The Nifty crossed 7,000 today, and continued the uptrend which started a few months ago or the bigger trend that started a few years ago.

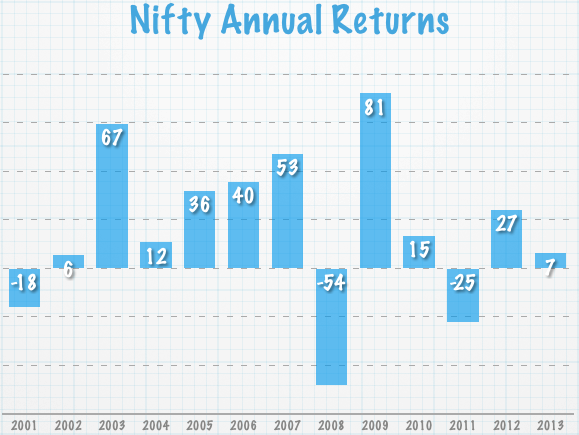

If you look at the annual Nifty returns — 2011 returned a negative 25%, 2012 returned a positive 27%, 2013 returned about 7% and we have seen the Nifty up about 11% already this year.

This kind of optimism usually brings with it new investors, and emboldens existing investors to invest more in the markets, which is what we’re seeing now as well.

AMFI reported that 400,000 new accounts were added last month taking the number of total equity folios to 29.56 million, which is still less than its peak of 41.13 million in March 2009, but does speak of people gaining confidence and returning to equity. Interestingly, if you see the chart below you would see that the peak was reached in a year when the market did tremendously well. However, what the chart can’t tell you is that the pain you feel when the market halves in value is much more than any 81% gain you could ever witness.

Even personally, I feel that more people are talking about equity right now than any time in the past and I have a feeling this will continue for at least a few more months.

In terms of investing strategy though, getting into the markets, and increasing your equity positions when there is optimism in the market is not the right way to go and I’d caution any readers who are only now getting into the market, or increasing their SIPs at this time.

What you should have ideally done is buy into the markets when they were depressed, and that would have ensured that you were sitting on considerable gains right now, but if you haven’t done that and plan to chase returns right now, then that’s a dangerous approach.

The long term plan of any investor should be to get into a mindset where they can put in a reasonable sum of money into equity every month, and adjust that sum upwards or downwards based on market conditions. The hard part about this is you must adjust that sum upwards when the market is down, and lower it a little when the market is up. I’ve been doing this for years now, and also recommending others do this, as I find that this is a certain way to accumulate stocks at a reasonable price, and then take advantage of market highs to book some profits from time to time.

If you’re in the category of investors who don’t have any equity investments, and want to start now then I’d say start with a SIP that is smaller than the maximum you can put in the markets. That way when the market falls, you can increase that allocation and take advantage of the fall.

If you are already in the market, and were thinking about increasing your allocation, then I’d say there is no reason to increase your allocation just on the basis of this market rise alone. The time to increase allocation will eventually come, and you will be able to take advantage of that if you position yourself from now and be in a mindset that looks for crashes and downfalls.

If you were investing when the market were down and are sitting on profits now – good job, and I hope OneMint had a small part to play in it.

NIFTY weak on heavy selling by FIIs & BREXIT Concerns

Stock Market Today by Shailesh Saraf – 14th June 2016

Indian Market Outlook:

The Indian Markets are slated to open gap down by 20 points at 8110, as per SGX Nifty at 8.15 am. FII and PRO combined have sold 1.44 Cr shares in the Index options in last 4 days. This above average selling indicates the panic affecting our Markets. If the Markets trade below the low of 8060, which is 2 weeks low, the short term trend will turn to sell.

International Market Outlook

: International Markets have collapsed as many as 3 surveys are indicating a higher probability of BREXIT. The latest polls by “The SUN”, UK’s largest circulated daily, shows 55% people voting for the leave campaign. This nervousness is bound to continue till 23rd June, when the Referendum takes place. Dax has touched its one month low falling 500 points in the past one week. The Asian Markets are reflecting the same mood this morning. Markets would now be keenly eyeing the FED policy decision due tomorrow night at 11:30 PM IST.

Profit booking in Nifty seen ahead of BREXIT

Stock Market Today by Shailesh Saraf – 10th June 2016

Indian Market Outlook:

Today morning, SGX Nifty is trading at 8216 at 8:35 am IST. As per SGX, Nifty is expected to open at 8216 i.e. at a gap down of 14 points. FII and PRO combined have sold 4411500 shares in Index options yesterday signaling profit booking.

