I wrote a post about screening companies for investing about a month ago, and one of the big ideas of that post was to look for products that you use every day in your life, find out the companies behind them, see if they are listed, and finally try to get a sense of whether they are fairly priced or not.

Ashok, Harinee and I had the following comment exchange on that post.

Ashok November 18, 2013 at 7:52 pm [edit]

Based on my casual observations, I believe water filter manufacturers will have a good future. Almost every middle-class household buys one. It has a replacement life of 8-9 years only. There is recurring money made by company through AMC, installation, and servicing. And it has a “fear” factor- “what happens if you don’t use one” – which makes it a mandatory purchase.

Now if you can please look up the numbers and suggest 1-2 stocks in this space

?

Thanks !!

Ashok

- Manshu November 18, 2013 at 8:10 pm [edit]

Tell me a few company names Ashok, and I’ll try to do the numbers!

- Ashok November 23, 2013 at 11:14 am [edit]

Just top of the mind brand names recall: Eureka Forbes (they are the leaders I guess), Kent, PureIt (ITC ?, Unilever?).

- harineem November 19, 2013 at 10:50 am [edit]

Not to sound sceptical but I come from a city where almost everyone buys water cans. We did consider a water filter as it would save costs but we are so acclimatized to the canned water taste the water even after purification no way comes near this taste.

I assume this is one reason why Water filters are still not a hit!

Following up on the idea I went to look for Eureka Forbes first. I couldn’t find any ownership information on their website but I did notice a Shapoorji Pallonji logo on the top right of their site. So I searched for Shapoorji Pallonji and found that they are also a private company and Eureka Forbes is one of their several holding companies. All public companies have an “Investor Relations” link on their website, and any time you don’t see this link – it is safe to assume that this is a private company. A little Googling can confirm this for you as well.

The next name was Kent, and looking at their website, I found that this was a private company as well.

PureIt was next on the list, and one look at their logo tells you this is a HUL company. So, the next question is how big is this business for HUL?

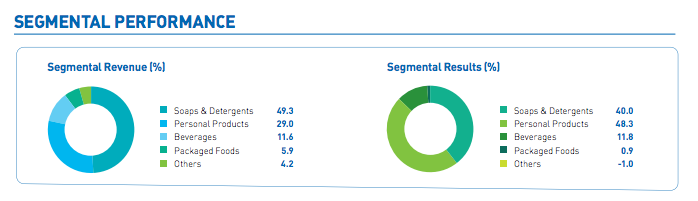

Going through their annual report I found that they don’t report on just the PureIt business but report it as part of their “Other” segment, and here are the relative numbers for each of their segments.

As you can see from the picture above – PureIt must be a very small part of HUL and may well be unprofitable for them. All this research took about 20 minutes for me, and unfortunately in this case Ashok can’t really invest in the trend that he spotted as far as I can see. I couldn’t find any other public companies operating in this space, but if you know of any please do leave a comment.

Being unable to invest in a stock for one reason or the other is the most common outcome when starting to look for an investment, but it doesn’t really matter that much because you only need 8 – 10 stocks in your portfolio anyway, and you will eventually find those 8 – 10 investments.

The process is fun, doesn’t take very long, and it increases your knowledge and awareness of things around you. That being said the point of the follow up was to looking at a stock and then analyze it which hasn’t happened in this post so if you have any ideas for another product or company please leave a comment and I’ll try to cover it.

Thanks I get a cheap thrill of being right 🙂

Awesome, Manshu and thanks for quoting me !!

Thanks for the research done about this.

Ashok

You can look at Tata Global Beverages.

They have the branks, Himalayan, Tata Water Plus and recently merged Mount Everest Mineral Water. However this segment is very young, it comprises around 1%.

Hi Manshu,

I believe biotech has a great future in years to come. In that context, how can I go about checking numbers for Biocon Ltd.?

Thanks,

PP

Biocon is a listed company so that is easy enough, you just have to go through their annual report to see their numbers.

I thought that was the purpose of this post – to make sense of numbers in any annual report. Biocon was just for example sake. Thanks though!

I misunderstood what you meant by checking the numbers, you mean the process of extracting the numbers from the annual report, which numbers to extract, what to look for in them etc. whereas I thought you meant just the source of the numbers.

Yes, the post I do for one of the companies mentioned earlier in this thread will have that information.

Thats great.

Then also think of mineral water producing companies.Their product are widely used from cities to village corners. Who are the market leaders, any listed one?

That’s similar to Harinee’s line of thinking although I don’t know of any listed names….I’ll have to look for them.

Sir,

One listed company is there for water purifies : Ion Exchange (India) Ltd and quoted around 90 Rs. Can you give your comments about this company

Thank you for the recommendation Kausikan, I will take a look at this.

Actually this is the right way to invest, but sadly in India, it never really works. There are not many coz who have worldclass products and are listed in india.

If you look at nyse or DAX ( german Exchange). All the coz that form these index are well identified by even in india .

Waiting for the day when we have similar coz listed in BSE , which are indian ofcourse.

🙂

Just my opinion.

I think there are companies enough who make good products, Dabur is one that comes to mind that I owned a number of years ago. But there are countless others, I’m not just looking for world class companies, but companies that make good products even if they can’t be considered world class for whatever reason.

Hi Manshu & Ashok,

You might be interested in looking at Va Tech Wabag Ltd. which is into the business of designing and installing water treatment and desalination plants.

Cheers!

Mayank

And this one is listed, so I am going to take a look at this – thanks for the recommendation!