This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

In today’s volatile equity markets, investors are increasing their allocation to fixed income investments. But, it is still an untapped market as far as debt fund investments are concerned. Investors here still remain wary of these fund investments as they do not understand where and how their money gets invested and hence, still prefer to park their money in bank fixed deposits.

But, as a matter of fact, in a falling interest rate environment, bank fixed deposits give lower returns as compared to debt funds, especially, market-linked debt-funds. There are a couple of reasons for that, first, whenever the interest rates fall, the banks also cut their deposit rates and second, a fall in interest rates results in an appreciation in the market prices of debt fund holdings.

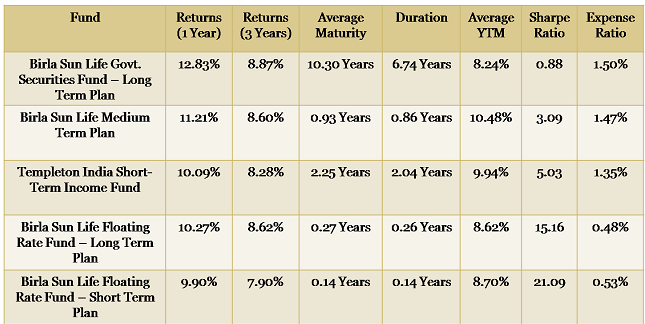

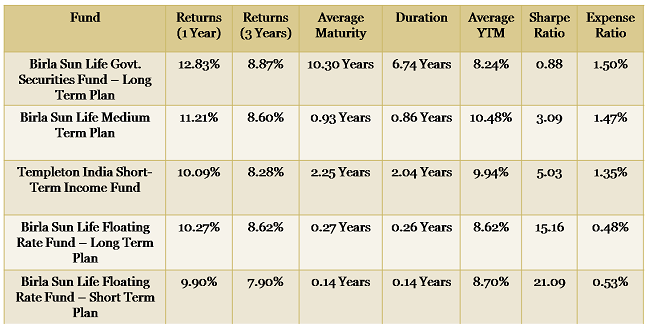

In the past one year ending 31st October, 2012, debt funds category has generated returns between 8.44% (Gilt Short-Term Funds) and 11.54% (Gilt Medium & Long-Term Funds), with Income Funds, Short-Term Funds, Ultra Short-Term Funds and Liquid Funds generating 10.53%, 10.04%, 9.55% and 9.35% respectively.

So, what are these debt funds and what factors should the investors look out for to get potentially higher returns?

Equity vs. Debt – Like equity funds invest in equity capital of various companies listed on the stock exchanges, debt funds invest in various listed or unlisted debt instruments of such companies. Fundamentally, this way, equity mutual funds become shareholders of these companies and debt mutual funds become the debtors of such companies.

The first step in any debt fund investment is to determine your time horizon and objective of the investment and also to understand what kinds of investments the debt fund makes. You should invest in a fund which is in sync with your investment horizon and risk profile.

Debt fund category has many sub-categories and it is important to understand how each sub-category is different from the other sub-categories.

Here are the sub-categories under the debt fund category and their characteristics:

Gilt Funds – Invest in Government Securities (G-Secs) primarily; Longest Maturity; Highest Duration; typically invest in securities with an average maturity of more than five years

Income Funds – Invest in corporate bonds and/or G-Secs primarily; Long Maturity; High Duration; typically invest in securities with an average maturity of more than three years

Short-Term Funds – Invest in short-term corporate instruments primarily; Short Maturity; Low Duration; typically invest in securities that mature in one to three years

Ultra Short-Term Funds – Invest in ultra short-term corporate instruments primarily; Shorter Maturity; Lower Duration; typically invest in securities with an average maturity of three months to one year

Liquid Funds – Invest in money-market instruments primarily; Shortest Maturity; Lowest Duration; typically invest in securities with an average maturity of less than three months

Fixed Maturity Plans (FMPs) – Invest in fixed maturity corporate instruments primarily; Fixed Maturity

So, if your investment horizon is short and the objective is to earn safe returns then you should not invest in a Gilt fund or an Income Fund as a rise in interest rates could result in negative returns for such funds.

Now, here are the factors that the investors need to consider while choosing a debt fund.

Performance/Returns

We invest in various asset classes to earn potential returns out of them. So, a fund’s past performance becomes the first important factor to be looked at. An investor should check a fund’s returns over different time periods, like six-month returns, one-year returns, three-year returns, five-year returns, returns since inception and returns since the current fund manager has taken over.