International Market Outlook

The Asian markets along with European and American peers are holding strong too suggesting a global strength in the Indices, however markets have seen a profit booking from the higher levels of S&P at 8120. S&P has been trading in a small range of 2120 to 2106 for last 4 days. The markets are eyeing BREXIT and the US FED meet due on 23rd June and 15th June respectively. The outcomes of these events would be very crucial in deciding the further course of the markets.

Nifty steady, eyes 8 month high of 8336

Stock Market Today by Shailesh Saraf – 9th June 2016

Indian Market Outlook:

Today morning, SGX Nifty is trading at 8297 at 8:35 am IST, which is well above the breakout level of 8276. As per SGX Nifty is expected to open at 8297 i.e. a 13 points gap up. Moreover, the huge buying of FII and PRO in future and options suggests that the buying spree is to be continued. However, 8336 Nifty spot would be a crucial resistance. Reduced oil production after the destruction of the Nigerian unit of chevron oil and decreasing oil stockpiles in the US has boosted oil prices.

International Market Outlook

The Asian markets along with European and American peers are holding strong too suggesting a global strength in the Indices after the FED chair Jennet Yellen reiterated on Friday that the rate hike would be a gradual process. However, Crude gave a breakout above $50 mark after 10 months on decreasing US oil stockpiles and the destruction of the Chevron Oil production Unit in Nigeria.

Nifty awaits RBI monetary policy today

ARCHIVE 07 Jun, 2016

Stock Market Today by Shailesh Saraf – 7th June 2016

Indian Market Outlook:

Today the markets would eagerly wait for the RBI policy statement to be announced today at 11:00 AM IST. Analysts expect RBI to keep the Interest Rates unchanged at 6.5% but the key lookout is whether Rajan would accept the extension of his tenure as RBI chief. This would lead to a consolidation phase until the policy announcement. Market would be deciding on its next course post RBI announcements today. SGX Nifty is trading at 8269 at 8:35 am IST. Nifty is expected to open at same levels i.e. a gap up of 38 points.

International Market Outlook

Asian Indices rallied, testing 5 week highs on Tuesday morning after FED chair Jennet Yellen in a speech yesterday said US rate hike would indeed be a gradual process not giving any reference to timings. She gave a positive assessment of the US economy and warned on giving too much weightage on one single data referring to the weak payrolls data last week. On the other hand the BREXIT polls, published by the Telegraph UK, that came in yesterday show an inclination of the British people towards exiting the EU. The FED’s policy statement due on 15th June and the BREXIT final outcome due on 23rd June would set the market tone going forward.

Nifty continues BUY trend, RBI policy awaited

ARCHIVE 06 Jun, 2016

Stock Market Today by Shailesh Saraf – 6th June 2016

Indian Market Outlook:

Today the markets would eagerly wait for the RBI policy statement to be announced tomorrow at 11:00 AM IST. This would lead to a consolidation phase for the day. We recommend a buy in Nifty share price at 8178 with a stop of 8150. The huge buying of FII and PRO in future and options suggests that 8336 are in the cards for Nifty in the coming days. SGX Nifty is trading at 8243 at 8:35 am IST. Nifty is expected to open at same levels i.e. a gap up of 10 points.

International Market Outlook

The US pay rolls data surprised the Investor expectation as it showed that the US economy added only 68K jobs in the last month indication the slowdown in the global markets thereby reducing the chances of any near term rate hike. However, the US indices are holding strong at 2100 levels. Asian and European peers hold steady.

Nifty BULLS controlling the markets, BUY at every correction

ARCHIVE 03 Jun, 2016

Stock Market Today by Shailesh Saraf – 3rd June 2016

Indian Market Outlook:

We recommend a buy in Nifty at 8178 with a stop of 8150. The huge buying of FII and PRO in future and options suggests that 8336 are in the cards for Nifty in the coming days. SGX Nifty is trading at 8264 at 8:15 am IST. Nifty share price is expected to open at same levels i.e. a gap up of 20 points.

International Market Outlook

Asian shares held steady on Friday as investors wait for U.S. payrolls data that could add to or detract from the case for a Federal Reserve interest rate hike later this month or in July. The data will be followed by a speech from Federal Reserve Chair Janet Yellen on Monday, the last chance for the Fed to communicate with markets before it begins a blackout period ahead of its policy meeting on June 14-15. In recent weeks global markets have been puzzling over what the Fed would do in the near term as relatively upbeat U.S. data have been undermined by a still-sluggish global economy and worries over the risk of Britain exiting the European Union. OPEC failed to agree a clear oil-output strategy on Thursday as Iran insisted on steeply raising its own production, though Saudi Arabia’s new oil minister promised not to flood the market. Yesterday, the ECB’s Governing Council left interest rates unchanged ahead of the launch of a highly-anticipated corporate bond buying program next week, as inflation continues to remain stubbornly low.

