higher chance of success. However, when you mentioned “option writer can have unlimited losses (theoretically) I could have misinterpreted”. Sorry for the assumption. You don’t have to make any correction – the article is well balanced and neutral.

However, research shows that a majority of the options expire worthless (the %age may vary by markets). This means majority of buyers lose their premium. I didn’t mean option writers are always successful, but tried to convey that they have a good chance or probability of success. You can also check this article-

http://optionalpha.com/time-to-dispel-the-stupid-myth-of-unlimited-losses-in-naked-option-selling-10540.html

Its a statistical fact that majority of options expire worthless …its not my view or experience but a fact in general.

If you start trading in options you will realize this basic fact that most people ignore. Option buyers can have a higher chance of gaining or benefiting if they are doing it for hedging purpose, but buying an option with a sole motive to sell at higher price is risky.

Hi

I know little bit about options and wish to trade in options. You confused me.

You said in the last paragraph

“….but buying an option with a sole motive to sell at higher price is risky.”

How it is risky, can you please explain it by citing an example.

Because as far as I know my risk is limited to the premium paid and that I have already paid at the time of purchase.

For example, suppose I buy one lot NIFTY 5700 CE SEP expiry on 17.9.12 at XX INR and suppose on 21.9.12 this CE is in the money and the price is XXX INR, I will sell my option holding and pocket the difference. Is there any risk in the trade.

Thanks

any financial product that sounds too complicated to understand — avoid

— intelligent buffett

alas, greed trumps sanity

Hi Manshu… Thanks for this nice post explained in a very simple language! A couple of things I want to point out here – you mentioned above “A Nifty Call Option is made of 200 units, so you pay 200 times whatever is listed in the LTP column” – actually Nifty carries a lot size of 50 units and not 200, so in the above example, the buyer needs to shell out Rs. 11600 (Rs. 232 * 50) per lot of Nifty Call Options and pay it to the seller who gets it for bearing the risk of Nifty rising to some unknown higher levels.

Though my 2nd point is not greatly important and might confuse some people but still I think it is better to mention it. The buyer of the Call Option needs to pay the “Ask Price” for one unit of Nifty & not the “LTP”. It is important here to mention it because sometimes a particular “Strike Price” attracts a very low trading interest and hence low volumes on it. That makes a huge difference between the LTP and the Ask Price.

Thanks for pointing out those two things Shiv. I have corrected the lot size and of course I agree with what you’re saying about Bid / Ask but for this post, let that remain LTP to explain the broader point.

Perhaps the 4th post on this series should be one that explains all the columns on this image and their relevance.

Thanks! Yes, you are right, probably that is the best thing to do to make people understand this point.