But, as with any investment, you need to understand that the returns in fixed income products also represent past performance and there is no guarantee that they will continue to give the same returns.

Making a comparison of the fund’s performance vis-a-vis the performance of other funds in the same category is a very important exercise. It gives you a clear idea how good or bad the fund has been performing. Also, make sure to check only the ‘Growth’ option of all the funds to make a meaningful comparison as different dividend payment dates of different funds would provide an unclear picture for comparison purposes.

Fund Management Team – Experience & Qualifications

Fixed income investing has become a difficult job in a much more complex economic environment and an uncertain yet dynamic interest rate scenario. How well a fund performs primarily depends on how good the fund manager is.

So, an investor must check the fund manager’s experience and qualification and the returns generated by the fund under his/her fund management tenure. A detailed summary of each fund’s management team, its experience and qualifications can be found in the fund’s prospectus.

Also, a fund house well equipped with thorough research and analysis tools in debt fund management will definitely be able to take quick quality decisions as compared to a team with lack of such tools.

Average Time to Maturity

A bond fund carries a weighted average time to maturity, which is the average of the current maturities of all the bonds held in the fund. The longer the average maturity, the more sensitive the fund tends to be to the changes in interest rates.

Duration

Though duration and maturity sound similar, never confuse duration of a bond or a fund with its time to maturity. Duration measures how much a bond’s price will rise or fall with a percentage fall or rise in interest rates and is calculated in a similar manner in which maturity is calculated. A fund with an average duration of 6.74 years (or just 6.74) will theoretically appreciate 6.74% in value with a 1% fall in interest rate, keeping all other factors constant.

Average Yield to Maturity

Yield to Maturity (or YTM) is the annualised rate of return that an investor earns on a fixed income instrument, if the investor purchases the bond today and holds it until maturity. Average yield to maturity of a debt fund is the average of the current maturities of all the bonds held in the fund.

Companies offer higher yields on their debt securities in order to attract common investors like you and me and also to attract the managers of these debt funds. Some fund managers get attracted to these higher yields and compromise on the quality front by investing in lower-quality securities. So, you should not invest in high yield bond funds only on the basis of its potential yield. You need to factor in the credit risk, risk of default associated with the issuers, and how that risk might affect the safety of your investment.

Standard Deviation and Sharpe Ratio

While a debt fund may generate a higher return, the return may be the result of potentially higher risk. Standard deviation calculates the sensitivity of a security or a fund. The higher the standard deviation, the higher the security’s volatility risk.

Sharpe Ratio is an equation to calculate risk-adjusted performance of a portfolio and for a debt fund, it is calculated by subtracting the risk-free rate from the debt fund’s return, divided by its standard deviation.

Sharpe Ratio = (Portfolio Return – Risk-Free Rate) / Portfolio Standard Deviation

The higher the Sharpe Ratio, the better the debt fund has performed after being adjusted for its risk.

Portfolio/Holdings and Credit Quality

Credit quality of a debt investment is the most important factor for any investor. The overall credit quality of a debt fund will depend on the credit quality of the securities in the portfolio. Different debt funds invest in different debt securities with varying degree of credit quality, ranging from risk-free government securities to high-risk corporate securities.

Though credit ratings do not guarantee against any default in payments and are not 100% foolproof either, the relative credit risk of a bond gets reflected in the ratings assigned to them by the independent rating companies such as Crisil, ICRA, CARE, Fitch and Brickwork. Bonds, which are considered to be the safest from credit risk point of view, are given the highest credit rating of AAA. The lower the ratings are for the securities of a debt fund, the riskier the fund becomes for you to invest.

Debt funds which invest in lower-quality securities can potentially deliver higher returns, but will also be vulnerable to some level of default risk both in terms of interest payments as well as principal repayments. So, the investors should choose debt funds with better asset quality.

Expenses/Charges/Fees

A fund charges expenses and fees for managing your investment. These expenses are a certain percentage of the total assets managed by the fund and hence are termed as the “Expense Ratioâ€. As these expenses are ultimately affect your returns only, the lower these expenses are the better it is for you. But, at the same time, you should focus more on the returns generated by a fund and less on the expenses.

Exit Load

After SEBI’s ban on “Entry Loadâ€, most mutual funds have introduced “Exit Loads†on most of their schemes and that too in different proportions with different applicable time periods. Also, exit load is charged on the investor’s total investment amount i.e. the principal investment amount plus the return generated on it. So, it becomes important for you as an investor to check the exit load before making the investment, as if the investment horizon is short, then the exit load might reduce your overall returns considerably.