Nifty holds strong, BUY at every correction

Stock Market Today by Shailesh Saraf – 2nd June 2016

Indian Market Outlook:

We recommend a buy in Nifty at 8120 with a stop of 8100. The huge buying of FII and PRO in future and options suggests that 8336 are in the cards for Nifty in the coming days. SGX Nifty is trading at 8182 at 8:30 am IST. Nifty is expected to open at same levels i.e. a gap down of 15 points.

International Market Outlook

Asian shares were steady on Thursday as Wall Street gave up modest gains. This was after the latest batch of U.S. data provided few clues on when the Federal Reserve might raise rates, while a resurgent yen pressured equity markets in Japan. The yen strengthened earlier today after Japanese Prime Minister Shinzo Abe said he was planning to delay a scheduled sales tax hike by two-and-a-half years, amid ongoing weakness in the economy.

To know more go to https://www.dynamiclevels.com/en/shailesh-saraf-stock-market-today-020616

Nifty upbeat, caution if US Treasury Yield trades above 36bps

Stock Market Today by Shailesh Saraf – 1st June 2016

Indian Market Outlook:

FII continued their buying spree across all segments in the Indian markets after buying worth Rs.16126 Cr in Index Options, worth Rs.9073 Cr in Index Futures and worth Rs.981 Cr in the cash segment in last 6 days. The huge buying of FII and PRO buy in future and options suggests that 8336 are in the cards for Nifty in the coming days. SGX Nifty is trading at 8205 at 8:40 am IST. Nifty is expected to open at same levels i.e. a gap up of 11 points.

International Market Outlook

China PMI announced today morning came a tad higher at 50.1 from the expectation of 50.0. Crude Oil prices are under pressure on Wednesday morning today’s OPEC meeting would set the tone for further price direction for crude. It is expected that the OPEC meeting scheduled on 2nd June would be to decide on the market share for the Oil production countries rather than putting control on the production levels. Moreover, the concerns over the slowing demand from the Chinese economy are pushing crude further down.

Foe details see https://www.dynamiclevels.com/en/shailesh-saraf-stock-market-today-010616

Nifty continues to be in a BUY trend

Stock Market Today by Shailesh Saraf – 30th May 2016

Indian Market Outlook:

FII’s have been net buyers worth Rs.3270 Cr in Index Options and worth Rs.2162 Cr in Index Futures. The rally in the markets has been triggered mainly due to the Global markets rallying last week which was triggered by, firstly, the BREXIT polls that suggested majority willing to stay in the Eurozone and secondly, the bailout of the Greece banks by the Eurozone to the extent of 12 Billion Euros. As per SGX today at 8:30 am IST, Nifty Share Price is expected to open at 8217.

International Market Outlook

Asian Markets along with European and American peers are trading in green Monday morning. Yellen in her speech on Friday remarked that the FED rate hike could be happening soon in the coming months, looking at the ripe situation of the US economy with good jobs and inflation data. The polls on the BREXIT suggested that the majority is willing to stay in the EUROZONE which has been one of the major triggers for the markets to stay positive. The markets would be keenly waiting for the 15 June FED meeting and the BREXIT which is scheduled on 23 June.

https://www.dynamiclevels.com/en/shailesh-saraf-stock-market-today-300516

Again nice and timely post.

It is very true … “If you were investing when the market were down and are sitting on profits now – good job, and I hope OneMint had a small part to play in it.” But should they book some profit at this point ? (NIFTY PE is 19.67)

Hi Mr Verma,

Nice article about the P/E ratio of nifty. On similar lines, i did some analysis based on famous Graham multiple. Though it is applied to the stocks but i tried to see Graham multiple of Nifty between ( 01 Jan 2001 to 01 may 2014). It appears , whenever Graham multiple of nifty has fallen below 30 ( for stocks Ben Graham suggested 22.5 as the threshold value).. it has bounced back and has gone upto 60, 89 and 95 . It has happened only 4 times during the period considered and somebody who has invested at those levels has been rewarded tremendously. In my opinion considering Graham multiple for nifty might prove to be a better way of entering and exiting market than P/E alone. Will appreciate your comments on my analysis.

Thanks 🙂

Quite honestly, I have never looked at this number to be able to to comment on how good an indicator this is. Sounds like it could be a useful measure but I don’t know for sure. I have used the P/E multiple as a measure and I would say that it is a useful indicator and the utility of these measures is that they give you some guidance and help directionally. You can’t rely too much on them but they are generally good in guiding whether the market is euphoric or unduly pessimistic.