I wrote about Franklin Templeton Dynamic PE Ratio Fund a little under two years ago, and I thought of looking at its recent performance when Business Line put in a buy recommendation for the fund in a recent article.Â

Essentially what this fund of funds does is allocate money in a debt or equity fund based on what the current P/E ratio of the market. This way it can allocate more money to equities when the market is down, and allocate more money to debt when the market is high and risks going down. Currently it has 60% in equity and 40% in debt.

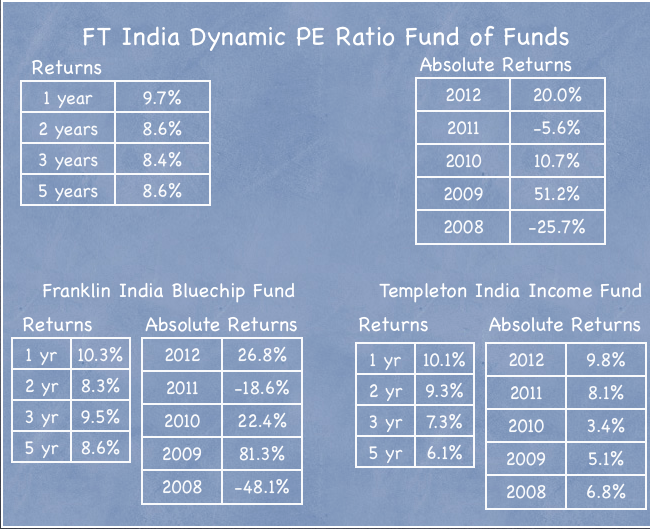

The two fund it invests its money are Franklin India Bluechip Fund and Templeton India Income Fund.

Now let’s take a look at how these three funds have performed in the past few years.

I think the chart above is a very useful way of looking at these three funds and see what’s going on in their performance.

Franklin Templeton Dynamic PE Fund returns similar to the returns of Franklin India Bluechip Fund

What strikes me most about this is that FT India Dynamic PE Fund has returns that matched the Franklin India Bluechip Fund in the longer run, and wasn’t able to out do it even when the equity markets haven’t been good for the past few years.

Protection against volatility

The second thing that strikes me about this is that if you wanted to invest in equities but were wary of the volatility and sudden crashes of the market then this would have proved to be a good option as it protected you from the violent downswings that the past few years have brought in the equity market.

Templeton India Income Fund dragging down returns

Moneycontrol ranks this income fund as one of the lower returning ones based on past returns and that has been consistent over the past few years, so you can see that this fund has been dragging down the returns of the Dynamic PE Fund as well.

Returns comparable to balanced funds

When I wrote about this fund almost two years ago I made the following observation about it with respect to balanced funds:

The fund still beat its benchmark but if you look at my best balanced funds post you will notice that there are quite a few funds that have bettered this performance over the 3 year and 5 year range.

So, when thinking about investing in a PE fund – whether this or another – just take a look at how other balanced funds are performing as well because they are similar in structure.

A good balanced fund like HDFC Prudence has returned 11.2% annualized in the past 5 years which is higher than this and while it is not fair to pick just one good balanced fund and compare its return with this fund the point I’m trying to make is that balanced funds that don’t rely on P/E strategies but invest about 35% or so in debt regardless of P/E levels have been doing at least as well as this fund.

P/E Strategy No Magic BulletÂ

Theoretically, the P/E strategy sounds good – you invest more when the market is down and more when the market is up, but in practice it’s no magic bullet. The fund has done well, and there is no harm in investing in such a fund, but where you would go wrong is to expect some kind of sensational returns. In the past it has performed like a balanced fund, and these are decent returns when thinking about how the equity market has done in the same time frame, but that’s about it – it hasn’t given you an edge over them, and won’t do so in the future either.

Source of returns:

Yes. Comparing with the pure equity fund the PE fund wins hands down as it delivered similar returns with much lower volatility.

It should have beaten balanced funds though. In essence, one can maybe summarize that the better risk adjusted returns came not from having a PE based approach to equity allocation, but rather having a mix of equity & debt over a period where equities hardly generated any returns.

So over a period of sideways returns from equities pure balanced funds have outperformed, and over a period of full on bull markets the equity fund would have far outperformed.

Comparing returns on the PE fund to the bluechip and saying that the returns are similar and PE should have done better is really a fair comparison. It has delivered similar returns at much lower volatility.

The current investment ratio is similar to that of balanced funds.. and maybe the PE fund actually held even greater equity % when market was at lower levels, thus should have beaten returns from balanced funds.

I think you meant really not a fair comparison? And it’s not just one blue chip balanced fund but a whole host of them.

Manshu is there any MF which actually got positive returns in 2008 (if that is a possibility)?

No that isn’t possible as far as equity mutual funds are concerned. There wasn’t a single one that had positive returns in ’08.

Manshu, I enjoy your posts.

The primary advantage of utilising a P/E strategy is reduction of volatility over the long term. So if you took annualized returns adjusted for risk, that is where you would see the P/E approach shining. The other factor is to give it time (5 may be insufficient). Regardless, over the long term the p/e approach comes through.