Taxation

Short-term capital gain (STCG) in debt funds is taxed as per your applicable income-tax slab, whereas long-term capital gain (LTCG) is eligible for the inflation indexation benefit and is taxed at the lower of the two, either 10% without indexation or 20% with indexation.

Dividend received from the debt funds are tax-free in the hands of its investors as the fund houses are required to deduct and pay dividend distribution tax (DDT) to the tax authorities. Liquid funds or money-market funds are required to pay dividend distribution tax at an effective rate of 27.0375% (25%*1.05*1.03), including 5% surcharge and 3% education cess. Dividend distribution tax for other debt funds is 13.51875% (12.5%*1.05*1.03) effectively.

So, if your investment horizon is less than a year and you fall in the 30% tax bracket, then you should invest in either an ultra short-term fund or a short-term fund and opt for a regular dividend option as the dividend will be tax-free for you and might result in a zero capital gain tax.

To me this is an exhaustive list of factors which you should consider as you decide to invest in debt funds. If you want to suggest some other factors to be considered, then you are most welcome to share them here. If you want to learn more about the fund you’re considering, you need to check the fund’s prospectus or its monthly factsheet.

Nice

Keep up the good work

Hi, Great Article. I am prospective borrower and was wondering how Factors that affects your loan against property tenure. https://www.loankuber.com/content/emi-calculator/factors-that-affects-loan-property-tenure/

Hi, great article.

Just had a thought, is investments nothing but a good debt that would benefit us in the future. We are sacrificing some part of your savings so that we build up a secured future for us. https://www.loankuber.com/content/peer-to-peer-lending/the-best-fixed-income-investment/

Thanks Shiv for your valuable feedback! Much appreciated!

You are welcome!

Hi Shiv,

Is this a good time to invest in 3 year FMP’s considering the impending fall in interest rates?

Between FMP and debt funds and hybrid funds (like ICICI equity income fund) which one is better ?

Regards,

SB

Hi SB,

I think open ended income funds or gilt funds are better poised to gain due to interest rates going down as compared to the FMPs. Also, it is better to invest in a combo of one equity fund and one debt fund as compared to a hybrid fund.

Dear Mr Shiv.

can we choose a combination of Longest Period Gilt Fund & Shortest Term Liquid fund to get maximum benefit in present condition ?

if the rate fall we benefit in Gilt Fund & if it rise get more interest in Liquid fund .. what do you suggest need to invest 10-20 lacs immediately .

I already have 15 lac in Short Term & 5 Lac in HDFC Gilt. and use SWP

to invest SIP in ELSS Funds. can i apply using your broker code ?

Dear Mr. Agarwal,

Sorry, I probably missed this one to reply. I think interest rates are getting southwards and that’s why it is a good time to invest in either bond funds or gilt funds. A small portion of your investible amount can be parked in liquid funds.

Moreover, if you apply through us, we do not charge for our advisory services.

After drastic fall in NAV in all liq debt funds bond funds where do we park our money to get at least 8 to 9 % tax free returns.

Big problem for retired person like me.

It seems now nothing should be invested for any long term as government policies changes any time .

Pls suggest where i can shift my holding from SBI Dynamic Bond UTI Bond & Birla Bond Funds

Hello Sir,

I think a panic situation is not the best of the times to exit any investment and the current situation looks to me some kind of panicky. I also think markets reward those who have a vision to predict future outcomes with some accuracy. Though dynamic bond funds’ performance depends on the abilities of the fund manager, I would advise you to stay invested with your MF holdings and wait for some clarity to emerge. In the medium to long term, these funds should give decent returns.

I have a surplus of 5 lac and i have invested the same in a FD having interest rate of 8.75% and my investment horizon is long term (say 5 yrs) does it make more sense to shift the same to gilt funds (i am currently taxed @20%). please guide vis-a-vis the riskiness and liquidity of the investment in gilt funds

Hi PJ… Gilt Funds are ideal in a falling interest rate scenario as there is a scope of capital appreciation. At the same time, Gilt funds are riskier than FDs as they might give very low or even negative returns in a rising interest rate regime. In the current interest rate environment, the probability of interest rates falling is more than interest rates rising. Gilt Funds are liquid also. So, one should invest in Gilt funds vis-a-vis Bank FDs.

