Decoupling is evident in the long run July 6, 2010 by

I have never taken decoupling seriously because of what normally happens during crashes. Here is a chart that illustrates it well.

When one major stock market falls, every other market in the world follows it. It can be the US, China or London or whatever.

When things are going good for emerging economies, people talk of decoupling and how domestic growth rates have insulated an economy from the international markets, and they make all sorts of other positive noises, but when things start going south – everything falls in tandem, and it feels like no one will be spared.

That is the reason I never took decoupling seriously, but today I read an awesome post by Sandip Sabharwal, and in it he talks about decoupling in a way I had never thought about earlier, and his way is perhaps the best way of thinking about decoupling.

Let me share the most powerful part of his post (emphasis his):

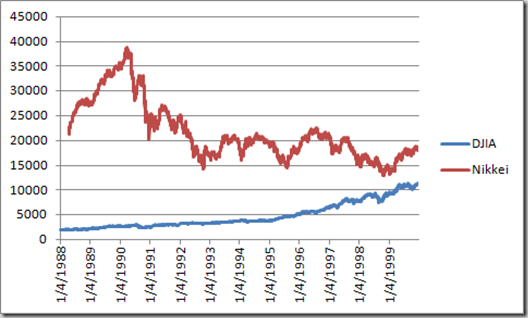

The Dow went up from a level of 1938 at the end of 1988 to a level of 11500 by the end of the year 1999. In the same time period the Japanese markets fell from a level of 39000 at the end of 1989 to a level of 19000 at the end of 1999. Thus the biggest boom of the stock markets in the US corresponded to the big decline in Japanese stock markets and the economy.

I believe that a similar thing is likely to happen over the next decade for India (and some other emerging economies).

Let me show you how this looks in a graph.

Essentially, he states that decoupling takes longer to show and while markets move together in the shorter run, in the long run, different markets move differently based on their own dynamics.

This was a very good post, and you should read the whole thing here.

Via Ranjan Varma

which stocks you own in India.. and why

can you do an article on it?

Nice one.

Got some thing new to learn today.