Reminds me of an excel exercise I did on nifty returns – a p/e based asset allocation adjusted monthly beats both static asset allocation as well as 100% equity over the long term (1992-2013)

If you compare the volatility with a balanced fund, I think you would see the same result.

The numbers here don’t make any sense. I’m pretty sure the 1 year – 5 year returns are wrong. The annual numbers look okay. For example, its easy to see that the 1 year returns for the equity funds must be wrong since the 2012 returns are 20% or so. Combined 2 year performance using 2011 and 2012 numbers should be 0% for the Bluechip fund. Similarly, if you look at the 2008 + 2009 performance, Bluechip fund would still be short by 10% while the PE fund would be up by 12% or so.

If I use the 2008-2012 annual numbers quoted above. Then the cumulative return over the 5 years are as follows: for the PE fund its 40%., its 20% for the Bluechip fund and 37% for the Income fund. The 5 years rates of return should be something like 3-4% for the Bluechip fund and 7% for the PE fund and the Income fund.

I hope I haven’t missed anything or made a mistake, but the conclusion from this seems to be the opposite, is it not?

I guess dividends could cause the difference. Maybe, the absolute returns don’t include dividends, while the 1yr-5yr returns do? I don’t know how valueresearchonline reports these two numbers.

Let’s see if we can make some sense out of this. I’m going to take the example of FT India Dynamic PE Ratio Fund of Funds for this exercise but you can take any one yourself and verify.

First up, the Returns number is annualized, so the 5 year 8.6% number means 8.6% gain every year for 5 years, and not absolute gain of 8.6% in 5 years.

So, now to verify this say I start with a 100 bucks and then apply the absolute return number to arrive at what I have left at the end. Here is how that table will look like.

Use the CAGR calculator to see how much this is annualized. This comes out to 7.08%. But why isn’t this 8.6%.

CAGR calculator: http://www.moneychimp.com/calculator/discount_rate_calculator.htm

That’s because the time frame for the 8.6% is from Feb 9 2008 to Feb 9 2013 whereas the absolute numbers are for Jan to Dec only.

Now let’s see how the absolute gain for 2012 is 20% while the 1 year return in 9.7%. In order to do this you need the NAV numbers which you can get from this link.

http://www.moneycontrol.com/india/mutualfunds/mfinfo/hist_graph/MTE025

1 year number:

Calendar Year Number:

So not only was there a significant gain from 2 Jan 2012 to 9 Feb 2012, there were no gains from 2 Jan 2013 to 9 Feb 2013 and that explains the difference between the 20% calendar year return but only 9% last 12 month return.

Does this make sense, do you have any questions?

Ah, ok. I can see how the 1yr – 5y returns might be correct. Its a different 5 year period, duh!

But, my point remains. If you consider Feb 2008 – Feb 2013 (using the 5yr returns) then you get the conclusion of this post. But, if you consider Jan 08 – Jan 13, using the absolute returns of each year from this post, then you reach the opposite conclusion. This is from the cumulative and annual returns I posted in my previous comment.

31 Dec 07 to 9 Feb 08 (the period which causes the discrepancy) is a big differentiator apparently. The PE fund returned -2.8 and the Bluechip fund -16.8%. And, since this is the first month of a five year period, the gap gets compounded. So, it explains the 3-4% differential that I was looking for in the 5 year returns.

The conclusion for me is that one month can make a big difference. The 5 yr returns suggests something opposite to the absolute returns. Thanks for the explanation. You should have just mentioned the time period and pointed me to moneycontrol. 🙂

Actually, this discrepancy suggests the superiority of the PE fund. It matches up to the better fund in each of the two periods. But, again this is only looking historically. Who knows how the fund managed risk in future.

I am comparing it to balanced funds because they have debt.

I agree on the part in the post on how it compares with balanced funds. There may be better ways of doing allocation between equity and debt. One doesn’t have to go with the PE method.

What I didn’t agree with are the points below. These conclusions are true when looking at Feb to Feb returns, but not when using the absolute returns.

“Franklin Templeton Dynamic PE Fund returns similar to the returns of Franklin India Bluechip Fund”

“Templeton India Income Fund dragging down returns”

I couldn’t have reached the conclusion without following these steps and I had to write down these steps anyway so just presenting it here is not a big deal plus I learned how to paste a table in comments which came up in another post 🙂

Dear Manshu,

Can you compare PE funds with Axis Triple Advantage fund, which is not dynamic, but averages investment in Equities, Debt and Gold.

What does it do? Invest equal amounts or they too have a formula or something?

As long as 2008-2009 years fall under the past 5 yr performance data, the return numbers are going to be skewed to the higher side.

The fund managers are kidding themselves (and hence the public) that they are doing something great to get these returns. It will be interesting to see these fund managers’ performance during a flatline market.

“..get me a monkey, ask it to throw some darts to pick a a list of stocks in the index, you have a fund manager”