Also, taxability is also favourable for Gilt Funds – LTCG is applicable for investing in it for more than 1 year, which is taxed at 10% without indexation or 20% with indexation, whichever is lower. STCG is added to your income and taxed as per you tax slab. In the last 1 year, Gilt fund category has given 10.20% return.

Thanks for the info.I already have a PAN & I am KYC compliant to.

In that case, I think the fund house is wrong in deducting withholding tax. Please check whether your PAN is updated with the fund house and whats new they have to say about it.

Thanks Shiv for your prompt reply. PLease find reply from my fund house.

we wish to inform you that the Long Term Capital Gain Tax for debt schemes is 10% without indexation or 20% with indexation + applicable Education Cess i.e. 3% . As per Income-tax Act, the Assessee has the option to either pay the Long Term Capital Gain Tax as per either of the above rates .. However, as deductor our responsibility is to deduct withholding tax @ 20% + applicable cess and do not have any authority to extend the benefit of Indexation to NRI investors as per Income – Tax Act. The tax deducted by our RTA being in the nature of withholding tax may be claimed/adjusted by NRI investors directly from Income-tax Deptt by exercising his option for 10% without indexation or 20% with indexaction as may be beneficial to him and desired by him.

Is this correct????

The response seems correct now but that is the case if you do not have a PAN with you. Please check it yourself about the indexation and the withholding tax –

http://www.kotakmutual.com/kmw/downloads/TaxReckoner_FY2012-13.pdf

http://mutualfund.birlasunlife.com/UploadDocuments/ToolsandKnowledge/TaxReckoner/TAX-Reckoner-2012-2013.html

I am an NRI & redeemed a Ultra short term debt mutual fund -Growth Option after one year.I was taxed 20.6.% LTCG by the mutual fund without indexation benefits even though their web site displayed a table showing that NRI’s would be taxed 10.30 % without indexation and 20.60 % tax with indexation.

Surprisingly, I did not get any indexation benefits.When I questioned them about taxation,they referred to Section 115 and told me that NRI’s do not get indexation benefits .It seems that there was one line below the table which when clicked took u to another word document, where these rules are mentioned.I never read this page before investing.

But I have read other mutual fund houses taxation rules for NRI’s which mention that under Section 112 NRI’s should get indexation benefits.In 2010 when I redeemed a similiar growth fund with HDFC after one year,they did not deduct any LTCG tax.This prompted me to invest further in debt mutual funds.

Each mutual fund house inteprets in it’s own way.Could u throw some light on LTCG taxation rules for debt mutual funds for N.R.I’s?

Even though there are loads of articles in the media about benefits for NRI’s to invest in debt mutual funds,I feel NRE Fixed deposits are the best if your horizon is longer than a year.

Hi NKN… NRI’s are taxed at 10.30% without indexation and 20.60% with indexation. The AMC is wrong in saying that the NRIs do not get indexation benefits but they are right in deducting TDS @ 20.60%. But again NRIs are eligible for indexation benefit on TDS too.

Taxation laws are uniformly applicable to all AMCs and it is illegal if they are not adhering to the law. I think the problem is with some of the AMCs’ working style and their service quality and not with the debt fund category as a whole. I hope you agree.

Awesome post again Shiv! Somebody had asked how to start on Finance from Zero. For me your articles are one medium!

Absolutely! couldn’t agree more!

It is like Tendulkar praising Unmukt Chand… Thanks a ton Manshu! 🙂

Thanks a lot harinee! These motivational words are the driving factors for bloggers like me.

Hi Priya… I think the bias would be towards an Ultra Short-Term Fund but definitely without an exit load. Dynamic Bond Fund is not any sub-category within the Debt Fund category and that is why, are not featuring here in this post. They are like ‘flexi’ debt funds, which have the flexibility of investing your money into short-term or long-term instruments, depending on the fund manager’s outlook on interest rates and other factors.

You should have an investment horizon of at least 1 year to invest in a Dynamic Bond Fund. But, more importantly, the fund manager of your dynamic bond fund must really be dynamic. 🙂

Thanks for the reply SHIV.

IS there any chance of capital loss in liquid & liquid Plus schemes??

Theoretically & ideally No. But in case of big & sudden default, probably Yes.

Thanks Shiv for the wonderful article…

Financial planners always advise about shifting money from Equity MF’s to Debt mutual funds 2-3 yrs away from the goal for de-risking. For this purpose which category of debt funds shd be considered??

What happens if our investment duration exceeds the average maturity of the fund. For e.g as u mentioned in the table above-

The average maturity of TEMPLETON INDIA SHORT TERM INCOME fund is 2.28 yrs. Wht if i stay invested in it for 4-5 yrs?? Do i end up with a loss?? Does it erase off whatever capital gains i made in 3 yrs??

Thanks Sameer!

Initially, you can consider Gilt Funds or Income Funds and then you can shift to Short-Term Funds, Ultra Short-Term Funds or Liquid Funds.

Duration exceeding average maturity does not result in a loss. Please dont mix the two. I think you did not get the significance of Duration. Please try google to understand more about Duration.

The fund will be regularly buying and selling debt holdings, either because the time to maturity of a holding decreases below what the fund wants to hold, or simply due to fund inflows/outflows. Some holdings may be held to maturity, especially in liquid or ultra short term funds. But, for the Templeton example, the fund will likely sell holdings when their time to maturity decreases below some limit and replace them such that the portfolio’s average maturity is maintained close to 2 years, consistent with the fund mandate of holding short term debt.

As a result, the fund will be booking capital gains or losses as it sells holdings. The NAV will reflect the cumulative capital gains/losses over the investment duration. Whether it is a cumulative gain or a loss will primarily depend on how interest rates have moved over the investment duration (and also on credit quality changes, fund management, etc).

Hope this helps.

Hi Shiv,

Thanks for such an exhaustive update…

If investment horizon is 3-6 months ( 30% tax bracket), then which of the following is a better option- ULTRA SHORT TERM or SHORT TERM?? Most of the short term funds do have an exit load…

U have not mentioned about Dynamic Bond fund…For wht investment horizon shd investment in Dynamic bond fund be appropriate?

Nice article. A couple of questions:

Are the short term and ultra-short term funds classified as money market funds for the purpose of tax?

About the dividend option, i had the opposite opinion because the 10% tax rate is less than the 13% DDT. Even though the difference is only 3%, its still in favor of using the growth option, no?

Thanks.

Thanks DJ! Short-term funds and Ultra Short-Term Funds are not classified as Liquid Funds and thus enjoy a lower DDT of 12.5% plus surcharge and education cess.

If the investor’s investment horizon is more than a year, only then 10% without indexation or 20% with indexation comes into the picture. In that case, one should go for the growth option.

Its nice to know that those funds have a lower tax rate. Oh, yes, my question was assuming that I’m investing for longer than a year, which may not be the case (especially since the funds are “short-term”).

Just this weekend, I was struggling with how to balance out the average maturity of the debt portion of my portfolio. I have gone with 15% medium and long term gilts (5 to 11 years), 50% short and ultra-short term (3 months to 9 months) and 35% in mixed debt funds with maturity 2-5 years.

I wanted to move some of the 50% short term allocation into short term gilts (especially after the Deccan Chronicle default scare), but they yield 1 to 2% lower than short term funds with CPs and CDs.

From what I could make out, there is virtually no (or very little) difference between the liquid, short term and ultra short term funds – in terms of average YTMs. Credit quality and sector exposure varies quite a bit. I wonder how one should evaluate that, other than looking at proportion of P1+.

Thanks.

I think Long-Term Gilt Funds make more sense as compared to the Short-Term Gilt Funds in the current interest rate scenario with slow economic growth. Dont you think so ?

Nobody can manage your money better than you. Your own research about the portfolio holdings and their credit quality along with the credit ratings is a prerequisite before you invest in these funds. One should not invest in funds with high exposure to some risky sectors or unknown companies.

Maybe… I didn’t have any long term gilts before this weekend and now I have 15%. 🙂

But, at the same time, I feel that 5% growth (vs desired 8%) is a smaller problem than 10% inflation (vs desired <6%). Since last Dec, RBI has been telling us that inflation is coming down in the next couple of months and it hasn't. As long as inflation is a concern, difficult for rates to go down… maybe inflation will start to trend down soon. Who knows…

The probability of rates falling, sooner or later, is high as compared to rates rising. At the same time, the probability of growth falling more from here and the govt. taking no actions, still even after such a bad reputation of derailing the economic growth, is very low. But, still you are right, you never know.

I think we should decide first and find out the appropriate proportion for each type: Equity and debt. Then invest in both to make your portfolio versatile….

Absolutely !! Risk Profiling and Asset Allocation are the primary activities all investors must begin with before investing in any of the asset classes.